SpaceX Acquires xAI in Record $1.25 Trillion Mega-Merger Ahead of Blockbuster IPO

February 3, 2026 · by Fintool Agent

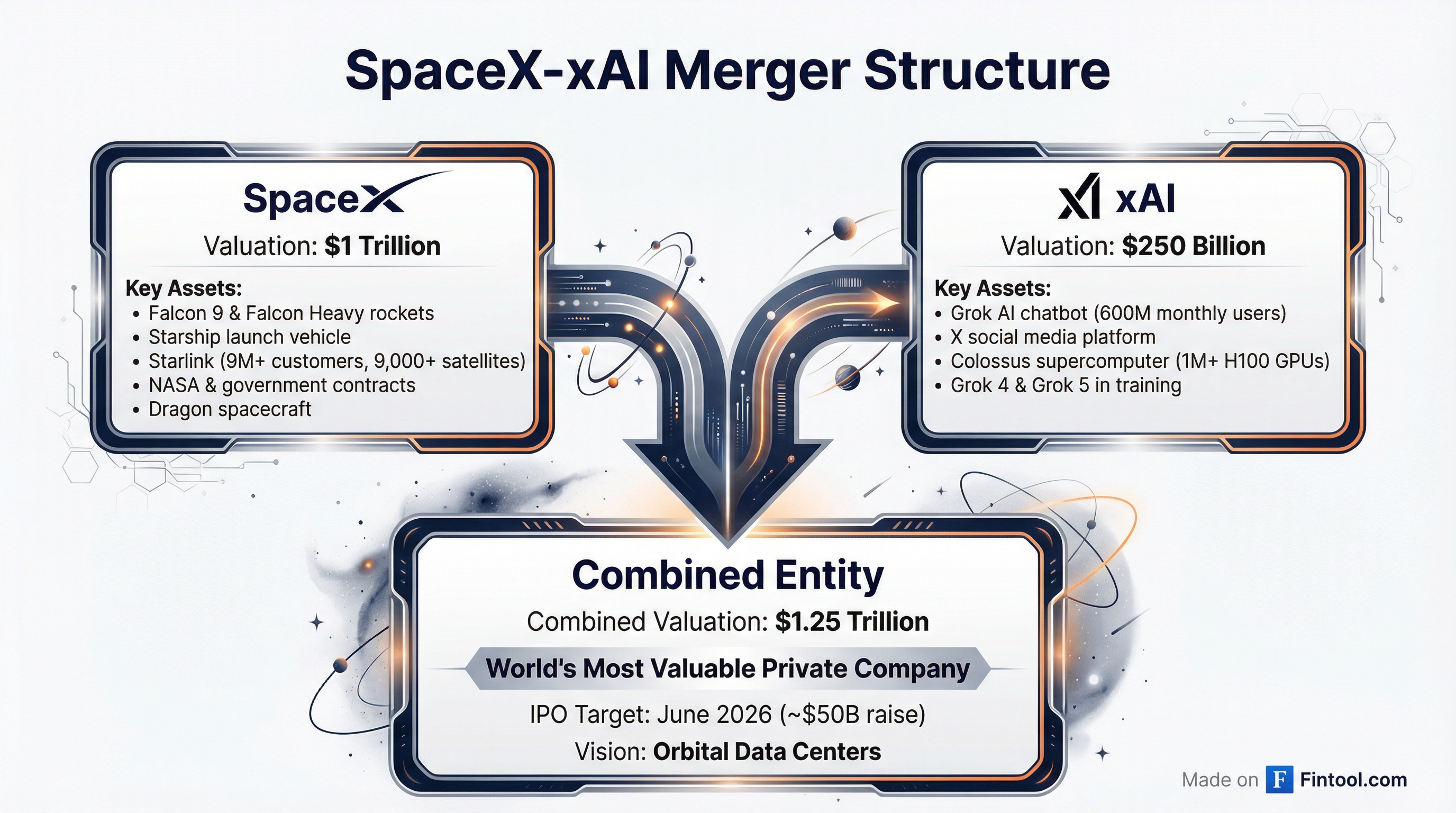

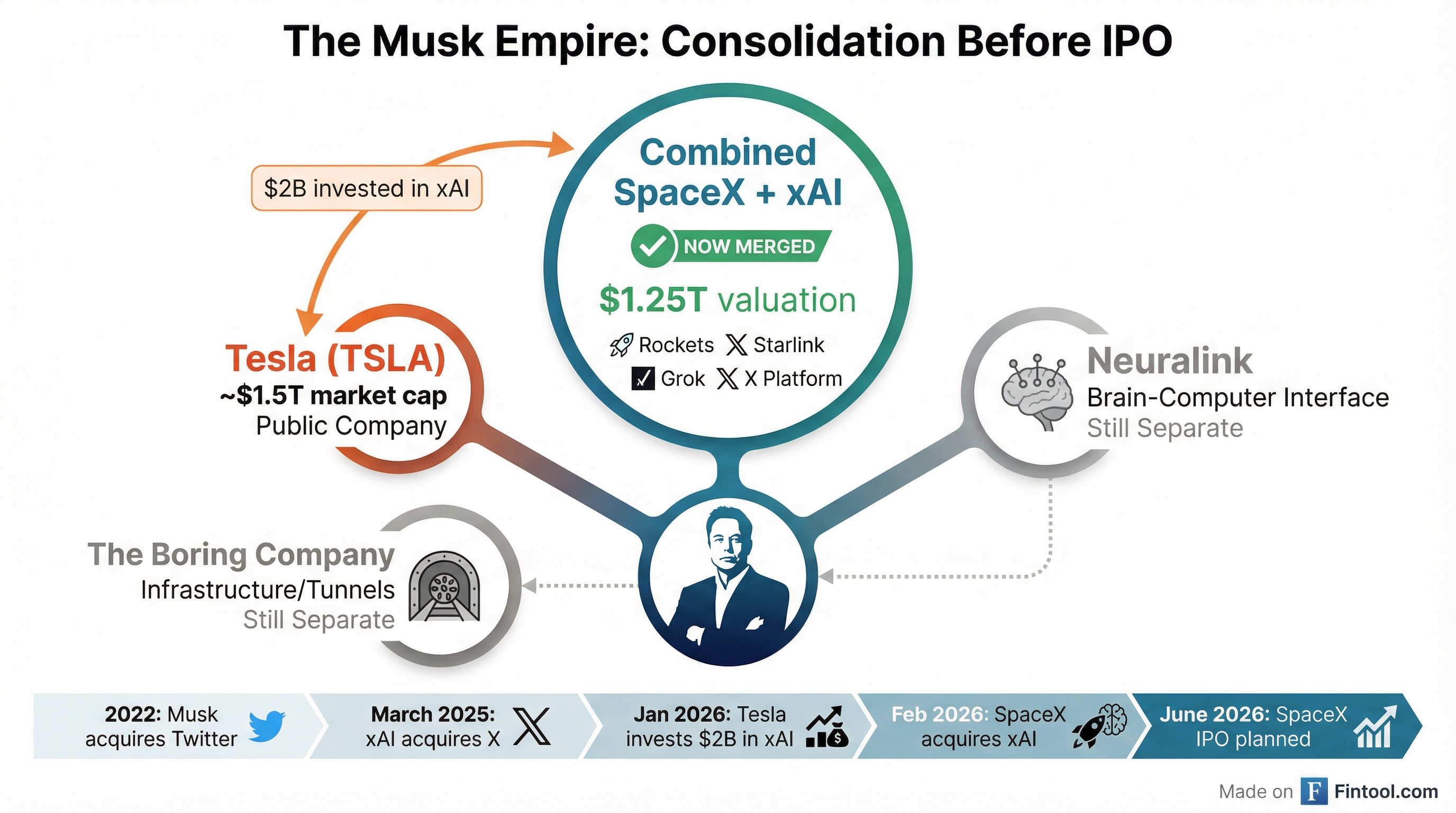

SpaceX has acquired Elon Musk's artificial intelligence startup xAI in an all-stock transaction valued at a combined $1.25 trillion, creating the most valuable private company in history and setting the stage for what could be the largest IPO ever.

The deal, announced Monday, values SpaceX at $1 trillion and xAI at $250 billion—a significant step-up from xAI's $230 billion valuation just weeks ago when it closed a $20 billion Series E round.

Musk described the combined company as "the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet, direct-to-mobile device communications and the world's foremost real-time information and free speech platform."

The Vision: Data Centers in Orbit

The merger's strategic rationale centers on Musk's audacious vision to build artificial intelligence infrastructure in space. SpaceX recently filed with the FCC for authorization to launch up to one million satellites as part of its "orbital data centers" initiative.

"Current advances in AI are dependent on large terrestrial datacenters, which require immense amounts of power and cooling," Musk wrote in a memo to employees obtained by The New York Times. "Global electricity demand for AI simply cannot be met with terrestrial solutions, even in the near term, without imposing hardship on communities and the environment."

"In the long term, space-based AI is obviously the only way to scale," Musk added, predicting that "within 2 to 3 years, the lowest cost way to generate AI compute will be in space."

Setting Up the Decade's Biggest IPO

The merger consolidates Musk's empire ahead of a long-anticipated SpaceX IPO, expected around June 2026. Sources familiar with the plans told Reuters the offering could raise up to $50 billion at a valuation exceeding $1.5 trillion.

The timing is notable: Musk turns 55 on June 28, around the same time as a rare planetary alignment of Jupiter and Venus—details that have fueled speculation about Musk's flair for theatrics in business announcements.

Emily Zheng, a senior analyst at Pitchbook, said the deal has "all the markings of a company preparing for a public listing."

"The sheer cost of compute, infrastructure, and energy is why we are seeing many of venture's most valuable startups like SpaceX prepare to go public this year," Zheng noted. "Consolidating these companies ahead of an IPO allows SpaceX to present a differentiated, capital-efficient growth narrative to public investors."

What SpaceX Gets—And What It Inherits

Through the acquisition, SpaceX gains:

xAI's AI capabilities:

- Grok, one of the leading AI chatbots, now in its fourth generation with Grok 5 in training

- Approximately 600 million monthly active users across X and Grok platforms

- Colossus I and II supercomputers in Memphis, Tennessee, with over one million H100 GPU equivalents

The X social media platform:

- xAI acquired X (formerly Twitter) in an all-stock deal in March 2025

- Provides real-time data for AI training and distribution platform for Grok

But SpaceX also inherits xAI's challenges. The AI company has been burning approximately $1 billion per month on infrastructure costs as it races to catch up with OpenAI and Google's AI capabilities.

One investor in both companies, speaking to Axios, described xAI as "a money-burning laggard" that will make SpaceX's balance sheet "much more complicated."

xAI has also drawn regulatory scrutiny globally. The European Commission and UK's Ofcom recently launched investigations into concerns that Grok's image generation features enabled the creation of nonconsensual sexualized images. Similar probes are underway in California, Australia, India, Ireland, and France.

Tesla's Complicated Position

The merger raises interesting questions about Tesla's relationship with the combined entity.

Just last week, Tesla disclosed in its Q4 2025 earnings report that it had invested $2 billion in xAI's Series E funding round. That investment now converts to an indirect stake in the SpaceX-xAI combined company.

The investment was notable because Tesla shareholders had effectively voted against it. In a November 2025 advisory vote, while 1.06 billion shares voted in favor and 916.3 million opposed, the number of abstentions—which count as "no" votes under Tesla's bylaws—meant the measure was technically rejected. Tesla proceeded anyway.

Tesla was not included in the SpaceX-xAI merger, though early rumors had speculated about a three-way combination. Integrating a publicly traded company with a complex shareholder base into a private entity would have posed significant fiduciary complications.

Musk has previously suggested that xAI would serve as an "orchestra conductor" for Tesla's autonomous vehicles and Optimus humanoid robots—a vision of a vertically integrated AI-robotics-transportation ecosystem.

Market Reaction and Industry Impact

U.S. space stocks rallied following the announcement, with investors betting the deal validates the commercial potential of AI infrastructure in space.

"SpaceX and xAI are the leaders in two incredibly frontier technologies," said Emma Wall, chief investment strategist at Hargreaves Lansdown. "Because this is entirely private, it hasn't been tested by the market in the same way Tesla has."

The deal also raises long-term antitrust questions. If space-based data centers become a reality and Musk's combined company achieves a near-monopoly on orbital AI infrastructure, regulators may scrutinize whether other AI model makers would have fair access.

What to Watch

IPO timing and pricing: The planned June 2026 offering will be the largest in history if it proceeds at the rumored $1.5 trillion valuation. Watch for S-1 filing details in coming months.

Regulatory review: The deal may face scrutiny from CFIUS given foreign investors in both companies, including Qatar Investment Authority and Abu Dhabi's MGX.

Orbital data center progress: SpaceX's FCC application for one million AI satellites will be a key indicator of whether the space-based infrastructure vision is advancing.

xAI's burn rate: How quickly the combined company can reduce xAI's $1 billion monthly cash burn while still advancing Grok 5 development.

Tesla's next moves: Whether Musk pursues further integration between Tesla and the SpaceX-xAI entity, potentially through additional investments or partnerships.

Related: