Salesforce Lands $5.6B Army Contract for AI-Powered Defense Modernization

January 26, 2026 · by Fintool Agent

Salesforce won a $5.6 billion, 10-year contract with the U.S. Army to deploy its Missionforce National Security platform across the Pentagon, marking the company's largest defense deal ever and a significant expansion of its government business.

The stock rose 0.6% in regular trading to $229.40 and climbed an additional 1.5% after hours to $232.78 following the announcement. While modest on the day, the contract adds significant forward visibility to a company that CEO Marc Benioff has called the government "our largest and most important customer."

Deal Structure

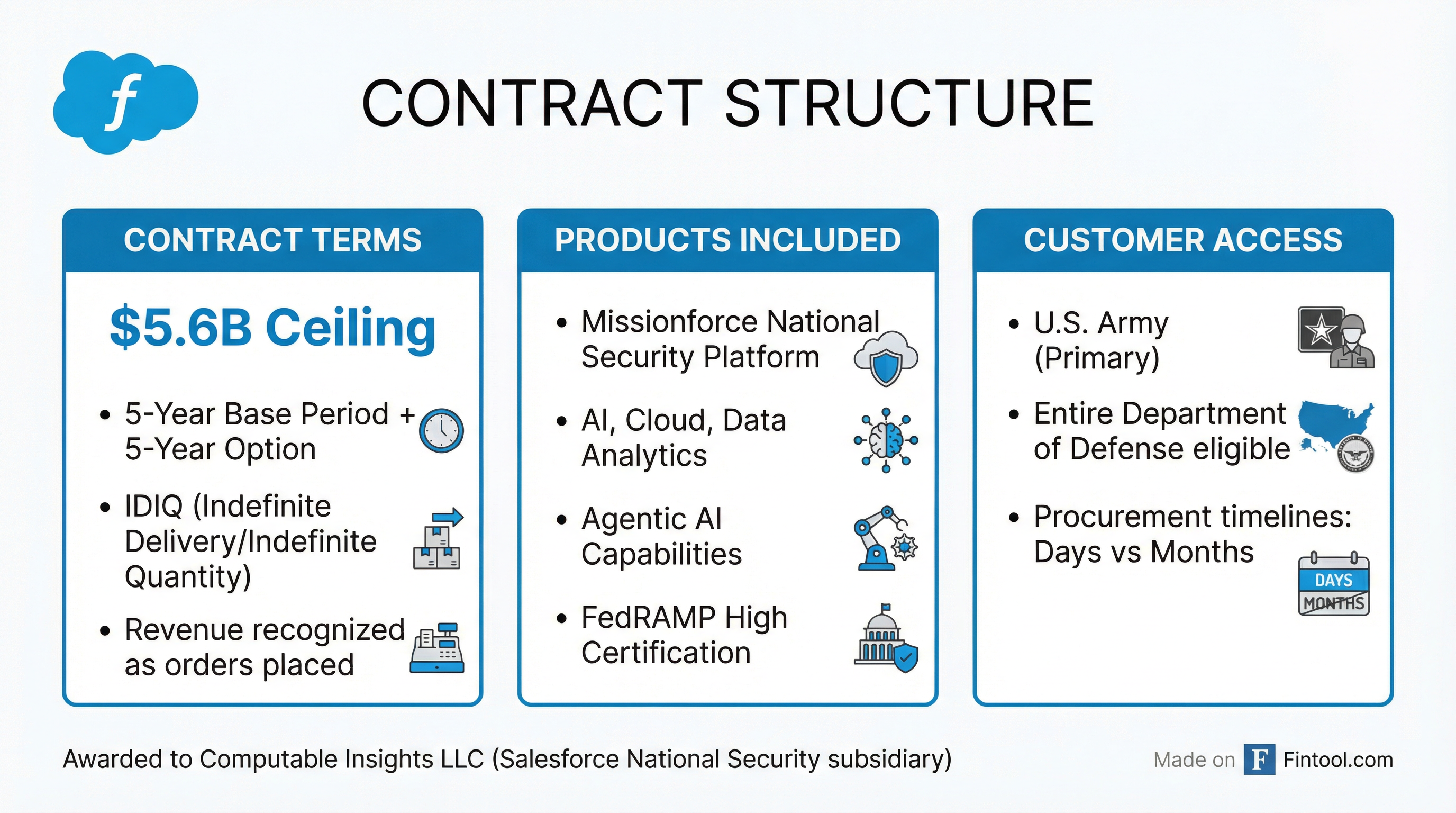

The contract, awarded to Computable Insights LLC (Salesforce's wholly owned national security subsidiary), is structured as an indefinite-delivery, indefinite-quantity (IDIQ) agreement with a 5-year base ordering period and one 5-year optional extension.

