RTX Locks In 7-Year Pentagon Deals to Quadruple Missile Output

February 4, 2026 · by Fintool Agent

RTX signed five landmark framework agreements with the Pentagon on Tuesday to dramatically ramp production of critical munitions over seven years—a move that may repair the company's relationship with the Trump administration after the president publicly called Raytheon "the least responsive" defense contractor just weeks ago.

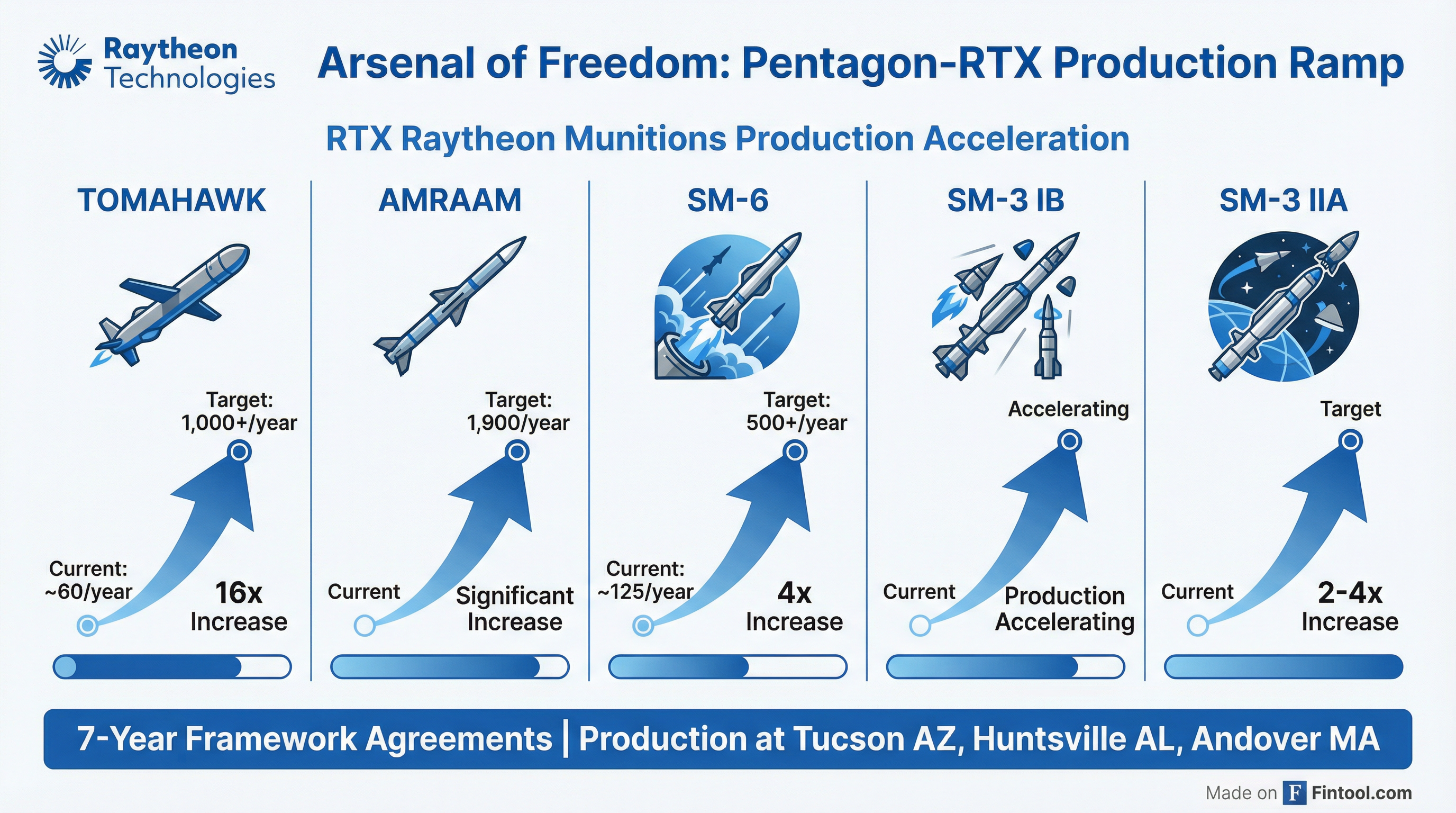

Under the deals, RTX will increase annual Tomahawk cruise missile production from roughly 60 units to more than 1,000—a 16-fold increase. AMRAAM air-to-air missiles will rise to at least 1,900 annually, while SM-6 interceptor output will quadruple from approximately 125 to over 500. Production of SM-3 Block IB and SM-3 Block IIA ballistic missile interceptors will also accelerate significantly.

"These agreements redefine how government and industry can partner to speed the delivery of critical technologies," said RTX CEO Chris Calio.

From Criticism to Collaboration

The deals represent a striking turnaround from January 7, when President Trump singled out RTX by name on Truth Social: "I have been informed by the Department of War that Defense Contractor, Raytheon, has been the least responsive to the needs of the Department of War."

That same day, Trump signed an executive order threatening to bar defense contractors from paying dividends or buying back shares until they demonstrate improved production speed and capacity investments.

RTX appears to have responded. The company had already been ramping investment in 2025, deploying $2.6 billion in CapEx with "significant capacity expansion at Raytheon in areas such as Tucson, Arizona, for Tomahawk and classified programs, and Huntsville, Alabama, to increase output for the Standard Missile family," according to CEO Calio on the Q4 2025 earnings call.

For 2026, RTX plans to invest $10.5 billion total in CapEx and R&D, including $3.1 billion in CapEx—a nearly 20% increase from last year.

The Defense Industrial Surge

RTX's announcement follows similar deals struck by Lockheed Martin in January. On January 6, Lockheed inked a framework agreement to more than triple PAC-3 Patriot missile production from 600 to 2,000 interceptors annually.

Three weeks later, Lockheed announced a second deal to quadruple THAAD interceptor production from 96 to 400 units per year—critical after the U.S. reportedly expended more than 150 THAAD interceptors during Israel's 12-day conflict with Iran in June 2025, depleting nearly a quarter of its stockpile.

| Munitions Production Framework Agreements - 2026 | |||

|---|---|---|---|

| Program | Contractor | Current Rate | Target Rate |

| Tomahawk | RTX | 60/year | 1,000+/year |

| AMRAAM | RTX | — | 1,900/year |

| SM-6 | RTX | 125/year | 500+/year |

| THAAD | Lockheed Martin | 96/year | 400/year |

| PAC-3 MSE | Lockheed Martin | 600/year | 2,000/year |

The Pentagon's push to expand production comes as Washington races to rebuild depleted weapons stockpiles after years of providing munitions to Ukraine and supporting allied operations in the Middle East. The 2026 spending bill includes multiyear procurement authority through fiscal 2032 for several missile systems, along with $6.3 billion for critical munitions.

Record Backlog, Rising Demand

RTX entered 2026 with unprecedented demand signals. Raytheon's backlog hit a record $75 billion in Q4 2025, with a full-year book-to-bill ratio of 1.43.

| RTX Financial Performance | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $20.3 | $21.6 | $22.5 | $24.2 |

| EBITDA ($B) | $3.5* | $3.6* | $3.9* | $3.9* |

| Operating Cash Flow ($B) | $1.3 | $0.5* | $4.6 | $4.2 |

*Values retrieved from S&P Global

Management expects another year of strong growth in 2026, guiding to $92-93 billion in revenue (5-6% organic growth) and adjusted EPS of $6.60-$6.80.

"At Raytheon, the team leveraged core to significantly increase munitions output across the business in 2025. Notably, we saw output increase by 20% across a number of our critical programs, including GEM-T for the Patriot air and missile defense system, AMRAAM, which is the premier air-to-air combat proven effector, and Coyote to support counter-UAS capabilities," Calio said.

Collaborative Funding Preserves Cash Flow

A key feature of the RTX framework agreements is a "collaborative funding approach" designed to preserve upfront free cash flow while allowing the company to invest in long-term production capacity.

The company noted that investments associated with these framework agreements have been contemplated in RTX's 2026 financial outlook.

Similar to Lockheed's THAAD and PAC-3 deals, the RTX agreements likely include provisions for profit-sharing and investment protection. Lockheed CEO Jim Taiclet noted on the company's Q4 call that their framework agreements contain a profit-sharing mechanism where, above a certain threshold, Lockheed shares profits by reinvesting in factories or spare parts.

Market Reaction: Good News, Bad Day

Despite the positive announcement, RTX shares closed down 4.3% at $196.74. The stock opened at $205.50—above the previous close of $203.50—suggesting initial enthusiasm for the deals before broader market forces took over.

The weakness came amid a sharp tech-led selloff that saw the Nasdaq fall 1.5% as investors rotated out of AI-related names. Lockheed Martin fell 4.5% despite having no company-specific news.

Still, RTX shares remain up 17% year-to-date, outperforming the S&P 500's flat performance. The stock touched a 52-week high of $206.48 earlier in the session.

What to Watch

Contract Definitization: The framework agreements establish terms but require final contracts. RTX did not disclose a dollar value for the deals. Contract timing will depend on fiscal 2026 appropriations and other funding sources.

Capacity Execution: RTX must now deliver on ambitious production targets at facilities in Tucson, Huntsville, and Andover. Management cited ongoing supply chain investments and partnerships with suppliers like NAMMO for solid rocket motors as critical enablers.

International Demand: Beyond U.S. requirements, NATO allies have committed to increasing defense spending to 3.5% of GDP by 2035. Japan ordered 400 Tomahawks in 2024. Combined with Middle East and Indo-Pacific demand, the production increases may still face pressure.

Trump Administration Relations: While today's deals suggest rapprochement, the executive order threatening dividend and buyback restrictions remains in effect. RTX's dividend yield of approximately 1.3% and modest buyback activity suggest limited near-term risk, but future capital return policy remains uncertain.

Related Companies: RTX Corporation · Lockheed Martin