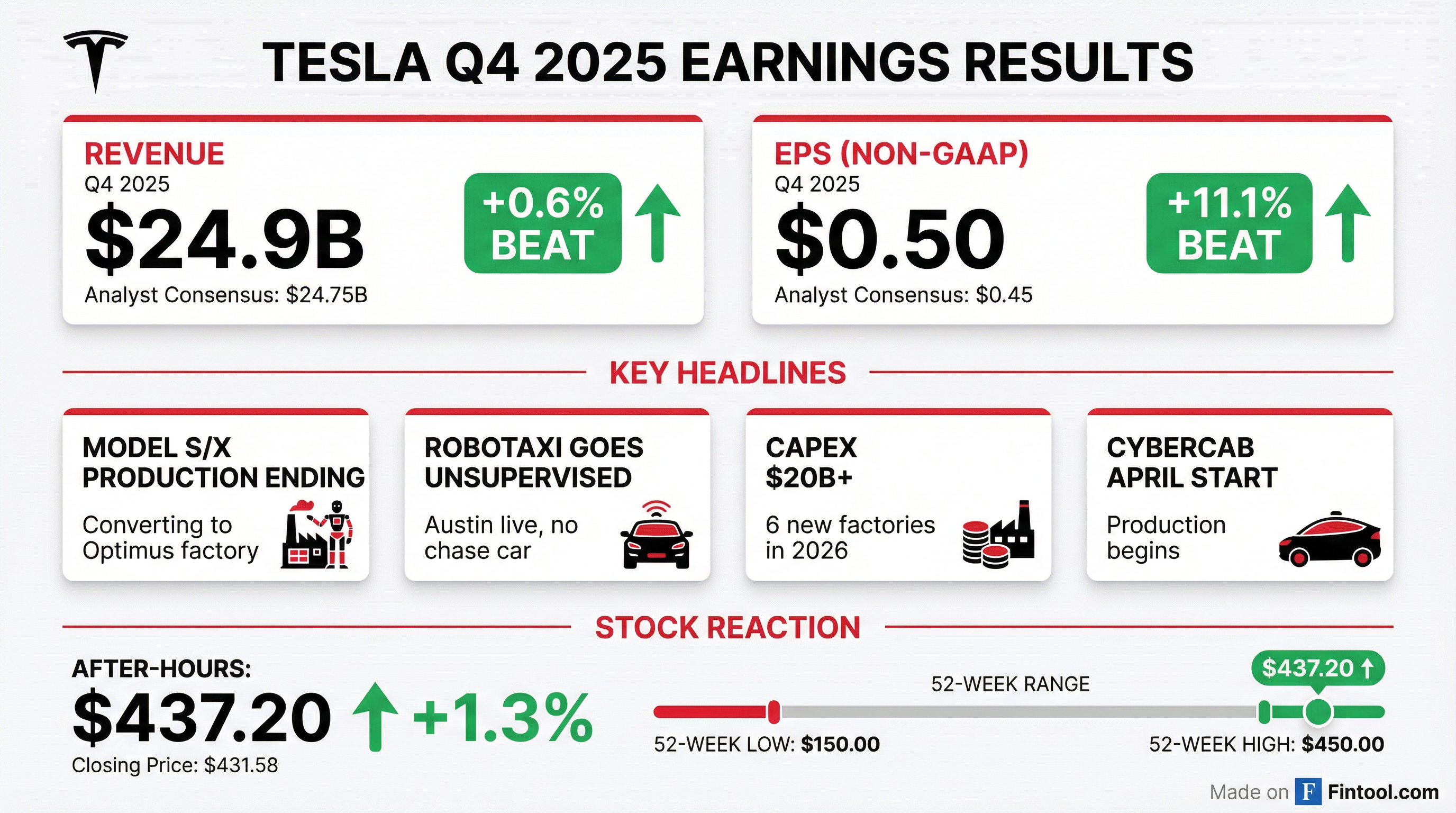

Earnings summaries and quarterly performance for Tesla.

Executive leadership at Tesla.

Board of directors at Tesla.

Research analysts who have asked questions during Tesla earnings calls.

Dan Levy

Barclays PLC

6 questions for TSLA

Emmanuel Rosner

Wolfe Research

6 questions for TSLA

Adam Jonas

Morgan Stanley

4 questions for TSLA

Pierre Ferragu

New Street Research

3 questions for TSLA

Colin Rusch

Oppenheimer & Co. Inc.

2 questions for TSLA

Walter Piecyk

LightShed Partners

2 questions for TSLA

Colin Langan

Wells Fargo & Company

1 question for TSLA

Daniel Roeska

Bernstein Research

1 question for TSLA

George Gianarikas

Canaccord Genuity

1 question for TSLA

Mark Delaney

The Goldman Sachs Group, Inc.

1 question for TSLA

William Stein

Truist Securities

1 question for TSLA

Xin Yu

Deutsche Bank

1 question for TSLA

Recent press releases and 8-K filings for TSLA.

- Victor Nechita, Tesla’s Cybercab vehicle program manager, is departing after nearly six years to start a new role in Boston.

- His exit comes as Tesla gears up for volume production of the purpose-built Cybercab in April, following the first unit roll-off at Gigafactory Texas.

- Nechita’s departure is one of several recent executive exits amid two years of declining sales, including the announced departure of Raj Jegannathan and the firing of Omead Afshar.

- Despite leadership changes and sales pressures, Tesla reported 1.64 million global deliveries in 2025, maintains a $1.53 trillion market cap, and holds an Altman Z-Score of 18.24.

- Tesla sues California DMV, challenging a ruling that its Autopilot and Full Self-Driving branding constituted false advertising, arguing the DMV never proved consumer confusion.

