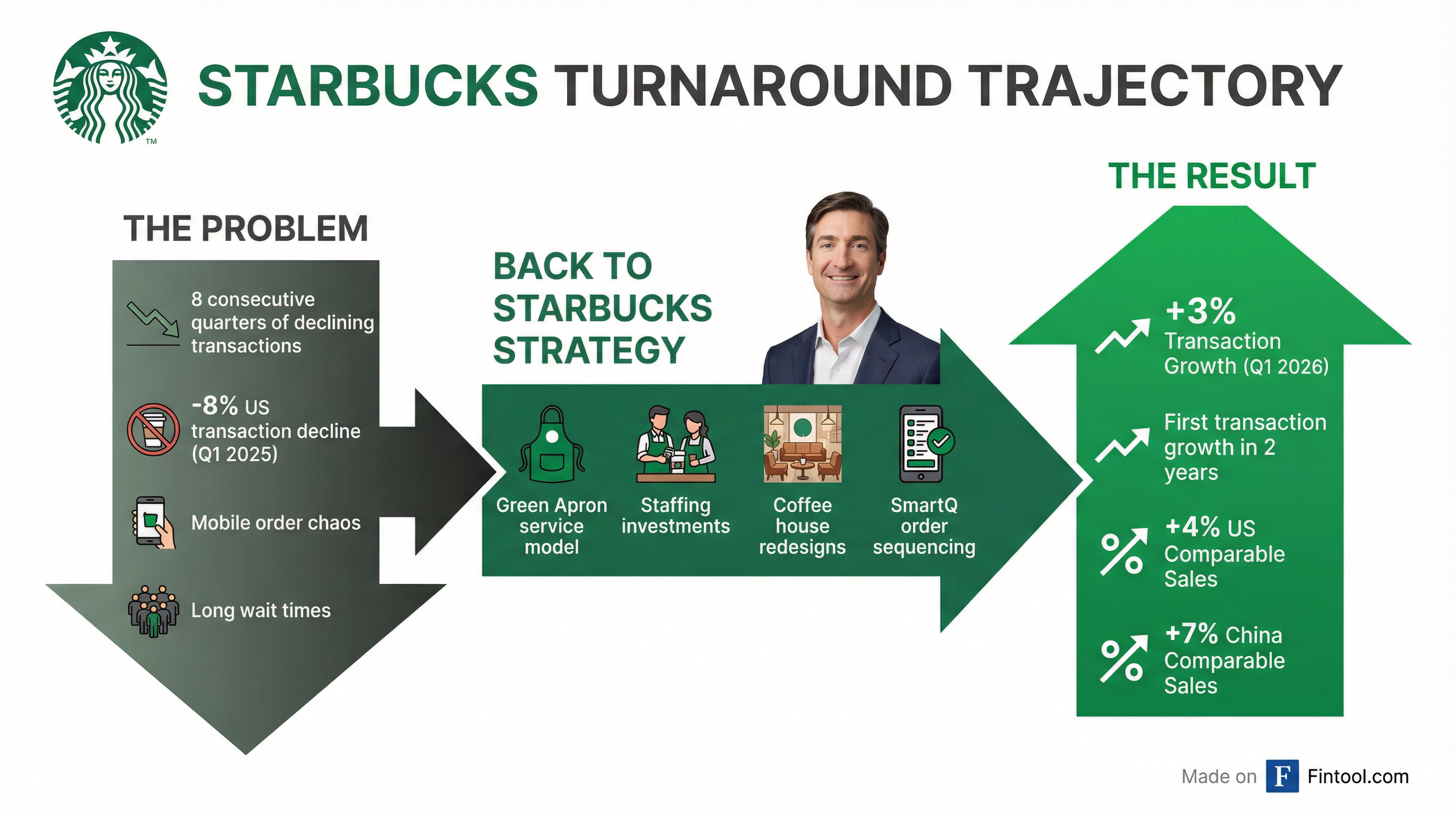

Starbucks Delivers First Transaction Growth in Two Years as 'Back to Starbucks' Strategy Gains Traction

January 28, 2026 · by Fintool Agent

Starbucks reported its first quarter of positive U.S. transaction growth in eight quarters—two full years—as CEO Brian Niccol's "Back to Starbucks" turnaround strategy begins delivering measurable results. Global comparable store sales accelerated to 4% in Q1 fiscal 2026, driven by a 3% increase in transactions, with Niccol declaring the company is "ahead of schedule."

The coffee giant's fiscal Q1 results (ended December 28, 2025) beat revenue expectations at $9.92 billion versus $9.67 billion estimated, though adjusted earnings per share of $0.56 fell short of the $0.59 consensus.

"Our Q1 results demonstrate our 'Back to Starbucks' strategy is working and we believe we're ahead of schedule," Niccol said. "It's great to see the sales momentum driven by more customers choosing Starbucks more often, and this is just the beginning."

The Numbers: A Dramatic Reversal

The transaction growth marks a stark reversal from a year ago, when Starbucks reported an 8% decline in U.S. transactions during Q1 fiscal 2025.

| Metric | Q1 2026 | Q1 2025 | Change |

|---|---|---|---|

| Global Comparable Sales | +4% | -4% | +800 bps |

| U.S. Comparable Sales | +4% | -4% | +800 bps |

| U.S. Transactions | +3% | -8% | +1,100 bps |

| China Comparable Sales | +7% | -6% | +1,300 bps |

| Total Revenue | $9.92B | $9.40B | +6% |

| Non-GAAP Operating Margin | 10.1% | 11.9% | -180 bps |

| Non-GAAP EPS | $0.56 | $0.69 | -19% |

The margin compression reflects labor investments to support the turnaround, along with inflationary pressures from elevated coffee pricing and tariffs.

What Changed: The Green Apron Revolution

When Niccol took over in August 2025, Starbucks faced a crisis of its own making: mobile order chaos overwhelming baristas, long wait times alienating customers, and a brand that had drifted from its coffeehouse roots. His solution—dubbed "Back to Starbucks"—centered on three pillars:

1. Green Apron Service Model: Starbucks' biggest-ever investment in operating standards, establishing consistent service expectations and improved staffing. Early pilots showed double-digit improvements in cafe orders completed under four minutes.

2. SmartQ Technology: An advanced order sequencing algorithm that brought order to mobile ordering chaos. Where deployed, 80% of in-cafe orders now meet the four-minute target.

3. Coffeehouse Redesigns: Store uplifts emphasizing warmth, community, and craft—with ceramic mugs, expanded free refill policies, and "great seats" designed to entice customers to stay.

"We're not just getting back to Starbucks, we're building a better Starbucks," Niccol told analysts in July 2025. "One that is once again the gold standard in customer service, partner experience, the coffeehouse experience and financial performance."

China: The $5 Billion Question

China comparable sales surged 7%—driven by 5% transaction growth and 2% ticket growth—the strongest performance in years for Starbucks' second-largest market.

But the quarter also marked a pivotal strategic shift. In November, Starbucks announced a joint venture with Boyu Capital, which will acquire up to 60% of Starbucks' China retail operations. Starbucks retains a 40% stake and continues to own the brand and intellectual property.

The transaction, expected to close in spring 2026, triggered a 61.7% effective tax rate in Q1 due to changes in indefinite reinvestment assertions—explaining most of the gap between GAAP EPS of $0.26 and adjusted EPS of $0.56.

| China Metrics | Q1 2026 | Q1 2025 | Change |

|---|---|---|---|

| Revenue | $823M | $744M | +11% |

| Comparable Sales | +7% | -6% | +1,300 bps |

| Transactions | +5% | -2% | +700 bps |

| Store Count | 8,011 | 7,685 | +4% |

What's Next: Investor Day Tomorrow

Starbucks will host its 2026 Investor Day on January 29, where executives are expected to unveil long-term financial targets and provide additional detail on the turnaround roadmap.

For fiscal 2026, management guided:

- Global and U.S. comparable sales growth of 3% or greater

- Non-GAAP operating margin to slightly improve year-over-year

- Non-GAAP EPS of $2.15 to $2.40

- 600 to 650 net new stores globally

The stock, trading around $96, has gained approximately 14% year-to-date—easily outpacing the S&P 500—as investors bet that Niccol can replicate his successful Chipotle turnaround.

The Bottom Line

Niccol's first full quarter delivered the proof point investors have been waiting for: transactions are growing again. But the margin pressure from turnaround investments means the harder work—translating top-line momentum into bottom-line growth—lies ahead.

"With our 'Back to Starbucks' initiatives gaining traction, we have clear line of sight to translating topline strength into sustainable earnings growth that positions us for long-term profitable growth," CFO Cathy Smith said.

The real test comes tomorrow at Investor Day, where Starbucks must convince Wall Street that today's investments will compound into the margin expansion and earnings growth the stock price has already begun to anticipate.

Related