Steel Partners Goes Hostile on InMode, Offering $18 for 51% Stake in Cash-Rich Medtech

January 29, 2026 · by Fintool Agent

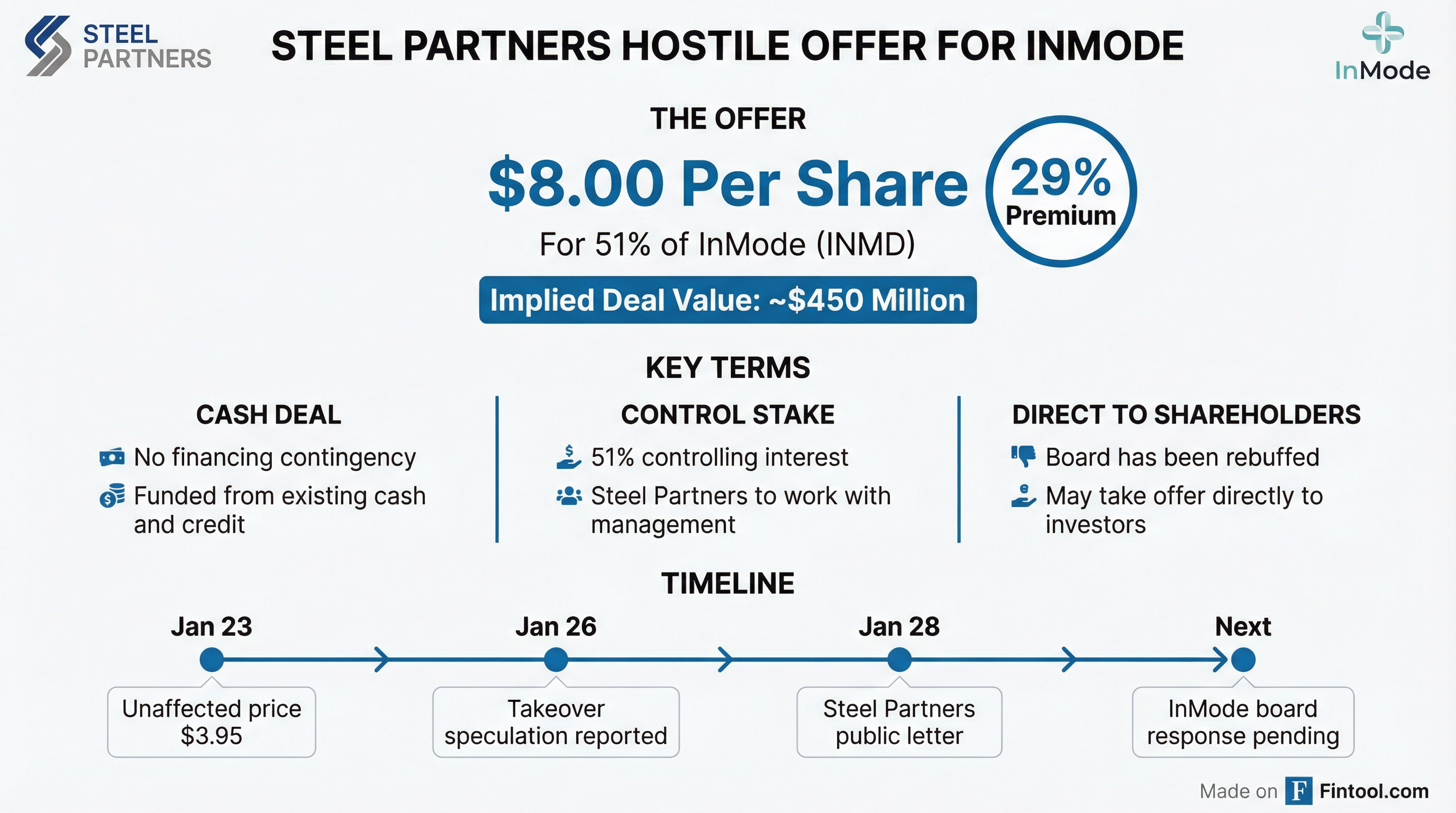

Steel Partners Holdings, the diversified conglomerate controlled by activist investor Warren Lichtenstein, has gone public with an unsolicited $18-per-share offer for 51% of Inmode LTD., the Israel-based maker of minimally invasive aesthetic medical devices. The 29% premium signals an aggressive move on a company that Steel Partners describes as chronically mismanaged, sitting on a $532 million cash hoard while its stock has cratered 56% over three years.

InMode shares jumped 6% on Thursday to around $16, though still well below the $18 offer price—suggesting skepticism about whether the deal will materialize. InMode has not publicly responded to the offer.

The Offer

Steel Partners' proposal is straightforward: $18 per share for 51% of InMode, funded entirely from cash and existing credit facilities with no financing contingency.

| Term | Details |

|---|---|

| Offer Price | $18.00/share |

| Premium | 29% to unaffected close (Jan 23) |

| Stake Sought | 51% (controlling interest) |

| Implied Equity Value | $1.1 billion (100%) |

| Deal Size | $550 million (51% stake) |

| Financing | Cash + credit facility, no contingency |

The offer comes after Steel Partners attempted private engagement that was "rebuffed" by InMode's leadership, according to the activist's shareholder letter.

"We have made multiple attempts to engage privately with InMode's leadership about our attractive proposal but have so far been rebuffed. Therefore, we believe it is imperative that you, the company's true owners, are made aware of this opportunity," Steel Partners wrote in its letter to shareholders.

The Activist's Case Against InMode

Steel Partners laid out a scathing critique of InMode's performance and capital allocation in its public letter.

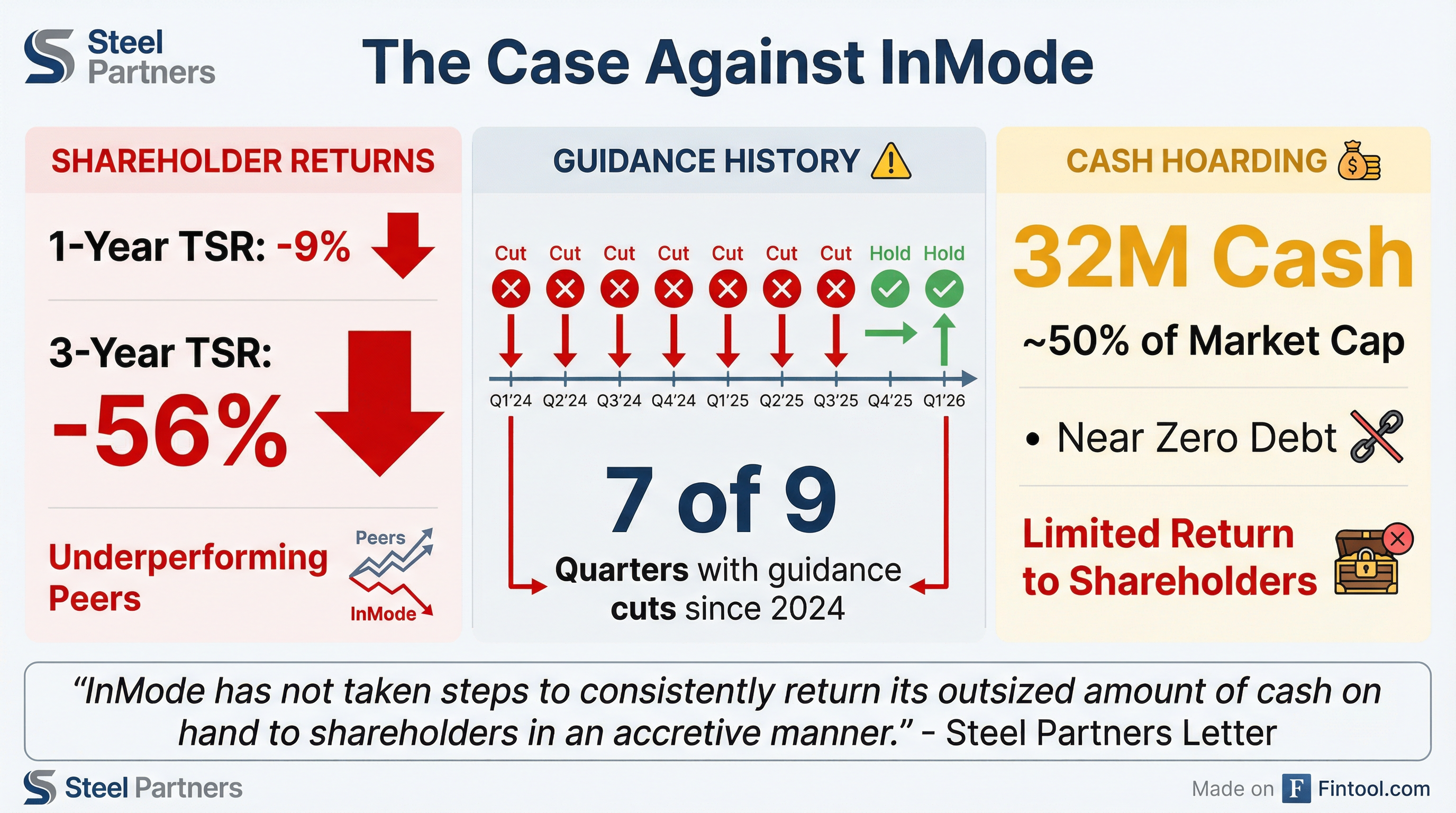

Dismal Shareholder Returns

The numbers paint a grim picture for InMode shareholders:

- 1-year total return: -9%

- 3-year total return: -56%

- 5-year total return: Underperforming peers significantly

The stock has collapsed from highs above $45 in 2021 to around $16 today, while the broader medical device sector has rallied.

Serial Guidance Cutter

Most damning is InMode's pattern of persistent guidance cuts. Steel Partners highlighted that the company has cut guidance in seven of the past nine quarters—including as recently as January 8, 2026, when InMode lowered the top end of its 2025 revenue and gross margin guidance.

For 2026, InMode is guiding to $365-375 million in revenue—versus analyst estimates of $384 million—suggesting the pattern may continue.

The $532 Million Question

Perhaps Steel Partners' sharpest criticism targets InMode's balance sheet. As of Q3 2025, the company held $532.3 million in cash and cash equivalents—representing nearly 50% of its market capitalization—with minimal debt.

"It is concerning that, despite enjoying the enviable position of having a large amount of cash on its balance sheet and no debt, InMode has not taken steps to consistently return its outsized amount of cash on hand to shareholders in an accretive manner," Steel Partners wrote.

InMode's Financials: A Business in Decline

The financial data supports Steel Partners' thesis. InMode's revenue has declined meaningfully over the past two years as the medical aesthetics market faces discretionary spending headwinds.

| Metric | Q4 2023 | Q3 2024 | Q4 2024 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $127M | $130M | $98M | $93M |

| Gross Margin | 84% | 82% | 79% | 78% |

| Net Income | $55M | $51M | $83M | $22M |

| Cash Position | $144M | $165M | $155M | $252M |

Revenue peaked above $130 million quarterly in late 2024 before sliding to the low-$90 million range. Gross margins have compressed from 84% to 78%. Meanwhile, cash continues to pile up on the balance sheet.

InMode trades at just 6x earnings—a massive discount to the medical equipment industry average of 31x—suggesting the market has priced in sustained underperformance.

Warren Lichtenstein: The Man Behind Steel Partners

Steel Partners is controlled by Warren Lichtenstein, a veteran activist investor who founded the firm in 1990 with just $600,000. From 1990 to 2007, the fund earned gross annual returns of 22%, establishing Lichtenstein's reputation as an aggressive value investor.

Today, Steel Partners Holdings is a $3.6 billion revenue diversified conglomerate operating across industrial manufacturing, energy, defense, supply chain, banking, and youth sports. The company holds stakes in businesses like Aerojet Rocketdyne (where Lichtenstein serves as executive chairman) and WebBank.

Lichtenstein has served on the boards of more than 30 public companies worldwide, with a track record of operational engagement—sometimes welcome, sometimes not. His approach: acquire controlling stakes in undervalued companies, engage with management to improve operations and capital allocation, and realize value over time.

Steel Partners currently owns approximately 800,000 InMode shares (1.3% of outstanding), a toehold position that positions the firm as a credible acquirer.

What Happens Next

The ball is now in InMode's court. The company has several options:

- Engage with Steel Partners: Enter negotiations, potentially leading to a higher price or different deal structure

- Reject the offer: Publicly rebuff the proposal and defend current strategy

- Seek alternative buyers: Launch a sale process to find a higher bidder

- Do nothing: Let the offer languish, forcing Steel Partners' next move

Steel Partners has signaled it won't wait indefinitely. "If InMode's board and management do not engage, we may proceed with a binding proposal directly to shareholders," the activist warned.

The threat to go directly to shareholders—bypassing the board—suggests Steel Partners is prepared for a potentially hostile campaign. With no financing contingency and a meaningful premium, the offer puts pressure on InMode's board to either engage or articulate a compelling alternative.

Key dates to watch:

- February 10: InMode reports Q4 2025 earnings

- TBD: Potential InMode board response

- TBD: Steel Partners' next move if rebuffed

The Investment Case

For shareholders, the Steel Partners offer creates an interesting setup:

Bull case for accepting:

- 29% premium is real money after years of losses

- Steel Partners' operational expertise could improve execution

- Cash hoard suggests opportunity for special dividends or buybacks under new ownership

- Board may be unable to articulate credible alternative

Bear case for rejecting:

- $18 may undervalue long-term potential if aesthetics market rebounds

- InMode's proprietary RF technology remains differentiated

- Serial guidance cuts may reflect conservative forecasting, not operational failure

- Loss of independence as public company

At $16 per share, InMode trades at an implied 11% discount to the offer, reflecting market skepticism about completion. If the board engages and a deal materializes, shareholders capture the premium. If the board fights and wins, they're left with a company that still faces the same challenges that attracted an activist in the first place.

For now, InMode's silence speaks volumes. The company has earnings in two weeks—plenty of time to formulate a response. Until then, shareholders are left wondering whether $18 is the floor or the ceiling.