Tesla Sets Expectations Low: Company Publishes Gloomy Delivery Consensus Ahead of Q4 Report

December 31, 2025 · by Fintool Agent

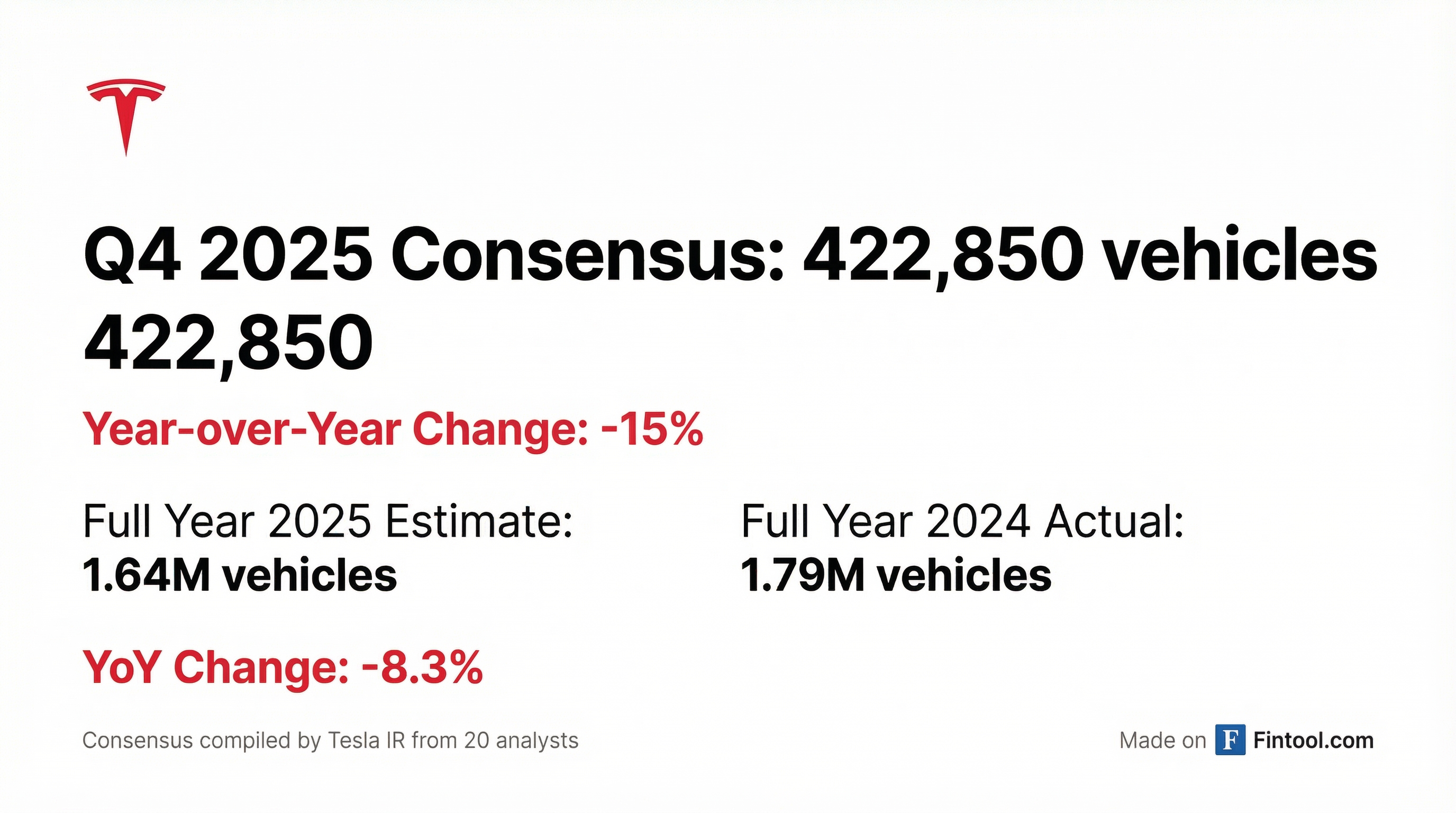

Tesla+3.50% took the highly unusual step of publishing its own analyst delivery consensus on Monday, broadcasting expectations for a 15% fourth-quarter sales decline that is more pessimistic than Wall Street's own estimates—a move that veteran Tesla watchers called "highly unusual" and one that appears designed to set a low bar ahead of Friday's delivery report.

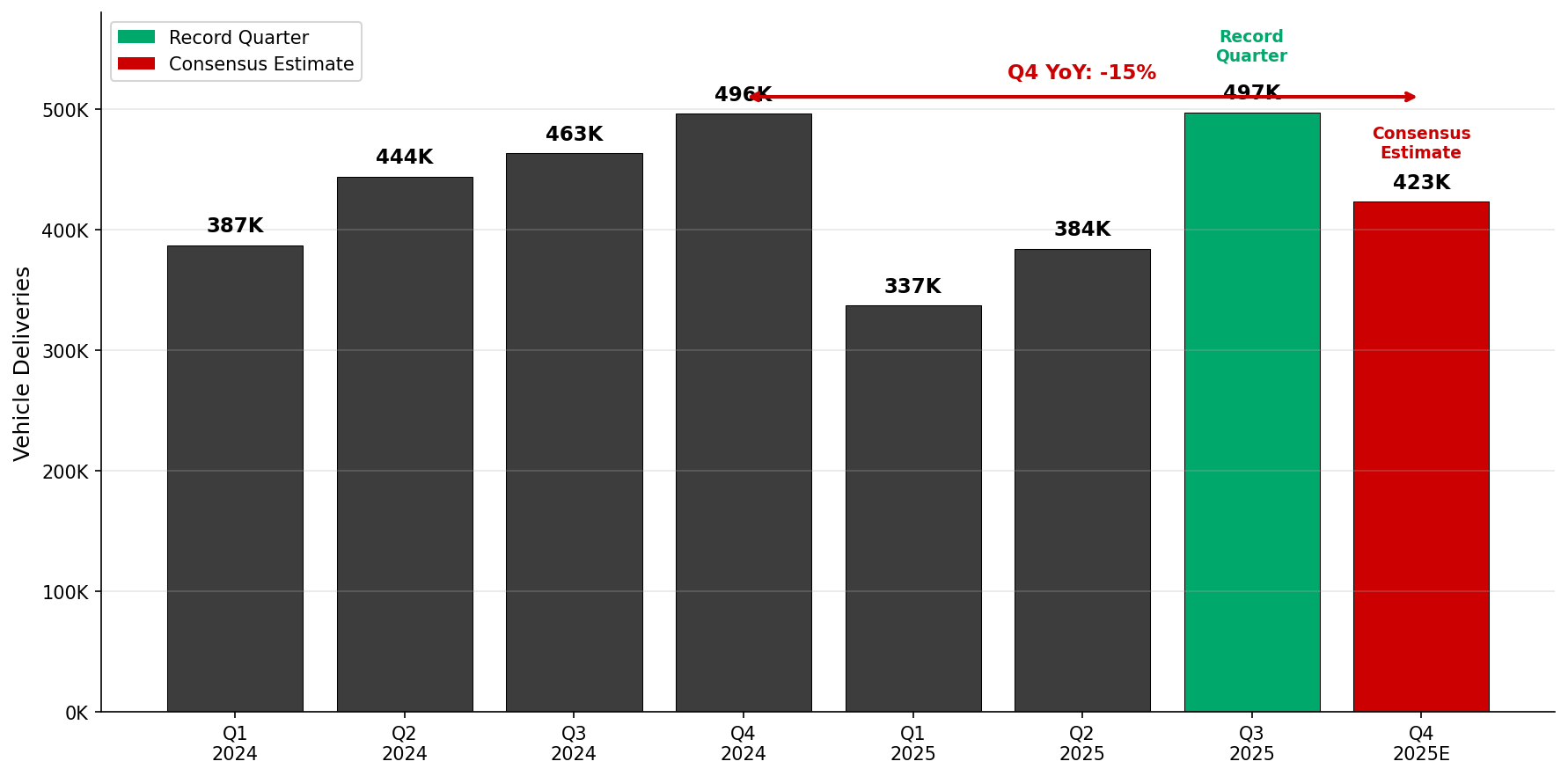

The company-compiled consensus shows analysts expecting 422,850 Q4 deliveries, down from 495,570 a year earlier. For full-year 2025, the consensus points to 1.64 million deliveries versus 1.79 million in 2024—marking Tesla's second consecutive annual decline in vehicle sales.

The Numbers Tell the Story

Tesla's IR-compiled consensus from 20 analysts paints a bleaker picture than the broader Street view. Bloomberg's consensus stands at roughly 441,000 Q4 deliveries—an 11% decline—while FactSet shows 447,000. Tesla's decision to highlight the lower number is telling.

| Period | Deliveries | YoY Change |

|---|---|---|

| Q3 2024 | 462,890 | — |

| Q4 2024 | 495,570 | — |

| Q1 2025 | 336,681 | -27% |

| Q2 2025 | 384,122 | -15% |

| Q3 2025 | 497,099 (Record) | +7% |

| Q4 2025E | 422,850 | -15% |

Source: Tesla 8-K filings and IR consensus

The contrast with Q3 is stark. Just two months ago, Tesla celebrated a record quarter with 497,099 deliveries—up 7% year-over-year—driven by strong demand across all regions. Greater China and APAC were up 33% and 29% respectively, while North America climbed 28%.

Why the Sudden Transparency?

Tesla has never before publicly posted its own analyst consensus. The move appears calculated to:

- Anchor expectations low before Friday's report

- Control the narrative rather than let media outlets set the bar

- Pre-empt "miss" headlines based on outlier bullish estimates

"This is highly unusual," Gary Black, co-founder of Future Fund Advisors, wrote on X. "Obviously, someone at TSLA wanted the IR-derived consensus to be distributed as widely as possible."

The timing aligns with warnings CEO Elon Musk delivered back in July. "Q, you know, Q4, Q1, maybe Q2...we probably could have a few rough quarters," Musk told analysts on the Q2 call. He wasn't wrong.

The Tax Credit Hangover

The primary culprit: the September expiration of $7,500 federal EV tax credits under the IRA. CFO Vaibhav Taneja laid out the challenge on the Q2 earnings call:

"The first among those changes is the repeal of the IRA EV credit of $7,500 by the end of this quarter. Given the abrupt change, we have limited supply of vehicles in The US this quarter as we have already with the lead times to auto parts to build cars."

Q3's record deliveries were partly driven by consumers rushing to buy before credits expired. Q4 represents the hangover.

Tesla has responded with lower-priced Model 3 and Model Y "Standard" variants, each under $40,000. But these alone haven't offset the lost incentive.

The Stock Doesn't Care (Yet)

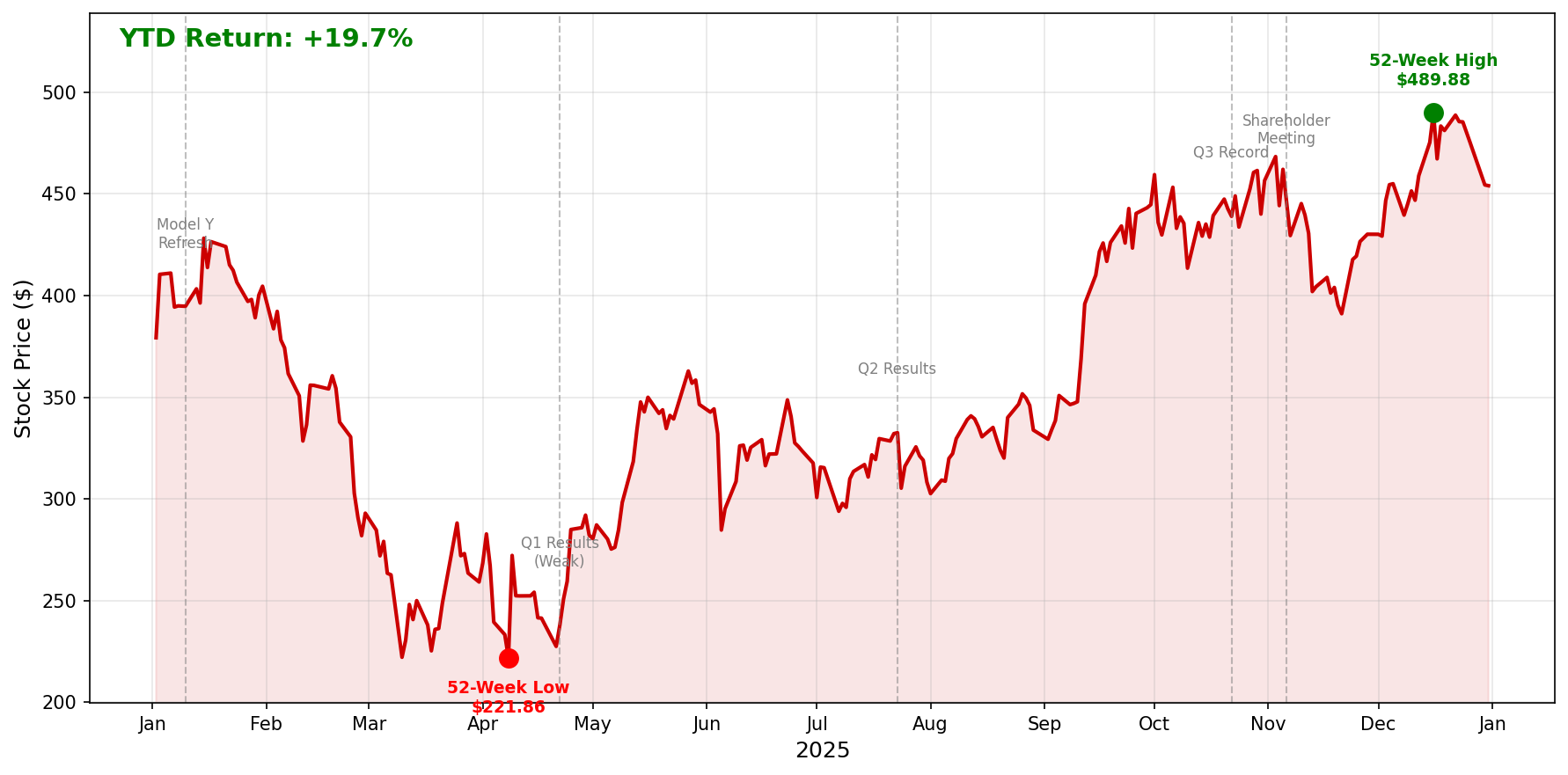

Despite facing its second straight annual delivery decline, Tesla shares are up roughly 14% year-to-date—albeit trailing the S&P 500's 17% gain. Shares fell modestly on Tuesday after the consensus publication before recovering.

The resilience reflects investor enthusiasm around Tesla's AI pivot: robotaxi deployment in Austin and the Bay Area, Optimus humanoid robots, and Full Self-Driving technology. Musk has reframed Tesla as an AI company that happens to make cars.

"I feel confident in expanding Tesla's production. That is our intent to expand as quickly as we can our future production," Musk said on the Q3 call. "I was reticent to do that until we had clarity on achieving unsupervised Full Self-Driving. At this point, I feel like we've got clarity."

What to Watch Friday

Tesla reports Q4 and full-year 2025 deliveries on January 3, 2026. Key questions:

Beat the low bar? The company-compiled 422,850 consensus is roughly 18,000 units below Bloomberg's. Even a slight beat could be positioned positively.

Regional breakdown: Q3's strength came from China/APAC. Did that continue, or did trade tensions and domestic EV competition bite?

Inventory levels: Q3 ended with just 10 days of supply—historically tight. Has Tesla been production-constrained or demand-constrained?

Energy storage: Tesla's Megapack business hit record deployments of 12.5 GWh in Q3, up 81% YoY. The energy segment increasingly provides cover for automotive softness.

The Bigger Picture

Tesla's delivery struggles come amid fierce EV competition. Chinese manufacturers like BYD, NIO, and XPeng continue gaining share, while legacy automakers Ford and GM have introduced more affordable EVs.

| Metric | Q3 2025 | Q3 2024 | Change |

|---|---|---|---|

| Revenue | $28.1B | $25.2B | +12% |

| Automotive Revenue | $21.2B | $20.0B | +6% |

| Gross Margin | 18.0% | 19.8% | -180 bps |

| Operating Margin | 5.8% | 10.8% | -501 bps |

| Free Cash Flow | $4.0B | $2.7B | +46% |

Source: Tesla 10-Q

Revenue grew 12% in Q3 thanks to energy storage and services, but automotive margins compressed significantly due to tariffs (over $400 million impact) and lower regulatory credit revenue.

Deutsche Bank analyst Edison Yu expects the delivery decline to be "driven largely by sales in North America and Europe."

What Musk Is Really Focused On

Tesla's Q3 earnings call spent remarkably little time on vehicle deliveries. Instead, Musk devoted extensive commentary to:

- Robotaxi expansion to 8-10 metro areas by year-end, including Nevada, Florida, and Arizona

- Unsupervised FSD expected in "large parts of Austin" with no safety drivers within months

- Optimus V3 reveal planned for Q1 2026, targeting 1 million-unit production line

- AI5 chip described as "40 times better than AI4 by some metrics"

- Cybercab production starting Q2 2026, optimized for autonomous operation

"Do I think we'll sacrifice margins? I don't think so. I think the demand will be pretty nutty," Musk said of the autonomous future. "Here's the killer app, really, what it comes down to is can you text while you're in the car?"

The implication is clear: today's delivery numbers matter less than tomorrow's AI ambitions. Whether investors buy that narrative long-term remains to be seen.

Related: