SenesTech CEO Joel Fruendt to Retire After Launching Evolve, Record Revenue

January 28, 2026 · by Fintool Agent

Senestech CEO Joel Fruendt announced his retirement after a three-year tenure that saw the micro-cap rodent control company launch its flagship Evolve product, achieve record quarterly revenues, and secure distribution across major retailers including Amazon, Lowe's, Home Depot, and Walmart.

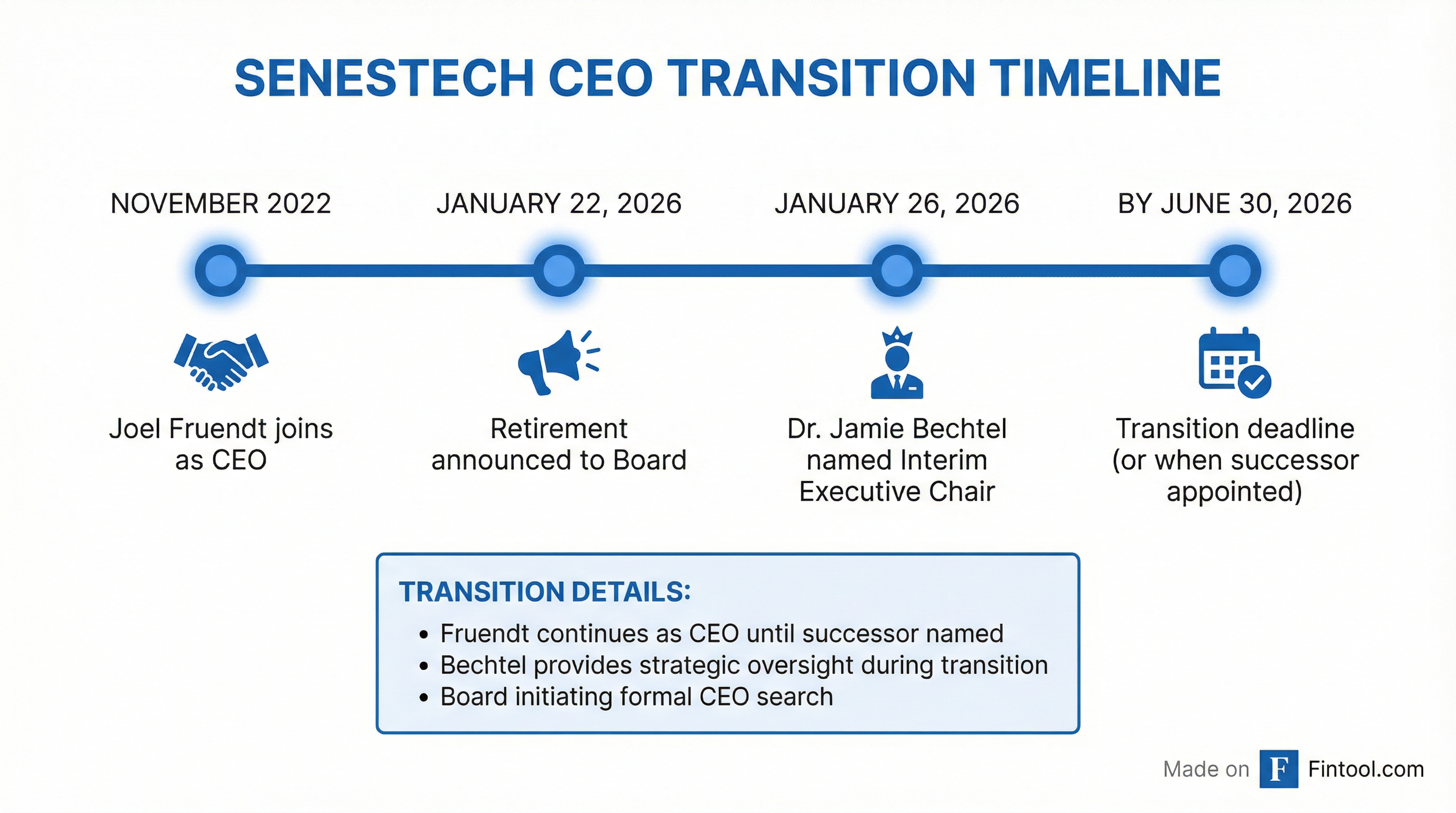

The $10 million market cap company disclosed the transition in an 8-K filed today, revealing Fruendt notified the board on January 22, 2026. He will continue as President and CEO until the earlier of June 30, 2026 or when a successor is appointed. Board Chair Dr. Jamie Bechtel was named Interim Executive Chair on January 26 to support the transition.

"Joel has played a pivotal role in positioning SenesTech for future growth, particularly through the successful launch of Evolve, and a renewed focus on operational execution," Bechtel said in a press release.

Shares are trading at $1.93, down roughly 5% since the retirement was announced internally on January 22. The stock is near its 52-week low of $1.30 hit in April 2025, well off its August peak of $6.24.

The Fruendt Era: From ContraPest to Evolve

Fruendt joined SenesTech in November 2022, succeeding Ken Siegel with a mandate to commercialize the company's fertility-based rodent control technology. A pest control industry veteran with 15 years at Clarke Environmental, Fruendt brought distribution expertise to a company struggling to gain market traction with its original ContraPest product.

The transformation came through Evolve—a reformulated soft bait that replaced ContraPest's liquid delivery system. Under Fruendt, the company pivoted its go-to-market strategy from professional pest management to consumer retail channels.

The results speak to the commercial progress:

| Metric | Q4 2023 | Q3 2025 | Change |

|---|---|---|---|

| Quarterly Revenue | $295K | $690K | +134% |

| Gross Margin | 44% | 63% | +19 pts |

| Cash Position | $5.4M | $7.3M | +35% |

E-commerce now represents 54% of revenue, with Amazon posting double-digit monthly growth. Retail partnerships expanded to include Ace Hardware (254% year-over-year sales growth), Home Depot, Walmart, and most recently Lowe's.

Municipal deployments in New York City, Chicago, and Baltimore demonstrated the product's efficacy, with one Chicago customer noting: "We now see in a week the rat activity we used to see in a day."

The Unfinished Business: Profitability Still Elusive

For all the commercial progress, SenesTech remains unprofitable. The company posted a $1.3 million net loss in Q3 2025, though Fruendt emphasized this represented the "best adjusted EBITDA loss in the company's history."

| Period | Net Loss | Adj. EBITDA Loss |

|---|---|---|

| Q3 2024 | $(1.5M) | $(1.4M) |

| Q3 2025 | $(1.3M) | $(1.2M) |

The path to profitability remains the successor's primary challenge. Management has outlined a roadmap: continued revenue growth at current 43% year-over-year rates, maintaining 63% gross margins, and disciplined operating expense control.

"We see a potential path to the future that may not require further equity offerings," Fruendt told investors in November's earnings call.

That optimism comes with caveats. SenesTech executed two reverse stock splits during Fruendt's tenure—a 1-for-12 in November 2023 and 1-for-10 in July 2024—to maintain Nasdaq listing compliance. The company also faces litigation from Levatech, a rodenticide manufacturer alleging NDA violations and IP infringement—claims the company calls "baseless."

Transition Structure

The separation agreement provides Fruendt with:

- Cash severance: Base salary continuation through December 15, 2026

- Healthcare: Premium payment or reimbursement through December 31, 2026

- Equity: Acceleration of unvested stock options

Bechtel's Interim Executive Chair role—compensating $247,500 annually on top of board fees—focuses on strategic alignment and board-management communication rather than day-to-day operations.

The company has not disclosed criteria for the CEO search or a target timeline beyond the June 30 deadline.

What to Watch

Near-term catalysts:

- Q4 2025 earnings (expected February 2026) will show holiday season e-commerce performance

- Lowe's brick-and-mortar pilot potentially in ~100 stores by Q2 2026

- CEO search progress and candidate announcements

Key risks:

- Leadership uncertainty could slow retail partnership negotiations

- Continued losses may require dilutive capital raises despite management optimism

- Levatech litigation outcome remains unpredictable

For a $10 million market cap company, the CEO transition represents significant operational risk. The board's ability to attract qualified candidates willing to lead a pre-profit micro-cap will be the ultimate test of whether Fruendt's commercial foundation can translate to shareholder value.