Texas Instruments Surges 9% on Industrial Recovery Signal: First Above-Seasonal Q1 Guidance in 15 Years

January 28, 2026 · by Fintool Agent

Texas Instruments delivered something investors haven't seen in a decade and a half: above-seasonal first quarter guidance. The analog chipmaker's shares surged 9% to $214 after management forecast Q1 revenue of $4.32-4.68 billion, beating the Street's $4.42 billion estimate and signaling that the long-awaited industrial recovery is finally gaining traction.

"The first quarter guidance is significantly stronger than seasonal," noted Deutsche Bank analyst Ross Seymore. "And if my math is right, it seems like it's the first time you've guided up sequentially since right after the financial crisis 15 years ago, roughly."

The strong outlook overshadowed a mixed Q4 report, where revenue of $4.42 billion (+10% YoY) and EPS of $1.27 came in slightly below consensus. But it's the forward look that matters—and CEO Haviv Ilan delivered.

Industrial Has "A Lot of Room to Go"

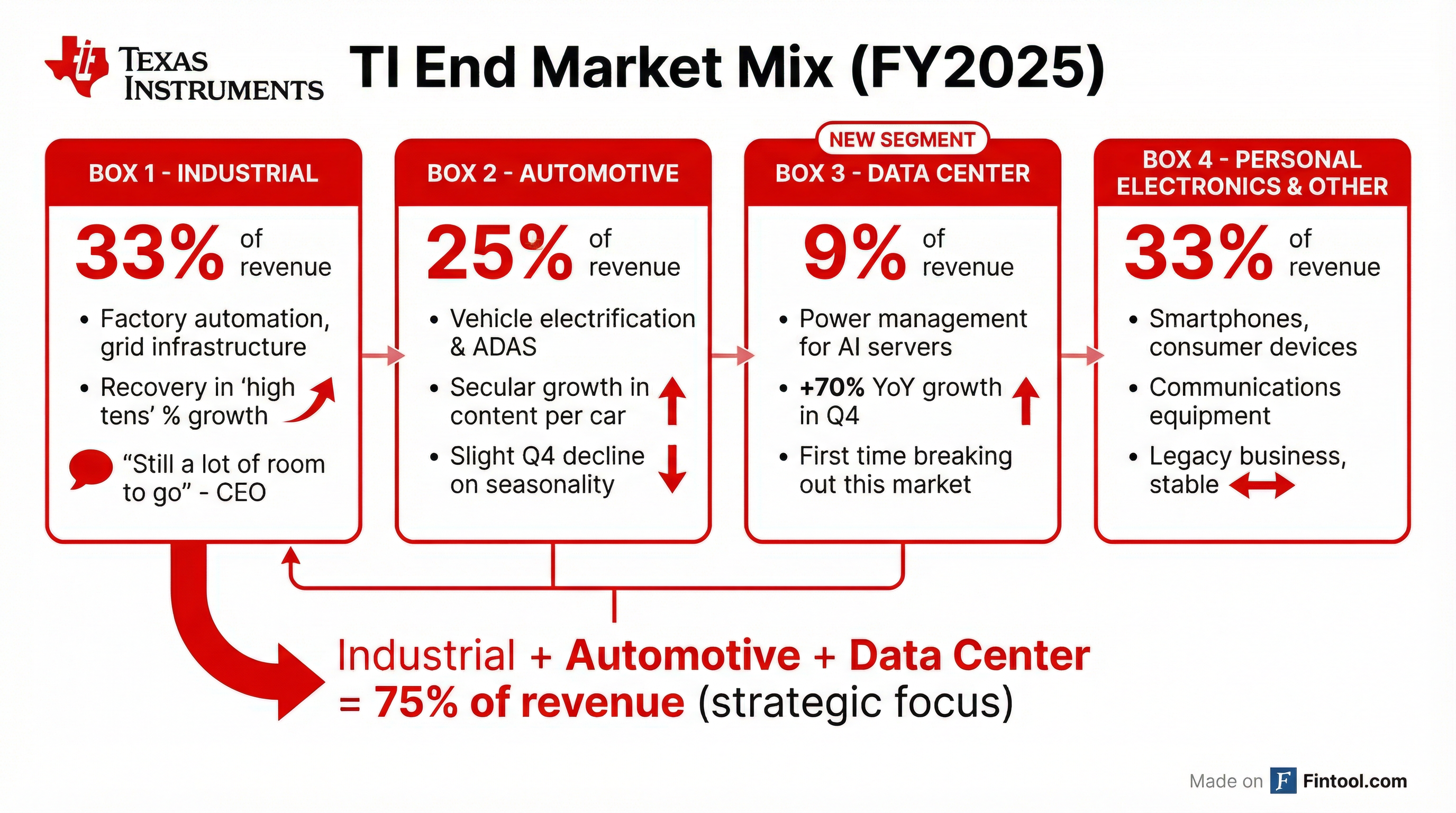

The industrial end market, which represents roughly one-third of TI's revenue, is finally showing sustained recovery after a brutal two-year downturn driven by post-pandemic inventory corrections.

"Remember that on the industrial market, we still have a lot of room to go when you think about the previous peaks," Ilan said on the earnings call. "So, if you will, the compare, it's still easy for industrial to continue to recover."

Industrial revenue grew in the "high tens" percentage year-over-year, with recovery broadening across factory automation, grid infrastructure, and building systems. Analysts at BNP Paribas noted earlier this month that a restocking cycle is underway in industrial semiconductors, and TI's guidance confirms that thesis.

Data Center Emerges as Growth Engine

Perhaps more significant than the industrial recovery is TI's decision to begin reporting data center as a standalone segment—a clear signal of the market's growing importance to the analog giant.

Data center revenue surged 70% year-over-year in Q4 and now accounts for 9% of total company sales. While TI doesn't make the flashy AI accelerators sold by Nvidia, its analog chips perform critical functions in data centers:

- Power management for servers and racks

- Signal conversion between analog and digital

- Voltage regulation for high-performance computing

- Interface chips for data communication

"Underscoring the growing importance of AI-driven demand to TI's finances, CEO Haviv Ilan said the company would now begin breaking out sales to the data center end-market in its results," Reuters reported.

Combined with automotive (about 25% of revenue), industrial, automotive, and data center now represent 75% of TI's total sales—all three segments with secular growth tailwinds.

Q4 Results and Full-Year Performance

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $4.42B | $4.01B | +10% |

| Operating Profit | $1.47B | $1.38B | +7% |

| Net Income | $1.16B | $1.21B | -3% |

| EPS | $1.27 | $1.30 | -2% |

Source: Company filings

For full-year 2025, TI reported revenue of $17.68 billion (+13% YoY) with operating profit of $6.02 billion (+10%). The company generated $7.2 billion in trailing 12-month operating cash flow and returned $6.5 billion to shareholders through dividends and buybacks.

The Q4 EPS included a 6-cent hit that wasn't in original guidance, related to non-recurring items. Excluding this, results would have been in-line with expectations.

Inventory Correction Complete

The elephant in the room for analog semiconductors has been a prolonged inventory correction that began when pandemic-era over-ordering left supply chains bloated. TI's guidance beat suggests this headwind is finally abating.

"With the inventory correction that has plagued the industry during the last two years essentially complete, we believe the company is well positioned to see acceleration of growth as we move throughout 2026," Stifel analyst Tore Svanberg said.

TI's own inventory stood at $4.8 billion at quarter-end, down $25 million sequentially—a modest but meaningful signal of stabilization.

Capacity Investments Pay Off

TI has been investing heavily in 300mm wafer manufacturing capacity, with major fabs in Sherman, Texas and Lehi, Utah benefiting from CHIPS Act incentives. The company received $670 million in CHIPS Act cash benefits in 2025 and continues to expand domestic production.

"Our cash flow from operations of $7.2 billion for the trailing 12 months again underscored the strength of our business model, the quality of our product portfolio and the benefit of 300mm production," Ilan noted.

Free cash flow for the trailing 12 months came in at $2.9 billion, up 96% from 2024, positioning TI to continue its shareholder-friendly capital allocation—$4.6 billion in capex, $5 billion in dividends, and $1.5 billion in share repurchases.

What to Watch

Near-term catalysts:

- Q1 2026 results (late April) to confirm industrial recovery trajectory

- Data center segment reporting details in upcoming quarters

- Auto demand through typical Q1 seasonal weakness (Chinese New Year)

Longer-term considerations:

- Whether industrial recovery reaches prior peak levels, as Ilan suggested is possible

- Data center share expansion beyond 9% as AI infrastructure buildout continues

- Capacity ramp timing for Sherman and Utah fabs

- Analog pricing environment as demand recovers

TI's above-seasonal guidance marks a potential inflection point for the broader analog semiconductor industry after two difficult years. With industrial recovering, data centers surging, and inventories normalizing, the setup for 2026 appears favorable—though the stock's 9% move suggests investors are already pricing in significant improvement.