SAP Crashes 15% in Worst Day Since 2020 as Cloud Backlog Misses Expectations

January 29, 2026 · by Fintool Agent

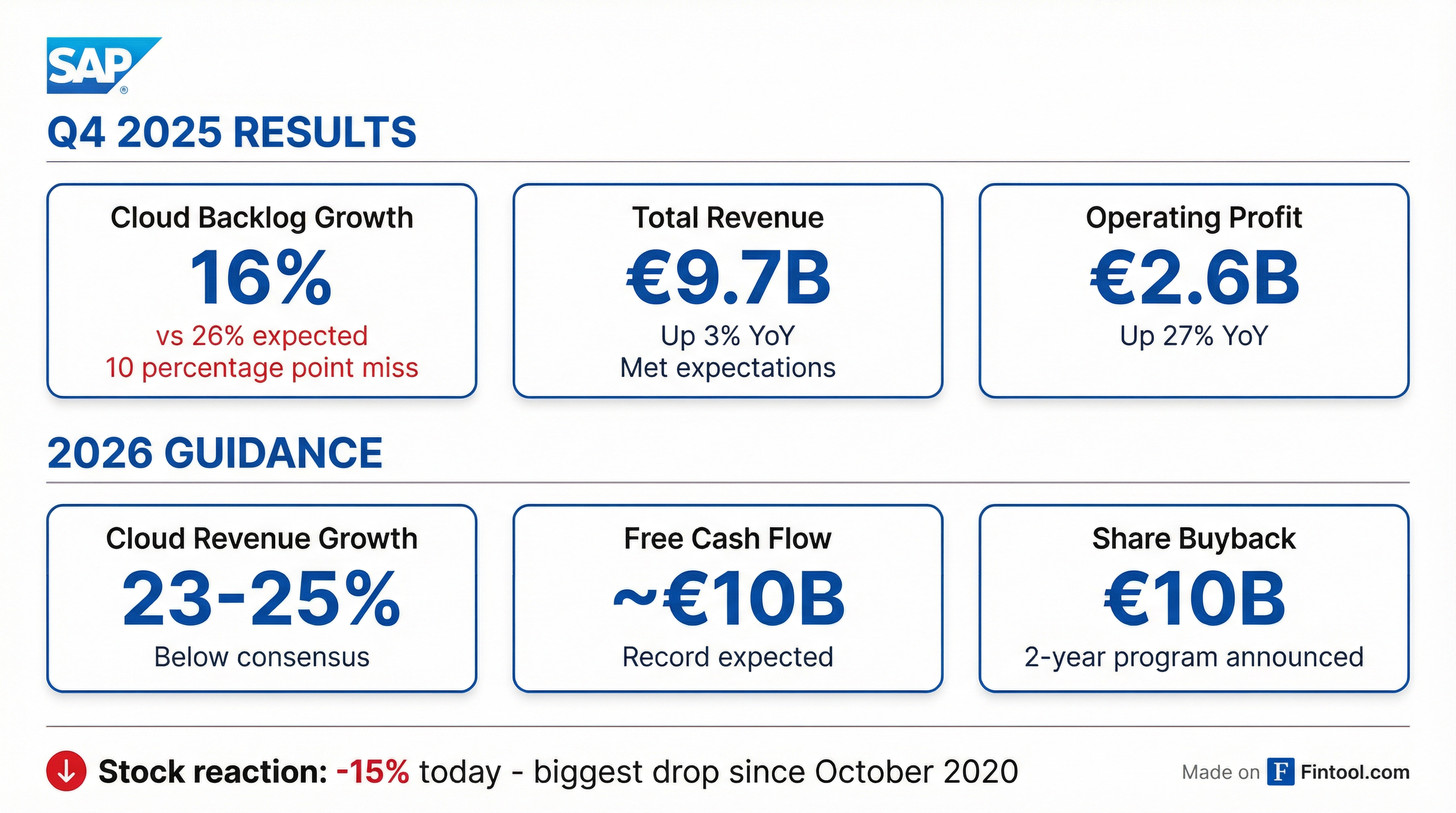

Europe's largest software company just handed investors their worst day in over five years. Sap shares plunged as much as 15% Thursday after the German enterprise software giant reported cloud backlog growth of 16%—far below the 26% analysts expected—wiping roughly $150 billion off its market value from its 2025 peak.

The selloff marks SAP's steepest single-day decline since October 2020, when the stock crashed 22% after a pandemic-driven earnings miss. This time, the trigger is different but equally concerning: mounting evidence that the company's cloud transformation is hitting speed bumps just as AI disruption fears grip the entire enterprise software sector.

The Miss That Moved Markets

SAP's current cloud backlog reached €21.1 billion ($25.3 billion) in Q4, up 16% year-over-year. While that sounds respectable, UBS analysts had been expecting 26% growth—a 10 percentage point gap that sent shockwaves through European markets.

"SAP needed an all-round acceleration to fight the trough sector sentiment, and with puts and takes in the update we see shares underperforming," said Citi analyst Balajee Tirupati.

The company blamed the backlog miss on a shift toward larger transformational deals that take longer to ramp up, combined with increased demand for sovereign cloud solutions driven by geopolitical tensions. These government and defense contracts often include termination-for-convenience clauses that keep them out of near-term backlog calculations.

The Numbers Behind the Pain

While the cloud backlog disappointed, SAP's broader Q4 results were mixed:

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Total Revenue | €9.7B | €9.4B | +3% |

| Operating Profit (IFRS) | €2.6B | €2.0B | +27% |

| Cloud Revenue (FY) | €21.0B | €17.1B | +26% |

| Total Cloud Backlog | €77.3B | €59.5B | +30% |

| Free Cash Flow (FY) | €8.2B | €4.2B | +95% |

Source: SAP Q4 2025 Earnings Report

CEO Christian Klein defended the results, noting that total cloud backlog—which includes longer-term contracted revenue—grew 30% to a record €77 billion. "The significant Current Cloud Backlog growth in Q4 has laid a strong foundation for accelerating Total Revenue growth through 2027," Klein said.

But it was the 2026 guidance that really spooked investors. SAP expects cloud revenue growth of 23-25%—below what many analysts had modeled—and warned that current cloud backlog growth will "slightly decelerate" from the 25% posted in 2025.

CFO Dominik Asam acknowledged this represents a "bigger-than-anticipated slowdown," attributing it to deal mix rather than weakening demand.

The AI Elephant in the Room

Beyond the immediate backlog miss, investors are grappling with a more existential question: Will AI disrupt enterprise software the way it's disrupting other industries?

SAP briefly became Europe's largest company by market cap last March, but gave up that crown later in the year as concerns about AI's potential disruptive effects on legacy software providers intensified.

"What is clear is that one of the killer applications of AI is to completely transform the way companies develop code, i.e. software," CFO Asam told CNBC. "So there is the question, will the customers now not be able to do everything themselves, and that means the pie will shrink?"

Oddo BHF analyst Nicolas David said the sharp decline reflects "overall distrust of the market regarding software names" as investors rotate capital into semiconductors. "In the current context you can't miss by even the slightest portion," he said.

SAP is trying to position itself as a beneficiary rather than victim of AI. The company reports that SAP Business AI was included in two-thirds of Q4 cloud orders, up more than 20 percentage points from Q3. Management claims about 60% of cloud customers are actively using SAP AI, with another 20% in the process of adopting it.

The Buyback Response

In an attempt to shore up investor confidence, SAP announced a new two-year share repurchase program worth up to €10 billion—its largest ever. The buyback will begin in February 2026 and reflects what Asam called "confidence in the business and a commitment to disciplined capital returns."

The company also guided for record free cash flow of approximately €10 billion in 2026, up from €8.2 billion in 2025. SAP has been executing a €3.2 billion restructuring program while migrating legacy database customers to cloud subscriptions. Major Q4 customer wins included Dexco, Lockheed Martin, and Rolls-Royce.

Historical Context: The October 2020 Parallel

Today's crash echoes SAP's October 2020 collapse, when shares dropped 22% after the company slashed its outlook and announced a restructuring plan amid pandemic headwinds. That crisis came as SAP struggled to articulate its cloud strategy and faced mounting competition from nimbler rivals.

Four years later, the company has made significant progress migrating its customer base to cloud products like S/4HANA and Business Technology Platform. The cloud now generates €21 billion in annual revenue. But Thursday's results suggest the transformation remains bumpy—and investors have little patience for stumbles.

What to Watch

Near-term: SAP shares are trading at their lowest level since mid-2024. The €10 billion buyback provides some floor, but sentiment toward enterprise software remains fragile.

Medium-term: Watch Q1 2026 cloud backlog growth for signs of stabilization. SAP warned that currency headwinds will knock about 8% off Q1 cloud revenue growth.

Long-term: The €77 billion total cloud backlog represents significant contracted future revenue. If SAP can convert this backlog while maintaining its AI positioning, the current selloff may prove overdone. But if cloud growth continues to decelerate, today's crash could be just the beginning.