Smucker Eliminates COO Role, John Brase Out After Less Than 10 Months as President

February 10, 2026 · by Fintool Agent

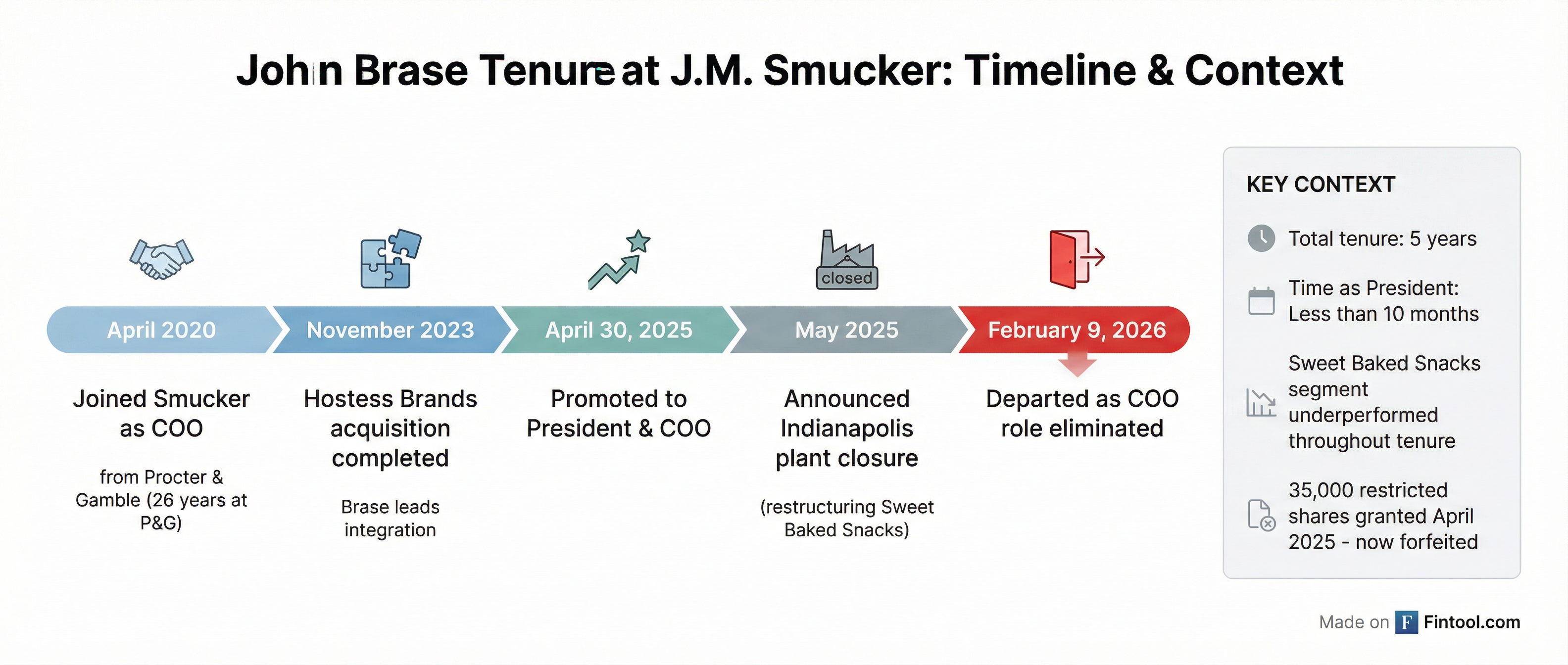

J.M. Smucker eliminated its Chief Operating Officer role and parted ways with John Brase, who had served as President and COO for less than 10 months, in a sweeping management restructuring announced Monday . CEO Mark Smucker reclaimed the President title, centralizing control just two weeks before the company's Q3 earnings call and annual CAGNY investor conference.

The abrupt departure caps a turbulent five-year tenure for Brase, who joined from Procter & Gamble in April 2020 and was tasked with leading the integration of the $5.6 billion Hostess Brands acquisition—a deal that has delivered persistent headaches in the Sweet Baked Snacks segment.

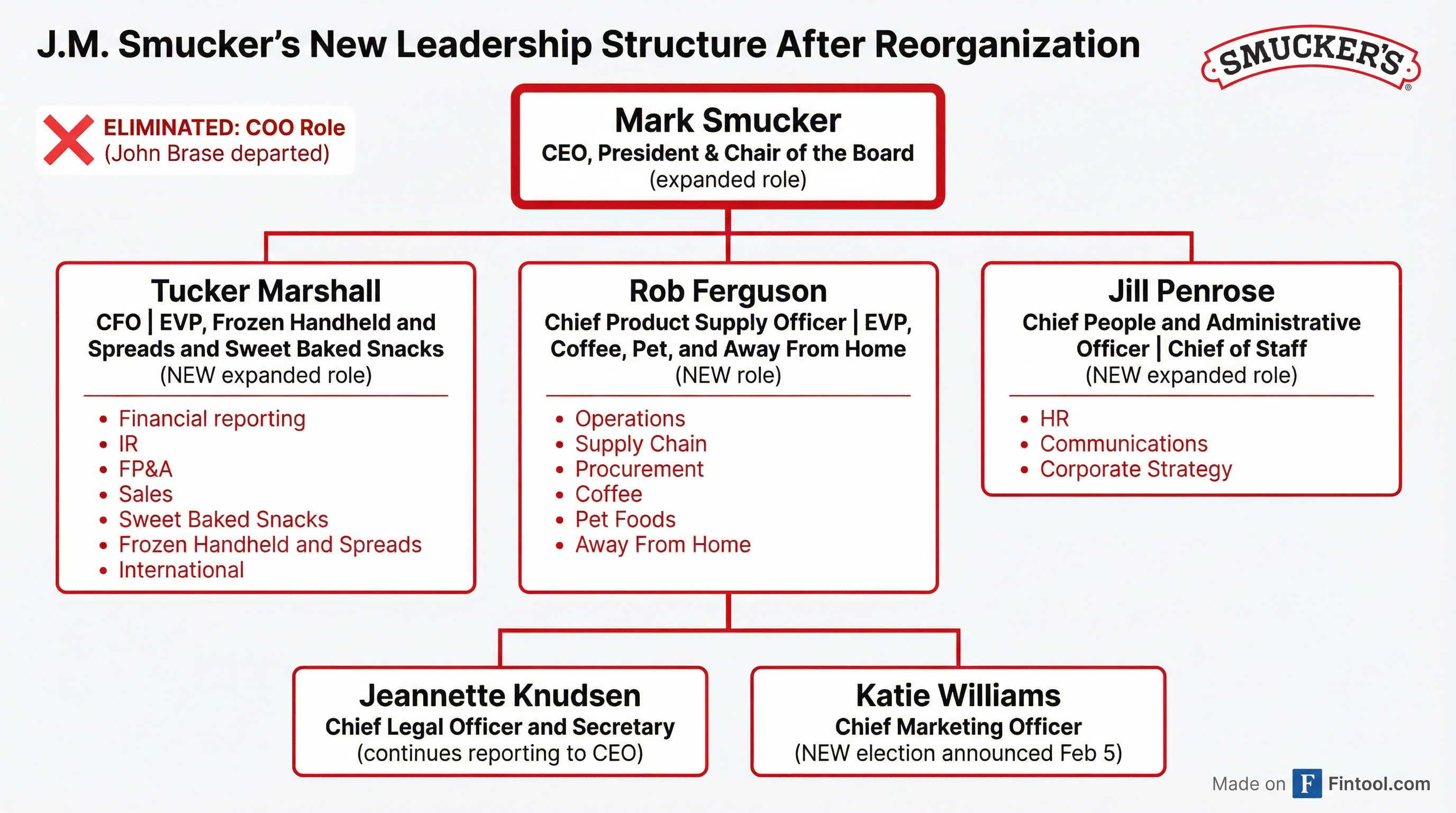

The Restructuring: Three Executives Split the COO Role

Rather than replacing Brase, Smucker is distributing his responsibilities across three promoted executives, each now carrying expanded dual titles :

Tucker Marshall, the CFO since 2015, adds oversight of the struggling Sweet Baked Snacks segment, Frozen Handheld and Spreads, International business, and the entire sales organization. His base salary increases from $725,000 to $745,000 .

Robert Ferguson, previously SVP and GM of Coffee and Procurement, is elevated to the newly created Chief Product Supply Officer role, taking over operations, supply chain, procurement, and strategic leadership of Coffee, Pet Foods, and Away From Home businesses .

Jill Penrose becomes Chief People and Administrative Officer and Chief of Staff, adding corporate strategy responsibilities to her HR and communications duties. Her salary jumps from $595,000 to $645,000 .

The Hostess Problem: Sweet Baked Snacks Drags on Results

The timing of Brase's departure is no coincidence. The Sweet Baked Snacks segment—built around the November 2023 Hostess acquisition—has consistently underperformed, directly impacting executive compensation and strategic credibility.

According to the company's fiscal 2025 proxy statement, the segment's underperformance was "the primary factor" for missing total company net sales targets, resulting in zero payout on the sales portion of short-term incentive awards for all executives .

The numbers tell the story:

| Metric | Q2 2026 | Q1 2026 | Change |

|---|---|---|---|

| Sweet Baked Snacks Net Sales | Down $59.4M YoY | Down $80.5M YoY | Continuing decline |

| Segment Profit | Down $48.8M | Down $40.2M | Deteriorating margins |

| Volume/Mix Impact | -2pp | -8pp | Weak demand persisting |

Source: Smucker Q2 2026 10-Q

Management acknowledged the challenges on the November earnings call, noting that profit in Sweet Baked Snacks "did not meet our expectations" in Q2, driven by "the transition of our bakery network or environment and just more cost that we absorb through our supply chain" .

The company is closing its Indianapolis manufacturing facility to cut costs, expecting $30 million in annualized savings, with $10 million flowing through in Q4 .

A Short-Lived Promotion

Brase's trajectory at Smucker illustrates the rapid reversal:

Just nine months ago, in April 2025, CEO Mark Smucker praised Brase's "positive impact on our business performance over the past five years," noting his "relentless focus on growth brands" and leadership of the Transformation Office, which "generated significant cost savings and productivity improvements" .

At that promotion, Brase received a special one-time equity award of 35,000 restricted shares with a five-year vesting period . With his departure, unvested equity awards are "generally forfeited upon an employee's voluntary departure," though the company indicated it "anticipates that it will enter into a separation agreement" with Brase .

His potential severance package for involuntary termination without cause totaled over $4.2 million, including $1.125 million in severance, $750,000 cash incentive, and $2.2 million in vested performance units .

Stock Performance and Market Reaction

SJM shares closed at $107.46 on February 9, down 1.9% from $109.51 on February 6, as the stock pulled back ahead of the announcement . The stock has traded in a range of $93.30 to $121.48 over the past 52 weeks .

The company carries a consensus "Hold" rating from analysts, with an average price target of approximately $114.93 . Morgan Stanley downgraded the stock in January, citing "increasing competitive risk with value-focused pricing, private label momentum, and promotions accelerating" .

What to Watch: Earnings Call on February 26

The leadership shakeup comes just two weeks before Smucker's Q3 2026 earnings call on February 26 and the CAGNY investor conference . Investors will be listening for:

- Management commentary on the reorganization rationale — Was this performance-driven or strategic simplification?

- Sweet Baked Snacks trajectory — Can the segment achieve promised stabilization?

- Integration costs and timeline — Any additional restructuring charges ahead?

- FY2027 outlook — Company has guided to "on-algorithm or better" performance next year

The company reaffirmed its fiscal 2026 guidance, with adjusted EPS expected at $8.75-$9.25 versus analyst consensus of $9.88 .

The Broader Pattern: Family Control Tightens

Mark Smucker's move to reclaim the President title continues a pattern at the 128-year-old family-controlled company. He has served as CEO since May 2016 and added the Chairman title in August 2022. Now holding all three top titles—CEO, President, and Chair—Smucker is consolidating control at a moment when the company faces pressure on multiple fronts: Hostess integration challenges, coffee commodity volatility, and a cautious consumer environment.

The departures of two additional senior vice presidents—Randy Day (Operations) and Bryan Hutson (Information Services and Supply Chain)—signal further organizational change ahead . The company is also creating a new Chief Technology Officer role focused on "advancing the Company's artificial intelligence strategy across the enterprise."