Silver Surges Past $90, Analysts See Path to $150 as 'All Roads Lead to Precious Metals'

January 14, 2026 · by Fintool Agent

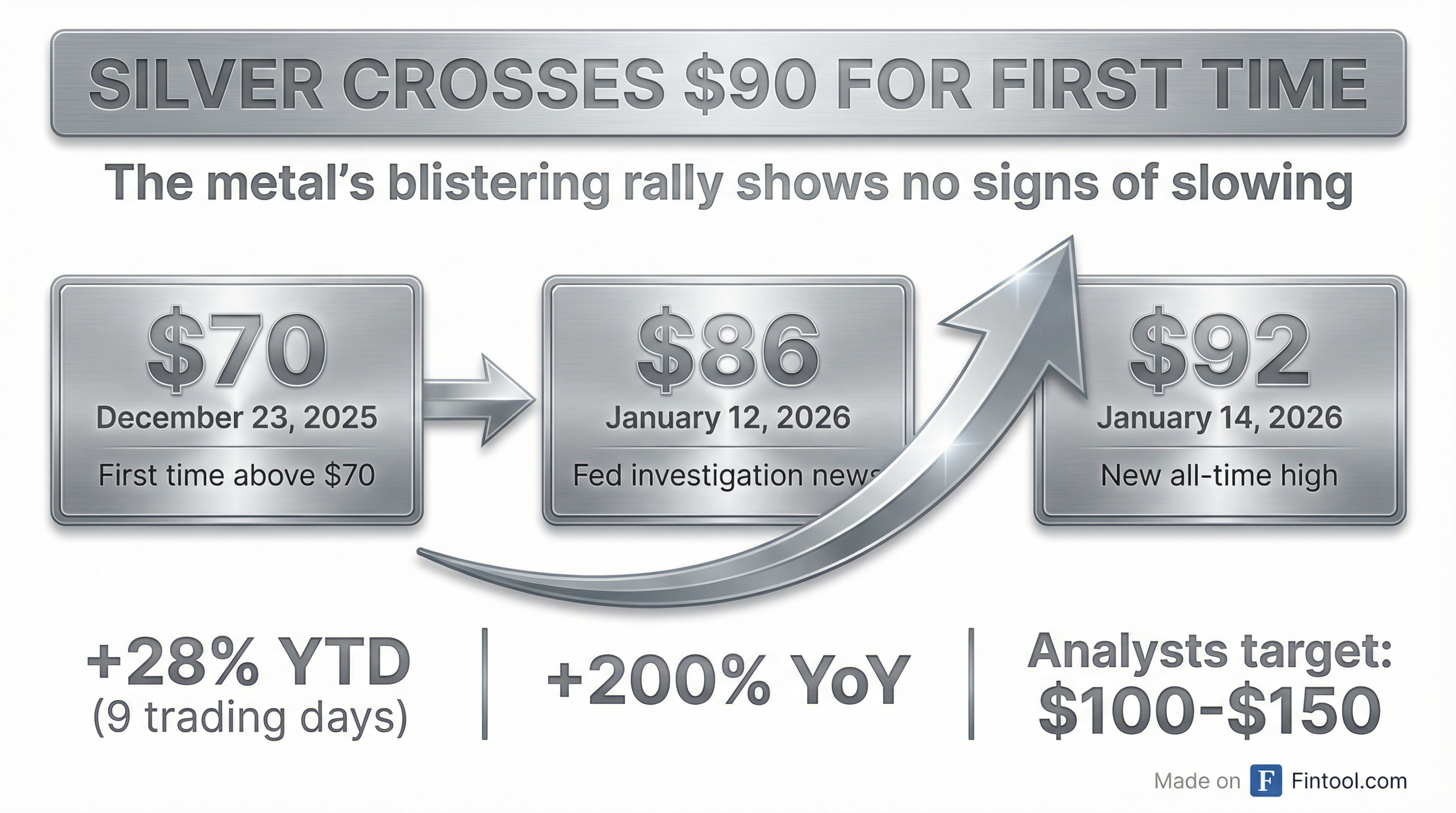

Silver exploded past $90 per ounce for the first time in history on Wednesday, hitting an intraday record of $92.23 as investors stampeded into precious metals amid concerns about Federal Reserve independence, escalating geopolitical tensions, and persistent supply deficits. The white metal has now gained 28% in just nine trading days—an extraordinary start to a year that analysts say could see triple-digit prices.

"All roads are leading to gold and silver," said Alex Ebkarian, COO at Allegiance Gold, noting the market is in a "structural bull phase" driven by diverse buyers and persistent uncertainty.

From $70 to $92 in Three Weeks

The velocity of silver's move is remarkable even by the metal's volatile standards. On December 23, silver first breached $70—itself a historic milestone. In the three weeks since, the metal has tacked on another 30%+, with the rally accelerating dramatically in recent days.

| Date | Price | Milestone |

|---|---|---|

| December 23, 2025 | $70.66 | First time above $70 |

| January 12, 2026 | $86.25 | Fed investigation news breaks |

| January 14, 2026 | $92.23 | New all-time high |

Silver began 2025 under $30 per ounce. The 140-150% gain last year marked its strongest annual performance since 1979, when geopolitical turmoil and inflation sent investors fleeing to hard assets.

What's Driving the Rally

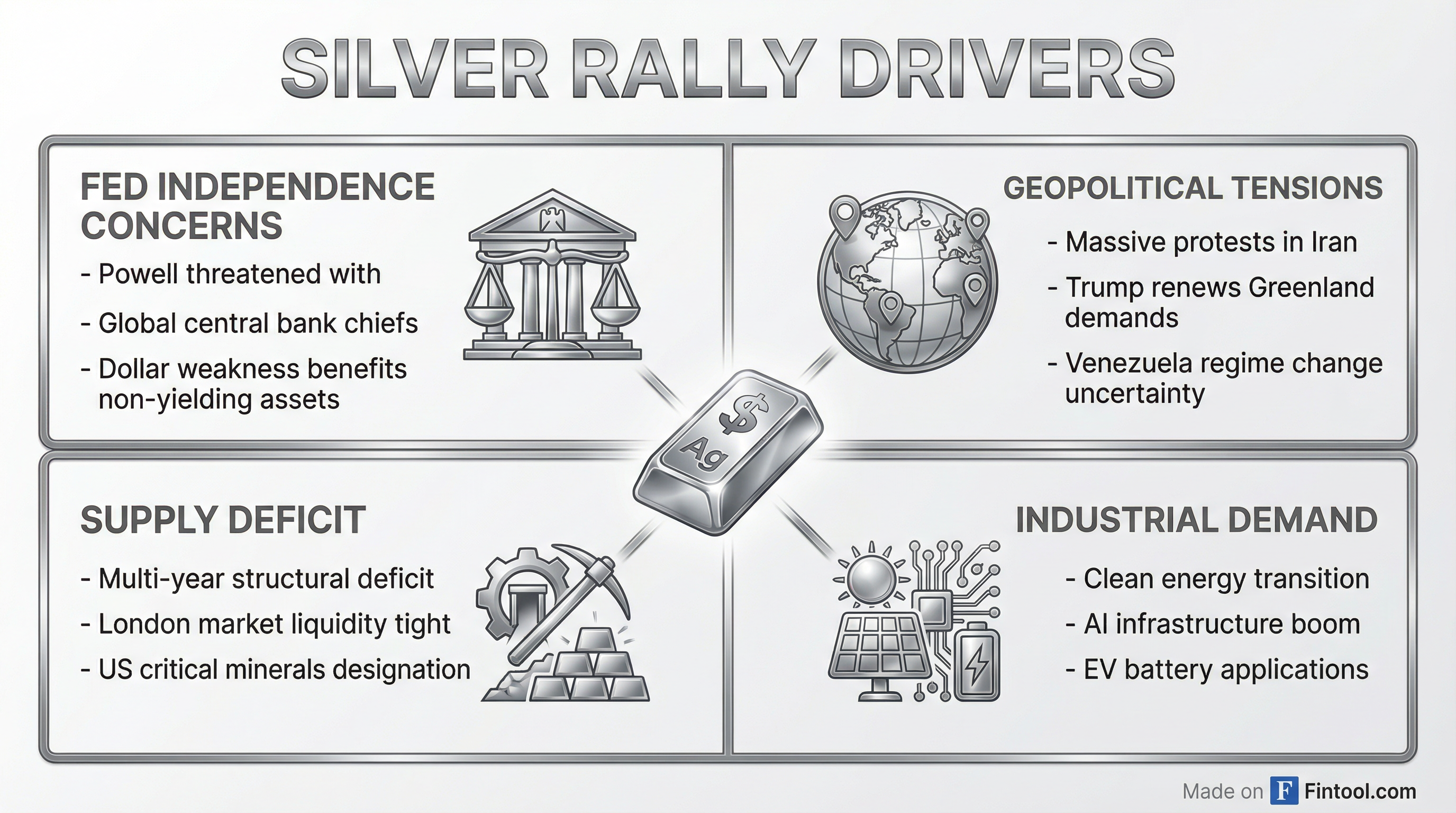

Fed Independence Under Fire

The most immediate catalyst came Sunday, when Fed Chair Jerome Powell revealed the Trump administration threatened him with a criminal indictment tied to the Federal Reserve's headquarters renovation. The news sent shockwaves through markets, with central bank chiefs from around the world—including the heads of the European Central Bank and Bank of England—issuing a rare joint statement Tuesday declaring "full solidarity" with Powell and the Fed.

"The statement from Fed Chairman Jerome Powell regarding the investigation into his testimony about the renovation of the Federal Reserve building has increased concern about the independence of the Fed and US monetary policy," said Peter Syms, noting this spurred "further interest in Gold as a perceived safe haven asset and inflation hedge."

Geopolitical Powder Kegs

Haven demand has been amplified by multiple geopolitical flashpoints:

-

Iran: Massive protests are sweeping the country, with President Trump telling Iranians to "keep protesting" and declaring "help is on its way." Iran warned it would strike American bases in neighboring countries if Washington intervenes, with the death toll approaching 2,600.

-

Greenland: Danish and Greenlandic ministers met Vice President Vance at the White House Wednesday amid Trump's renewed demands for U.S. control of the territory.

-

Venezuela: The U.S. seizure of Venezuelan leader Nicolás Maduro continues to generate regional uncertainty.

Supply Deficit Deepens

Beyond macro and political factors, silver faces fundamental tightness. The market has been in a structural deficit for years, with the situation exacerbated by historically tight liquidity in London. Tariff fears have prevented supplies from flowing from packed U.S. warehouses, creating a persistent squeeze.

"We see the deficit in the silver market continuing throughout 2026, primarily on higher investment demand," BMI, a unit of Fitch Solutions, noted. "Industrial consumption has also tightened the physical market to an unprecedented degree."

Silver's designation as a critical mineral in the U.S. and speculation about potential tariffs under Section 232 investigations have added further price support.

Analysts Target Triple Digits

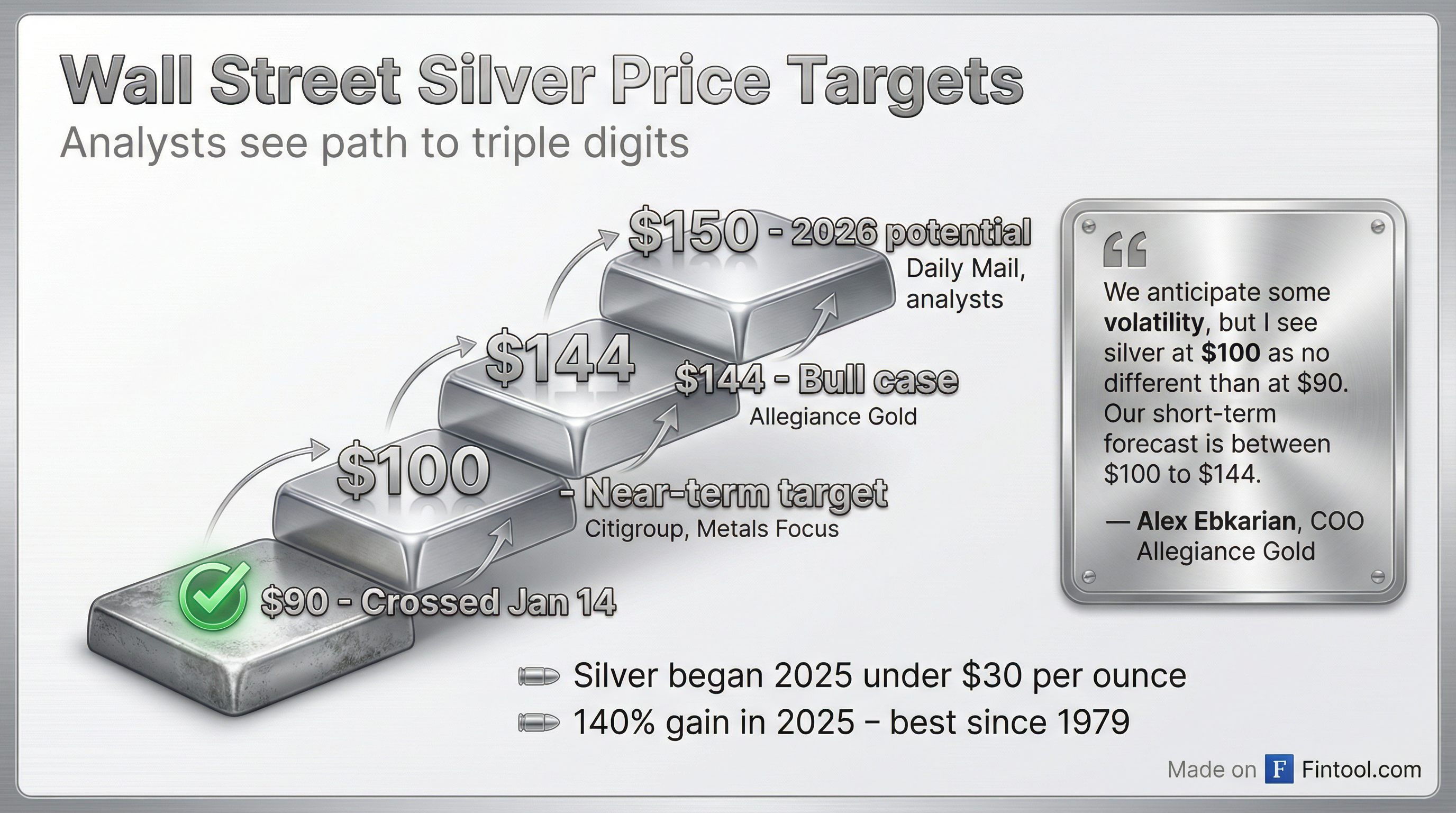

Wall Street is scrambling to update forecasts. Citigroup this week upgraded its three-month targets to $100 for silver and $5,000 for gold.

"We anticipate some volatility, but I see silver at $100 as no different than at $90," said Ebkarian of Allegiance Gold. "Our short-term forecast is between $100 to $144." He added that metals are likely to maintain their upward trend through the first quarter.

Metals Focus has said a three-digit peak is "looking likely" as silver's smaller market size amplifies price movements when it benefits from the same macroeconomic factors driving gold investment.

| Firm | Silver Target | Timeframe |

|---|---|---|

| Citigroup | $100/oz | 3 months |

| Allegiance Gold | $100-$144/oz | Near-term |

| Metals Focus | $100+/oz | 2026 |

| Various analysts | Up to $150/oz | 2026 potential |

The Daily Mail reported silver is "tipped to head towards $150 an ounce in 'flabbergasting' rally."

Mining Stocks Surge

Silver's breakout sent mining equities sharply higher:

-

First Majestic Silver+8.59% (AG) jumped to a 13-year high, gaining nearly 10% on the day. The company gets an industry-leading 57% of revenue from silver.

-

Hecla Mining+6.85% (HL), owner of one of the world's largest silver mines at Greens Creek in Alaska, rose 4.2% in pre-market trade.

-

London-listed Fresnillo touched a record high, capping a 452% gain in 2025—the best performer on the FTSE 100 last year.

-

The Ishares Silver Trust+5.25% (SLV) ETF, which holds 528 million ounces of physical silver, surged more than 6%. ProShares' Ultra Silver ETF gained over 12%.

Evy Hambro, Global Head of Thematics and Sector Investing at BlackRock, told CNBC that the investment manager had long been bullish on silver but only moved into related equities in 2024 "as prices had risen to levels that allowed the companies to make a decent return."

Gold Also at Records

Silver's rally occurred alongside continued strength in gold, which hit a fresh record of $4,641.40 per ounce. The yellow metal is up 71% year-over-year.

| Metal | Current Price | YTD Change | YoY Change |

|---|---|---|---|

| Silver | $92.23/oz | +28% | +198% |

| Gold | $4,641/oz | +7% | +71% |

| Platinum | $2,391/oz | +3% | +157% |

| Copper | Record | +1% | +39% |

Copper also hit unprecedented levels, underscoring the broad-based commodities rally.

What to Watch

Several catalysts could drive further moves in precious metals:

-

Supreme Court tariff ruling: The Court could rule any day on the legality of Trump's global tariffs—a decision that could significantly impact trade-sensitive commodities.

-

January 21 Fed case: The Supreme Court hears oral arguments in the case against Fed Governor Lisa Cook, which Wells Fargo strategists say could trigger a 2% decline in the dollar if the administration prevails.

-

Section 232 investigation: Results could lead to U.S. tariffs on silver, platinum, and palladium, potentially accelerating the supply crunch.

-

Iran escalation: Any U.S. military intervention would likely trigger further safe-haven flows into precious metals.

For investors who missed the run, Hambro offered a framework: "We expect 2026 returns to be driven by how company management teams allocate the increased cashflows. Should there be ongoing discipline, such as massive dividend increases rather than over investment or M&A, this will differentiate miners in 2026."

Related: Gold Hits $4,500, Silver Touches $70: Precious Metals Deliver Their Best Year Since 1979

Companies mentioned: Ishares Silver Trust (slv)+5.25% · Pan American Silver (paas)+5.34% · First Majestic Silver (ag)+8.59% · Wheaton Precious Metals (wpm)+3.88% · Hecla Mining (hl)+6.85% · Endeavour Silver (exk)+8.81% · SPDR Gold Shares (gld)+3.07%