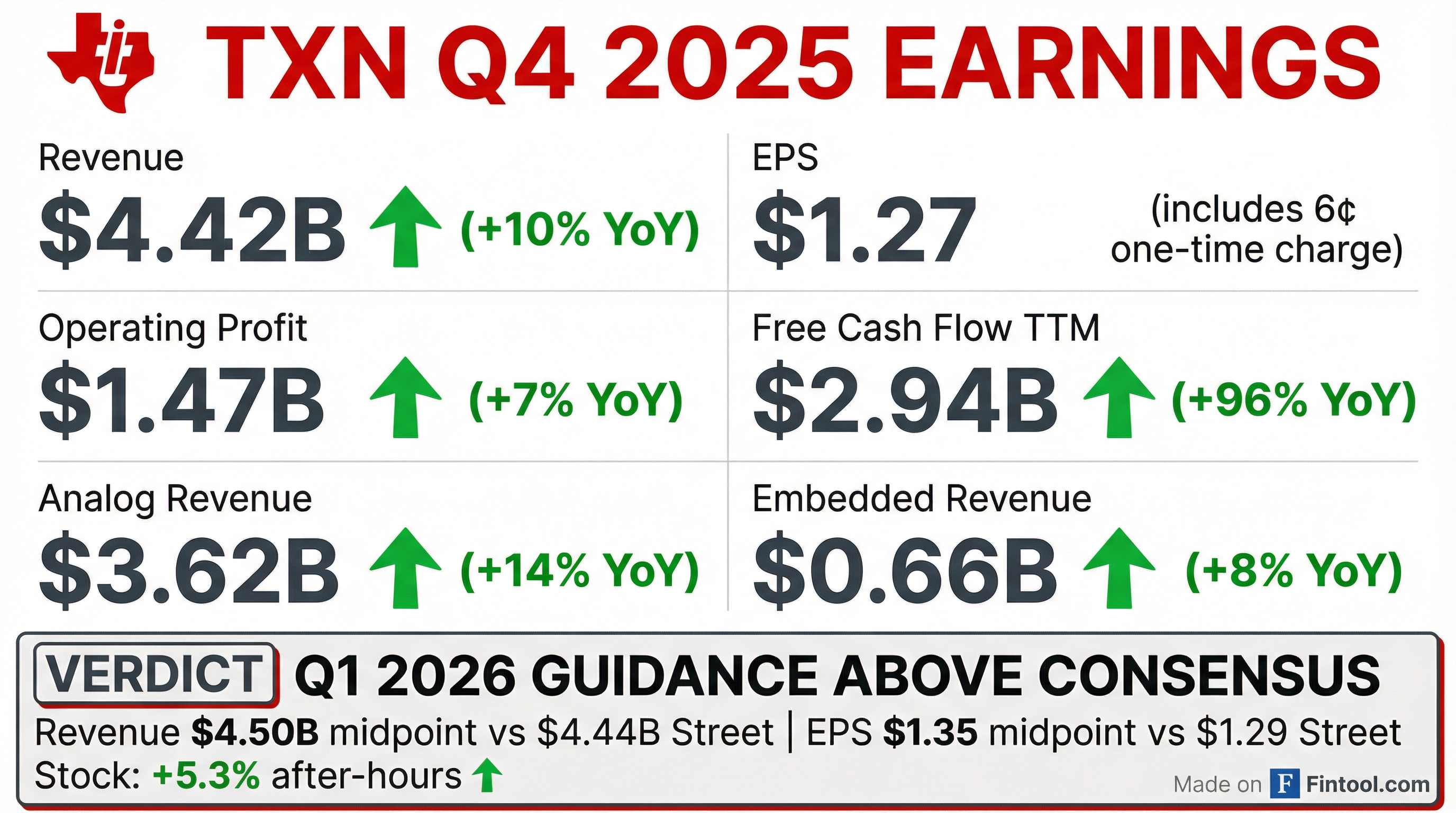

Earnings summaries and quarterly performance for TEXAS INSTRUMENTS.

Executive leadership at TEXAS INSTRUMENTS.

Haviv Ilan

President and Chief Executive Officer

Amichai Ron

Senior Vice President, Embedded Processing

Hagop Kozanian

Senior Vice President, Analog Signal Chain

Katie Kane

Senior Vice President, Secretary and General Counsel

Rafael Lizardi

Senior Vice President and Chief Financial Officer

Board of directors at TEXAS INSTRUMENTS.

Carrie Cox

Director

Curtis Farmer

Director

Janet Clark

Director

Jean Hobby

Director

Mark Blinn

Director

Martin Craighead

Director

Pamela Patsley

Director

Reginald DesRoches

Director

Robert Sanchez

Director

Ronald Kirk

Director

Todd Bluedorn

Lead Director

Research analysts who have asked questions during TEXAS INSTRUMENTS earnings calls.

Ross Seymore

Deutsche Bank

7 questions for TXN

Timothy Arcuri

UBS

6 questions for TXN

Stacy Rasgon

Bernstein Research

5 questions for TXN

Thomas O’Malley

Barclays Capital

5 questions for TXN

Vivek Arya

Bank of America Corporation

5 questions for TXN

William Stein

Truist Securities

5 questions for TXN

Harlan Sur

JPMorgan Chase & Co.

4 questions for TXN

Joseph Moore

Morgan Stanley

4 questions for TXN

Joshua Buchalter

TD Cowen

4 questions for TXN

Chris Caso

Wolfe Research LLC

3 questions for TXN

Christopher Caso

Wolfe Research

3 questions for TXN

Christopher Danely

Citigroup Inc.

3 questions for TXN

Blaine Curtis

Jefferies

2 questions for TXN

Christopher Muse

Cantor Fitzgerald

2 questions for TXN

James Schneider

Goldman Sachs

2 questions for TXN

James Snyder

Goldman Sachs

2 questions for TXN

Tore Svanberg

Stifel Financial Corp.

2 questions for TXN

Torres Vanberg

Stifel

2 questions for TXN

CJ Muse

Cantor Fitzgerald

1 question for TXN

Jim Schneider

Goldman Sachs

1 question for TXN

Toshiya Hari

Goldman Sachs Group, Inc.

1 question for TXN

Recent press releases and 8-K filings for TXN.

- Free cash flow target of 25–35% of revenue (TTM); 2026 gross CapEx guidance of $2–3 billion and inventory target of 150–250 days.

- Q4 2025 dividend raised 4% to $1.42 per share, marking 22 consecutive years of increases; dividend yield of 2.58% as of February 20, 2026.

- Industrial, automotive and data center end markets comprised ~75% of 2025 revenue, reflecting strategic emphasis on high-growth segments.

- R&D allocation in 2025: 33% to both industrial and automotive, and 9% to data center, up from 6% in 2024.

- Agreed to acquire Silicon Labs for $231 per share (EV $7.5 billion), expected to close in H1 2027, accretive to EPS in the first full year post-close.

- TI guides 2026 CapEx of $2 billion–$3 billion, down from $4.6 billion in 2025, as 300 mm capacity expansions near completion.

- Inventory days target raised to 150–250 days to balance customer service levels and minimize obsolescence.

- Agrees to fund the Silicon Labs acquisition, expected to close in H1 2027, using cash on hand and debt financing.

- Achieved $3.23 per share of free cash flow in 2025, on track for >$8 per share in 2026, with 22 consecutive years of dividend increases.

- Advancing 300 mm fab build-out into phase three—RFAB2 nearly fully equipped, SM1 in production, and SM2 shell complete—targeting >95% internally sourced wafers by 2030.

- 2025 capital allocation included $4.6 B CapEx and $6.5 B cash returns; 2026 CapEx is guided to $2–3 B, and inventory days target is 150–250 days.

- Funding for the Silicon Labs acquisition will come from cash on hand and debt financing, with closing expected in first half of 2027.

- 300 mm wafer fab expansion has moved into phase three across RFAB2 (Richardson), LFAB1 (Lehi) and SM1/SM2 (Sherman) to support long-term growth.

- Free cash flow per share rose to $3.23 (+97% YoY) in 2025 and is on track to exceed $8 in 2026; dividend was increased for the 22nd consecutive year (4% in Q4 2025).

- Industrial, automotive and data center end markets represented ~75% of revenue in 2025, underpinning growth expectations.

- 2025 capital scorecard: CapEx of $4.6 B and cash returned of $6.5 B; 2026 CapEx guidance of $2 B–$3 B and updated inventory days target of 150–250 days.

- Silicon Labs acquisition to close in H1 2027, funded with cash and debt; TI remains committed to returning all free cash flow via dividends and share repurchases.

- CHIPS Act funding to date totals $630 M in direct grants, including $555 M in Q1 2026; ITC rate increased to 35% for U.S. CapEx.

- Free cash flow per share in 2025 was $3.23 (+97% YoY); on track for >$8.00 per share in 2026.

- Fiscal 2026 capex will be $2–3 billion, down from roughly $4.6 billion in 2025, signaling a step-down in spending.

- Shares fell about 3.4–3.7% to around $212 after the investor update, with trading volume at 45.6% of the stock’s average.

- Inventory-days target was raised to 150–250 days to balance customer service against obsolescence.

- Recent insider selling (12 transactions, including 71,628 shares by Rafael Lizardi) and significant Q4 2025 institutional trimming added downward pressure on the stock.

- Texas Instruments will acquire Silicon Labs for $231 per share in cash, funded with cash on hand and approximately $7 billion of incremental debt, with the transaction expected to close in 1H 2027 pending regulatory and shareholder approvals.

- The deal adds 1,200 embedded wireless connectivity products, bolstering TI’s portfolio; Silicon Labs has delivered ~15% revenue CAGR since 2014 and holds a strong industrial and diversified customer base.

- TI expects to generate over $450 million of annual manufacturing and operational synergies within three years post-close, primarily from COGS efficiencies, and anticipates the acquisition to be EPS-accretive in the first full year, excluding transaction costs.

- Silicon Labs’ manufacturing will transition into TI’s 300 mm wafer fabs and internal assembly/test facilities, with TI’s 28 nm process optimized for wireless solutions, targeting internalization of about 75% of Silicon Labs’ revenue by 2030.

- TI will acquire Silicon Labs for $231 per share in cash, funding the deal with cash on hand and ~$7 billion of incremental debt, while maintaining its 100% free cash flow return policy.

- Transaction expands TI’s embedded wireless connectivity portfolio by 1,200 products, building on Silicon Labs’ 15% revenue CAGR since 2014 and leveraging TI’s low-cost manufacturing footprint.

- Deal expected to deliver >$450 million in annual manufacturing and operational synergies within three years post-close and be EPS accretive in the first full year.

- Closing anticipated in 1H 2027, subject to customary regulatory and Silicon Labs shareholder approvals.

- Texas Instruments agreed to acquire Silicon Labs at $231 per share in cash for an implied $7.5 billion enterprise value.

- The transaction is expected to be accretive to EPS in the first full year and deliver $450 million of annual synergies within three years post-close.

- Financing will combine balance sheet cash and investment-grade debt, with TI committed to maintaining its current credit rating and returning 100% of free cash flow via dividends and share repurchases.

- Closing is anticipated in the first half of 2027, subject to Silicon Labs shareholder approval and customary regulatory conditions.

- Texas Instruments will acquire Silicon Labs for $231 per share in cash, with the transaction expected to close in the first half of 2027; funding will come from cash on hand and new debt.

- The acquisition adds 1,200 products to TI’s portfolio, enhancing its leadership in embedded wireless connectivity by combining Silicon Labs’ wireless IP and TI’s manufacturing and market channels.

- TI anticipates generating over $450 million in annual manufacturing and operational synergies within three years post-close, and expects the deal to be accretive to EPS, excluding transaction-related costs, in the first full year after closing.

- The deal leverages TI’s 300 mm wafer fabs and in-house assembly and test capabilities to internalize Silicon Labs’ production, ensuring dependable, low-cost supply at scale.

- Texas Instruments will acquire Silicon Labs for $231 per share in cash, implying an enterprise value of $7.5 billion.

- The transaction is expected to be EPS accretive in the first full year post-close (excluding transaction-related costs) and generate >$450 million of annual manufacturing and operational synergies within three years.

- The deal expands TI’s embedded wireless connectivity portfolio by adding ~1,200 products and leverages TI’s industry-leading, low-cost manufacturing capacity to serve customers at scale.

- Financing will come from a combination of cash on hand and debt, with closing anticipated in 1H 2027, subject to regulatory and shareholder approvals.

Fintool News

In-depth analysis and coverage of TEXAS INSTRUMENTS.

Texas Instruments Targets $8+ Free Cash Flow Per Share in 2026 as CapEx Cycle Ends

Texas Instruments Bets $7.5 Billion on Wireless Connectivity in Biggest Deal Since 2011

Texas Instruments Eyes $7 Billion Silicon Labs Acquisition in Biggest Deal in Over a Decade

Texas Instruments Surges 9% on Industrial Recovery Signal: First Above-Seasonal Q1 Guidance in 15 Years

Texas Instruments Adds Data Center Segment After 70% Growth, Guides Above Consensus as Analog Chip Recovery Takes Hold

US Delays China Chip Tariffs to 2027, Giving Legacy Chipmakers an 18-Month Reprieve

Quarterly earnings call transcripts for TEXAS INSTRUMENTS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more