Schneider Taps 27-Year Veteran Jim Filter as CEO, Mark Rourke Moves to Executive Chair

January 28, 2026 · by Fintool Agent

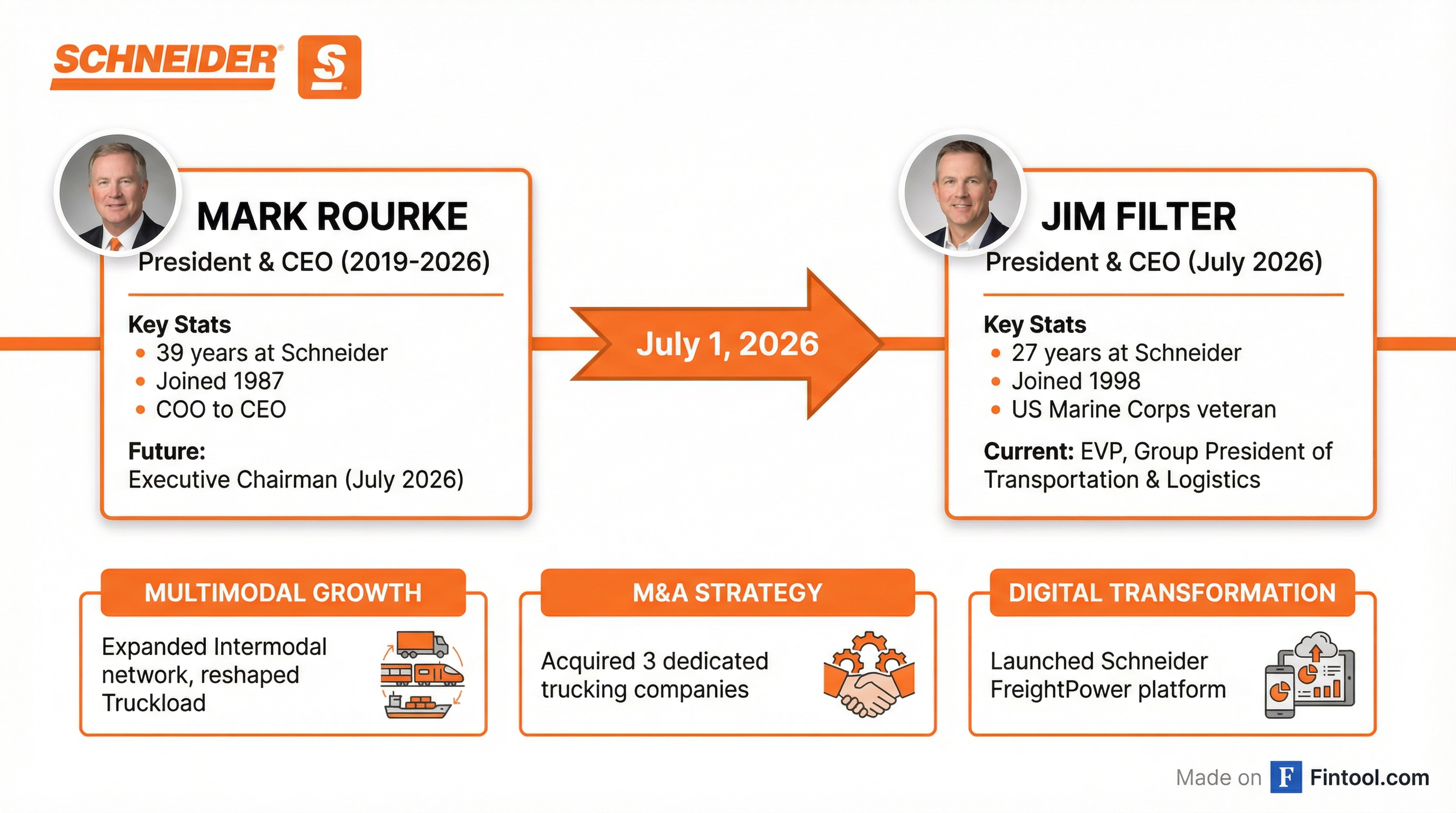

Schneider National-1.47% has named Jim Filter as its next President and CEO, promoting the 27-year company veteran to succeed Mark Rourke, who will become Executive Chairman effective July 1, 2026.

The planned transition—part of Schneider's multi-year succession planning process—comes as the trucking giant navigates its way through one of the longest freight recessions in industry history while positioning for an eventual market recovery.

Shares rose 2.2% to $30.21 on the news, touching a new 52-week high of $30.98.

The New Guard

Filter, 54, brings deep operational expertise forged through nearly three decades at the Green Bay, Wisconsin-based carrier. He has served as Executive Vice President and Group President of Transportation and Logistics since April 2022, overseeing all three of Schneider's operating segments: Truckload, Intermodal, and Logistics.

His path to the top reflects the classic Schneider career arc: Filter joined the company in 1998 as a Maintenance Team Leader after serving in the United States Marine Corps. He subsequently held leadership roles including Division General Manager positions in Logistics & Supply Chain Management, Mexico Operations, and Intermodal before advancing to Senior Vice President-General Manager of Intermodal and Chief Commercial Officer.

"I am honored to take the helm at Schneider and continue to build on the momentum Mark and our team have created," Filter said. "Schneider is well positioned for significant growth, and I'm eager to lead our talented team in advancing our technology solutions, expanding our multimodal network, and driving operational growth and excellence."

Rourke's Legacy: Steering Through the Storm

Mark Rourke's tenure as CEO will be remembered for guiding Schneider through extraordinary market volatility—from pandemic-era freight boom to the industry's most punishing downcycle in recent memory.

Rourke joined Schneider in 1987 as a service team leader and rose through the ranks over 32 years before taking the CEO role in 2019. Under his leadership, Schneider expanded its Intermodal network, transformed Truckload into a preeminent Dedicated carrier through both organic growth and acquisitions, and launched the Schneider FreightPower digital freight platform.

The financials tell the story of a CEO who navigated extraordinary cyclicality:

| Metric | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|---|

| Revenue ($B) | $4.55* | $5.61* | $6.60* | $5.50* | $5.29* |

| Net Income ($M) | $212* | $405* | $458* | $239* | $117* |

| EBITDA Margin (%) | 12.5%* | 14.6%* | 14.9%* | 11.8%* | 10.4%* |

*Values retrieved from S&P Global

Revenue peaked at $6.6 billion during the 2022 freight boom, when trucking capacity was tight and rates soared. The subsequent freight recession—which industry analysts describe as one of the longest and most difficult downcycles in history—has compressed margins across the sector as overcapacity and weak demand persist.

Stock Performance Under Rourke

Despite the challenging freight environment, Schneider shares have delivered solid returns under Rourke's leadership:

The stock has gained approximately 59% since Rourke became CEO in early 2019, weathering both the COVID crash (when shares bottomed at $15.36 in March 2020) and the freight recession low ($20.11 in October 2024). The 12% rally year-to-date in 2026 suggests investors are optimistic about the company's positioning for an eventual freight market recovery.

Why Filter, Why Now?

The timing of this succession appears deliberate rather than reactive. There is no evidence of activist pressure, scandal, or board dissatisfaction—the 8-K explicitly frames this as a "comprehensive multi-year succession planning process aligned with the company's growth strategy."

Filter's selection signals continuity with an operational edge. As the executive overseeing all three of Schneider's operating segments, he has been the architect of the company's day-to-day response to the freight recession. He has appeared frequently on earnings calls alongside Rourke, addressing questions on pricing discipline, capacity management, and the dedicated trucking pipeline.

Board Chair James Welch will transition to the newly created role of Lead Independent Director, ensuring governance continuity as Rourke shifts to Executive Chairman.

Compensation Package

Filter's CEO compensation reflects the magnitude of the role:

| Component | Value |

|---|---|

| Base Salary | $775,000 |

| Annual Cash Incentive (Target) | $969,000 (125% of base) |

| Long-Term Equity Incentive | $3,300,000 |

Rourke's salary will be reduced to $750,000 as Executive Chairman, though his fiscal 2026 incentive compensation will be based on his current CEO role.

Industry Context: Freight Recession Bottoming

Filter inherits a company navigating what ACT Research calls "one of the longest, most difficult downcycles in recent history." The trucking industry has been mired in a freight recession since mid-2022, characterized by weak demand, elevated costs, and sustained margin compression.

However, there are signs the worst may be over. Schneider has reported sequential earnings improvement for several quarters, driven by cost discipline and modest pricing gains. Management noted on the Q2 2025 call that the company has "demonstrated the ability to grow earnings through uncertainty" based on structural actions within its control.

The dedicated trucking pipeline—Filter's direct responsibility—is described as "robust" with multiple large late-stage opportunities.

What to Watch

July 1, 2026: The official transition date when Filter assumes the CEO role and Rourke becomes Executive Chairman.

Q3 2025 Earnings (expected late October): Filter's final earnings call as Group President before assuming the CEO title—watch for any preview of strategic priorities.

Freight Market Inflection: Industry analysts expect capacity contraction to accelerate in 2026, potentially setting the stage for a rate recovery. Filter's ability to capitalize on this turning point will define his early tenure.

M&A Activity: Schneider has signaled appetite for more dedicated trucking acquisitions, with CEO Rourke previously stating the company would like to complete a purchase "every 12 to 18 months." Whether Filter maintains this M&A tempo will signal strategic continuity or evolution.

Related Companies: Schneider National (sndr)-1.47%