Roblox Soars 20% After Blowout Q4: 144 Million Daily Users, Bookings Up 63%

February 5, 2026 · by Fintool Agent

Roblox stock surged over 20% in after-hours trading Thursday after the gaming platform delivered a blowout fourth quarter that shattered expectations on every key metric. In a week defined by tech carnage—from AI capex fears hammering software stocks to Bitcoin's continued collapse—Roblox emerged as a rare bright spot, proving that viral content and platform scale can still drive explosive growth.

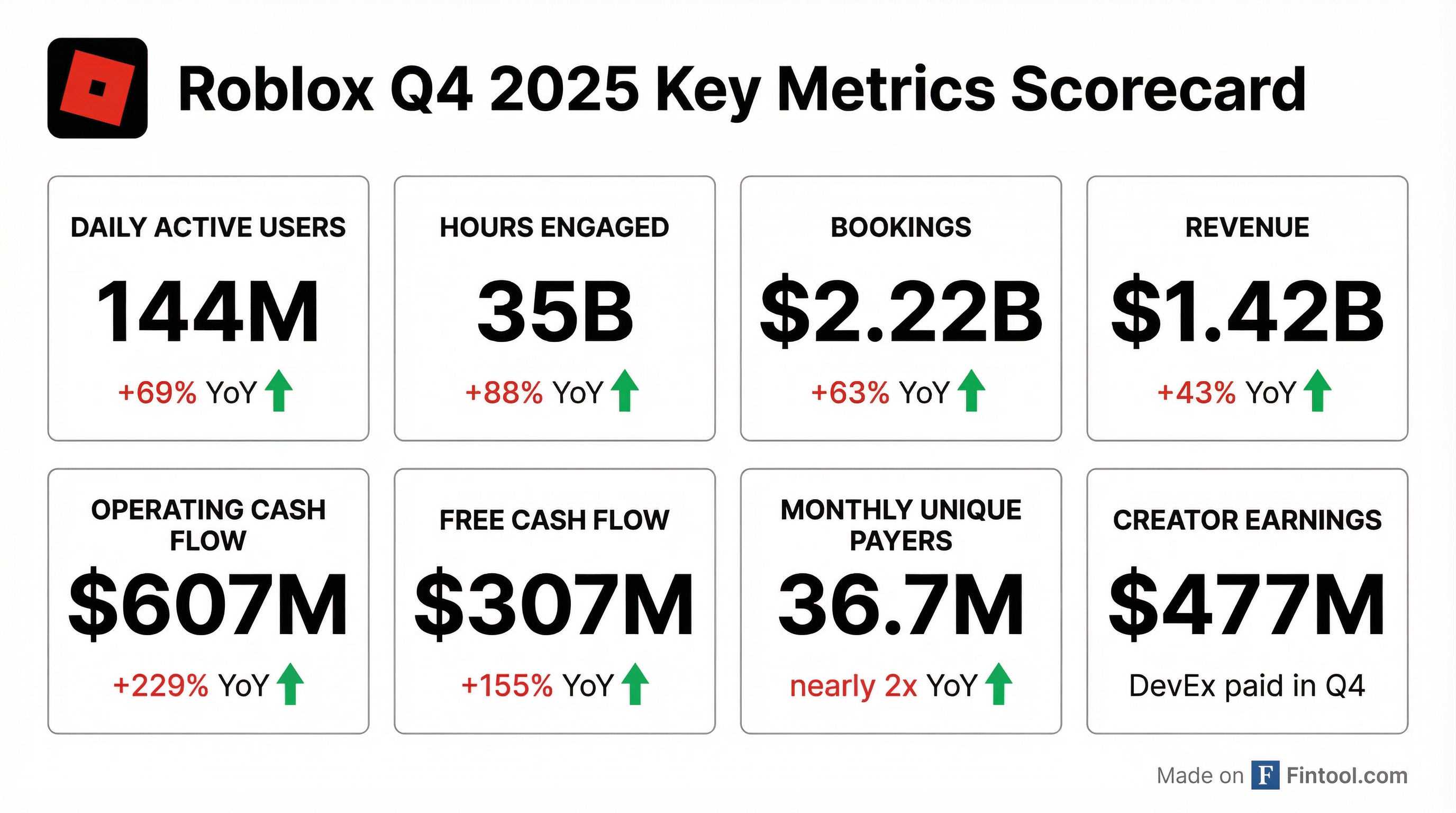

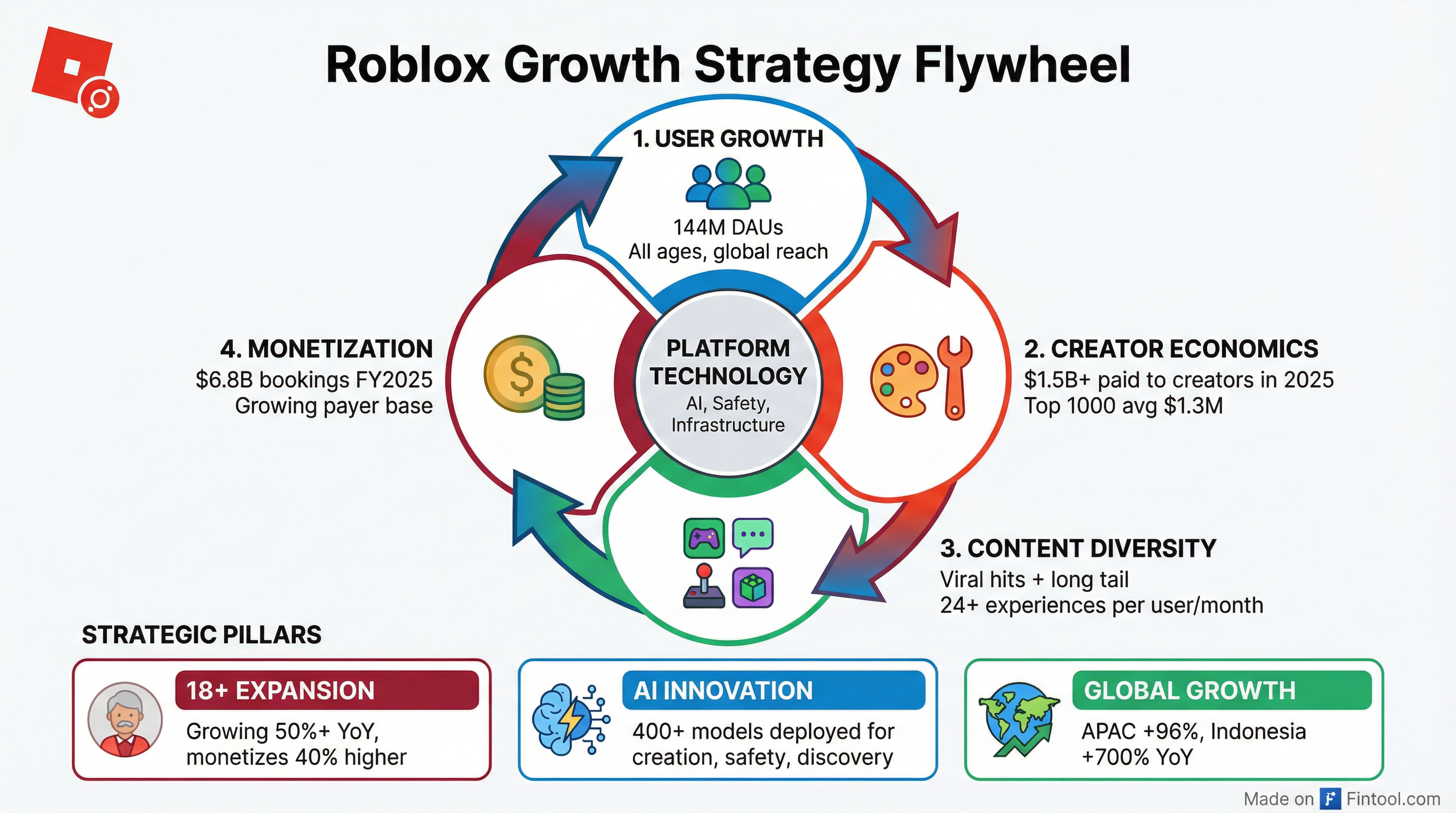

The numbers speak for themselves: 144 million daily active users (up 69% YoY), 35 billion hours engaged (up 88%), and bookings of $2.22 billion (up 63%). For a company that many had written off as a pandemic beneficiary, these results mark a definitive statement that Roblox's flywheel is accelerating, not decelerating.

The Numbers: A Quarter That Exceeded Every Metric

Fourth quarter results crushed both guidance and Street expectations across the board:

| Metric | Q4 2025 | YoY Growth | Expectation |

|---|---|---|---|

| Daily Active Users | 144M | +69% | 138M |

| Hours Engaged | 35B | +88% | N/A |

| Bookings | $2.22B | +63% | $2.05B |

| Revenue | $1.42B | +43% | $2.07B |

| Operating Cash Flow | $607M | +229% | N/A |

| Free Cash Flow | $307M | +155% | N/A |

| Monthly Unique Payers | 36.7M | 2x | N/A |

For the full year, Roblox delivered $4.9 billion in revenue (up 36%) and $6.8 billion in bookings (up 55%), generating $1.8 billion in operating cash flow—a performance CEO David Baszucki called a "banner year."

The 18+ Opportunity: Bigger Than Expected

Perhaps the most significant strategic revelation came from Roblox's age-check initiative. The company has been rolling out mandatory age verification globally, and the data reveals something surprising: the user base skews younger than self-reported data suggested, but this actually creates a larger opportunity in the 18+ demographic.

"We estimate our 18 and over cohort is growing at over 50%, and this cohort monetizes 40% higher than younger cohorts," Baszucki noted on the earnings call.

The breakdown from age-checked users (45% of DAUs have now verified):

- 35% under 13 years old

- 38% ages 13-17

- 27% over 18

In the U.S., Roblox currently reaches fewer than 10% of adults ages 18-34 daily—a massive whitespace opportunity that's growing at 2x the rate of under-18 users. To capture this cohort, Roblox is investing heavily in "Novel" games—higher-fidelity experiences in genres like shooters, RPGs, and sports/racing that appeal to older audiences.

AI as Growth Accelerant

While other companies are warning about AI disruption, Roblox is leaning into it as a growth driver. The company now runs over 400 AI models powering creation, discovery, safety, and social communication.

Key AI innovations include:

- 4D Generation: Users can create functional, interactive objects through text prompts—create a car, then drive it in a racing game

- Cube 3D/4D: Roblox's proprietary foundation model for 3D asset creation with interactivity

- Real-time dreaming: Research into letting users create fully interactive worlds from images or prompts

- Safety models: Voice toxicity detection, child endangerment detection (Roblox Sentinel), and PII classifiers—several of which have been open-sourced

"Every day, we capture roughly 30,000 years of human interaction data on Roblox in a PII and privacy-compliant way," Baszucki said. "We're actively using this data to develop and train AI models."

Creator Economics: The Engine Behind Content Diversity

Roblox paid creators $477 million in Q4 alone via Developer Exchange (DevEx), up 70% year-over-year—reflecting both platform growth and an 8.5% rate increase implemented in September. For all of 2025, creators earned over $1.5 billion.

The top 1,000 creators averaged $1.3 million in earnings, up over 50% from the prior year.

This investment in creators is paying dividends in content diversity. CFO Naveen Chopra highlighted that experiences outside the top 10 are growing faster than ever—68% engagement growth and 53% growth in Robux spending for the "long tail."

"Q4 saw significant engagement and bookings growth without large new viral experiences," the shareholder letter noted, demonstrating platform health beyond hit-driven volatility.

International Expansion: APAC as Growth Engine

Geographic diversification continues to accelerate. While U.S. and Canada grew a healthy 32% in DAUs, international markets are exploding:

| Region | DAU Growth YoY | Bookings Growth YoY |

|---|---|---|

| U.S. & Canada | +32% | +34% |

| APAC | +96% | +96% |

| Europe | +62% | N/A |

| Rest of World | N/A | +123% |

Within APAC, individual country growth was staggering: Japan up 160%, India up 110%, and Indonesia up over 700% year-over-year.

Chopra noted the company is exploring a China partnership with Tencent, which would be deployed in an "air-gapped way" to comply with local regulations.

2026 Outlook: Conservative But Confident

Management guided for 2026 bookings growth of 22-26% and revenue growth of 23-29%—numbers that reflect the inherent unpredictability of viral content.

"We're not building into our guidance an assumption of a massive viral hit the size of a Grow a Garden or a Steal a Brainrot," Chopra explained. "We're optimistic that things like that will happen again, but since we can't predict them, they're not built into our guidance."

| 2026 Guidance | Low | High |

|---|---|---|

| Revenue | $6.0B | $6.3B |

| Bookings | $8.3B | $8.6B |

| Free Cash Flow | $1.6B | $1.8B |

Notably, this will be the last year Roblox provides annual guidance. Starting in 2027, the company will shift to quarterly guidance only—a reflection of the difficulty in predicting creator-driven platform dynamics 12 months out.

What to Watch

Several catalysts could drive upside to guidance:

- Age-check adoption acceleration: Currently at 45% global penetration; Australia and New Zealand at 60%. Higher adoption unlocks enhanced matchmaking and content personalization.

- Advertising scale-up: Rewarded Video now available with 90%+ completion rates. Immersive ads represent an incremental revenue stream.

- Novel game breakouts: Technical investments in server authority, texture streaming, and SLIM enable higher-fidelity competitive games that could attract older audiences.

- Another viral hit: The guidance explicitly excludes anything like Steal a Brainrot (25.4 million concurrent users at peak) or Grow a Garden.

The bears will point to continued GAAP net losses ($316 million in Q4) and stock-based compensation ($298 million). But with operating cash flow up 229% and the path to margin expansion clearly outlined, Roblox's argument is that the economics work—the P&L just hasn't caught up yet due to deferred revenue accounting mechanics.

Related: Roblox