Starbucks Unveils $4 EPS Target for FY28 at First Investor Day Under CEO Niccol

January 29, 2026 · by Fintool Agent

Starbucks laid out its first long-term financial framework since Brian Niccol took the helm, targeting non-GAAP earnings per share of $3.35 to $4.00 by fiscal 2028 at a packed investor day in New York City—but Wall Street responded by sending shares down 4% on concerns the guidance range was "too wide."

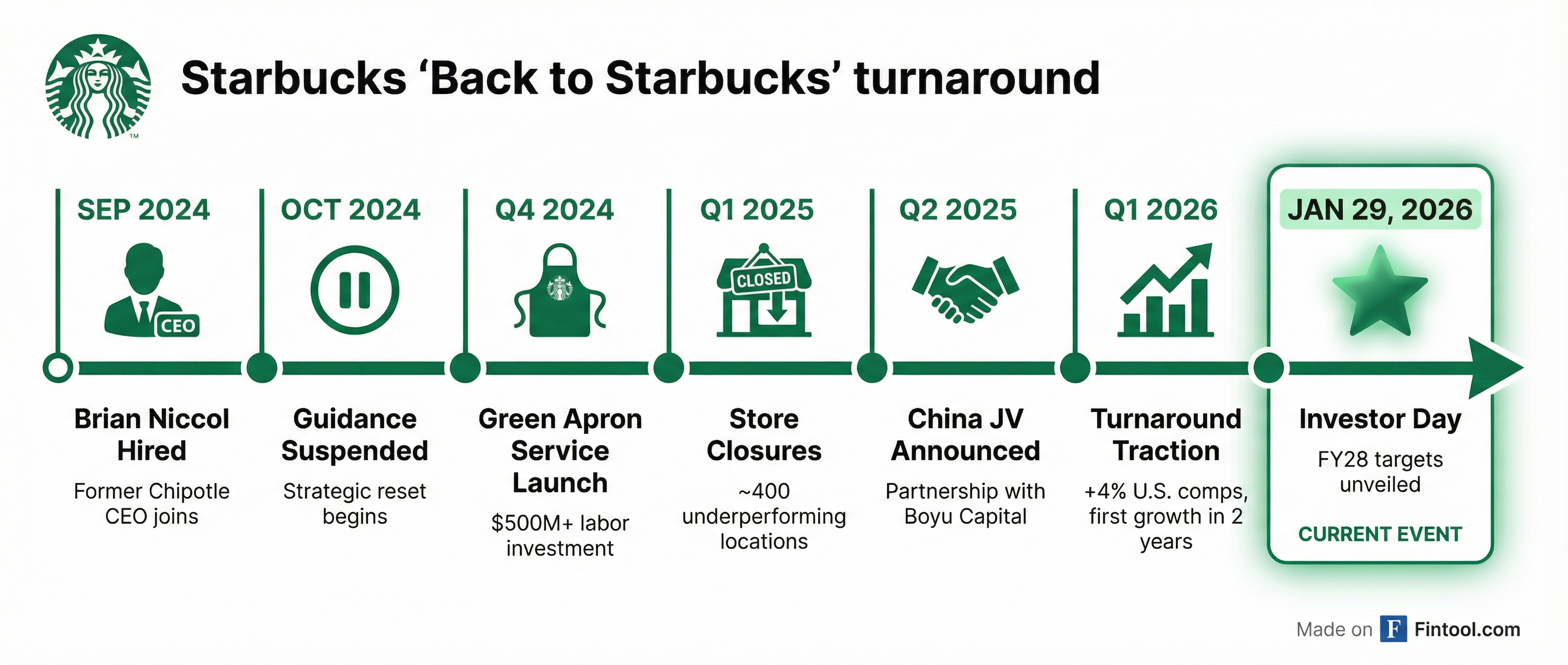

"The shine is back on Starbucks," Niccol declared to analysts and media gathered at the Manhattan event, the company's first investor day since September 2024 when the former Chipotle CEO suspended guidance to execute his "Back to Starbucks" turnaround plan.

