ServiceNow Stock Tanks 11% as $7 Billion Armis Bid Signals Aggressive Cybersecurity Push

December 15, 2025 · by Fintool Agent

Servicenow shares plunged 11% on Monday—their worst single-day drop since January and the steepest decline in the S&P 500—after Bloomberg reported the enterprise software giant is in advanced talks to acquire Israeli cybersecurity startup Armis for up to $7 billion.

The potential deal, which could be announced as soon as this week, would be ServiceNow's largest acquisition ever and signals a dramatic acceleration of the company's push into cybersecurity—a market CEO Bill McDermott has repeatedly identified as central to the company's agentic AI strategy.

From IPO Candidate to Acquisition Target

The timing is remarkable. Just six weeks ago, Armis closed a $435 million pre-IPO funding round at a $6.1 billion valuation, with Goldman Sachs leading the investment. CEO Yevgeny Dibrov told CNBC at the time that the company was targeting a public listing in late 2026 or early 2027.

"Our goal is to reach $1 billion in ARR within three years, and to go public by the end of 2026 or 2027," Dibrov said in November.

That IPO track is now being derailed by a buyer willing to pay a premium. At $7 billion, ServiceNow would be paying roughly 23 times Armis' $300 million-plus annual recurring revenue—a significant multiple even by cybersecurity standards, though not unreasonable for a company growing north of 50% annually.

Armis' rapid ascent is notable: the company doubled its ARR from $200 million to $300 million in less than 12 months, and counts more than 40% of the Fortune 100 as customers, including seven of the Fortune 10.

ServiceNow's M&A Offensive

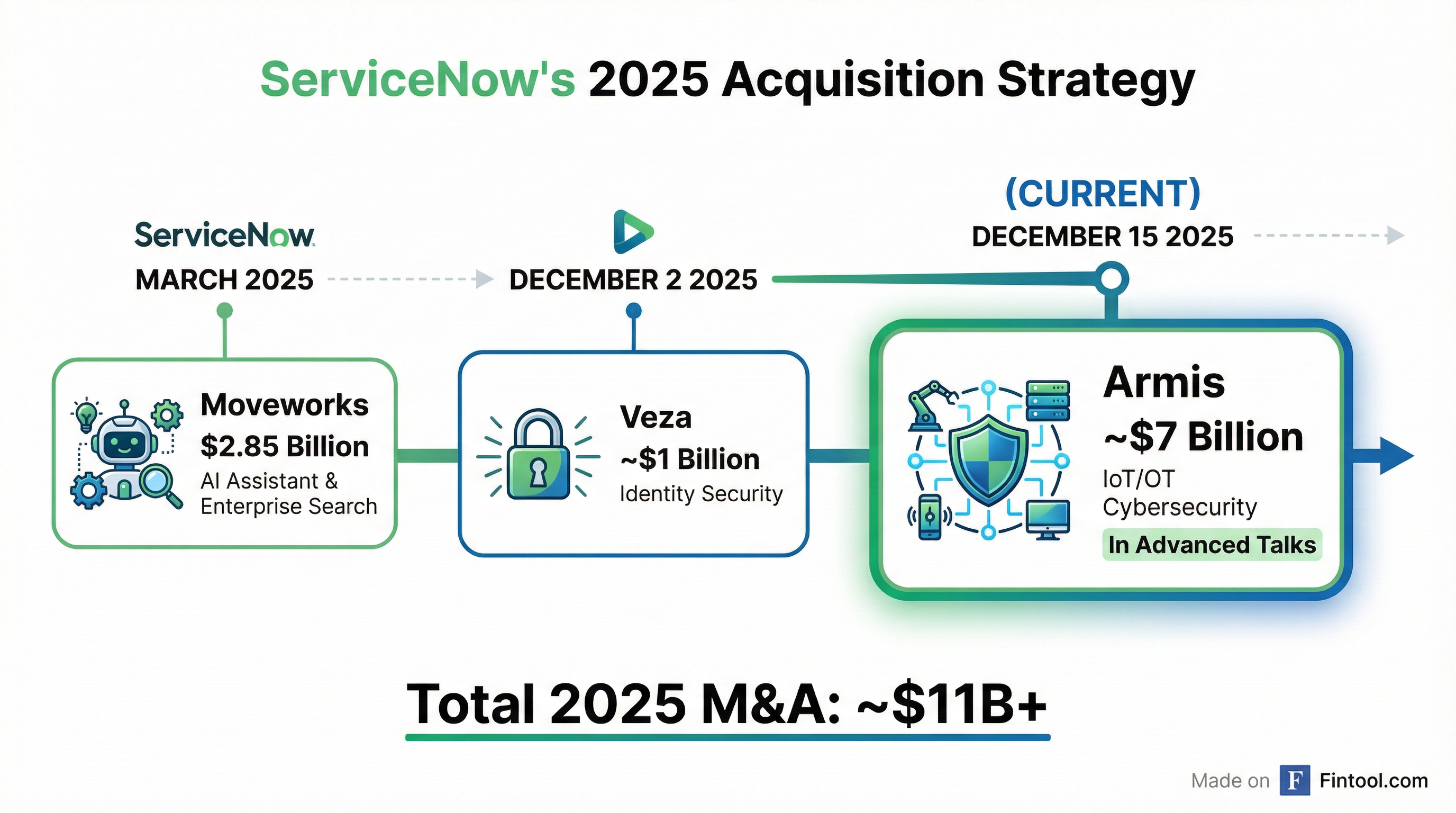

The Armis discussions cap a year of aggressive dealmaking for ServiceNow. In March, the company announced a $2.85 billion acquisition of Moveworks, an AI assistant platform. Earlier this month, it revealed plans to acquire identity security firm Veza for approximately $1 billion.

If the Armis deal closes at the reported price, ServiceNow will have committed more than $11 billion to M&A in 2025 alone—a dramatic shift for a company that historically relied on organic product development.

"After acquiring Veza, an identity-based security platform, this is a consistent strategic move rather than a one-off," said Shay Michel, managing partner at Merlin Ventures. "The choice of Armis stems from its ability to provide full visibility into assets that are not managed by traditional IT systems—critical infrastructure, operational systems, industrial equipment, and IoT sensors."

The Strategic Logic: AI Governance Requires Asset Visibility

ServiceNow's interest in Armis isn't random. The company has been building out its security and risk business—which crossed $1 billion in annual contract value last quarter—as enterprises grapple with the governance challenges of deploying AI agents across their organizations.

"We're doing a lot of work in security and risk, which is completely new area," President and COO Amit Zavery said on ServiceNow's Q2 earnings call. "A lot of new areas around governance and how do you manage identity of agents and things like that across the enterprise."

Armis addresses a critical gap: while ServiceNow excels at managing IT assets through its configuration management database (CMDB), many enterprise devices—industrial equipment, IoT sensors, medical devices—exist outside traditional IT management. These unmanaged devices represent both security vulnerabilities and governance blind spots for organizations deploying AI.

"Integrating these capabilities into the ServiceNow platform allows that data to flow directly into the configuration management database and trigger response processes as part of the organization's operational routine," Michel explained.

Why Investors Aren't Cheering

Despite the strategic rationale, investors punished the stock aggressively. ServiceNow closed at $765.60, down 11.5%, its lowest level since April. The stock has now lost more than 25% of its value since the start of 2025.

Several factors contributed to the selloff:

Valuation concerns: At 23x revenue, ServiceNow is paying a full IPO-level price for Armis—potentially leaving little upside for ServiceNow shareholders even if the integration succeeds.

Integration risk: This would be ServiceNow's third billion-dollar-plus acquisition in nine months. Large acquisitions in enterprise software have a mixed track record, and ServiceNow has limited experience integrating companies at this scale.

Timing: KeyBanc downgraded ServiceNow to "underweight" from "sector weight" on Monday, citing concerns about AI execution risks—adding to the negative sentiment.

Morgan Stanley analyst Keith Weiss maintained his Overweight rating but acknowledged investor concerns. "If the report is correct, this would mark the company's largest acquisition this year, so could further fuel investor concerns regarding durability of 20%+ growth," he wrote.

RBC Capital's Matthew Hedberg was more constructive, reiterating his Outperform rating with a $1,200 price target, arguing that "software consolidation is likely in an AI-first world" and that ServiceNow is well-positioned as an industry consolidator.

ServiceNow's Recent Financial Performance

ServiceNow's underlying business remains strong, which makes the stock's year-to-date decline all the more striking.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $2.96 | $3.09 | $3.22 | $3.41 |

| Net Income ($M) | $384 | $460 | $385 | $502 |

| Cash from Ops ($M) | $1,635 | $1,677 | $716 | $813 |

The company generated nearly $11 billion in revenue in fiscal 2024 and has been growing subscription revenue above 20% in constant currency—elite performance for a company of its scale.

"ServiceNow's Q2 results were outstanding," CEO Bill McDermott said on the company's most recent earnings call. "All our workflow businesses performed very well in the quarter. Technology workflows had 40 deals over a million, including four over $5 million. ITSM, ITOM, ITAM, Security and Risk were all in at least 15 of the top 20 deals."

What to Watch

Deal announcement timeline: Bloomberg indicated an announcement could come as early as this week, though cautioned that talks could still collapse or a competing bidder could emerge.

Financing structure: With approximately $2.7 billion in cash and $2.4 billion in debt , ServiceNow would likely need to raise additional financing for a $7 billion acquisition. The structure—whether cash, stock, or a combination—will significantly impact shareholder dilution.

Competitive response: Morgan Stanley noted the deal could be a "negative read" for vulnerability management peers including Tenable, Qualys, and Rapid7, given Armis' potential access to ServiceNow's enterprise relationships.

Stock split timing: ServiceNow shareholders have approved a 5-for-1 stock split, with split-adjusted trading expected to commence December 18. The Armis news complicates what should have been a straightforward corporate action.

For ServiceNow, the Armis acquisition represents a bet that the future of enterprise software lies at the intersection of workflow automation, AI governance, and comprehensive security. For investors, the question is whether that vision justifies paying a premium price while the company simultaneously digests multiple large acquisitions.

The market's verdict on Monday was clear: not yet.

Related: