Samsung to Ship HBM4 to NVIDIA First, Challenging SK Hynix's AI Memory Dominance

January 25, 2026 · by Fintool Agent

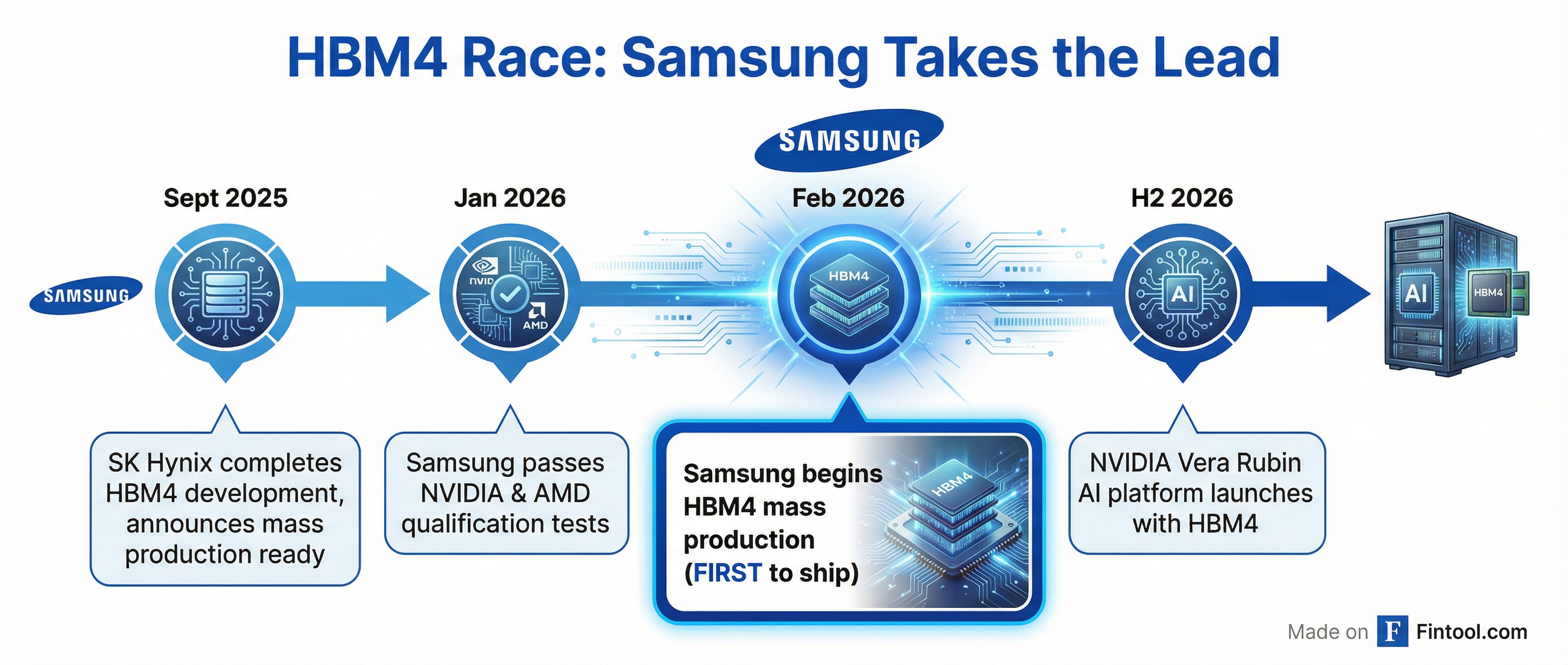

Samsung is set to become the first company to ship HBM4 memory chips to Nvidia, a breakthrough that could reshape the AI memory market where rival SK Hynix has dominated with over 60% share. Production begins next month at Samsung's Pyeongtaek campus, according to Reuters, with the Korean chipmaker also passing qualification tests for AMD.

