Earnings summaries and quarterly performance for RGC RESOURCES.

Research analysts who have asked questions during RGC RESOURCES earnings calls.

Recent press releases and 8-K filings for RGCO.

RGC Resources Reports Q1 2026 Results, Files Rate Case, and Addresses Winter Storm Impact

RGCO

Earnings

Guidance Update

Revenue Acceleration/Inflection

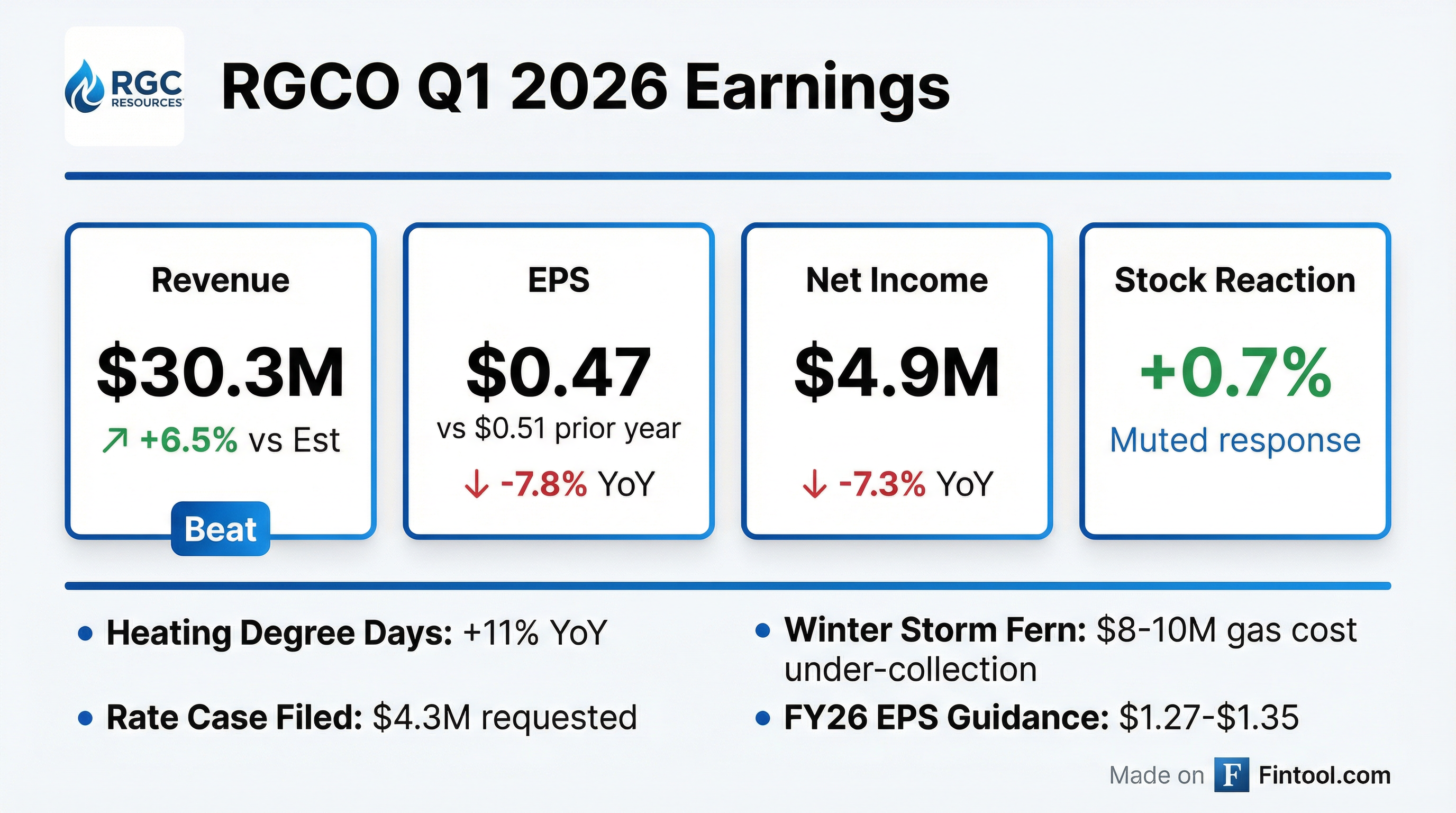

- RGC Resources reported net income of $4.8 million or $0.47 per share for Q1 2026, a decrease from $5.3 million or $0.51 per share in Q1 2025, primarily due to higher costs for personnel, IT, property taxes, and depreciation, which offset nominally higher gas margins and lower interest expense.

- The company filed an expedited rate case in December 2025, with interim rates effective January 1, 2026, seeking approximately $4.3 million in incremental annual revenue. The case is expected to be adjudicated by the end of the calendar year.

- Winter Storm Fern in January 2026 led to an unprecedented spike in natural gas prices and an estimated $8 million-$10 million undercollection on gas costs, which the company plans to recover through rates over the next 12-18 months.

- The fiscal year 2026 capital expenditures forecast remains $22 million, and earnings per share guidance is maintained at $1.27-$1.35, though Q2 construction may be hampered by recent winter weather.

Feb 10, 2026, 2:00 PM

RGCO Reports Q1 2026 Results and Reaffirms FY 2026 Guidance

RGCO

Earnings

Guidance Update

Debt Issuance

- RGC Resources reported net income of $4.8 million or $0.47 per share for Q1 2026, compared to $5.3 million or $0.51 per share in Q1 2025.

- Capital expenditures for Q1 2026 were $5.6 million, flat year-over-year. The company maintains its FY 2026 capital forecast of $22 million and EPS guidance of $1.27-$1.35.

- An expedited rate case was filed in December, seeking approximately $4.3 million in incremental annual revenue, with interim rates effective January 1st, 2026.

- Winter Storm Fern in January 2026 resulted in an estimated $8 million-$10 million undercollection on gas costs, which the company plans to recover through rates over the next 12-18 months.

- A $15 million note maturing in August is now a current liability and is expected to be refinanced.

Feb 10, 2026, 2:00 PM

RGCO Reports Q1 2026 Results and Reaffirms FY 2026 Guidance

RGCO

Earnings

Guidance Update

Debt Issuance

- RGC Resources reported net income of $4.8 million or $0.47 per share for the first quarter of fiscal year 2026, compared to $5.3 million or $0.51 per share in the same quarter a year ago.

- The company filed an expedited rate case in December 2025, seeking approximately $4.3 million in incremental annual revenue, with interim rates becoming effective on January 1, 2026.

- The full fiscal year 2026 earnings per share forecast remains $1.27-$1.35, and the capital forecast is $22 million.

- Winter Storm Fern led to an estimated $8 million-$10 million undercollection on gas costs, which the company plans to work with the commission to build into rates for collection over the next 12-18 months.

- A $15 million note for Roanoke Gas matures in August 2026 and is now classified under current liabilities, with preliminary refinancing conversations underway.

Feb 10, 2026, 2:00 PM

RGCO Reports First Quarter 2026 Earnings

RGCO

Earnings

New Projects/Investments

Dividends

- RGC Resources, Inc. announced consolidated Company earnings of $4.9 million, or $0.47 per share, for the first quarter ended December 31, 2025, a decrease from $5.3 million, or $0.51 per share, for the same period in the prior year.

- The decrease in earnings was primarily due to flat margins and higher costs for personnel, IT, property taxes, and depreciation, which were partially offset by lower interest expense.

- The Company filed a rate case in early December 2025, seeking $4.3 million in additional annualized revenue to address these higher costs, with interim rates effective January 1, 2026.

- Roanoke Gas continues to experience steady customer growth and is making investments in its utility infrastructure.

- Cash dividends per common share increased to $0.2175 for the first quarter ended December 31, 2025, from $0.2075 in the prior year.

Feb 5, 2026, 9:00 PM

RGC Resources Announces Annual Shareholders Meeting Results and Leadership Changes

RGCO

Board Change

Management Change

Proxy Vote Outcomes

- At its annual shareholders meeting on January 26, 2026, RGC Resources, Inc. elected John B. Williamson III as Chairman of the Board and Paul W. Nester as President and CEO of RGC Resources, Inc. and Roanoke Gas Company.

- Shareholders elected Jacqueline L. Archer, Frank Russell Ellett, and Robert B. Johnston as directors for three-year terms and ratified Deloitte & Touche, LLP as independent auditors for fiscal 2026.

- Shareholders approved an additional 50,000 Common Shares for issuance under the Stock Bonus Plan and passed a non-binding advisory vote approving executive compensation.

Jan 28, 2026, 10:10 PM

RGCO Reports Record FY 2025 Earnings, Announces Dividend Increase and 2026 Rate Case Filing

RGCO

Earnings

Guidance Update

Dividends

- RGC Resources reported record net income of $13.3 million or $1.29 per share for fiscal year 2025, a 15% increase from fiscal 2024, driven by record gas deliveries.

- For Q4 2025, the company experienced a net loss of $204,000 or $0.02 per share, attributed to higher expenses and non-recurring gains from housing authority donations.

- The company filed a new rate case on December 2nd, 2025, seeking an approximate $4.3 million increase in annual revenues, with new rates expected to be effective January 1st, 2026.

- RGC Resources' board authorized an annualized dividend increase of $0.04 per share to $0.87 per share for 2026, an almost 5% increase.

- The capital budget for fiscal year 2026 is projected at $22 million, including an anticipated $1-$1.5 million investment in the MVP Boost and Southgate projects.

Dec 4, 2025, 2:00 PM

RGCO Reports Q4 and Full-Year 2025 Results, Provides 2026 Outlook

RGCO

Earnings

Guidance Update

New Projects/Investments

- RGC Resources reported a net loss of $204,000 or $0.02 per share for Q4 2025, while full-year 2025 net income increased 15% to $13.3 million or $1.29 per share.

- Operational highlights for fiscal 2025 included installing nearly five main miles (50% higher than FY 2024) and connecting over 700 new services, contributing to record volumes of gas delivered.

- For fiscal year 2026, the company anticipates a capital budget of $22 million and has increased its annualized dividend by $0.04 per share to $0.87 per share.

- An expedited rate case was filed on December 2nd, seeking an approximate $4.3 million increase in annual revenues, with new rates expected to become effective January 1, 2026.

- Debt supporting the Mountain Valley Pipeline investment was refinanced to 2032, and $4-$5 million is planned for investment in the Southgate and Boost projects over several years, with $1-$1.5 million allocated for 2026.

Dec 4, 2025, 2:00 PM

RGC Resources, Inc. Reports Fiscal Year 2025 Earnings

RGCO

Earnings

Debt Issuance

New Projects/Investments

- RGC Resources, Inc. reported consolidated earnings of $13.3 million, or $1.29 per share, for the fiscal year ended September 30, 2025, an increase from $11.8 million, or $1.16 per share, for the prior fiscal year. For the fourth quarter ended September 30, 2025, the company recorded a net loss of $204,000, or $0.02 per share, compared to a net income of $141,000, or $0.01 per share, in the same quarter of 2024, due to it being a seasonally weaker quarter with higher expense levels.

- The strong fiscal year performance was attributed to record levels of gas deliveries and higher operating margins, though partially offset by inflationary cost increases and lower equity earnings from the Mountain Valley Pipeline (MVP).

- The company also made further investments in its utility infrastructure and successfully refinanced and extended the maturity of RGC Midstream’s debt in September 2025.

Nov 19, 2025, 10:16 PM

RGCO Reports Strong Q1 2025 Results and Reaffirms FY 2025 Guidance

RGCO

Earnings

Guidance Update

Debt Issuance

- RGC Resources reported net income of $5.3 million, or $0.51 per share, for Q1 2025, an increase from $5 million, or $0.50 per share, in Q1 2024.

- Operational highlights for Q1 2025 include the installation of 1.1 miles of main and connection of 197 new services, contributing to a 16% increase in total delivered gas volumes compared to Q1 2024.

- The company maintains its fiscal year 2025 earnings per share forecast in the $1.18-$1.25 range and expects total capital spending to be in the $21.5 million-$22 million range.

- RGC Resources is actively working to refinance the $26.2 million current portion of long-term debt due December 31, 2025, and a rate case stipulation recommending a $4.08 million revenue requirement increase has been recommended for adoption.

Feb 11, 2025, 2:00 PM

RGC Resources Reports Q1 2025 Results and Reaffirms Full-Year EPS Guidance

RGCO

Earnings

Guidance Update

Debt Issuance

- RGC Resources reported net income of $5.3 million, or $0.51 per share, for the first quarter of fiscal year 2025, compared to $5 million, or $0.50 per share, in the same period a year ago.

- The company reaffirmed its fiscal year 2025 EPS forecast in the range of $1.18 to $1.25.

- Operational highlights for Q1 2025 included installing 1.1 miles of main and connecting 197 new services, with total delivered gas volumes increasing 16% year-over-year. Total capital spending for the quarter was $5.7 million, and the full-year capital spending forecast remains at $21.6 million.

- RGC Resources expects to refinance $26.2 million in current long-term debt, including a $25 million non-revolving line, prior to its December 31, 2025 maturity.

Feb 11, 2025, 2:00 PM

Fintool News

In-depth analysis and coverage of RGC RESOURCES.

Quarterly earnings call transcripts for RGC RESOURCES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more