Earnings summaries and quarterly performance for Stock Yards Bancorp.

Executive leadership at Stock Yards Bancorp.

Board of directors at Stock Yards Bancorp.

AJ

Allison J. Donovan

Detailed

Director

CG

Carl G. Herde

Detailed

Director

DP

David P. Heintzman

Detailed

Director

ES

Edwin S. Saunier

Detailed

Director

JL

John L. Schutte

Detailed

Director

LL

Laura L. Wells

Detailed

Director

PJ

Paul J. Bickel III

Detailed

Director

RA

Richard A. Lechleiter

Detailed

Director

SB

Shannon B. Arvin

Detailed

Director

SM

Stephen M. Priebe

Detailed

Lead Independent Director

Research analysts covering Stock Yards Bancorp.

Recent press releases and 8-K filings for SYBT.

Stock Yards Bancorp Announces Acquisition of Field & Main Bancorp

SYBT

M&A

New Projects/Investments

Board Change

- Stock Yards Bancorp (SYBT) announced a merger to acquire Field & Main Bancorp in an all-stock transaction valued at approximately $105.7 million, with Field & Main shareholders receiving 0.655 shares of Stock Yards common stock per share.

- The acquisition is expected to be 5.7% accretive to Stock Yards' earnings per share in 2027, with approximately 0.9% tangible book value dilution earned back in under one year, driven by 34% cost savings of Field & Main's non-interest expenses.

- The combined organization will have approximately $10.4 billion in assets, $7.9 billion in gross loans, $8.6 billion in deposits, and $8.4 billion in trust assets under management, operating an 81-branch network.

- Stock Yards intends to manage its balance sheet to stay below the $10 billion regulatory threshold at year-end 2026, with the formal crossing anticipated at year-end 2027, and an estimated annual Durbin interchange impact of $9.5 million starting in 2028.

Jan 28, 2026, 2:00 PM

Stock Yards Bancorp, Inc. Announces Acquisition of Field & Main Bancorp, Inc.

SYBT

M&A

New Projects/Investments

- Stock Yards Bancorp, Inc. announced the acquisition of Field & Main Bancorp, Inc. for approximately $105.7 million, or $44.55 per share, in an all-stock transaction involving 0.6550 SYBT shares for each Field & Main share.

- The acquisition is expected to create a combined entity with approximately $10.4 billion in assets, $8.4 billion in wealth and trust assets under management, and $7.0 billion in deposits, strengthening Stock Yards' position as a leading Kentucky banking franchise and expanding its presence in Western Kentucky.

- The transaction is anticipated to be ~5.7% accretive to Stock Yards' 2027 earnings per share and result in approximately 0.9% tangible book value per share dilution at closing, with an earnback period of approximately 0.9 years.

- The deal is subject to customary regulatory approvals and Field & Main shareholder approval, with a targeted closing date in the first half of 2026.

Jan 28, 2026, 2:00 PM

Stock Yards Bancorp Announces Acquisition of Field & Main Bancorp

SYBT

M&A

New Projects/Investments

Guidance Update

- Stock Yards Bancorp announced the acquisition of Field & Main Bancorp in an all-stock transaction valued at approximately $105.7 million, based on Stock Yards' closing price of $68.01 on January 26, 2026.

- The transaction is expected to be 5.7% accretive to Stock Yards' earnings per share in 2027 once cost savings are fully phased in, with tangible book value dilution of approximately 0.9% expected to be earned back in just under one year.

- Field & Main Bancorp, headquartered in Henderson, Kentucky, reported approximately $861 million in assets, $652 million in loans, and $781 million in deposits as of December 31, 2025.

- The combined entity will have approximately $10.4 billion in assets, $7.9 billion in gross loans, $8.6 billion in deposits, and $8.4 billion in trust assets under management.

- Stock Yards Bancorp anticipates closing the transaction during the second quarter of 2026 and plans to manage its balance sheet to stay below the $10 billion regulatory threshold until year-end 2027.

Jan 28, 2026, 2:00 PM

Stockyards Bancorp Announces Acquisition of Field and Main Bancorp

SYBT

M&A

Guidance Update

New Projects/Investments

- Stockyards Bancorp (SYBT) announced the acquisition of Field and Main Bancorp in an all-stock transaction valued at approximately $105.7 million, based on SYBT's closing price of $68.1 on January 26, 2026.

- The merger is expected to be 5.7% accretive to Stockyard's earnings per share in 2027 once cost savings are fully phased in, with approximately 0.9% tangible book value dilution expected to be earned back in just under one year.

- Field and Main Bancorp, headquartered in Henderson, Kentucky, reported approximately $861 million in assets, $652 million in loans, and $781 million in deposits as of December 31, 2025.

- This acquisition significantly expands Stockyard's reach into Western Kentucky, creating a combined organization with approximately $10.4 billion in assets.

- Stockyards Bancorp plans to manage its balance sheet to stay below the $10 billion regulatory threshold at year-end 2026, with the formal crossing expected at year-end 2027. The transaction is anticipated to close during the second quarter of 2026.

Jan 28, 2026, 2:00 PM

SYBT: Stock Yards Bancorp Announces Acquisition of Field & Main Bancorp

SYBT

M&A

Board Change

Management Change

- Stock Yards Bancorp (SYBT) announced the acquisition of Field & Main Bancorp, a privately held bank headquartered in Henderson, Kentucky, with approximately $861 million in assets, $652 million in loans, and $781 million in deposits as of December 31, 2025.

- The $105.7 million aggregate transaction value will consist of 100% stock consideration, with Field & Main shareholders receiving 0.655 shares of Stock Yards common stock for each share.

- The merger is expected to be 5.7% accretive to Stock Yards' earnings per share in 2027, with approximately 0.9% tangible book value dilution that is expected to be earned back in just under one year.

- The combined organization will have approximately $10.4 billion in assets, $7.9 billion in gross loans, 8.6 billion in deposits, and an 81-branch network.

- The transaction is anticipated to close in the second quarter of 2026, with Stock Yards planning to manage its balance sheet to cross the $10 billion regulatory threshold at year-end 2027.

Jan 28, 2026, 2:00 PM

Stock Yards Bancorp to Acquire Field & Main Bancorp

SYBT

M&A

Board Change

Earnings

- Stock Yards Bancorp, Inc. (SYBT) announced a definitive agreement to acquire Field & Main Bancorp, Inc. in an all-stock transaction, expected to close during the second quarter of 2026.

- Field & Main shareholders will receive 0.6550 shares of Stock Yards common stock for each share of Field & Main common stock, implying an aggregate transaction value of approximately $105.7 million based on SYBT's closing price of $68.01 on January 26, 2026.

- The acquisition is projected to be 5.7% accretive to Stock Yards' earnings per share once cost savings are fully phased in, with tangible book value dilution of approximately 0.9% to be earned back in about 0.9 years.

- As of December 31, 2025, Field & Main reported approximately $861 million in assets, $652 million in loans, and $781 million in deposits.

- Scott P. Davis, Chairman and CEO of Field & Main, is expected to be appointed to the Stock Yards Board of Directors following the transaction.

Jan 27, 2026, 10:09 PM

Stock Yards Bancorp to Acquire Field & Main Bancorp

SYBT

M&A

New Projects/Investments

- Stock Yards Bancorp, Inc. (SYBT) announced a definitive agreement to acquire Field & Main Bancorp, Inc. in an all-stock transaction with an aggregate value of approximately $105.7 million, based on Stock Yards' closing stock price of $68.01 on January 26, 2026.

- The transaction is expected to close during the second quarter of 2026 and is anticipated to be 5.7% accretive to Stock Yards' earnings per share once cost savings are fully phased in.

- Tangible book value dilution is projected to be approximately 0.9%, with an expected earn-back period of approximately 0.9 years.

- As of December 31, 2025, Field & Main reported approximately $861 million in assets, $652 million in loans, and $781 million in deposits.

- The combined franchise will serve customers through 81 branches with total assets of approximately $10.4 billion, $7.9 billion in gross loans, $8.6 billion in deposits, and $8.4 billion in trust assets under management.

Jan 27, 2026, 10:00 PM

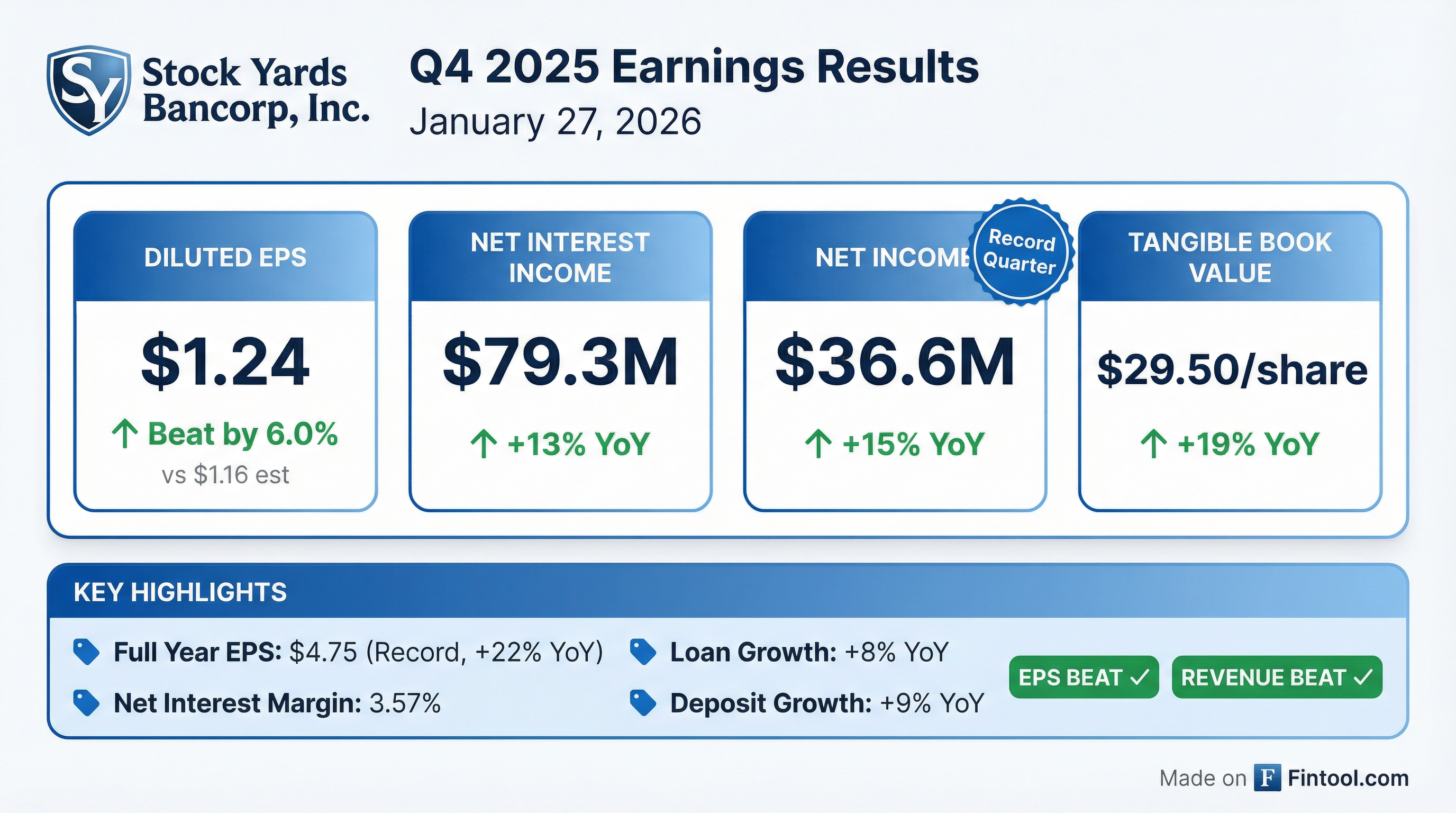

Stock Yards Bancorp Reports Record Fourth Quarter and Full-Year 2025 Earnings

SYBT

Earnings

Revenue Acceleration/Inflection

Dividends

- Stock Yards Bancorp reported record net income of $36.6 million or $1.24 per diluted share for the fourth quarter ended December 31, 2025, and record full-year net income of $140.2 million or $4.75 per diluted share for the year ended December 31, 2025.

- The company achieved solid loan growth of 8% to $7.04 billion and deposit growth of 9% to $7.79 billion year-over-year as of December 31, 2025.

- Non-interest income increased $1.6 million (7%) over the fourth quarter of 2024, with the Wealth Management & Trust division achieving record results.

- Credit quality remained strong, with non-performing loans totaling $13.0 million (0.19% of total loans) as of December 31, 2025, a decrease from $22.2 million (0.34%) a year prior.

- Tangible book value per share increased 19% year-over-year to a record $29.50 as of December 31, 2025, and the company declared a quarterly cash dividend of $0.32 per common share in November 2025.

Jan 27, 2026, 9:59 PM

Stock Yards Bancorp Reports Record Fourth Quarter and Full Year 2025 Earnings

SYBT

Earnings

Revenue Acceleration/Inflection

Dividends

- Stock Yards Bancorp reported record earnings for the fourth quarter and full year ended December 31, 2025, with net income of $36.6 million or $1.24 per diluted share for Q4 2025, and $140.2 million or $4.75 per diluted share for the full year.

- The company achieved solid loan growth of 8% and deposit growth of 9% year over year, contributing to a 13% increase in net interest income for Q4 2025 compared to Q4 2024.

- Tangible book value per share increased 19% year over year to a record $29.50 as of December 31, 2025.

- Credit quality remained strong, with non-performing loans decreasing to 0.19% of total loans outstanding as of December 31, 2025.

Jan 27, 2026, 9:59 PM

Stock Yards Bancorp Reports Record Third Quarter 2025 Earnings

SYBT

Earnings

Dividends

Revenue Acceleration/Inflection

- Stock Yards Bancorp reported record earnings of $36.2 million, or $1.23 per diluted share, for the third quarter ended September 30, 2025, an increase from $29.4 million, or $1.00 per diluted share, for the same period in 2024.

- Total loans increased $651 million, or 10%, over the last 12 months to $6.93 billion as of September 30, 2025.

- Total deposits expanded $918 million, or 14%, over the past 12 months to $7.64 billion as of September 30, 2025.

- Net interest income increased $12.1 million, or 19%, to $77.0 million in Q3 2025 compared to Q3 2024, with the net interest margin expanding 23 basis points to 3.56%.

- In August 2025, the board of directors increased its quarterly cash dividend to $0.32 per common share.

Oct 29, 2025, 11:30 AM

Fintool News

In-depth analysis and coverage of Stock Yards Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more