RGC Resources Bids Farewell to Two Long-Serving Directors at Annual Meeting

January 26, 2026 · by Fintool Agent

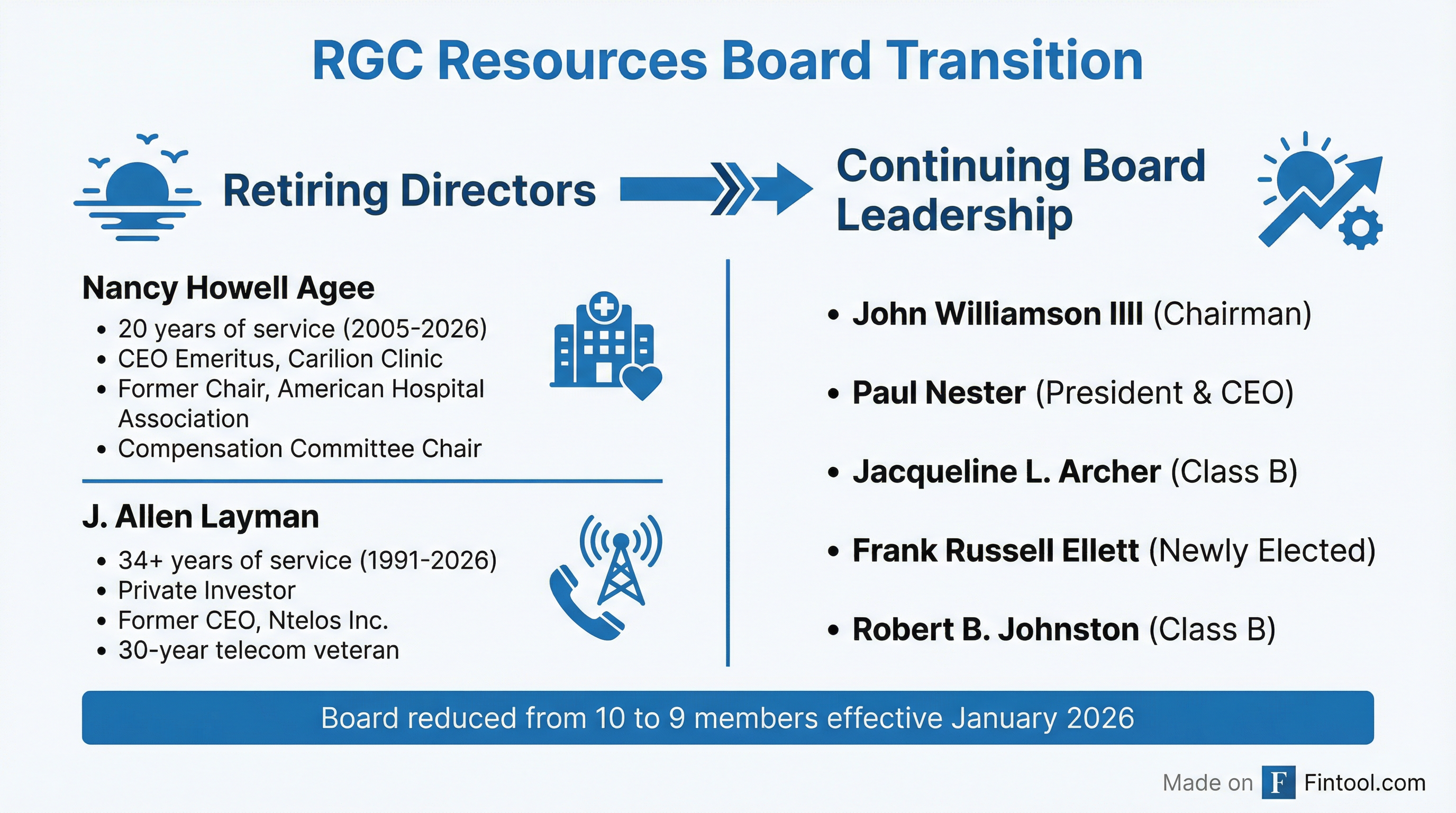

RGC Resources closed a chapter in its 142-year history today as shareholders approved all proposals at the company's annual meeting while marking the retirement of two directors with a combined 54 years of board service.

Nancy Howell Agee, the former CEO of Carilion Clinic and past Chair of the American Hospital Association, departs after 20 years (2005-2026). J. Allen Layman, former Chairman and President of Ntelos Inc. with three decades in telecommunications, steps down after serving since 1991—making him one of the longest-tenured directors in the Virginia utility's history.

Both directors reached the company's retirement age threshold, triggering the transition.

Strong Shareholder Support Across All Proposals

The Roanoke-based natural gas distributor saw robust engagement with 82.68% of its 10.35 million outstanding shares voting. All proposals passed by wide margins:

| Proposal | For | Against/Withheld | Approval Rate |

|---|---|---|---|

| Class B Directors (Archer, Ellett, Johnston) | 6,968,792 | 290,017 | 96.0% |

| Deloitte & Touche Ratification | 8,534,492 | 19,687 | 99.7% |

| 50,000 Share Stock Bonus Expansion | 7,100,740 | 125,436 | 98.3% |

| Executive Compensation (Say-on-Pay) | 7,119,486 | 98,873 | 98.6% |

Frank Russell Ellett, President and CEO of Excel Truck Group, joins the board as a newly elected Class B director, filling the vacancy created by Agee's departure. The board will reduce from 10 to 9 members effective immediately.

Departing Directors: A Healthcare Titan and Telecom Veteran

Nancy Howell Agee

Agee's departure removes a nationally recognized healthcare leader from RGC's boardroom. As CEO Emeritus of Carilion Clinic—a nearly $2.4 billion integrated health system serving over one million people in Virginia and West Virginia—she led the organization's transformation from a hospital collection to a physician-led clinic and helped forge the Virginia Tech Carilion School of Medicine.

Her credentials include:

- Past Chair of the American Hospital Association, representing 5,000 hospitals nationwide

- Modern Healthcare's Top 100 Most Influential People (multiple years)

- Virginia Business Person of the Year (2017)

- Chair of RGC's Compensation Committee (2023-2025)

Chairman John Williamson noted in the resolution honoring Agee that she "provided the board of directors and management of RGC Resources with sage advice and insightful inquiry" during her two-decade tenure.

J. Allen Layman

Layman's 34-year tenure spans nearly a quarter of RGC Resources' corporate existence. A private investor and retired telecom executive, he built a 30-year career in telecommunications culminating as Chairman and President of Ntelos Inc., a regional wireless and wireline provider in Virginia and West Virginia.

His regulatory expertise—gained from leading a utility through multiple business cycles—proved valuable to RGC's board. He served on the Audit, Compensation, and Governance and Nominating committees. The shareholder resolution honoring Layman cited his "over 34 years of dedicated service."

Financial Context: Record Year Provides Strong Handoff

The board transition comes as RGC Resources delivers its strongest financial performance in years. For fiscal 2025 (ended September 30), the company reported:

| Metric | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Revenue | $84.2M | $97.4M | $84.6M | $95.3M |

| Net Income | ($31.7M)* | $11.3M | $11.8M | $13.3M |

| Diluted EPS | ($3.48)* | $1.14 | $1.16 | $1.29 |

| Return on Equity | (32.9%)* | 11.7% | 11.3% | 12.0% |

*FY 2022 loss reflects Mountain Valley Pipeline investment write-down

CEO Paul Nester attributed the strong year to "record levels of gas deliveries aided by higher operating margins" and noted the company delivered gas effectively during "one of the coldest winters in the last decade, resulting in the highest annual volume of gas we have ever delivered."

The board rewarded shareholders with a 4.8% dividend increase in November 2025, raising the annual payout to $0.87 per share—marking 22 consecutive years of dividend growth.

Market Reaction and Investor Profile

RGCO shares traded at $21.03 at today's close, down 0.5% on light volume of 1,260 shares—typical for this thinly traded small-cap utility with a $218 million market capitalization. The stock has traded in a narrow range between $19.50 and $23.82 over the past year.

| Metric | Value |

|---|---|

| Market Cap | $218M |

| P/E Ratio (TTM) | 16.8x |

| Dividend Yield | 4.1% |

| 52-Week Range | $19.50 - $23.82 |

| Avg. Daily Volume | 11,000 shares |

| Beta | 0.52 |

The company's low beta (0.52) reflects its defensive utility characteristics, while the 4%+ dividend yield appeals to income-focused investors. Institutional ownership stands at approximately 38%, with retail investors controlling about 41% of shares.

In Memoriam

The meeting also acknowledged the passing of Thomas L. Robertson, a board member from 1986 to 2005 who died in March 2025. Robertson, described by Chairman Williamson as a mentor, served on the audit committee for most of his 19-year tenure.

What to Watch

Q1 FY2026 Earnings Call: Management will host an earnings call on Tuesday, February 10, 2026, to review first quarter results and provide fiscal year outlook. The call will address operational updates on customer growth, the Mountain Valley Pipeline expansion projects (MVP Boost and Southgate), and potential rate case timing.

Capital Plan: RGC Resources has outlined a $22 million capital plan for FY2026, focused on SAVE (Steps to Advance Virginia Energy) investments, system growth, and medical facility expansion in the Roanoke region.

Board Composition: With Agee's healthcare expertise and Layman's regulatory knowledge departing, investors should monitor how the reconstituted board navigates upcoming rate proceedings and capital allocation decisions.

Related

Data sources: Company filings, S&P Global, RGC Resources Annual Shareholder Meeting Transcript (January 26, 2026)