Spero Founder Exits Board Two Weeks After SEC Settlement

January 30, 2026 · by Fintool Agent

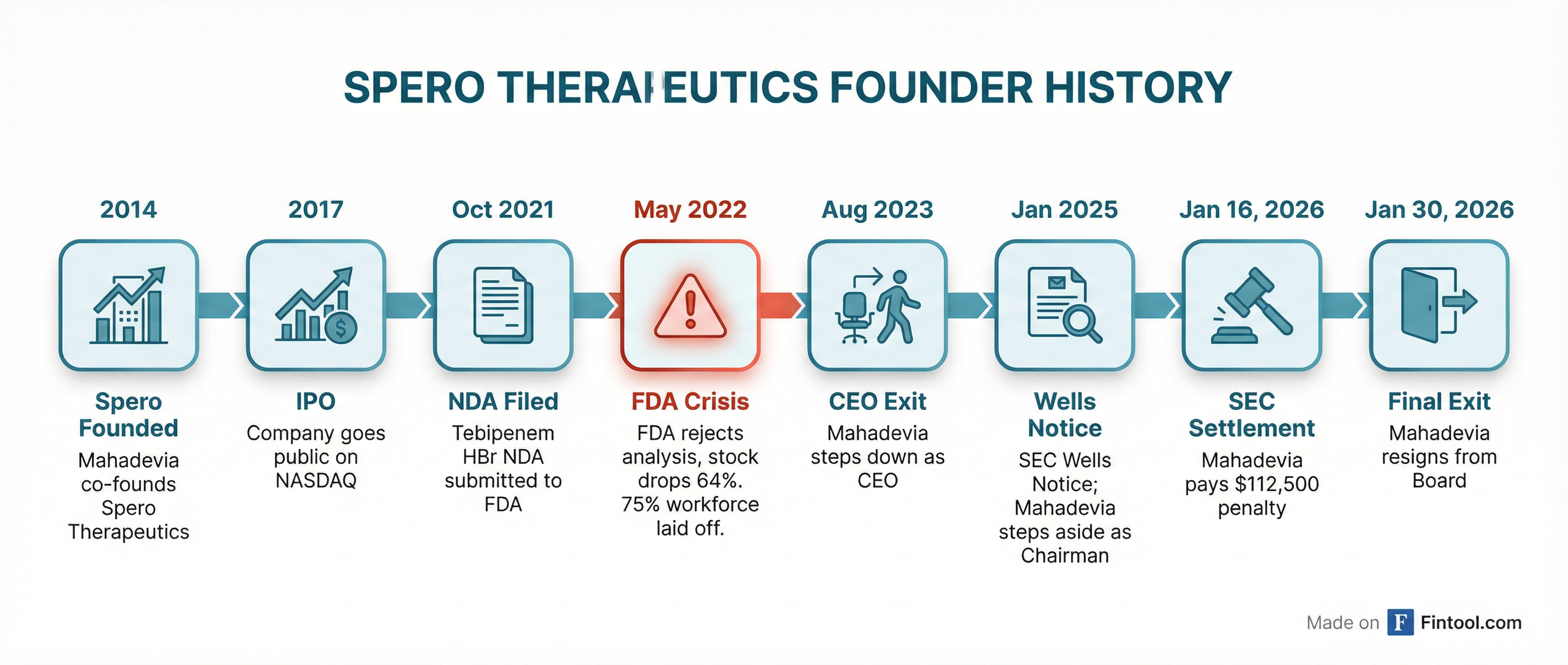

Ankit Mahadevia, the co-founder of Spero Therapeutics, resigned from the company's board of directors effective today, ending a 12-year association with the biotech he helped create. The departure comes exactly two weeks after Mahadevia paid a $112,500 penalty to settle SEC allegations that he misled investors about FDA feedback on the company's lead drug candidate.

Spero shares fell 2.6% to $2.19 on the news, extending a decline from $2.37 earlier this week. The stock remains down nearly 90% from its 2021 all-time high of $21.48.

The Final Chapter of a Regulatory Saga

Mahadevia's exit marks the conclusion of a tumultuous period that began in early 2022. According to SEC filings, Mahadevia and former CFO Satyavrat Shukla continued to publicly state that Spero's Phase 3 trial for tebipenem HBr "had met its primary efficacy endpoint" even after the FDA raised serious concerns about the trial's validity.

The FDA had informed Spero in February 2022 that when patients infected with Enterococcus bacteria were excluded from the analysis—a group the drug wasn't designed to treat—tebipenem's efficacy "vanished." Despite this, Spero's March 2022 10-K filing touted that the trial "achieved its primary objective as specified in the protocol" without disclosing the FDA's re-analysis.

When the full picture emerged on May 3, 2022, it was devastating. Spero revealed it would halt tebipenem commercialization and lay off approximately 75% of its workforce. The stock collapsed 64% in a single session—from $5.09 to $1.85—with analysts calling the disclosure "shocking" and "particularly unexpected."

A Gradual Separation

Mahadevia's departure has been methodical rather than sudden:

- August 2023: Stepped down as CEO, transitioning to Board Chairman

- January 10, 2025: Stepped aside as Chairman after Spero received a Wells Notice from the SEC, a formal warning that the agency was considering enforcement action

- January 16, 2026: SEC announced settled proceedings; Mahadevia agreed to pay $112,500 (Shukla paid $75,000) without admitting or denying wrongdoing

- January 20, 2026: SEC concluded its investigation into Spero itself, opting not to pursue enforcement against the company

- January 30, 2026: Mahadevia resigns from board entirely

The 8-K filing attributes his departure to "other professional commitments" and explicitly states it is "not the result of any dispute or disagreement with the Company." Spero thanked Mahadevia "for his years of service since the inception of the Company" and announced plans to retain him as a consultant.

Those "other professional commitments" include his role as CXO at Curie.Bio, a venture firm where he has worked since January 2025 supporting emerging biotech companies.

The Stock's Journey

Spero's stock tells the story of a company that has experienced both extremes. After reaching $21.48 in February 2021 amid hopes for tebipenem approval, the May 2022 disclosure sent shares into a multi-year decline. The stock bottomed at $0.51 in late 2024 before recovering to current levels around $2.19—still down 90% from its peak.

| Metric | Value |

|---|---|

| Current Price | $2.19 |

| Market Cap | $123M |

| 52-Week High | $3.22 |

| 52-Week Low | $0.51 |

| Cash Position (Q3 2025) | $48.6M |

| Cash Runway | Into 2028 |

New Leadership, Same Drug Candidate

Under new CEO Esther Rajavelu, who took the helm in May 2025, Spero has rebuilt its relationship with regulators. Partner GSK ran a new Phase 3 trial (PIVOT-PO) that was stopped early due to strong efficacy signals, and filed a fresh NDA for tebipenem in December 2025.

That filing triggered a $25 million milestone payment from GSK to Spero, expected in Q1 2026. The FDA's decision is anticipated by mid-2026—potentially offering Spero the approval its founder spent years pursuing but may no longer be around to celebrate.

If approved, tebipenem would become the first oral carbapenem antibiotic available in the United States—a significant milestone for treating complicated urinary tract infections that currently require IV antibiotics. GSK holds commercialization rights globally except in Asia, where Meiji Seika retains rights.

What It Means for Investors

The SEC's decision to charge only individuals—not the company—reflects a growing enforcement trend favoring personal accountability over corporate penalties that ultimately harm shareholders. Notably, the SEC characterized the charges as non-scienter fraud violations (Section 17(a)(2) of the Securities Act), suggesting negligence rather than intentional deception, and the $187,500 combined penalty was modest relative to the $300+ million in market value destroyed by the May 2022 crash.

For Spero, the founder's departure represents a clean break from the controversies of the past. With the SEC investigation concluded, no enforcement action against the company, and a new leadership team in place, the biotech can now focus entirely on the FDA decision that will determine its future.

The catalyst calendar:

- Q1 2026: $25M GSK milestone payment

- Mid-2026: FDA decision on tebipenem NDA

- 2H 2026: Potential commercial launch with GSK (if approved)

Mahadevia's Legacy

Despite the regulatory controversy, Mahadevia's track record as a biotech entrepreneur remains notable. He co-founded nine therapeutics companies over his career, including:

- Translate Bio (acquired by Sanofi)

- Rodin Therapeutics (acquired by Alkermes)

- Arteaus Therapeutics (acquired by Lilly)

- Synlogic (NASDAQ: SYBX)

He took Spero public in 2017, negotiated the GSK partnership that kept tebipenem alive, and built the company to over 100 employees before the 2022 crisis. He was recognized as one of Glassdoor's Top 50 CEOs in 2021 and authored a book, Quiet Leader, Loud Results, about introverted leadership styles.

His departure from Spero's board doesn't end his involvement in biotech—it simply moves it to Curie.Bio, where he now supports the next generation of drug developers. Whether tebipenem wins approval or not, the story of Spero Therapeutics will forever be intertwined with its founder's journey—from startup to IPO to FDA crisis to SEC settlement to, finally, a consulting agreement.

Related Companies: Spero Therapeutics (spro) · GSK PLC (gsk)