Key terms:

- $5.6B ceiling over 10 years (not a guaranteed amount)

- Revenue recognized as orders placed—management will provide financial impact guidance on the Q4 earnings call

- DoD-wide access—while awarded by the Army, the entire Department of War can procure through this vehicle

- Procurement acceleration—reduces acquisition timelines from months to days

What the Pentagon Gets

Through Missionforce National Security, the Department of War gains access to Salesforce's full commercial technology stack adapted for classified environments:

Capabilities included:

- AI, cloud, and data analytics platform

- Agentic AI capabilities—autonomous AI agents for mission support

- FedRAMP High certification for classified environments

- Government Cloud for Top Secret access

- Integration across Army Human Resources Command and Army Accessions Information Environment

"This new contract...will operationalize Missionforce across the Army and DOW, delivering trusted data and seamless interoperability, and supporting the DOW's transformation into an agentic enterprise," said Kendall Collins, CEO of Missionforce and Government Cloud.

The deal positions Salesforce at the center of the Pentagon's AI-first strategy. Defense Secretary Pete Hegseth has pushed aggressively to integrate generative AI across the military, including launching the GenAI.mil platform in December 2025.

Building on Government Momentum

Benioff telegraphed this expansion during the Q2 2026 earnings call, noting the company had "finalized an incredible agreement...with the US Army, a fast pass that enables army teams to quickly access and deploy Salesforce."

Salesforce's government business already includes:

- Veterans Affairs—running core operations

- U.S. Coast Guard—mission-critical systems

- Army Human Resources Command—digital transformation

- Army Accessions Information Environment—recruiting modernization

"Our government is already our largest and most important customer. It's a multibillion dollar customer for Salesforce, and we've been driving efficiency and performance and taxpayer savings for more than a decade," Benioff said on the call.

The Army is already planning to launch a "digital front door" for its human resource command, providing 24/7 AI-powered service and support to soldiers, personnel, and millions of veterans.

Financial Context

| Metric | Q4 2025 | Q1 2026 | Q2 2026 | Q3 2026 |

|---|---|---|---|---|

| Revenue ($B) | $10.0 | $9.8 | $10.2 | $10.3 |

| Net Income ($B) | $1.7 | $1.5 | $1.9 | $2.1 |

| Gross Margin | 77.8% | 77.0% | 78.1% | 78.0% |

| EBITDA Margin | 36.0% | 27.1% | 30.8% | 32.2% |

The $5.6B contract ceiling represents roughly 14% of Salesforce's trailing twelve-month revenue of approximately $40.3 billion, though actual revenue recognition will depend on order volume over the contract term.

Forward estimates (consensus):

| Period | Revenue Estimate | EPS Estimate |

|---|---|---|

| Q4 2026 | $11.2B* | $3.05* |

| Q1 2027 | $11.0B* | $3.01* |

| Q2 2027 | $11.4B* | $3.24* |

*Values retrieved from S&P Global

Competitive Landscape

Salesforce's win carves out a distinct niche in the defense IT market:

| Contract | Ceiling | Vendors | Focus |

|---|---|---|---|

| JWCC (2022) | $9B | AWS, Microsoft, Google, Oracle | Cloud infrastructure |

| C2E (2020) | Multi-billion | AWS, Microsoft, Google, Oracle, IBM | Intelligence Community cloud |

| WildandStormy (2022) | $10B | AWS | NSA classified cloud |

| Salesforce IDIQ (2026) | $5.6B | Salesforce | CRM, AI, data analytics |

While the hyperscalers compete for infrastructure contracts, Salesforce's deal targets the application layer—specifically customer relationship management, data unification, and agentic AI for military operations.

"The move to an IDIQ contract marks a shift from buying software to orchestrating outcomes at scale," said Alan Webber, program vice president for defense and intelligence at IDC.

What to Watch

Near-term catalysts:

- Q4 FY26 earnings call guidance on contract contribution

- Task order awards under the IDIQ framework

- Additional service branch adoptions (Navy, Air Force follow-on)

Risks:

- IDIQ ceiling is not guaranteed revenue—depends on actual orders

- Government contracting subject to budget cycles and political priorities

- Competition from specialized defense contractors (Palantir, CACI, Booz Allen)

Related

- Salesforce — Company profile