Tesla Records First-Ever Annual Revenue Decline as BYD Claims EV Crown

January 28, 2026 · by Fintool Agent

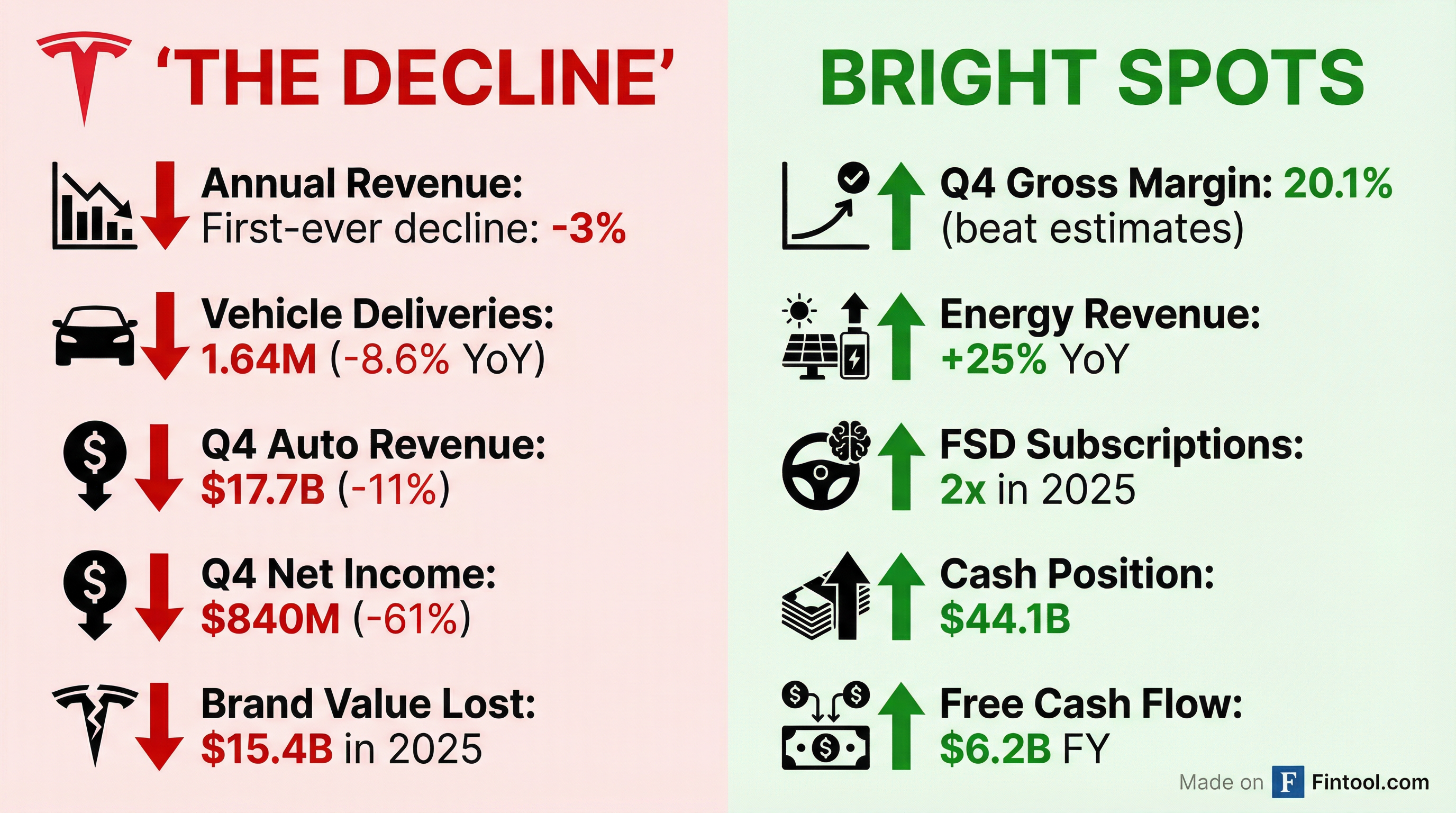

Tesla+3.50% posted its first-ever annual revenue decline on Wednesday, closing the books on a turbulent 2025 that saw the pioneering EV maker cede its global sales crown to China's BYD+4.78%. Full-year revenue fell 3% to $94.8 billion, while vehicle deliveries plunged 8.6% amid a perfect storm of political backlash, intensifying competition, and the loss of U.S. federal EV incentives.

Despite the grim annual figures, shares rose 3% in after-hours trading after Tesla beat Q4 earnings estimates and announced a $2 billion investment in CEO Elon Musk's AI startup xAI—a signal that Wall Street is betting on the company's pivot from cars to robotaxis and robots.

The Numbers: A Historic Reversal

Tesla's Q4 results capped off a year that will be remembered as an inflection point:

| Metric | Q4 2024 | Q4 2025 | Change |

|---|---|---|---|

| Revenue | $25.7B | $24.9B | -3.1% |

| Auto Revenue | $19.8B | $17.7B | -10.6% |

| Net Income | $2.32B | $840M | -63.8% |

| Gross Margin | 16.3% | 20.1% | +380bps |

| Deliveries | 495,570 | 418,227 | -15.6% |

For the full year, the picture was equally sobering. Vehicle deliveries totaled 1.64 million, down from 1.79 million in 2024—marking the second consecutive year of annual delivery declines. Annual net income collapsed 46% to $3.8 billion.

The Musk Factor: A Brand in Crisis

The financial decline can't be separated from the political firestorm surrounding Musk. The billionaire's work with President Donald Trump's administration, incendiary political rhetoric, and endorsements of far-right figures sparked a consumer backlash that devastated sales in key markets.

The toll on Tesla's brand was staggering:

- Brand value collapsed 36% ($15.4 billion) in 2025, marking a third consecutive year of declines

- German sales plunged 48% for the year, with December sales down nearly half

- European registrations fell 28% to 203,382 vehicles in the first 11 months of 2025

- U.S. recommendation scores hit a new low of 4.0 out of 10, down from 8.2 in 2023

A Yale School of the Environment study found that Musk's partisan political activities since acquiring Twitter in 2022 have cost Tesla over 1 million EV sales cumulatively, with the effect accelerating through 2025.

"Tesla Takedown" protests erupted at dealerships across the U.S. and Europe, with vehicles vandalized in multiple countries. The backlash was particularly severe in Germany, where Musk's virtual participation in an AfD election rally and calls to move past Nazi guilt triggered corporate boycotts.

The New King: BYD's Coronation

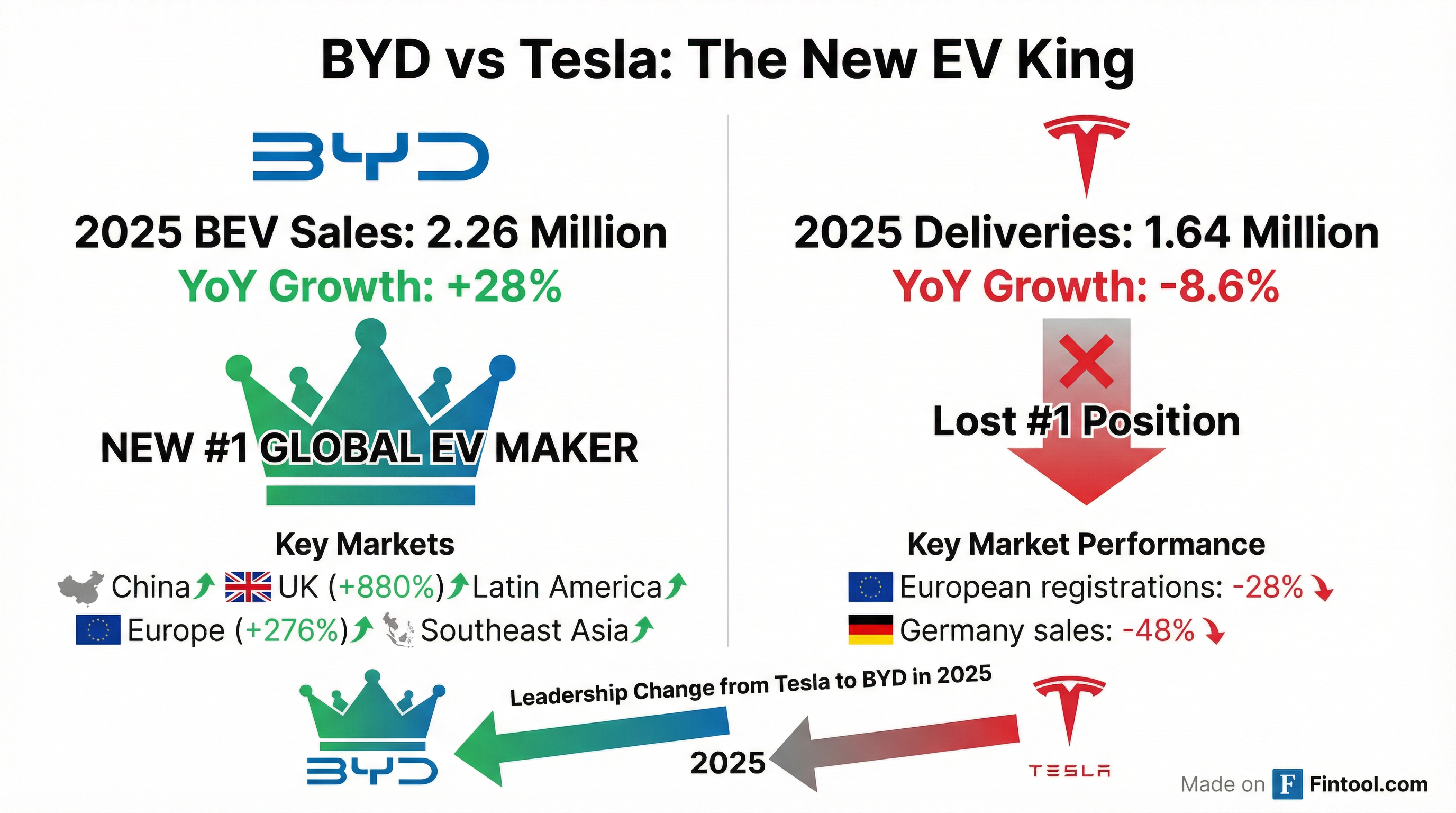

As Tesla stumbled, China's BYD seized the crown. The Shenzhen-based manufacturer sold 2.26 million battery electric vehicles in 2025, up 28% year-over-year, surpassing Tesla for the first time to become the world's largest EV maker.

The shift wasn't just about volume—it reflected fundamentally different trajectories:

| Metric | Tesla 2025 | BYD 2025 |

|---|---|---|

| BEV Deliveries | 1.64M | 2.26M |

| YoY Growth | -8.6% | +28% |

| Total NEV Sales | 1.64M | 4.6M* |

| European Growth | -28% | +276% |

BYD total includes plug-in hybrids

BYD's aggressive pricing and rapid international expansion proved particularly effective. UK sales surged 880% year-over-year, and the company expanded rapidly across Latin America and Southeast Asia. In Germany, BYD sold more cars than Tesla in 2025, a remarkable reversal.

The Bull Case: Robotaxis and Robots

Despite the automotive carnage, Tesla bulls remain convinced the company is undergoing a successful transformation "from a hardware-centric business to a physical AI company," as Tesla stated in its shareholder letter.

Key developments fueling optimism:

Robotaxi Progress: Tesla removed safety monitors from customer rides in Austin earlier this month on a limited basis, a critical milestone for its autonomous ambitions. The company plans to expand robotaxi coverage to seven additional U.S. markets in H1 2026: Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas.

Optimus Robots: Tesla said it will unveil Optimus V3 in Q1 2026, with production planned before year-end and eventual capacity of 1 million robots annually. The company is converting its Model S and X production line at Fremont into an Optimus robot line.

FSD Momentum: Full Self-Driving subscriptions doubled in 2025, and Tesla is transitioning to subscription-only access as it sunsets the upfront payment option.

xAI Partnership: The $2 billion investment in Musk's AI startup signals Tesla's intent to leverage xAI's capabilities for its autonomous driving and robotics efforts.

Energy Storage: The energy segment was a bright spot, with revenue jumping 25% to $3.84 billion and record Q4 deployments.

Financial Deep Dive

A closer look at Tesla's quarterly trajectory reveals the depth of the automotive challenge:

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $19.3 | $22.5 | $28.1 | $24.9 |

| Net Income ($M) | $409 | $1,172 | $1,373 | $840 |

| Gross Margin (%) | 16.3% | 17.2% | 18.0% | 20.1% |

| Op. Cash Flow ($B) | $2.2 | $2.5 | $6.2 | $3.8 |

The improving gross margin in Q4 (beating estimates of 17.1%) offered a glimmer of hope, driven by better pricing discipline and favorable mix. Cash position remained robust at $44.1 billion.

What to Watch

The next 12 months will determine whether Tesla can execute its transformation:

-

Cybercab and Semi Production: Both are scheduled to commence in H1 2026. Execution will be critical after years of delays on promised products.

-

Robotaxi Expansion: Can Tesla successfully expand beyond Austin while maintaining safety? Musk's track record on autonomous timelines has been poor—he promised 8-10 metro cities and 500 Austin vehicles by end of 2025, neither of which materialized.

-

European Recovery: With brand damage severe, can Tesla regain lost ground against surging Chinese competition?

-

Regulatory Approvals: FSD approval in China and Europe remains elusive and critical for global autonomous rollout.

-

Musk's Distractions: The CEO's political involvement shows no signs of abating. Every Trump administration controversy threatens further brand erosion.

For a company valued at $1.4 trillion—more than every other automaker combined—the stakes couldn't be higher. The automotive business that built Tesla is shrinking, and the AI-powered future that justifies its valuation remains tantalizingly out of reach.

Related: