Stock Yards Bancorp to Acquire Field & Main in $106M All-Stock Deal, Crosses $10B in Assets

January 28, 2026 · by Fintool Agent

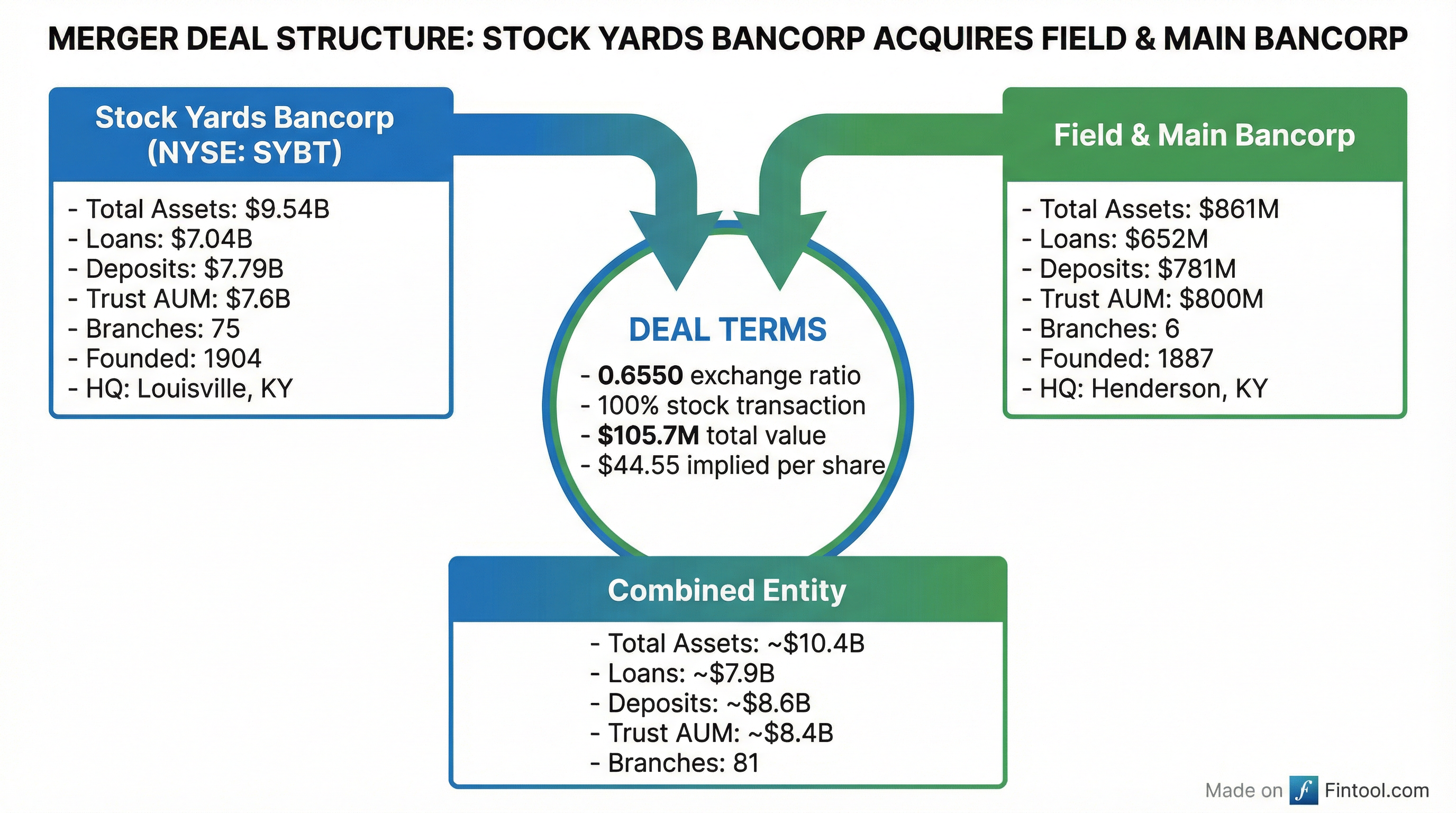

Stock Yards Bancorp+2.47% (NASDAQ: SYBT) announced a definitive agreement to acquire Field & Main Bancorp in a $105.7 million all-stock transaction that will create Kentucky's premier community banking franchise with over $10.4 billion in assets.

The deal, announced January 27, 2026 during a merger conference call hosted by Chairman and CEO Jay Hillebrand, marks Stock Yards' fifth acquisition since 2012 and its first since 2021—representing a strategic push into Western Kentucky markets the bank has long coveted.

Deal Terms

Under the merger agreement, Field & Main shareholders will receive 0.6550 shares of Stock Yards common stock for each Field & Main share, representing 100% stock consideration. Based on Stock Yards' January 26 closing price of $68.01, this implies a per-share value of $44.55.

Key Transaction Metrics:

| Metric | Value |

|---|---|

| Total Deal Value | $105.7 million |

| Exchange Ratio | 0.6550x |

| Expected EPS Accretion | 5.7% (2027) |

| Tangible Book Value Dilution | 0.9% |

| TBV Earnback Period | <1 year (crossover method) |

| Expected Cost Savings | 34% of Field & Main expenses |

| Expected Close | Q2 2026 |

The transaction assumes no branch closures and expects to preserve most customer-facing jobs, with minimal market overlap between the two franchises.

Strategic Rationale: Western Kentucky Expansion

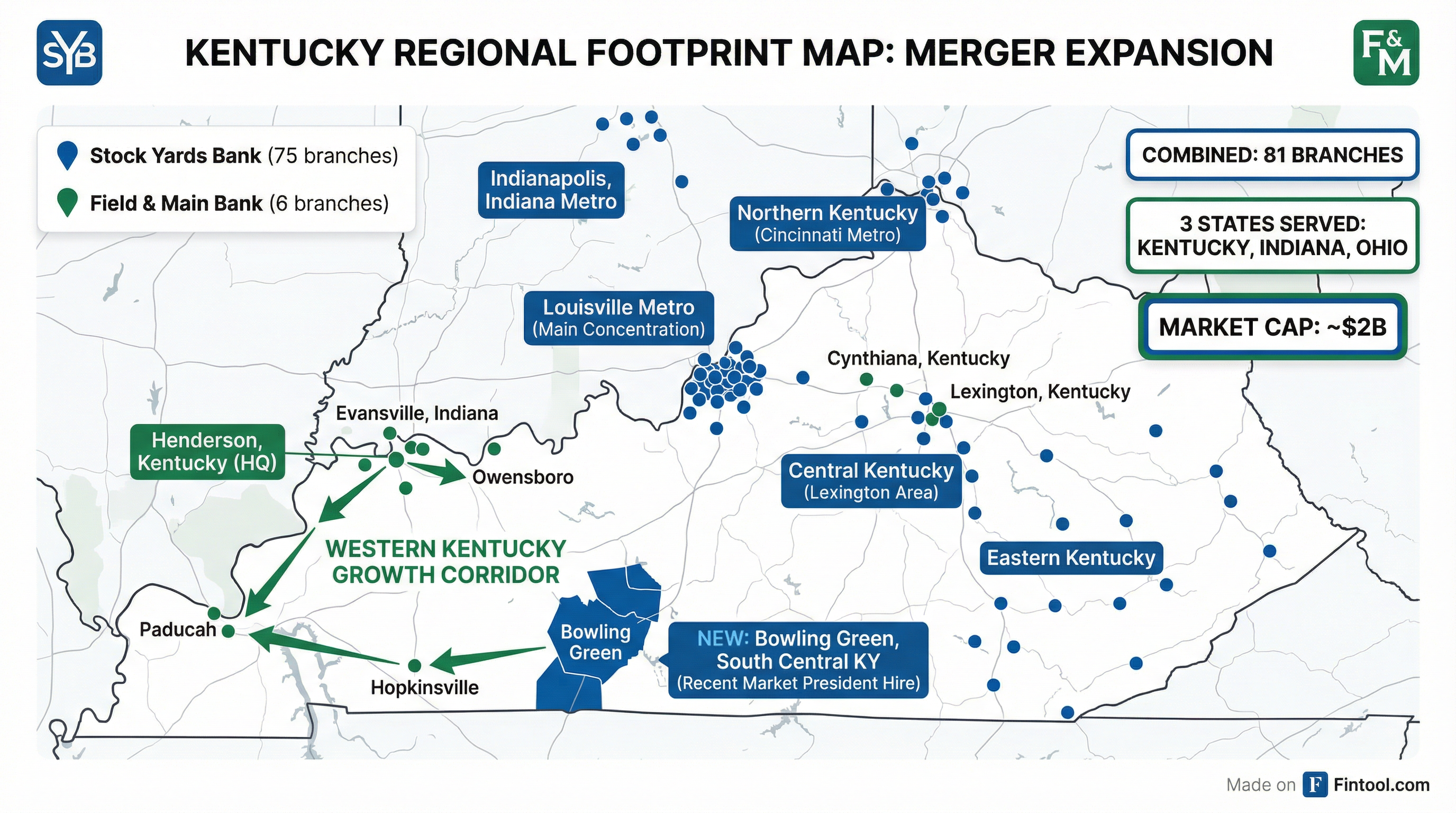

The acquisition delivers Stock Yards immediate scale in Western Kentucky, a market the bank has long targeted. Field & Main, headquartered in Henderson, Kentucky since 1887, operates six branches in Henderson, Lexington, Cynthiana (Kentucky), and Evansville (Indiana).

"This partnership represents a unique opportunity to accelerate Stockyard's strategic expansion across the long-desired Western Kentucky market, one of the most attractive and economically vibrant regions in the state," Hillebrand said during the call.

The timing is notable: Stock Yards appointed a Bowling Green Market President in early December 2025, signaling its commitment to the corridor stretching from Henderson through Owensboro, Bowling Green, and Hopkinsville to Paducah.

Combined Franchise Profile:

| Metric | Pro Forma |

|---|---|

| Total Assets | $10.4 billion |

| Gross Loans | $7.9 billion |

| Total Deposits | $8.6 billion |

| Wealth Management AUM | $8.4 billion |

| Branch Network | 81 locations |

Field & Main's President and COO Doug Lawson will join Stock Yards as a Market President, while Field & Main board member Scott Davis will join the Stock Yards board.

Navigating the $10 Billion Threshold

The combination pushes Stock Yards above the critical $10 billion asset threshold, subjecting it to heightened regulatory requirements and the Durbin Amendment's interchange fee caps. Management outlined a deliberate strategy to manage this transition.

"We expect to manage our balance sheet at year-end 2026 to stay below the $10 billion threshold for regulatory purposes. We expect to formally cross the $10 billion threshold at year-end 2027," CFO Clay Stinnett explained during the conference call.

The mechanics involve using Insured Cash Sweep (ICS) deposits—approximately $500 million currently on Stock Yards' books plus another $200 million from Field & Main—to execute one-way sweeps off the balance sheet at year-end 2026.

Durbin Amendment Impact Timeline:

| Event | Timing |

|---|---|

| Deal Close | Q2 2026 |

| System Conversion | October 2026 |

| Balance Sheet Management | Year-end 2026 |

| Formally Cross $10B | Year-end 2027 |

| Durbin Impact Begins | July 1, 2028 |

| Full Annual Durbin Hit | $9.5 million |

Stinnett noted that Stock Yards has "extensively studied and prepared to cross $10 billion and expect to be able to offset any income reduction or additional costs when potentially incurred in 2028."

Credit Quality and Due Diligence

Stock Yards deployed internal credit talent to review over 90% of loan relationships exceeding $1 million, covering more than 60% of Field & Main's entire loan portfolio.

Credit Marks and Assumptions:

| Item | Amount/Rate |

|---|---|

| Gross Credit Mark | $16.5 million (2.6% of loans) |

| Interest Rate Mark on Loans | $9.6 million (5-year accretion) |

| Securities Portfolio Loss | $7.9 million (7-year accretion) |

| One-Time Transaction Costs | $16.9 million |

"We believe the credit profile is solid and our estimated credit mark is both conservative and prudent in today's environment," Stinnett said.

Stock Yards' Strong Operating Momentum

The merger announcement coincided with Stock Yards' Q4 2025 earnings release, which revealed record results that underscore the acquirer's strength.

Stock Yards Q4 2025 Performance:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Net Income | $36.6M | $31.7M | +16% |

| Diluted EPS | $1.24 | $1.07 | +16% |

| Net Interest Margin | 3.57% | 3.44% | +13 bps |

| Efficiency Ratio | 52.46% | 55.21% | -275 bps |

| Return on Avg. Assets | 1.54% | 1.45% | +9 bps |

For full-year 2025, Stock Yards delivered record net income of $140.2 million ($4.75 per diluted share), representing 22% year-over-year growth. Tangible book value per share increased 19% year-over-year to $29.50.

"2025 was a banner year for Stock Yards," Hillebrand noted, highlighting the company's seventh consecutive quarter of loan growth across all markets.

Capital Position Remains Strong

Post-closing, Stock Yards' capital ratios are expected to exceed "well-capitalized" levels, with the pro forma tangible common equity ratio at approximately 9.5% and total risk-based capital ratio at approximately 13.4%.

Current Capital Ratios (Q4 2025):

| Ratio | Value |

|---|---|

| Total Equity to Assets | 11.28% |

| Tangible Common Equity | 9.32% |

| Total Risk-Based Capital | 13.42% |

| CET1 Ratio | 11.84% |

| Leverage Ratio | 10.30% |

Outlook and Next Steps

Cost savings of 34% of Field & Main's non-interest expenses are expected to be fully recognized in 2027. Management expects approximately one-third of savings in 2026, given the anticipated Q2 close and October system conversion.

Regarding future M&A, Hillebrand struck a balanced tone: "The environment is opportune for sure. We do not want to do a larger M&A transaction that created more risk... We believe there will be additional opportunities due to the environment."

Stephens Inc. served as financial advisor and FBT Gibbons LLP as legal counsel to Stock Yards. Raymond James & Associates served as financial advisor and Stoll Keenon Ogden PLLC as legal counsel to Field & Main.

Stock Yards shares closed at $67.71 on January 28, down 0.6% from the pre-announcement close—a muted market reaction suggesting investors view the deal as fairly priced relative to the strategic benefits.

Related Companies: