Earnings summaries and quarterly performance for BHP Group.

Research analysts who have asked questions during BHP Group earnings calls.

Anna Mulholland

Deutsche Bank

1 question for BHP

Clarke Wilkins

Citi

1 question for BHP

Duncan Simmonds

Bank of America Merrill Lynch

1 question for BHP

Glyn Lawcock

Barrenjoey

1 question for BHP

Hayden Bairstow

Argonaut

1 question for BHP

Heath Jansen

Citi

1 question for BHP

Hunter Hillcoat

Investec

1 question for BHP

James Gurry

Credit Suisse

1 question for BHP

Jason Fairclough

Bank of America Merrill Lynch

1 question for BHP

Lyndon Fagan

JPMorgan Chase & Co.

1 question for BHP

Menno Gerard Cornelis Sanderse

Morgan Stanley

1 question for BHP

Myles Allsop

UBS Group AG

1 question for BHP

Paul McTaggart

Credit Suisse

1 question for BHP

Paul Young

Goldman Sachs

1 question for BHP

Pete O'Connor

Shaw and Partners

1 question for BHP

Sylvain Brunet

BNP Paribas

1 question for BHP

Recent press releases and 8-K filings for BHP.

- Wheaton Precious Metals has acquired an additional silver stream on the Antamina mine in Peru from BHP for an upfront consideration of $4.3 billion, marking the largest precious metal stream ever executed.

- This transaction positions Wheaton as the largest precious metal streaming company globally and updates its production guidance to 50% growth by 2030, aiming for 1.2 million gold equivalent ounces annually.

- Under the new stream, Wheaton will receive 33.75% of payable silver until 100 million ounces are delivered, then 22.5% for the life of the mine, with ongoing payments of 20% of the spot silver price.

- The $4.3 billion upfront payment will be financed using $1.2 billion cash on hand (as of September 30, 2025), $400 million in expected free cash flows, $300 million from asset monetization, a $1.5 billion term loan, and a $900 million draw on its revolving credit facility.

- Attributable silver production from the BHP stream is projected to average approximately 6 million ounces per year for the first 5 years and 5.4 million ounces per year for the first 10 years. The Antamina mine life was extended to 2036 in 2024.

- Wheaton Precious Metals has acquired an additional silver stream on the Antamina mine in Peru from BHP for an upfront consideration of $4.3 billion, making it the largest precious metal stream ever executed.

- Under the terms of the new contract, Wheaton will purchase 33.75% of payable silver until 100 million ounces have been delivered, at which point it will receive 22.5% of payable silver for the life of the mine, with ongoing payments equal to 20% of the spot silver price.

- This acquisition updates Wheaton's production guidance, now pointing to 50% growth by 2030, with an estimated 1.2 million gold equivalent ounces to be produced annually in 2030.

- The transaction is expected to increase Wheaton's 2026 production by more than 11% on a pro forma basis, with estimated attributable production for 2026 forecast to range between 860,000 and 940,000 GEOs.

- The $4.3 billion upfront payment will be funded through a combination of existing liquidity, incremental free cash flows, monetization of non-core equity investments, a new $1.5 billion term loan, and a $900 million draw on Wheaton's existing $2 billion revolving credit facility.

- Wheaton Precious Metals has acquired an additional silver stream on the Antamina mine from BHP for an upfront consideration of $4.3 billion.

- Under the terms of the new contract, Wheaton will purchase 33.75% of payable silver until 100 million ounces have been delivered, after which it will receive 22.5% of payable silver for the life of the mine, with ongoing payments equal to 20% of the spot silver price.

- The acquisition is funded through a combination of $1.2 billion cash on hand (as of September 30, 2025), $400 million of incremental free cash flows, $300 million from monetized non-core equity investments, a new $1.5 billion term loan, and a $900 million draw on Wheaton's existing revolving credit facility.

- This transaction updates Wheaton's production guidance, forecasting 50% growth by 2030 to an estimated 1.2 million gold equivalent ounces annually, with Antamina expected to contribute approximately 18% of total production by 2030.

- Attributable silver production under the BHP stream is forecast to average approximately 6 million ounces of silver per year for the first 5 years and approximately 5.4 million ounces of silver per year for the first 10 years.

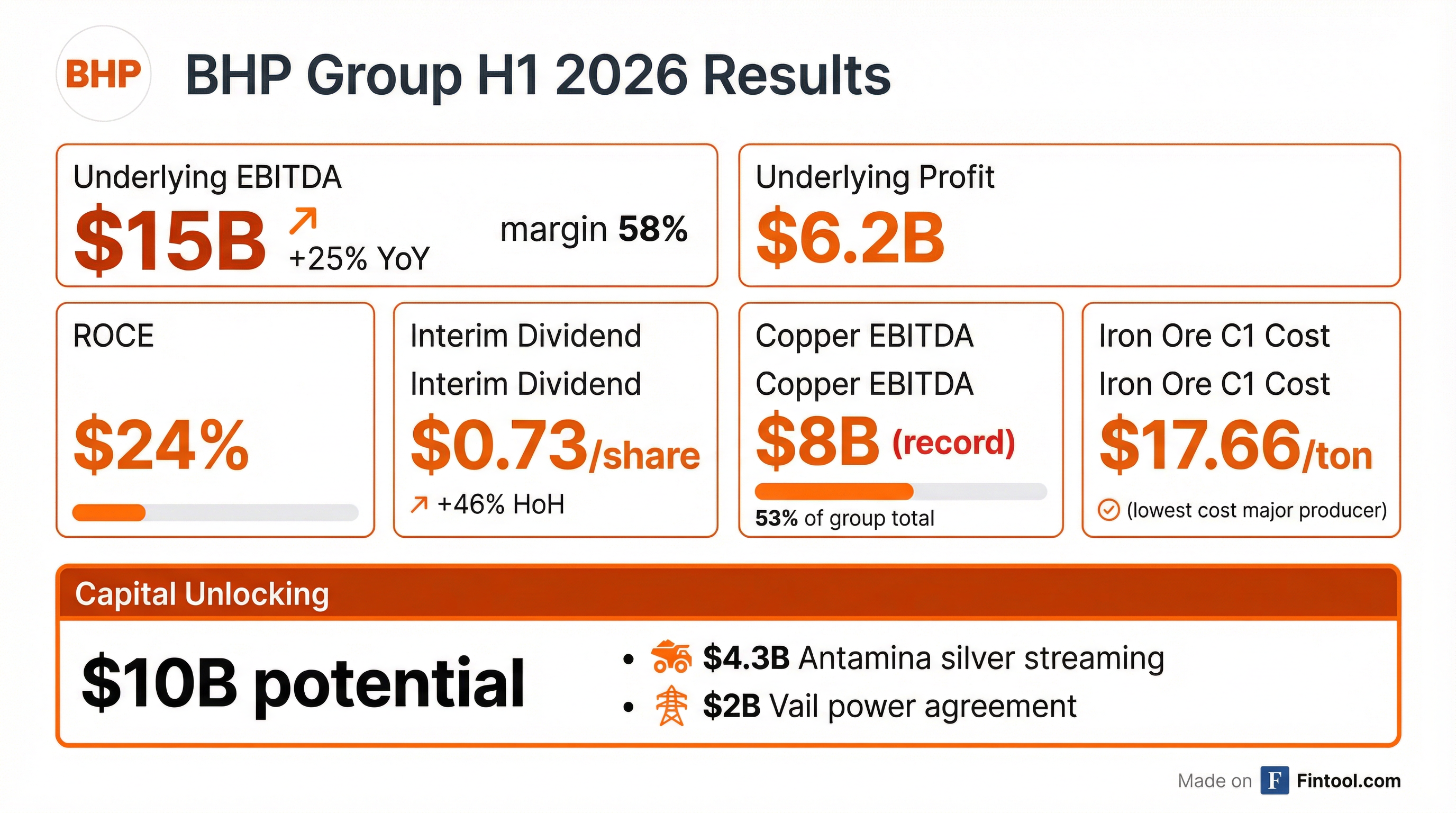

- For the half year ended December 31, 2025, BHP Group Limited reported Underlying EBITDA of US$15.5 billion and Underlying attributable profit of US$6.2 billion.

- The company determined dividends of US$3.7 billion, reflecting a 60% payout ratio, and reported net debt of US$14.7 billion.

- Copper became the largest contributor to Group EBITDA, accounting for 51% in H1 FY26, with increased FY26 production guidance.

- The Jansen Stage 1 potash project saw its cost estimate increase to US$8.4 billion and is 75% complete, with first production targeted for mid-CY27.

- BHP reported strong financial results for the half year ended 31 December 2025, with Underlying EBITDA increasing 25% to US$15.5 billion and Underlying Attributable profit rising over 20% to US$6.2 billion. Revenue also increased by 11% to US$27.9 billion.

- Copper became the largest contributor to Group Underlying EBITDA for the first time, accounting for 51% and reaching a record US$8.0 billion for the half year ended 31 December 2025. The company also increased its FY26 group copper production guidance to 1.9 – 2.0 Mt.

- The company declared an interim dividend of US 73 cents per share, equivalent to a 60% payout ratio, for the half year ended 31 December 2025.

- BHP generated US$9.4 billion in operating cash and ended the period with net debt of US$14.7 billion, comfortably within its US$10-20 billion target range. New agreements are expected to unlock over US$6 billion of cash, with potential for up to US$10 billion.

- Capital and exploration expenditure for the half year ended 31 December 2025 was US$5.3 billion, with the Jansen Stage 1 potash project expenditure increasing to US$8.4 billion and first production anticipated in mid-CY27.

- BHP Group Limited has entered into a long-term silver streaming agreement with Wheaton Precious Metals International Ltd., which includes an upfront payment of US$4.3 billion to BHP at completion.

- In exchange, BHP will deliver silver calculated by reference to its 33.75% share of silver produced at the Antamina mine, with Wheaton also paying 20% of the spot silver price for each ounce delivered.

- This agreement, effective April 1, 2026, is noted as the most valuable streaming transaction to date based on the upfront consideration received.

- The transaction is expected to unlock over $6 billion of cash (when combined with a recent transaction with Global Infrastructure Group) to strengthen BHP's balance sheet, support high-return growth projects, and enhance shareholder returns.

- BHP Group reported strong H1 2026 financial results, with underlying EBITDA growing by 25% and underlying attributable profit reaching $6.2 billion.

- The company declared an interim dividend of $0.73 per share, representing a 46% increase half-on-half.

- Operational records were set in copper and iron ore, with the copper business contributing over half of the group's earnings for the period.

- BHP raised its copper production guidance for FY 2027 to between 1-1.1 million tons and expects to unlock over $6 billion in cash from non-core asset agreements.

- BHP Group reported strong H1 2026 financial results, with underlying EBITDA growing by 25% to a 58% margin and underlying attributable profit reaching $6.2 billion.

- The company declared an interim dividend of $0.73 per share, representing a 46% increase half-on-half, reflecting strong performance and confidence in the outlook.

- Operationally, BHP achieved record production in copper and iron ore, with copper contributing over half of the group's earnings for the period, and unit costs improved by approximately 4.5%.

- Strategic initiatives, including the Antamina silver streaming agreement and WAIO power use agreement, are set to unlock over $6 billion in cash, contributing to a potential total of up to $10 billion for reinvestment or increased shareholder returns.

- BHP outlined a robust growth pipeline, particularly in copper, targeting around 2.5 million tons of copper equivalent per year by the mid-2030s and raising Escondida's FY 2027 production guidance.

- BHP Group reported strong H1 2026 financial results, with underlying EBITDA growing 25% to a 58% margin and underlying attributable profit reaching $6.2 billion.

- The company declared an interim dividend of $0.73 per share, marking a 46% increase half-on-half, with a 60% payout ratio.

- Operational performance was robust, setting records in copper and iron ore, leading to a 2% increase in group production and approximately 4.5% improvement in unit costs. Copper production guidance for Escondida was also raised.

- BHP is pursuing significant growth, particularly in copper, targeting around 2.5 million tons of copper equivalent per year by the mid-2030s, and has identified potential to unlock up to $10 billion in capital, including $4.3 billion from a silver streaming agreement and $2 billion from an inland power use agreement.

- BHP has entered a binding agreement with Global Infrastructure Partners (GIP), a part of BlackRock, for its share of Western Australia Iron Ore's (WAIO) inland power network.

- Under the agreement, GIP will provide US$2 billion in funding for a 49% stake in a trust entity, while BHP will retain 51% ownership and full operational control of WAIO's inland power infrastructure.

- This arrangement is expected to strengthen BHP's balance sheet flexibility and support long-term value creation, with completion anticipated towards the end of FY2026, subject to regulatory approvals.

Fintool News

In-depth analysis and coverage of BHP Group.

BHP's Copper Moment: Record $8B EBITDA Surpasses Iron Ore for First Time as $4.3B Silver Deal Funds Growth

BHP Unlocks $4.3 Billion in Record Silver Streaming Deal with Wheaton as H1 Profit Beats

BHP Beats Earnings, Unlocks $6.3B as Copper Overtakes Iron Ore for First Time

BHP Raises Copper Guidance as Escondida Fires, But Jansen Potash Blows Past $8B

China's Jiangxi Copper Secures Major Ecuador Copper Asset in $1.2 Billion SolGold Takeover

Quarterly earnings call transcripts for BHP Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more