Earnings summaries and quarterly performance for InMode.

Research analysts who have asked questions during InMode earnings calls.

Sam Eiber

BTIG, LLC

6 questions for INMD

Caitlin Cronin

Canaccord Genuity

4 questions for INMD

Dane Reinhardt

Robert W. Baird & Co.

3 questions for INMD

Danielle Antalffy

UBS Group AG

3 questions for INMD

Joseph Conway

Needham & Company, LLC

3 questions for INMD

Matthew Miksic

Barclays PLC

3 questions for INMD

Matt Miksic

Barclays Investment Bank

3 questions for INMD

Michael Sarcone

Jefferies

3 questions for INMD

Caitlin Roberts

Canaccord Genuity

2 questions for INMD

Jeffrey Johnson

Robert W. Baird & Co. Inc.

2 questions for INMD

Michael Matson

Needham & Company

2 questions for INMD

Danielle Antalffy

UBS

1 question for INMD

Matthew Taylor

Jefferies

1 question for INMD

Matt Taylor

Jefferies & Company Inc.

1 question for INMD

Mike Matson

Needham & Company, LLC

1 question for INMD

Tommy Han

Robert W. Baird & Co. Incorporated

1 question for INMD

Recent press releases and 8-K filings for INMD.

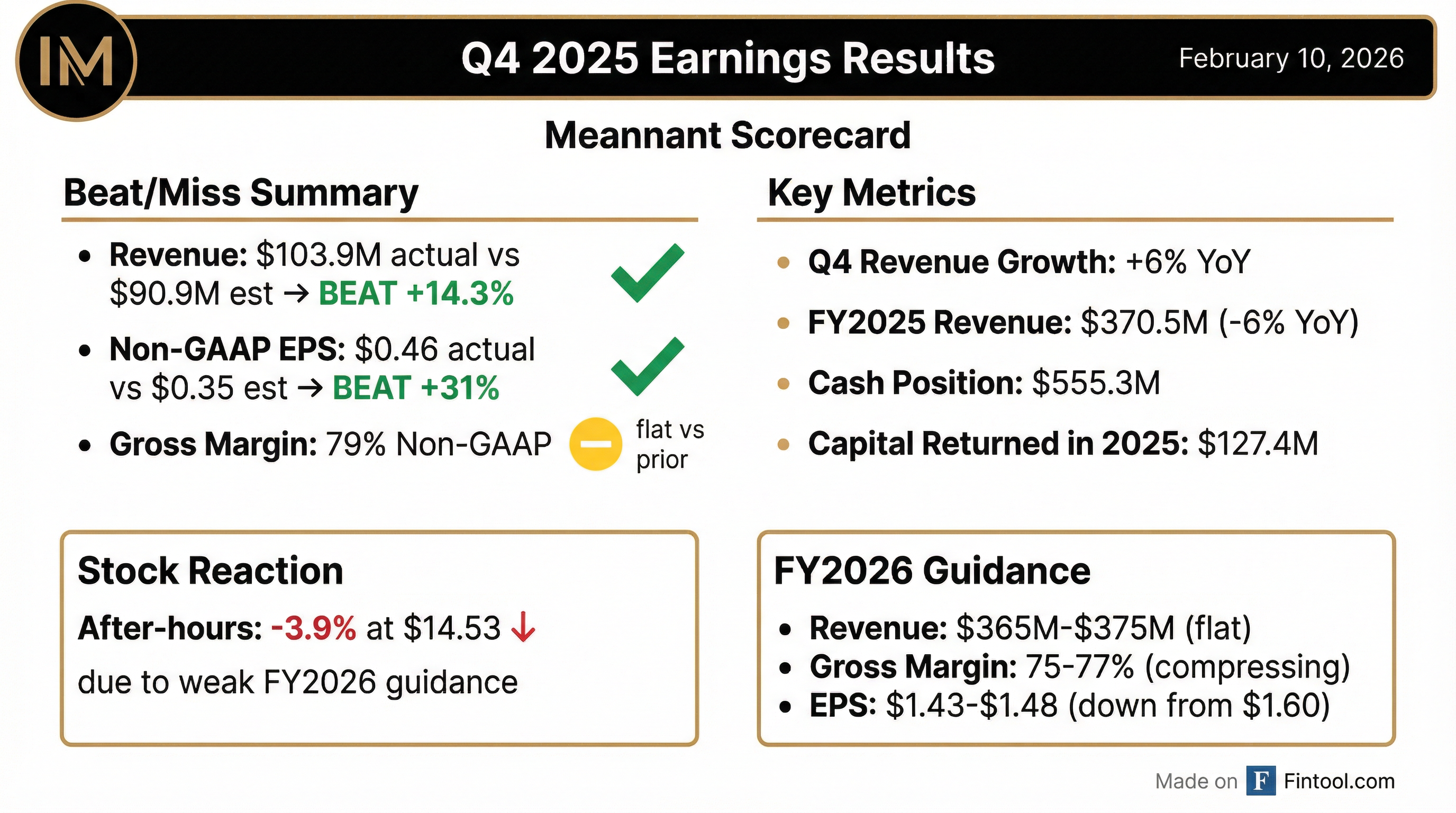

- InMode generated $103.9 million in total revenue for the fourth quarter of 2025, and $370.5 million for the full year 2025, representing a 6% decrease compared to 2024. Non-GAAP diluted earnings per share for Q4 2025 was $0.46, and $1.60 for the full year 2025.

- For 2026, InMode expects total revenues to be between $365 million and $375 million, with Non-GAAP diluted earnings per share projected between $1.43 and $1.48.

- The company views 2026 as a stabilization year for the business, following a period of industry softness. InMode plans to introduce two new platforms in 2026: a Korean-made Pico laser device and a device combining new Morpheus technology with Erbium YAG laser. These new laser products are expected to result in a Non-GAAP gross margin guidance of 75%-77% for 2026, partly due to higher costs and shared margins with suppliers.

- The board of directors is evaluating strategic alternatives to improve company value and has engaged Bank of America to assist in this process. The company also returned $127.4 million to shareholders through a share repurchase program.

- InMode reported Q4 2025 revenue of $103.9 million, an increase from Q4 2024, but full-year 2025 revenue decreased by 6% to $370.5 million compared to 2024, with Non-GAAP diluted EPS of $1.60 for the full year.

- The company provided 2026 revenue guidance between $365 million and $375 million and Non-GAAP diluted EPS between $1.43 and $1.48, anticipating 2026 to be a stabilization year amidst ongoing industry challenges.

- InMode plans to introduce two new platforms in 2026, including a Korean-made Pico laser and a device combining new Morpheus technology with Erbium YAG laser, which are expected to impact gross margins due to higher costs.

- The board of directors is actively considering strategic alternatives to enhance company value and has engaged Bank of America to assist in this process.

- InMode reported Q4 2025 revenue of $103.9 million, an increase from $97.9 million in Q4 2024, and full-year 2025 revenue of $370.5 million, marking a 6% decrease compared to 2024. Non-GAAP diluted EPS for Q4 2025 was $0.46, up from $0.42 in Q4 2024, while full-year 2025 Non-GAAP diluted EPS was $1.60, down from $1.76 in 2024.

- The company provided 2026 guidance, projecting revenues between $365 million and $375 million and Non-GAAP diluted EPS between $1.43 and $1.48. Management characterized 2026 as a stabilization year for the business.

- InMode plans to introduce two new platforms in 2026: a Korean-made Pico laser device and a device combining new Morpheus technology with Erbium YAG laser. The introduction of these laser products is expected to weigh on gross margins, which are guided between 75%-77% for 2026, partly due to lower margins on laser equipment and U.S. tariffs.

- The board of directors is exploring strategic alternatives to enhance company value, having previously executed a share repurchase program totaling almost $508 million over the last two and a half years.

- In Q4 2025, InMode reported revenue of $103.9 million and Non-GAAP diluted earnings per share of $0.46, with a Non-GAAP gross margin of 79% and Non-GAAP net income of $29.4 million.

- For the full year 2025, the company achieved revenue of $370.5 million and Non-GAAP diluted earnings per share of $1.60, maintaining a Non-GAAP gross margin of 79% and recording Non-GAAP net income of $105.5 million.

- InMode operates globally, selling in 101 countries with 285 direct sales representatives, and has a worldwide installed base of 30,980 units, including 13,100 units in the US.

- The company is a leading global provider of innovative, minimally-invasive aesthetic and wellness solutions, leveraging 22 patented technologies across 12 product families.

- InMode reported GAAP revenues of $103.9 million for Q4 2025, a 6% increase compared to Q4 2024, and $370.5 million for the full year 2025, representing a 6% decrease from 2024.

- GAAP net income for Q4 2025 was $27.0 million ($0.42 per diluted share) and $93.8 million ($1.43 per diluted share) for the full year 2025. On a non-GAAP basis, net income was $29.4 million ($0.46 per diluted share) for Q4 2025 and $105.5 million ($1.60 per diluted share) for the full year 2025.

- As of December 31, 2025, the company's total cash position was $555.3 million, and it returned $127.4 million of capital to shareholders through share repurchases during 2025.

- For the full year 2026, InMode expects revenues to be between $365 million to $375 million and non-GAAP diluted earnings per share between $1.43 to $1.48.

- Management noted early signs of stabilization in the industry, with initial growth in Europe, and plans to launch two new laser-based platforms in 2026.

- InMode reported GAAP revenues of $103.9 million for Q4 2025 and $370.5 million for the full year 2025, representing a 6% year-over-year decrease.

- Non-GAAP diluted earnings per share were $0.46 for Q4 2025 and $1.60 for the full year 2025.

- The company returned $127.4 million of capital to shareholders through share repurchases during 2025.

- For the full year 2026, InMode provided guidance expecting revenues between $365 million to $375 million and non-GAAP earnings per diluted share between $1.43 to $1.48.

- Management noted early signs of stabilization in the industry, initial growth in Europe, and plans to launch two new laser-based platforms in 2026.

- InMode Ltd. is aware of recent market speculation and rumors, including a non-binding proposal from Steel Partners Holdings L.P. to acquire 51% of the Company's outstanding shares.

- The Company is currently evaluating potential strategic alternatives.

- An independent committee of directors has been established to oversee this review process and has retained independent legal and financial advisors.

- There is no assurance that this review will result in a transaction or any other strategic outcome, nor is there certainty regarding the timing or terms.

- InMode Ltd. is aware of recent market speculation and rumors, including a publicly announced non-binding proposal by Steel Partners Holdings L.P. to acquire 51% of the Company’s outstanding shares.

- The Company is currently evaluating potential strategic alternatives.

- A committee of independent directors has been established to oversee this review process, and it has retained independent legal and financial advisors.

- There is no assurance that this review will result in a transaction or any other strategic outcome for the Company.

- InMode Ltd. expects to release its Q4 and full year 2025 financial results on February 10, 2026.

- Preliminary Q4 2025 revenue is projected between $103.6 million and $103.8 million, with full year 2025 revenue expected between $370.2 million and $370.4 million.

- The company anticipates full year 2025 non-GAAP gross margin to be in the range of 78% to 79%.

- InMode provided full year 2026 revenue guidance in the range of $365 million to $375 million.

- InMode projects a revenue decline to $370 million for the full year 2025 due to a U.S. market slowdown since Q2 2023, primarily attributed to high interest rates affecting equipment leasing. Despite this, the company maintains an 80% gross margin and over $540 million in cash with no debt, expecting momentum to return in 2026.

- The company is expanding its product portfolio into wellness medical treatments, with its women's health product, Empower, generating $40 million in its first year, and InVision for dry eye generating $30 million in its first year. InMode is also developing new laser platforms (CO2, Erbium, Q-Switch, PICO) that combine with minimally invasive RF technology, with some launches planned for 2026 and others in 2027.

- InMode is shifting its capital allocation strategy from stock buybacks, having invested $508 million previously, to focusing on potential large, synergistic M&A opportunities in women's health, ophthalmology, or other aesthetic/wellness areas, backed by its substantial cash reserves.

- International expansion is a key focus, with AUW sales now matching U.S. sales at 50-50, up from 35%. The company is establishing new direct subsidiaries in markets like Japan, Argentina, and Thailand, and is actively pursuing CFDA approvals to expand its product offerings in the significant China market.

Fintool News

In-depth analysis and coverage of InMode.

Quarterly earnings call transcripts for InMode.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more