Musk's $1 Trillion Moonshot: SpaceX and xAI in 'Advanced Talks' to Merge

February 2, 2026 · by Fintool Agent

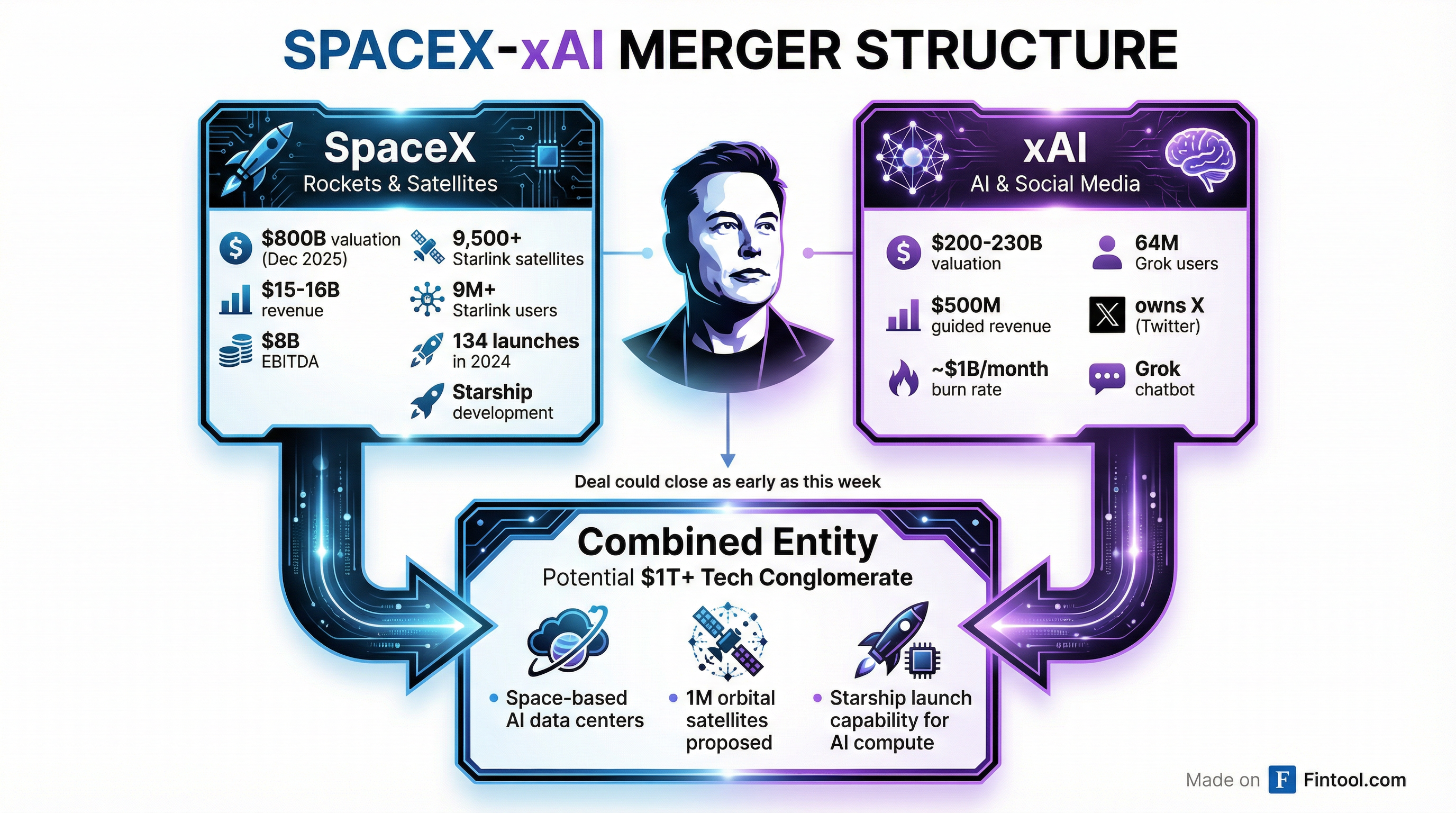

Elon Musk is in advanced talks to combine Spacex with xAI, merging two of the world's most valuable private companies into a potential trillion-dollar tech conglomerate, according to Bloomberg.

Both companies have informed some of their investors about the plans. A deal could be announced as soon as this week—though negotiations remain fluid and could still collapse.

The transaction would unite SpaceX's $800 billion rocket and satellite empire with xAI's $200 billion AI business, crystallizing Musk's vision of launching data centers into space to power next-generation artificial intelligence.

The Strategic Logic: AI's Insatiable Cash Appetite

The central catalyst for a merger is artificial intelligence's voracious need for capital. xAI has been burning through cash at a rate of approximately $1 billion per month to fund infrastructure and model training—a pace that has compelled Musk to blur corporate boundaries and pool resources across his empire.

SpaceX, by contrast, is highly profitable. The rocket company generated roughly $8 billion in EBITDA on $15 billion to $16 billion of revenue last year, according to sources familiar with the company's results—figures that have led some banks to estimate SpaceX could raise more than $50 billion at a valuation exceeding $1.5 trillion.

The merger would combine xAI's cash-burning AI operations with SpaceX's mature, cash-generating business model anchored by Starlink's 9 million-plus subscribers.

Orbital Data Centers: The Vision Takes Shape

Beyond financial synergies, the merger would enable Musk's most ambitious infrastructure play yet: launching AI data centers into space.

On Friday, SpaceX filed plans with the Federal Communications Commission to launch up to one million satellites into low-Earth orbit that would function as orbital data centers for artificial intelligence. The satellites would operate at altitudes between 500 and 2,000 kilometers, positioned to maximize time in sunlight for solar power generation.

"Freed from the constraints of terrestrial deployment, within a few years the lowest cost to generate AI compute will be in space," SpaceX wrote in the filing.

The company described the initiative as "a first step toward becoming a Kardashev Type II civilization—one that can harness the Sun's full power."

While regulators are unlikely to approve a full million satellites, the filing signals SpaceX's intent to dominate orbital infrastructure. The satellites would connect via high-bandwidth optical laser links to SpaceX's existing Starlink constellation, which would then relay data to ground stations.

The Numbers Behind the Deal

| Metric | SpaceX | xAI |

|---|---|---|

| Latest Valuation | $800B (Dec 2025) | $200-230B (Sep-Nov 2025) |

| Target Valuation | $1.5T (IPO) | — |

| 2025 Revenue | $15-16B | $500M guided |

| EBITDA | $8B | Negative ($1B/mo burn) |

| Key Product | Starlink (9M+ users) | Grok (64M users) |

| Total Funding | Private + upcoming IPO | $40-52B debt/equity |

| Employees | 13,000+ | Undisclosed |

Sources: Reuters, Bloomberg, Sacra research

xAI raised funds at a $200 billion valuation in September 2025, with subsequent talks in November discussing a $230 billion round. The company has raised approximately $40-52 billion in combined equity and debt across multiple rounds, including a $5 billion debt facility arranged by Morgan Stanley.

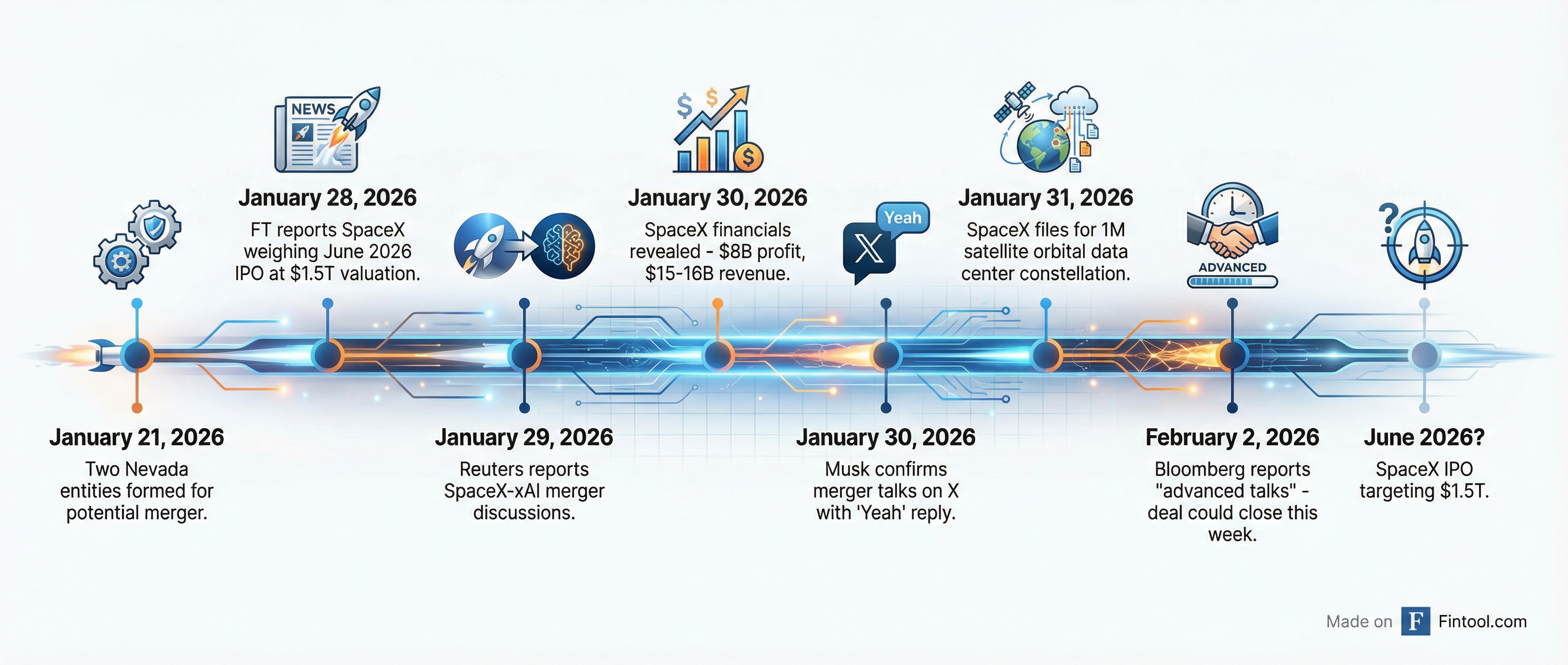

Timeline: How We Got Here

The merger discussions accelerated over the past two weeks:

- January 21: Two Nevada entities formed to facilitate a potential SpaceX-xAI transaction

- January 28: Financial Times reports SpaceX weighing a mid-June 2026 IPO at $1.5 trillion valuation

- January 29: Reuters reports SpaceX is in discussions to merge with xAI ahead of the IPO

- January 30: SpaceX's 2025 financials revealed—$8B EBITDA, $15-16B revenue

- January 30: Musk appears to confirm merger talks, replying "Yeah" on X to a post about SpaceX as a "Dyson Swarm company"

- January 31: SpaceX files FCC application for 1 million orbital AI data center satellites

- February 2: Bloomberg reports "advanced talks"—deal could close this week

Leadership: Who Runs the Empire?

Among those who may help Musk run a merged entity is Gwynne Shotwell, the longtime president and chief operating officer of SpaceX. Shotwell has been instrumental in SpaceX's commercial success and government contracts.

On the financial side, Anthony Armstrong serves as CFO of both xAI and X (formerly Twitter). Armstrong, a former Morgan Stanley executive, helped Musk complete the $44 billion Twitter acquisition and has been central to xAI's fundraising.

IPO Implications

A merger could reshape SpaceX's path to public markets. The rocket company has been weighing a mid-June 2026 IPO that would coincide with Musk's 55th birthday on June 28 and a rare planetary alignment of Jupiter and Venus.

SpaceX has engaged Bank of America, JPMorgan, Goldman Sachs, and Morgan Stanley for potential leading roles in the share sale. At a $1.5 trillion valuation, the IPO would be the largest in history, eclipsing Saudi Aramco's $29 billion raise in 2019.

A SpaceX-xAI combination could either accelerate the IPO by demonstrating AI optionality—or complicate it by adding a high-burn, relatively unproven asset to the offering.

Tesla's Shadow

Notably, SpaceX has also discussed the feasibility of a tie-up with Tesla (TSLA), Musk's publicly traded electric vehicle company.

Musk has previously stated he does not support a Tesla-xAI merger, though Tesla's board approved up to a $2 billion investment in xAI as part of the AI company's recent funding round.

Any SpaceX-Tesla combination would face significant regulatory and governance hurdles, given Musk's controlling stakes in both companies and the potential for conflicts of interest.

What to Watch

- Deal announcement: Bloomberg reports an agreement could come as soon as this week

- Deal structure: Reports suggest xAI shares may be exchanged for SpaceX stock, with some xAI executives potentially receiving cash

- IPO timing: Whether a merged entity proceeds with the June 2026 IPO or pushes later

- Regulatory approval: FCC decision on the million-satellite orbital data center constellation

- Cash burn: xAI's ability to scale revenue toward its $2 billion 2026 target while maintaining model development

The combination of Musk's rocket dominance with his AI ambitions could reshape both industries—or create the most complex corporate governance challenge in tech history.