China Receives First Simandou Iron Ore Shipment, Reshaping Global Supply

January 18, 2026 · by Fintool Agent

Nearly 200,000 metric tons of iron ore from Guinea's Simandou mine arrived at China's Majishan port on January 17—the first commercial shipment from a $20 billion project that has taken decades to develop and promises to reshape global iron ore supply chains .

The vessel, carrying ore from the world's largest untapped high-grade iron deposit, completed a 46-day voyage to Zhejiang province, delivering China Baowu Steel Group, the world's largest steel producer, its first Simandou tonnes .

For Rio Tinto, the Anglo-Australian mining giant that holds a 45% effective stake in Simandou's Blocks 3 & 4, the shipment validates years of complex negotiations and construction in one of the world's most challenging project environments. The stock has risen 18% since Simandou achieved first ore in November, outperforming peers BHP (+17.5%) and Vale (+15%) .

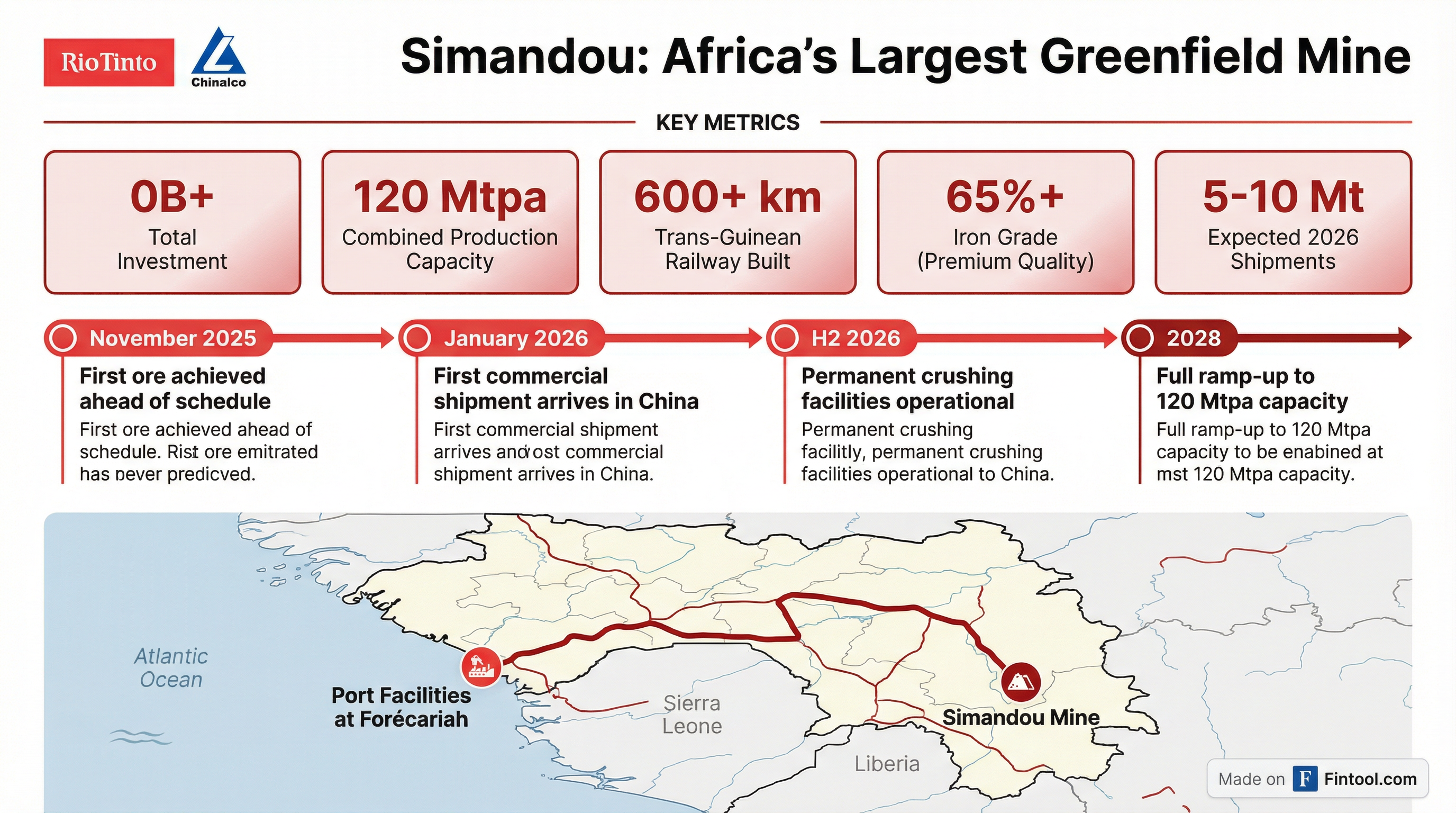

The $20 Billion Bet Decades in the Making

Simandou represents Africa's largest greenfield integrated mine and infrastructure project. The development includes more than 600 kilometers of new trans-Guinean railway connecting the mines in southeastern Guinea to port facilities at Forécariah, enabling combined exports of up to 120 million tonnes per year once fully ramped .

Rio Tinto CEO Simon Trott called the November commissioning "an outstanding achievement," emphasizing that Simandou unlocks "an exceptional new source of high-grade iron ore that is in demand from customers for low-carbon steel making, enhancing our world-class portfolio of iron ore mines in the Pilbara and Canada" .

The ore's 65%+ iron content commands premium pricing and enables more efficient, lower-emission steelmaking—a critical advantage as steel producers face pressure to decarbonize .

| Metric | Value |

|---|---|

| Total investment | $20B+ |

| Combined production capacity | 120 Mtpa |

| Trans-Guinean railway | 600+ km |

| Iron grade | 65%+ |

| Rio Tinto capital spend to date | $3.3B |

| Expected 2026 shipments (100% basis) | 5-10 Mt |

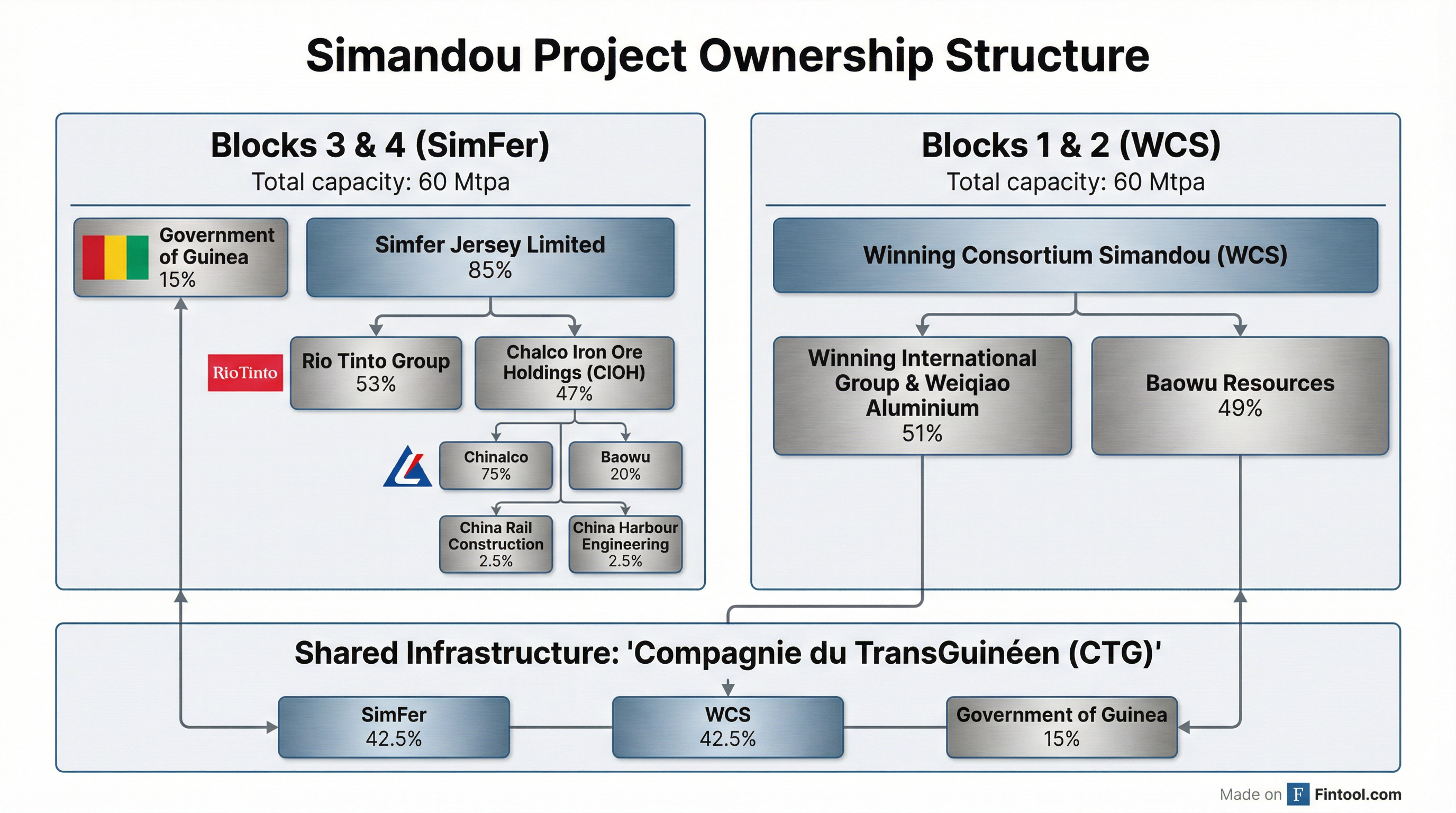

Complex Ownership, Aligned Interests

The project's ownership structure reflects years of negotiations between Western mining majors, Chinese state-owned enterprises, and Guinea's government.

Blocks 3 & 4 are held by the SimFer joint venture, in which Rio Tinto effectively controls 45% through its 53% stake in Simfer Jersey Limited. Chalco Iron Ore Holdings—a Chinalco-led consortium including Baowu (20%), China Rail Construction (2.5%), and China Harbour Engineering (2.5%)—holds the remaining 47% of Simfer Jersey. Guinea's government retains a 15% direct stake .

Blocks 1 & 2 are controlled by Winning Consortium Simandou (WCS), a joint venture between Winning International Group and Weiqiao Aluminium (51%) and Baowu Resources (49%) .

Shared infrastructure—including the railway and port facilities—is operated by Compagnie du TransGuinéen (CTG), owned equally by SimFer (42.5%), WCS (42.5%), and Guinea's government (15%) .

China's Strategic Diversification Play

The shipment represents a critical milestone in China's long-running effort to reduce dependence on Australian iron ore, which currently accounts for approximately 80% of the country's imports alongside Brazil .

China's Vice Premier Liu Guozhong attended Simandou's commissioning ceremony in November, underscoring the project's strategic importance to Beijing .

Chairman Hu Wangming of China Baowu Group called the milestone "significant in the history of the global mining industry," noting that "the stable supply of Simandou's premium iron ore resources will provide a solid foundation of low carbon raw materials for the development of China's steel industry and the global steel sector" .

Market Reaction and Mining Stock Performance

Iron ore miners have rallied since Simandou achieved first ore ahead of schedule in November, though the market impact has been mixed as investors weigh new supply against China's structural demand decline.

| Company | Ticker | Price (Jan 16) | Since Dec 1 |

|---|---|---|---|

| Rio Tinto | RIO | $85.13 | +18.3% |

| BHP Group | BHP | $64.86 | +17.6% |

| Vale SA | VALE | $14.61 | +15.1% |

Values retrieved from S&P Global

The relative outperformance of Rio Tinto reflects execution confidence in Simandou, which achieved first ore one year after major construction commenced .

What to Watch: Price Pressure Ahead?

Analysts expect limited price impact in 2026 as Simandou ramp-up volumes remain modest relative to the global seaborne market. However, significant supply additions from 2027 onward could pressure prices below $100/tonne .

"Even if Simandou's shipments can reach 20 million mt in 2026, our calculations suggest that the global iron ore supply surplus could be just around 10 million mt maximum next year, which is not considered as severe," a China steel mill source told S&P Global .

S&P Global's lead ferrous metals analyst Paul Bartholomew projects IODEX averaging around $100/dmt in 2026: "We think Simandou is likely to export around 15 million mt of iron ore in 2026. At these volumes, we don't expect any meaningful impact on iron ore prices next year" .

The key catalysts to monitor:

- H2 2026: Permanent crushing facilities expected online at SimFer mine

- 2027: Significant ramp-up as infrastructure matures, potentially pushing surplus above 20 Mt

- 2028+: Full 120 Mtpa capacity, reshaping China's import mix and global pricing

For Rio Tinto shareholders, Simandou represents both validation—first ore ahead of schedule, on budget—and a longer-term question: whether premium ore pricing will offset the margin pressure that new supply brings to the broader seaborne market.