Silver Smashes Through $100 for the First Time in History as Supply Squeeze Intensifies

January 23, 2026 · by Fintool Agent

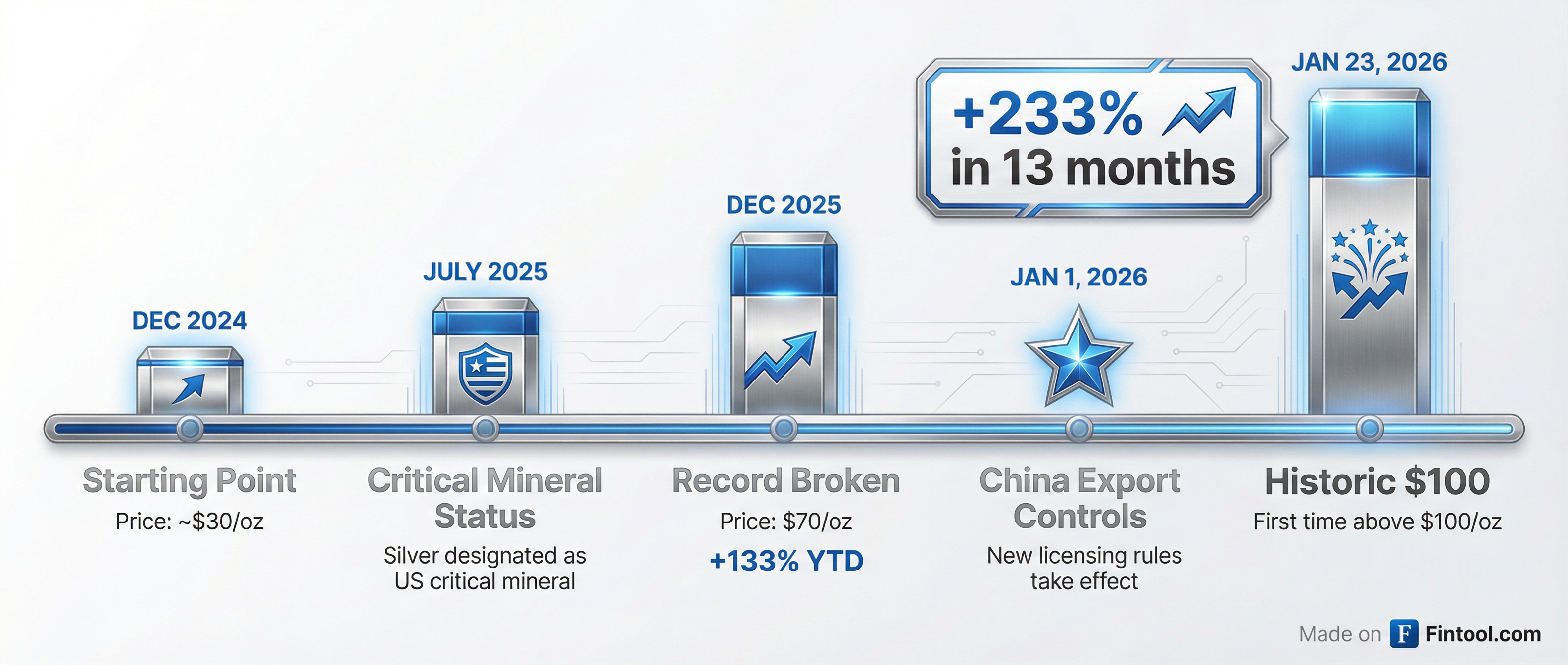

Silver blasted through the $100-per-ounce barrier for the first time in history on Friday, completing a 233% rally from $30 in December 2024 as China's export controls, chronic supply deficits, and surging industrial demand converge in what analysts are calling a "perfect storm" for the white metal.

Spot silver hit a record high of $100.19 per ounce in morning trading before settling around $100.10—a psychological milestone that traders have been eyeing since the metal breached $90 earlier this month . The move extends an extraordinary run that has seen silver more than triple in just over a year, dramatically outperforming gold's already impressive 64% gain.

"Faith in the U.S. and its assets have been shaken, maybe permanently, and this is driving money into precious metals. So the word rupture has been thrown around. I don't think that's an exaggeration," said Kyle Rodda, a senior market analyst at Capital.com .

Four Forces Driving the Rally

Silver's ascent has been nothing short of spectacular—tripling from around $30 per ounce at the end of 2024 to breach $100 today. Understanding what's behind this historic move requires examining four converging forces.

1. China's Export Crackdown

Effective January 1, 2026, China implemented strict new export licensing requirements that have fundamentally reshaped global silver supply chains . The new rules require exporters to meet two criteria:

- Minimum annual production of 80 tonnes

- Credit line of at least $30 million

This policy has slashed the number of eligible exporters to just 44 companies—down from hundreds previously—effectively restricting 60-70% of the world's refined silver supply .

"Prior to the introduction of the new export requirements, supply of physical silver was already tight," said Rich Checkan, president and COO of Asset Strategies International. "Last year was the fifth straight year of deficit production, bringing the physical silver deficit to just under a quarter of a billion ounces... 230 million to be exact" .

2. Structural Supply Deficit

The silver market has been in deficit for five consecutive years, with total supply in 2025 estimated at roughly 813 million ounces against demand of approximately 1.24 billion ounces .

A critical challenge is that only about 27% of silver output comes from primary silver mines—the rest is produced as a byproduct of copper, lead, zinc, and gold mining. This limits the industry's ability to respond quickly to higher prices and surging demand .

Meanwhile, inventories in London, China, and the United States have fallen to their lowest levels in years, reinforcing the tight market backdrop.

3. Industrial Demand Explosion

Unlike gold, silver has significant industrial applications that are driving structural demand growth:

| Sector | Silver Usage | Growth Driver |

|---|---|---|

| Solar Panels | 20 grams per panel | 70 GW of US capacity additions forecast for 2026-2027 could absorb 143M oz |

| Electric Vehicles | More than ICE vehicles | High-voltage components and power electronics |

| AI Data Centers | Growing rapidly | Silver is the most conductive metal, critical for high-density computing |

| Electronics | 15% of demand | Smartphones, computers, 5G infrastructure |

China is facing surging domestic demand from its booming solar panel manufacturing and EV sectors—a key motivation behind its export restrictions. By restricting exports, Beijing is effectively elevating silver to the status of a strategic mineral .

4. Safe-Haven Demand

Geopolitical tensions have supercharged investment flows into precious metals. The Trump administration's recent tariff threats on Europe, concerns over Federal Reserve independence, and ongoing Middle East tensions have driven investors toward traditional safe havens .

The U.S. government's $1.8 trillion budget deficit in fiscal 2025, which propelled the national debt to a record $38.5 trillion, has heightened concerns about currency debasement—making hard assets like silver more attractive .

The Historic Journey to $100

Silver's path to $100 has been a remarkable year-long journey:

| Date | Price | Event |

|---|---|---|

| December 2024 | $30/oz | Starting point before rally accelerated |

| July 2025 | $52/oz | US designates silver as critical mineral |

| December 23, 2025 | $70/oz | Silver breaks $70 for first time |

| January 1, 2026 | $84/oz | China export controls take effect |

| January 11, 2026 | $84/oz | Fed crisis drives precious metals surge |

| January 23, 2026 | $100/oz | Historic $100 milestone |

The $100 mark is a "psychological price level" that analysts say could trigger additional momentum buying from investors who have been waiting on the sidelines .

Gold Also Nearing $5,000

Silver's rally is part of a broader precious metals surge. Gold hit a record high of $4,887.82 per ounce on Wednesday and is now within striking distance of the psychologically important $5,000 level .

Goldman Sachs raised its year-end 2026 gold price forecast by more than 10% to $5,400 per ounce, up from $4,900 previously. The bank cited strong private-sector diversification into gold on top of already-robust central bank demand .

"The rally has accelerated since 2025 because central banks started competing for limited bullion with private sector investors," wrote Goldman analysts Daan Struyven and Lina Thomas .

| Bank | 2026 Target | Key Thesis |

|---|---|---|

| Goldman Sachs | $5,400/oz | Private sector + central bank diversification |

| JP Morgan | $5,055/oz avg by Q4 | Central bank buying averaging 566 tonnes/quarter |

| Peter Schiff | $6,000/oz | Extreme geopolitical scenario |

How to Play the Rally

Investors have multiple ways to gain exposure to silver's rally:

Silver ETFs

| ETF | Ticker | Strategy | 2026 YTD Return |

|---|---|---|---|

| Ishares Silver Trust | SLV | Direct physical silver exposure | +25% |

| SPDR Gold Shares | GLD | Gold exposure for diversification | +12% |

The iShares Silver Trust has returned 144% in 2025 and is already up 25% in the first three weeks of 2026, tracking silver's explosive move .

Silver Miners

Mining stocks offer leveraged exposure to silver prices, as their earnings amplify when metal prices rise faster than costs:

| Company | Ticker | Focus | Market Cap |

|---|---|---|---|

| Pan American Silver | PAAS | Largest primary silver miner | $24.2B |

| First Majestic Silver | AG | Pure-play silver producer | $10.9B |

| Endeavour Silver | EXK | Mexico-focused silver miner | $3.6B |

| Silvercorp Metals | SVM | China-focused silver producer | $2.6B |

"Silver can rise more than gold this year, especially since the growth parity hasn't been filled yet and governments haven't stockpiled silver like they have with gold," explains Achilleas Georgolopoulos, senior market analyst at Tradu.com .

What Could Derail the Rally?

While the structural case for silver remains compelling, investors should be aware of potential headwinds:

China Policy Reversal: If China removed or relaxed its export restrictions, silver would almost certainly experience a sharp correction. The country has enormous power over this market .

Historical Volatility: Prior to 2025, silver hadn't set a new record high in 14 years, and it suffered declines of over 70% on more than one occasion following powerful rallies in the past .

Tariff Headwinds: Trump's decision to hold off import duties on critical minerals has eased some tightness concerns. Additionally, global economic headwinds from broader tariffs could dampen industrial consumption .

What to Watch

Near-term catalysts:

- Gold's approach to $5,000—could trigger momentum buying across precious metals

- Federal Reserve policy signals and rate cut timing

- Further China export policy developments

- Solar and EV production data showing silver consumption trends

Longer-term:

- Whether the supply deficit persists or miners can ramp production

- Central bank behavior toward silver as a reserve asset

- Industrial demand trajectory from green energy transition

For investors who've missed the initial run from $30 to $100, the question is whether this is the beginning of a new paradigm for silver—or the late stages of a speculative surge. The structural forces of supply constraints, industrial demand, and safe-haven buying suggest the former, but silver's historical volatility counsels caution against over-concentration.

Related Companies: Ishares Silver Trust | Pan American Silver | First Majestic Silver | Endeavour Silver | Silvercorp Metals | SPDR Gold Shares | Newmont | Wheaton Precious Metals