Strategy's $54 Billion Bitcoin Bet Goes Underwater as Stock Hits 52-Week Low

February 5, 2026 · by Fintool Agent

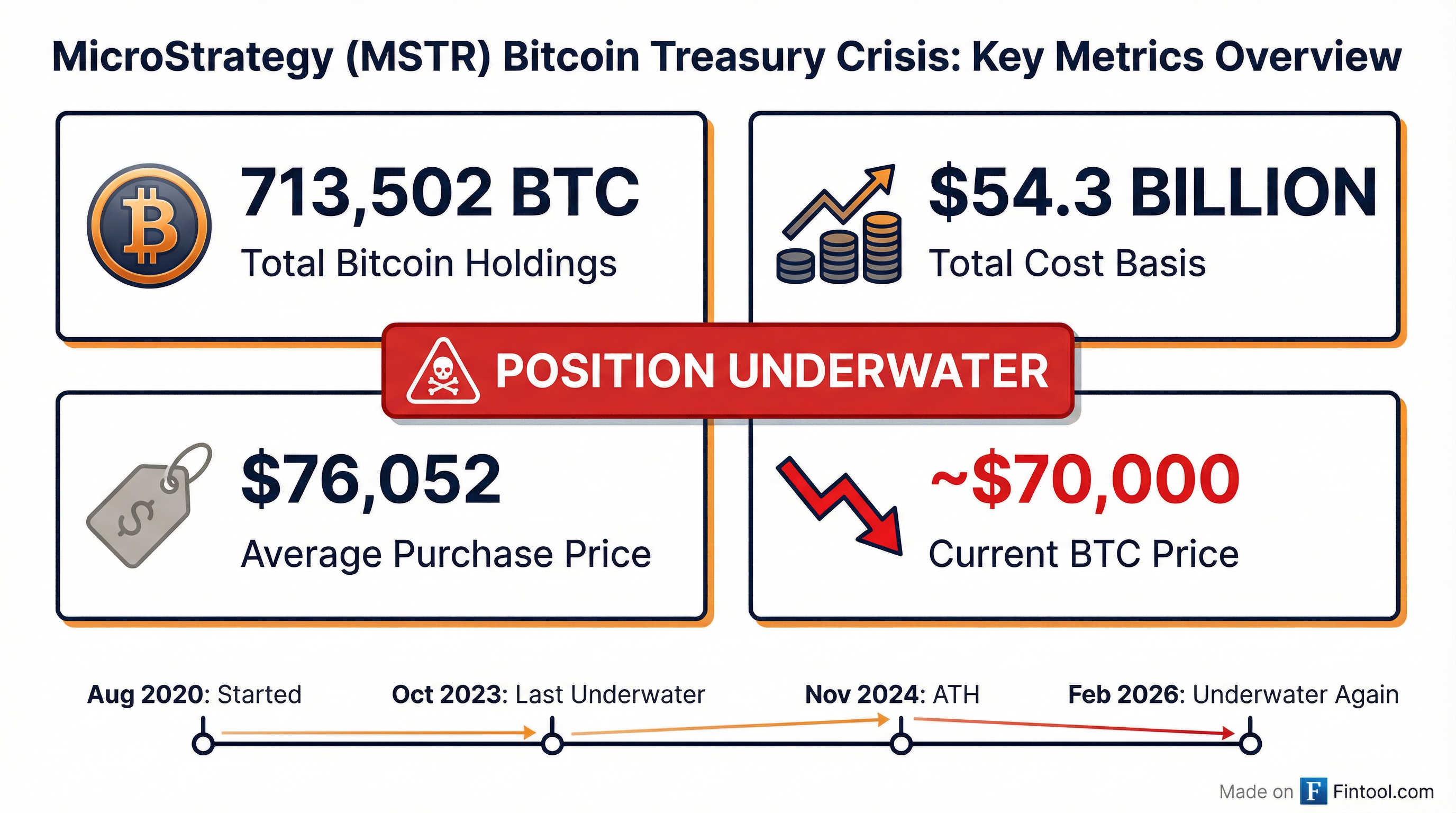

Strategy's Bitcoin treasury—the largest corporate cryptocurrency position in the world—has slipped underwater for the first time since October 2023, sending shares crashing to a 52-week low just hours before the company reports fourth-quarter earnings.

The stock plunged 14.4% to $110.54 in trading today, touching an intraday low of $109.01, as Bitcoin crashed below $70,000 in the worst single-day decline since November 2024.

With 713,502 BTC acquired at an average cost of $76,052 per coin, Strategy's $54.3 billion Bitcoin position is now approximately $4.3 billion underwater—a stark reversal from the $6 billion in unrealized gains the company touted just last quarter.