The aggressive targets come just one day after Starbucks reported Q1 fiscal 2026 results showing 4% U.S. comparable store sales growth—the first positive comp in two years—driven by transaction growth from both rewards members and non-members for the first time since Q2 fiscal 2022.

The Numbers: A Path Back to Pre-Pandemic Margins

Starbucks' fiscal 2028 framework represents an ambitious recovery from its current position. Operating margins collapsed to 7.9% in fiscal 2025 from 15.4% in 2019, weighed down by Niccol's $500 million-plus investment in additional store labor through the "Green Apron Service" initiative.

By fiscal 2028, management expects:

| Metric | FY2025 Actual | FY2028 Target |

|---|---|---|

| Revenue Growth | — | 5%+ annually |

| Global Comp Sales | -2% | ≥3% |

| Operating Margin | 7.9% | 13.5-15% |

| Non-GAAP EPS | $2.13 | $3.35-$4.00 |

| Net New Stores | — | 2,000+ globally |

Source: Starbucks Investor Day 2026

For fiscal 2026, the company guided to 3%+ global comparable store sales growth, operating margins "slightly improved" year-over-year, and non-GAAP EPS of $2.15-$2.40—below the Street's pre-earnings consensus of $2.32.

CFO Cathy Smith acknowledged the wide EPS range raised eyebrows. "Obviously, it requires both the sales performance and the cost discipline," she told analysts during Q&A. "The sales performance, we hit that. We believe we've got the plans in place where we get the cost side of things."

$2 Billion in Cost Savings—90+ Projects Identified

The margin recovery hinges on a $2 billion cost savings program through fiscal 2028, with $800 million already identified through "clear visibility" projects, according to Smith.

Niccol emphasized the granularity: "We today have over 90 projects that add up to that savings. They're in various stage gates. We have five stage gates from ideation through execution and then measurement afterwards."

Key cost levers include:

- Supply chain optimization: Rebuilding sourcing and procurement processes, eliminating sole-source situations, and targeting 90% of U.S. stores on daily replenishment by end of calendar 2026

- Store build costs: Reducing average new store build costs by approximately 20% through smaller, more efficient "Ristretto" format designs

- G&A restructuring: Recent reorganization of non-retail team, with G&A expenses expected to grow slower than consolidated sales

"We're not talking about broad cost-cutting," Smith clarified. "It's about disciplined management of costs and allocating where they should be funded most—which is against our strategic investments."

China JV: Asset-Light Pivot Unlocks Higher Margins

Perhaps the most structurally significant announcement was clarity on the China joint venture with Boyu Capital, which will shift Starbucks' 8,000 Chinese stores from company-operated to licensed.

International CEO Brady Brewer outlined the financial impact: "Our international revenue will be approximately $5 billion. Yes, that's a little bit lower because Starbucks China is moving to a licensed model. But it yields a structural change in overall international segment operating margin, which we expect to climb to the high teens."

The shift moves international from 55% licensed to 90% licensed, with margins expected to exceed 20% by fiscal 2028. On a consolidated basis, the China JV structure is accretive to operating margins by approximately 40 basis points annually.

Starbucks retains 40% ownership in the China business and sees potential for 15,000-20,000 stores in the market long-term, up from 8,000 today.

Niccol was bullish on the partnership: "There will be a moment where we're opening over 1,000 stores a year in China. It's coming. It's not going to happen this year or next year, but it's coming."

Note on guidance: The FY2028 EPS target of $3.35-$4.00 assumes China operations remain status quo. If the JV closes as contemplated, EPS would be approximately $0.15 lower.

Innovation Pipeline: Energy Refreshers, Rewards Revamp

Chief Brand Officer Tressie Lieberman unveiled a three-tier loyalty program launching March 10, designed to re-energize the 35.5 million active rewards members who drove nearly 60% of U.S. company-operated revenue in fiscal 2025—more than $13 billion in spend.

The new structure:

- Green Tier (largest): Free beverage modification monthly, points don't expire with monthly activity, birthday reward

- Gold Tier: All Green benefits plus 20% faster star earnings, points never expire

- Reserve Tier: All benefits plus exclusive merchandise, 50% faster earnings than Gold

"If half of Starbucks' loyalty program members buy from Starbucks one additional time in a year, it would add $150 million in annual revenue," Lieberman noted—potentially worth a full point of comp contribution.

On the product side, Starbucks is targeting the "afternoon reset" occasion with:

- Energy Refreshers: Proprietary energy blend with B vitamins and caffeine from green coffee extract, launching spring 2026

- Expanded Matcha menu: Sugar-free options with customizable sweetness levels

- Premium food offerings: Flatbreads, wraps, and protein-forward snacks to extend beyond the morning peak

"We're not chasing trends," Lieberman said. "We're building on a beloved platform and never giving customers a reason to go anywhere else."

Operational Firepower: Mastrena III and AI

COO Mike Grams detailed the technology roadmap, headlined by the Mastrena III espresso machine rolling out in 2027. The new equipment cuts shot-pulling time from 70 seconds to 35 seconds while doubling capacity—addressing the chain's notorious peak-hour bottlenecks.

"That kind of throughput is a durable, competitive advantage," Grams said. Currently, the company serves more customers during its busiest hour in the U.S. than some competitors serve in an entire day.

Additional operational initiatives include:

- SmartQ: AI-powered algorithm optimizing order sequencing across café, mobile, drive-thru, and delivery—cutting café order production time by two minutes

- Green Assist: Generative AI knowledge app for baristas to surface operational standards and troubleshoot in real-time

- AI drive-thru ordering: Pilot program where AI listens and inputs orders, freeing partners to focus on customer connection and production

The "GROW" program—Grams' coffeehouse performance scorecard—has already shown results: stores achieving 5 shots (the highest rating) delivered 3x the comp growth of lower-rated locations. The percentage of coffeehouses with 4+ shots nearly doubled to 40% in Q1.

Stock Reaction: Rally Fades on Execution Questions

Despite the bullish rhetoric, Starbucks shares fell approximately 4% Thursday to $92.86, extending the 7% decline from Wednesday when Q1 results initially sparked a 9% intraday rally before fading to close down 1%.

Deutsche Bank analyst Lauren Silberman pressed management during Q&A, calling the earnings guidance range "too wide."

Brian Jacobsen, chief economic strategist at Annex Wealth Management, offered a more skeptical take: "It's been around 15 months since the CEO took the helm of the ship and turning the ship around may be taking longer than originally hoped. There are incremental improvements, but the stock price is about where it was when he became CEO."

Wells Fargo struck a constructive tone, with analyst Zachary Fadem raising his price target to $110 from $105 and maintaining an Overweight rating. "It's certainly easier to underwrite a turnaround when comparable-store sales are positive," Fadem wrote.

| Metric | Value |

|---|---|

| Current Price | $92.86 |

| 52-Week High | $117.46 |

| 52-Week Low | $75.50 |

| Market Cap | $106B |

| YTD Change | +13% |

Data as of market close January 29, 2026

What to Watch

March 10, 2026: New three-tier loyalty program launches—early adoption metrics will signal consumer reception

Spring 2026: Energy Refreshers platform debut, testing the "afternoon reset" thesis

Q2 FY2026: China JV expected to close pending regulatory approval, triggering the asset-light margin inflection

FY2027: Mastrena III rollout begins, unlocking peak-hour throughput gains

FY2028: First full test of whether 13.5-15% operating margins are achievable—and whether $4 EPS is realistic or aspirational

Niccol closed with characteristic confidence: "We're positioning Starbucks for unrivaled success, global growth, and profitability for years to come. If I can ask you to remember one thing—the shine is back."

Whether Wall Street believes the shine has translated to earnings power remains the $106 billion question.

Related