Thoma Bravo Eyes $7 Billion Exit From Healthcare Cybersecurity Bet Imprivata

January 30, 2026 · by Fintool Agent

Thoma Bravo is exploring a sale of Imprivata, a healthcare identity and access management leader, in a deal that could value the company at up to $7 billion—a potential 13x return on the private equity giant's 2016 investment.

The world's largest software-focused investor has tapped JPMorgan and Evercore to run the sale process, which is currently in its early stages, according to three people familiar with the matter. The process is expected to attract interest from both strategic acquirers and private equity firms.

The $544 Million Bet That Grew 13-Fold

Thoma Bravo acquired Imprivata in a take-private transaction in 2016, valuing the Waltham, Massachusetts-based company at approximately $544 million. Since then, the firm has transformed Imprivata through what it describes as "four major stages of value creation"—expanding from its core single sign-on product into a comprehensive identity security platform.

Today, Imprivata generates approximately $500 million in annual revenue and is growing rapidly, according to sources. The company has grown through several strategic add-on acquisitions:

| Year | Acquisition | Strategic Rationale |

|---|---|---|

| 2022 | SecureLink | Third-party privileged access management |

| 2023 | Leadership transition | Fran Rosch named CEO from CyberArk background |

| 2025 | Verosint | Identity threat detection and protection |

The transformation illustrates Thoma Bravo's buy-and-build playbook in action—acquiring a niche leader, expanding its product footprint through bolt-on deals, and preparing for a premium exit.

Why Healthcare Cybersecurity Commands Premium Valuations

The timing of a potential sale aligns with surging demand for healthcare identity security. A recent Imprivata survey found that 85% of healthcare IT leaders view passwordless authentication as "very important or mission-critical," yet only 7% of organizations have fully implemented it—highlighting a massive growth runway.

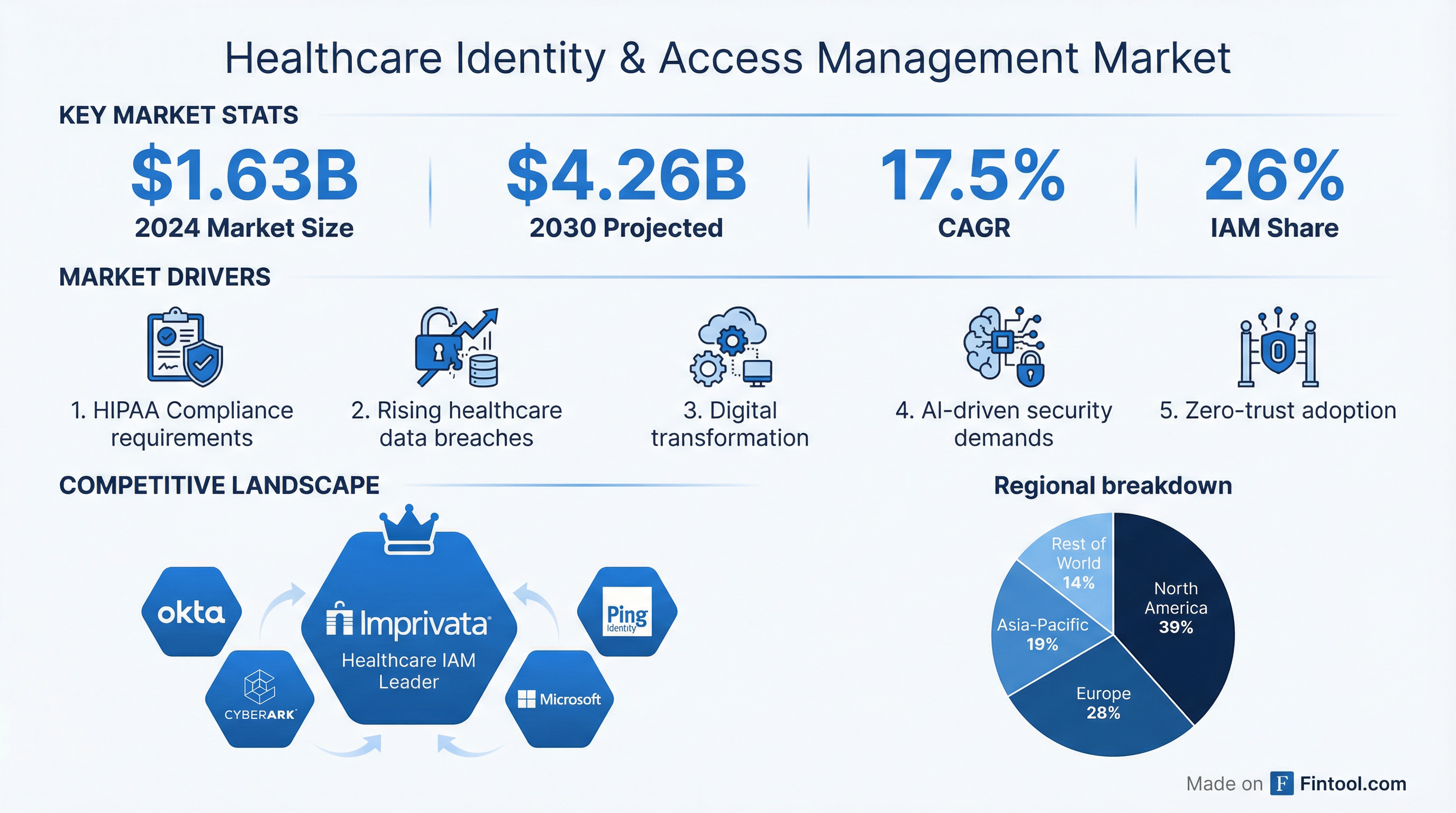

The global healthcare identity and access management market is projected to reach $4.26 billion by 2030, growing at a 17.5% compound annual growth rate. Identity and access management currently holds a 25.8% share of the broader healthcare cybersecurity market.

Several structural factors are driving demand:

Regulatory pressure: HIPAA compliance requirements and stricter enforcement by the Office for Civil Rights have elevated cybersecurity to a board-level priority.

AI-driven security concerns: The broader adoption of artificial intelligence is amplifying data protection concerns, pushing healthcare organizations to acquire tools that safeguard sensitive information and ensure regulatory compliance.

Elevated breach risk: Healthcare organizations face heightened vulnerability during M&A activity, with research showing data breach risk doubles in the year before and after healthcare deals.

Valuation Context: Premium Multiples for Security Leaders

A $7 billion valuation would represent approximately 14x Imprivata's estimated $500 million revenue—a premium multiple, but one that aligns with recent transactions in cybersecurity. High-growth security companies have continued to command elevated valuations, with CyberArk valued at more than 17x forward revenue when Palo Alto Networks acquired it.

The healthcare focus adds a strategic premium. Imprivata's deep specialization—serving healthcare workers who need to rapidly access patient data across shared devices while meeting strict HIPAA requirements—creates switching costs and competitive moats that generalist IAM vendors struggle to replicate.

Imprivata's key competitors include Okta, CyberArk, Ping Identity, and Microsoft's identity solutions, but the company has carved out dominant positioning in healthcare specifically.

Thoma Bravo's Exit Playbook

The potential Imprivata sale follows Thoma Bravo's recent exit from Raptor Technologies, a school safety software provider sold to Warburg Pincus in November 2025. The firm, which manages over $181 billion in assets, has built its track record through disciplined software investing and operational expertise.

Healthcare IT M&A activity has accelerated into 2026, with deal value surging 35% year-over-year in 2025. Private equity activity is expected to pick up further, "fueled by the need to monetize assets," according to Lazard's 2026 M&A outlook.

Cybersecurity has become a "non-negotiable diligence item" in healthcare transactions, according to Solganick's December 2025 healthcare IT M&A report, driving premiums for platforms with robust security infrastructure.

Who Might Buy?

The sale process is expected to attract interest from both strategic corporate buyers and private equity sponsors, sources said.

Strategic buyers could include large enterprise software or cybersecurity companies seeking healthcare vertical exposure. Companies like Palo Alto Networks, which acquired CyberArk, or enterprise software giants looking to expand identity capabilities, could find Imprivata's healthcare specialization attractive.

Private equity interest could come from firms seeking a platform investment in healthcare IT security—a sector with strong secular tailwinds and regulatory-driven demand that tends to be more recession-resilient than discretionary IT spending.

Thoma Bravo, JPMorgan, and Imprivata declined to comment. Evercore did not respond to requests for comment.

What to Watch

The sale process remains in early stages, but several factors will determine the ultimate outcome:

Valuation expectations: Whether strategic or financial buyers can meet the $7 billion-plus asking price will depend on Imprivata's growth trajectory and competitive positioning.

Regulatory scrutiny: Large technology acquisitions continue to face extended antitrust review timelines, particularly for deals that consolidate market position in critical infrastructure sectors like healthcare.

Market conditions: Cybersecurity M&A remains active, but broader market volatility and financing conditions could affect buyer appetite for large transactions.

For investors tracking private equity exits, healthcare IT, or cybersecurity M&A, the Imprivata process offers a window into how premium software assets are valued in an era of AI-driven security demand.

Related Companies

- JPMorgan Chase & Co. - Advising on the sale