- The company says it has complied with corrective demands—updated its marketing and moved FSD sales to a subscription model—but continues the legal fight after the DMV paused license suspension.

- An administrative law judge and the DMV found that Tesla’s marketing materials dating back to 2021 violated state law, citing potentially misleading consumer language.

- Tesla’s stock slipped 2.91% to $399.83 at Monday’s close before edging up to $400.57 in overnight trading, reflecting investor concern over regulatory challenges.

- Elon Musk confirmed a major upcoming FSD upgrade allowing natural-language commands, which may shape future regulatory scrutiny.

- U.S. District Judge Beth Bloom refused to overturn or reduce a $243 million verdict against Tesla over a 2019 Key Largo crash.

- A Miami jury assigned Tesla one-third of the fault, awarding $19.5 million and $23.1 million in compensatory damages plus $200 million in punitive damages.

- The crash involved a Model S on Enhanced Autopilot; the driver said he expected the system to brake automatically after dropping his phone.

- The ruling is likely to be appealed to the Eleventh Circuit and raises regulatory and reputational scrutiny of Tesla’s driver-assistance technology.

- Tesla launched a $59,990 dual-motor AWD base Cybertruck and cut the high-end Cyberbeast to $99,990 as part of its price reduction strategy.

- Cybertruck sales fell to 20,237 units in 2025, a 48% decline from nearly 39,000 in 2024, highlighting weakening demand.

- Price cuts were achieved by removing or downgrading comfort and convenience features, including swapping air suspension for coil springs and eliminating rear displays.

- Investors will watch order trends, margins, and upcoming delivery figures to assess if these cuts drive sustainable volume growth without overly compressing profitability.

- Tesla avoided a 30-day suspension of its California dealer and manufacturer licenses after halting use of "Autopilot" marketing in the state.

- The reprieve follows an administrative judge’s ruling that Tesla overstated Autopilot and FSD capabilities and an initially harsher penalty proposal.

- Regulators first brought charges in 2022, and the compliance action averts a potential sales freeze in Tesla’s largest U.S. market.

- The outcome arrives amid weakening EV demand post-tax credit expiry as Tesla pushes ahead on robotaxi and humanoid initiatives.

- Tesla reported 14 Robotaxi crashes in Austin since the service launched in June 2025 across roughly 45 vehicles, including five new incidents added by Electrek and NHTSA filings.

- The fleet has covered ~800,000 paid miles, implying a crash every 55,000–57,000 miles, or about nine times the average U.S. driver crash rate.

- Newly filed NHTSA reports detail collisions with a fixed object at 17 mph, a bus while stationary, a heavy truck at 4 mph, and two low-speed backing incidents at 1–2 mph.

- Tesla revised a July 2025 crash report from property damage only to Minor W/ Hospitalization for a right-turn collision with an SUV at about 2 mph.

- Market reaction: shares fell $11.28 (2.7%) to $406.16 on the trading day the new reports circulated, with trading volume around 31.95 million shares.

- China’s new-energy vehicle retail sales fell 20% YoY to about 596,000 units in January amid the end of tax exemptions and fading stimulus.

- Tesla’s Shanghai plant delivered 69,129 cars to Chinese buyers in January and exported 50,644 units that month.

- Overall Chinese vehicle exports reached 681,000 units, up 44.9% YoY despite a 9.5% MoM decline.

- Market leader BYD saw sales drop about 30% YoY, underscoring broad pressure on automakers.

- Raj Jegannathan, Tesla’s VP of IT and AI infrastructure, resigned after under seven months as North America sales chief, concluding a 13-year tenure at the company.

- Tesla’s 2025 revenue fell 3% year-over-year, marking its first annual decline on record.

- In the most recent quarter, deliveries declined 16% year-over-year, with U.S. sales down about 7% and Canadian sales plunging over 60% after rebate suspensions.

- This departure follows an April 2024 workforce reduction of over 10% and other senior exits in 2025, underscoring ongoing leadership turnover amid weakening demand.

- Tesla shares fell 2.2% to $397 in early trading amid a broader tech selloff over rising AI capital spending and valuation concerns.

- The company has set up an AI training center in China focused on local applications and assisted driving.

- Tesla’s core vehicle business is under pressure in Europe and the U.K., where Volkswagen surpassed Tesla in BEV deliveries and Tesla’s registrations and January U.K. deliveries plunged.

- Tesla’s Shanghai factory shipped 69,129 vehicles in January, up 9% from December and marking a third consecutive month of growth.

- This growth contrasts with sharp declines at domestic rivals BYD and Xpeng amid fading government incentives and policy shifts.

- Tesla has supported sales with seven-year ultra-low-interest loans and an 8,000 yuan insurance subsidy on Model 3/Y purchases in China.

- The company expanded its in-car dashcam buffer beyond the previous 60-minute limit and is developing Apple CarPlay for its vehicles.

Fintool News

In-depth analysis and coverage of Tesla.

Tesla Loses $243 Million Autopilot Verdict Appeal—First Major Plaintiff Win Sets Legal Precedent

SpaceX Acquires xAI in Record $1.25 Trillion Mega-Merger Ahead of Blockbuster IPO

French Prosecutors Raid X's Paris Office, Summon Musk to Appear in April

SpaceX Merges With xAI in Musk's Boldest Bet: $1.25 Trillion IPO Targets Orbital Data Centers

Musk's $1 Trillion Moonshot: SpaceX and xAI in 'Advanced Talks' to Merge

SpaceX and xAI in Merger Talks Ahead of $1.5 Trillion IPO

Quarterly earnings call transcripts for Tesla.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more