The Numbers: A 76% Collapse

| Metric | Value |

|---|---|

| Current Stock Price | $110.54 |

| All-Time High (Nov 2024) | $473.83 |

| Decline from Peak | -76% |

| 52-Week Low | $109.01 (hit today) |

| 2026 YTD Performance | -48% (worst in Nasdaq 100) |

| Market Cap | $32.0 billion |

Source: Market data as of February 5, 2026

Strategy's decline from its November 2024 peak represents one of the most dramatic collapses among major Nasdaq-listed stocks. The company is the worst performer in the Nasdaq 100 year-to-date, underperforming even struggling software stocks caught in the recent AI-driven selloff.

The Underwater Moment

This is only the second time Strategy's Bitcoin holdings have traded below cost basis since the company began its cryptocurrency accumulation in August 2020. The last occurrence was October 2023, when the company held just $5.3 billion in Bitcoin at an average price of $30,252—a fraction of today's exposure.

The key difference now: 10x the position size at 2.5x the cost basis.

| Period | Bitcoin Holdings | Cost Basis | Avg. Price |

|---|---|---|---|

| October 2023 | 174,000 BTC | $5.3B | $30,252 |

| February 2026 | 713,502 BTC | $54.3B | $76,052 |

Sources: Company 8-K filings

The aggressive accumulation strategy—Executive Chairman Michael Saylor famously declared the company would "never sell"—has left Strategy with a position that moves more than $7 billion for every 10% swing in Bitcoin's price.

Earnings Preview: What to Watch Tonight

Strategy reports Q4 2025 results after market close today at 5:00 PM ET. Here's what analysts expect:

| Metric | Consensus Estimate |

|---|---|

| Revenue | $119-122 million |

| EPS | -$18.64 |

| Bitcoin Holdings (as of Feb 1) | 713,502 BTC |

Source: Analyst estimates

Under FASB's fair value accounting rules adopted in 2025, Strategy's earnings are now directly tied to Bitcoin price movements. Last quarter, the company reported record profits of $10 billion when Bitcoin was soaring—tonight could show the painful reverse.

Key questions for the earnings call:

- Capital raising plans: With mNAV (market cap to NAV ratio) now below 1.0, will Strategy pause ATM share sales?

- Forced selling risk: Management has stated none of their Bitcoin is pledged as collateral—will they reaffirm?

- 2026 BTC yield targets: Can the company hit its 25% BTC yield target in a falling market?

Analyst Reactions: 60% Target Cut

Wall Street sentiment has deteriorated sharply. Canaccord Genuity analyst Joseph Vafi—long one of Strategy's most vocal bulls—slashed his price target by 60% from $474 to $185 while maintaining a Buy rating, citing Bitcoin's "identity crisis" and near-term volatility.

The revised target still implies 67% upside from current levels, but Vafi warned the stock could remain range-bound until Bitcoin finds a tradable bottom.

Other analyst concerns:

- Diluted shares rising faster than BTC holdings: Q4 saw diluted shares increase ~8% while Bitcoin holdings grew only ~5%, cutting Bitcoin per diluted share by 2.5%

- Rising operating expenses: R&D spending on next-generation analytics is "becoming tiresome" given execution challenges

- Trading volume surge: 104.9 million shares traded yesterday—157% above the 3-month average—indicating institutional repositioning

The Bull Case: "Never Sell" Hasn't Changed

Despite the carnage, Strategy's core thesis remains intact:

-

No forced selling: Unlike leveraged trading positions, Strategy has no Bitcoin pledged as collateral and faces no margin calls

-

$8 billion+ dry powder: The company retains over $8 billion in remaining ATM capacity across common and preferred shares

-

Long-term conviction: Saylor has consistently stated the company's "hurdle rate" for Bitcoin is just 7.2% annually to generate positive returns on fixed-income securities

-

Continued buying: Just last week, Strategy purchased an additional 855 BTC at $87,974 per coin—even as prices fell

As CFO Andrew Kang noted last quarter: "100% of our Bitcoin remain fully unencumbered... We've added Bitcoin to our balance sheet in every single quarter since August 2020."

What's Driving the Bitcoin Crash?

Today's crypto rout reflects multiple headwinds:

- $1.4 billion in liquidations: Forced selling cascaded through leveraged positions as Bitcoin broke key support levels

- ETF outflows accelerate: Galaxy Digital CEO Michael Novogratz warned "a seller's virus got into the market" as institutional buyers stepped aside

- Macro pressure: Risk-off sentiment tied to Fed policy uncertainty and broader tech selloff

Bitcoin is now down 40% from its late-2025 highs, erasing roughly half of its post-election rally and testing levels not seen since April 2024.

What to Watch

Tonight's earnings call at 5:00 PM ET will be critical. Key catalysts ahead:

| Event | Timing | Why It Matters |

|---|---|---|

| Q4 2025 Earnings | Today, after close | Fair value accounting impact on P&L |

| Q1 2026 BTC purchases | Ongoing | Will they pause buying at underwater levels? |

| Bitcoin technical levels | Near-term | $65K support; $80K resistance |

| 10-K Filing | Coming weeks | Full disclosure on capital structure and risks |

For a company that has staked its entire corporate identity on "being the most committed and consistent corporate holder of Bitcoin in the world," tonight's call will test whether that conviction holds when the position is $4 billion in the red.