The news sent Samsung shares up 2.2% in Monday trading while SK Hynix fell 2.9%—a notable divergence ahead of both companies' Q4 earnings reports on Thursday.

From Third Place to First Mover

Samsung's HBM4 breakthrough represents a dramatic reversal for a company that fell to third place in the high-bandwidth memory market just months ago.

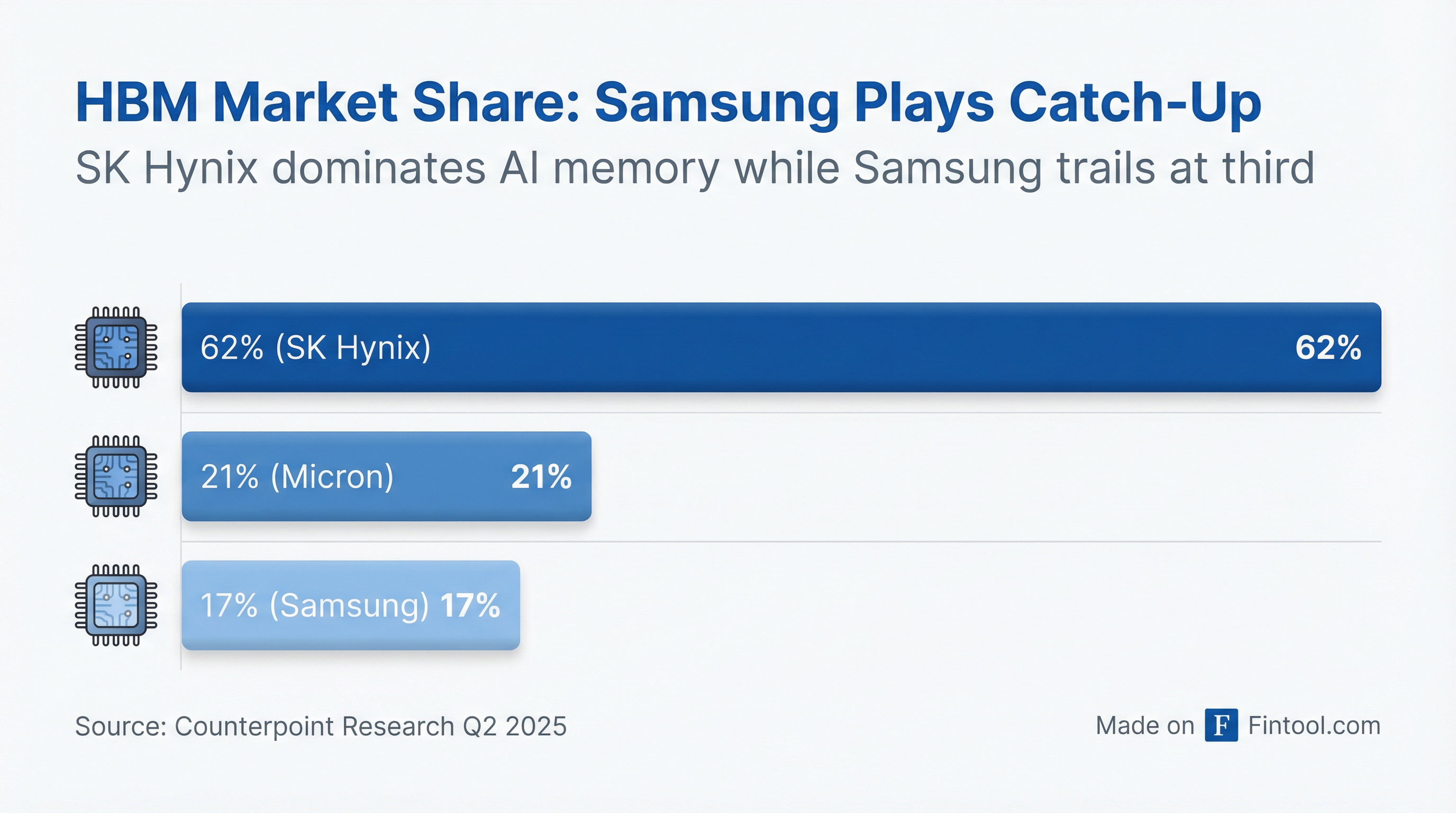

As of Q2 2025, SK Hynix commanded 62% of HBM shipments according to Counterpoint Research, with Micron at 21% and Samsung trailing at 17%. The Korean chipmaker struggled through the first half of 2025 after supply delays hit its earnings, watching SK Hynix lock up NVIDIA's business while Micron claimed the number-two spot.

Now Samsung appears poised to leapfrog both competitors to market with the next generation of AI memory.

"Samsung Is Back"

The February production start validates Samsung co-CEO Jun Young-hyun's January 2 message to employees, when he said customers had praised the company's HBM4 competitiveness with words of encouragement: "Samsung is back."

According to Korea Economic Daily, Samsung passed NVIDIA's rigorous qualification tests and will immediately begin shipping HBM4 to the AI chipmaker. The company also cleared AMD's qualification hurdles, opening a second major customer relationship.

Samsung's HBM4 reportedly achieved 11.7 Gbps in internal testing—an industry-leading figure that exceeds the JEDEC standard of approximately 10 Gbps. The chips will use Samsung's 10nm-class fabrication process for the base die, which the company claims delivers better performance than competitors.

The Vera Rubin Stakes

HBM4 is critical infrastructure for the next wave of AI hardware. Nvidia CEO Jensen Huang has repeatedly cited memory as "one of the largest bottlenecks" for AI systems, with the company consuming more high-speed memory than any other in the world.

Samsung's HBM4 chips will power NVIDIA's Vera Rubin AI accelerator platform, scheduled for launch in the second half of 2026. The platform represents NVIDIA's next major product cycle after Blackwell, which is currently ramping to volume production.

In NVIDIA's most recent earnings call, Huang emphasized the complexity of the HBM supply chain: "Almost every company in the world seems to be involved in our supply chain. We've got great partners—TSMC, Amphenol, Vertiv, SK Hynix, Micron..."

Samsung's name was notably absent from that list. Now, with HBM4 qualification complete, that appears set to change.

Market Implications

The HBM market is experiencing what Bank of America calls a "supercycle similar to the boom of the 1990s." BofA forecasts the HBM market will reach $54.6 billion in 2026, a 58% increase from the prior year, with Goldman Sachs predicting that demand for custom ASIC-based AI chips alone will drive 82% HBM growth.

Counterpoint Research projects Samsung's market share will exceed 30% in 2026 as HBM4 enters full-scale supply—nearly doubling from its current position. UBS had previously forecast SK Hynix would capture approximately 70% of the HBM4 market for NVIDIA's Rubin platform; that estimate may need revision.

For SK Hynix, the competitive pressure intensifies. CEO Kwak Noh-Jung acknowledged in New Year remarks that "AI demand was now a given rather than an upside surprise" and warned "the business environment in 2026 would be tougher than last year."

Both companies report Q4 earnings Thursday, when investors will scrutinize HBM4 order visibility and production capacity guidance.

What to Watch

Thursday's earnings calls: Samsung and SK Hynix report Q4 results. Watch for HBM4 production timeline updates, customer commitments, and capacity expansion plans.

NVIDIA GTC in March: Samsung is expected to make its official HBM4 debut at NVIDIA's GPU Technology Conference, potentially announcing further supply agreements.

Vera Rubin sampling: NVIDIA has already begun sampling next-generation systems to hyperscalers. HBM4 allocation decisions in the coming months will determine supplier share for the 2026-2027 AI infrastructure buildout.

Capacity constraints: Both Samsung and SK Hynix are racing to expand production. Samsung plans to increase HBM capacity by 50% in 2026 to approximately 250,000 wafers per month. Whether supply can meet surging demand will determine pricing power and margins.