Timberland Bancorp Reports All-Time Record Earnings at Annual Meeting, Raises Dividend

January 27, 2026 · by Fintool Agent

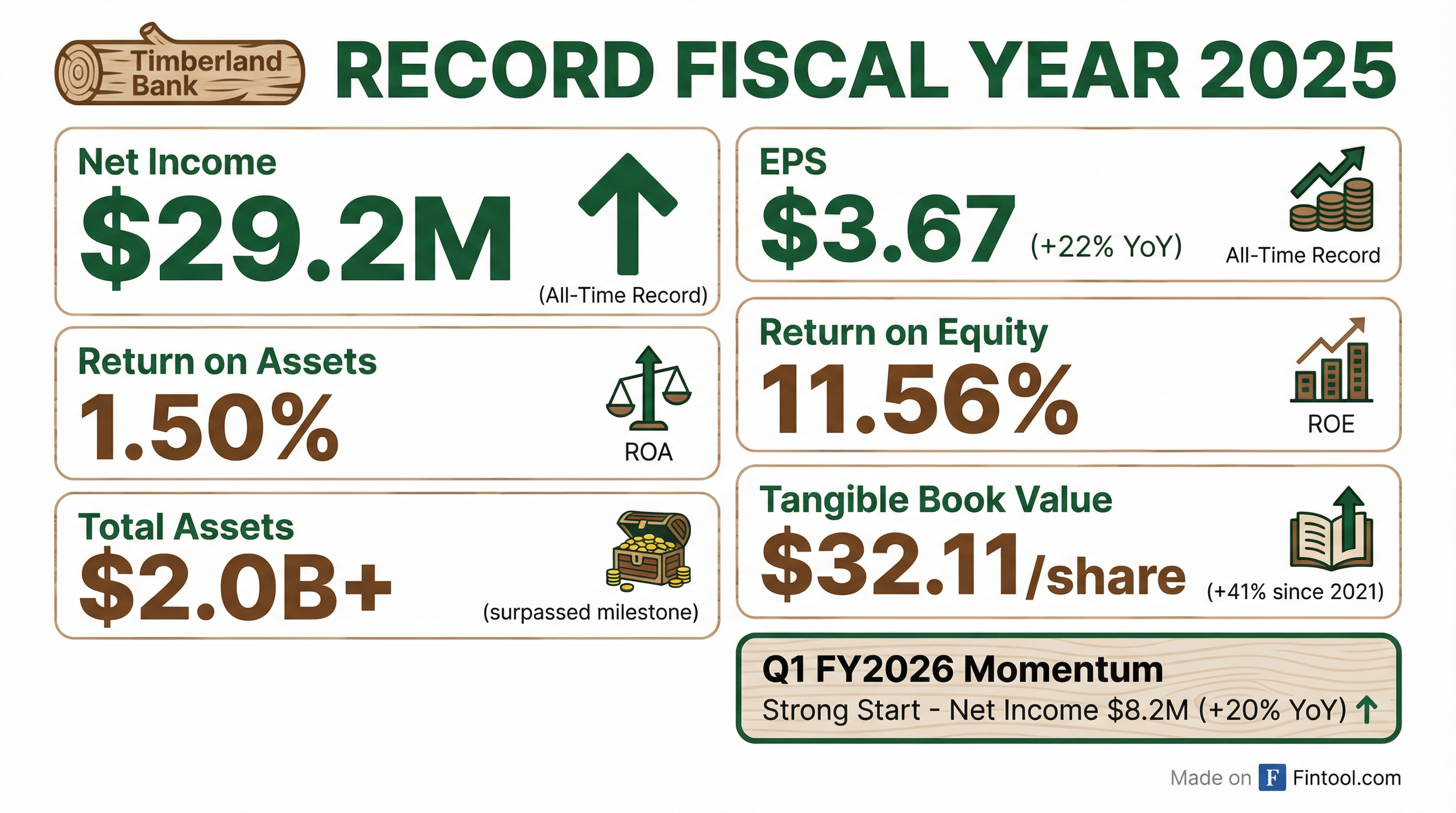

Timberland Bancorp delivered record financial results at its virtual annual meeting today, capping a breakthrough fiscal year with all-time highs in net income and earnings per share while raising its quarterly dividend for shareholders.

The $2 billion community bank, headquartered in Hoquiam, Washington, reported fiscal 2025 net income of $29.2 million—a record for the 116-year-old institution—representing a 20% jump from fiscal 2024's $24.3 million . Earnings per share hit $3.67, up 22% from the prior year's $3.01 and also an all-time record .

"We are pleased that we've been able to achieve very strong and consistent financial results throughout these various cycles and headwinds," CEO Dean Brydon told shareholders at the meeting .

The stock rose 2.4% to $37.42 on the news, pushing shares near their 52-week high of $38.28.

Q1 Fiscal 2026 Momentum Continues

The record annual results were punctuated by a strong start to fiscal 2026. First quarter net income reached $8.2 million, a 20% increase from the comparable quarter last year . EPS climbed 21% to $1.04 from $0.86 .

"Timberland delivered strong profitability this quarter, demonstrating the fundamental strength and resilience of our business model," Brydon said in the company's earnings release .

| Metric | Q1 FY2025 | Q1 FY2026 | Change |

|---|---|---|---|

| Net Income | $6.9M | $8.2M | +20% |

| Diluted EPS | $0.86 | $1.04 | +21% |

| Return on Assets | 1.43% | 1.60% | +17 bps |

| Return on Equity | 11.10%* | 12.33% | +123 bps |

*Values retrieved from S&P Global

Dividend Raised to $0.29—53rd Consecutive Quarter

Buoyed by the strong results and robust capital position, Timberland's board approved a 4% increase to the quarterly cash dividend to $0.29 per share, payable February 27, 2026 to shareholders of record on February 13 .

"This represents the 53rd consecutive quarter Timberland will have paid a cash dividend and demonstrates the Board's continued confidence in our long-term outlook," said President and COO Jonathan Fischer at the meeting .

The new annualized dividend of $1.16 yields approximately 3.1% at current prices, well above the sector median.

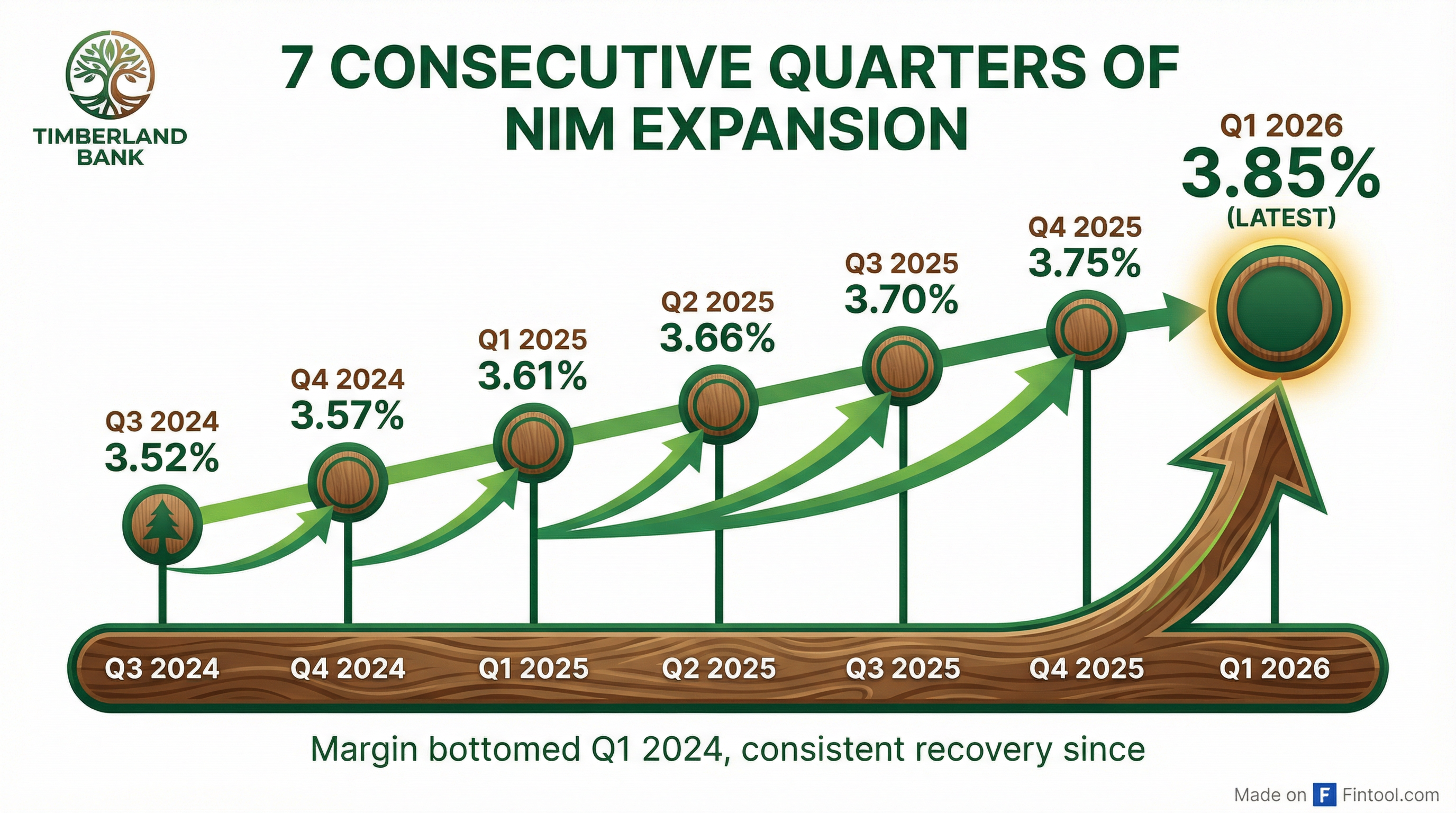

Seven Quarters of Margin Expansion

A key driver of Timberland's outperformance has been its net interest margin trajectory. After bottoming in early 2024 amid industry-wide compression from the inverted yield curve, the bank's NIM has expanded for seven consecutive quarters to reach 3.85% in Q1 FY2026 .

"Our margins compressed through mid-2024, but then we've seen a nice recovery," Brydon explained to shareholders, noting that net interest income rose to $18.9 million in Q1 from $17.0 million a year earlier .

This margin expansion aligns with broader sector trends. According to Morningstar DBRS, the 2026 outlook for U.S. community banks is favorable, with the sector "transitioning to disciplined earnings growth from balance sheet defense" after successfully navigating two challenging years .

Balance Sheet Strength: $2 Billion Milestone

Timberland crossed the $2 billion asset threshold in fiscal 2025, ending the year with total assets of $2.01 billion—up 5% from $1.92 billion . The bank's capital position remains robust:

| Metric | FY 2024 | FY 2025 | Change |

|---|---|---|---|

| Total Assets | $1.92B | $2.01B* | +5% |

| Total Equity | $245.4M | $262.6M | +7% |

| Tangible Book Value/Share | $29.05* | $32.11 | +11% |

| Total Capital | N/A | $268M | — |

*Values retrieved from S&P Global

"Our capital ratios continue to be very strong and exceed the regulatory levels needed to be classified as well capitalized," Brydon noted, adding that tangible book value per share has grown 41% since 2021 to $32.11 .

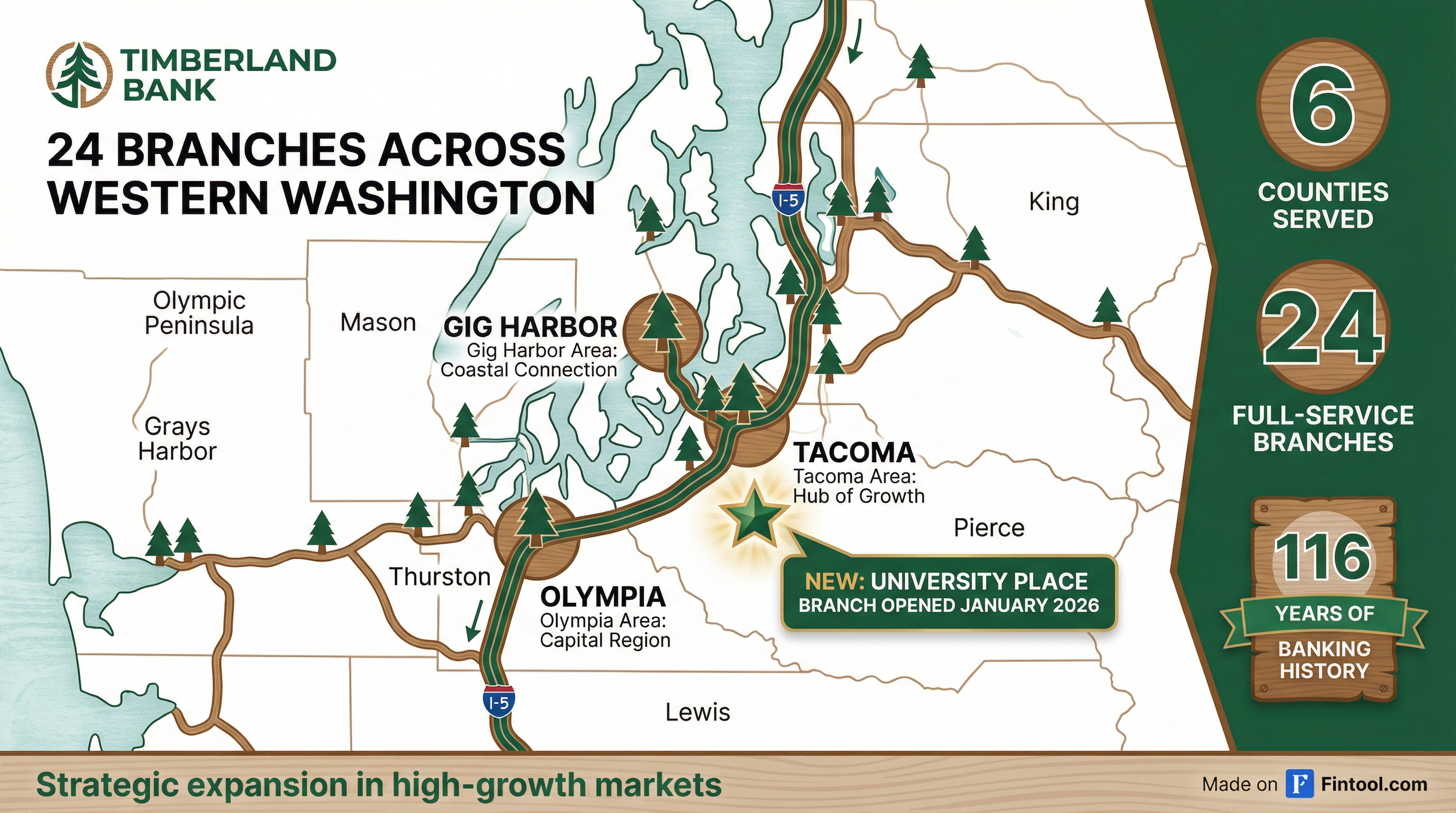

New University Place Branch Opens

On January 12, Timberland opened its 24th full-service branch in University Place, Washington—a market between its existing Tacoma and Gig Harbor locations .

"This strategic expansion positions us to deepen our presence in a dynamic market and build stronger commercial banking relationships with the businesses driving growth in this community," Fischer said .

The move bucks the industry trend of branch closures, with Fischer emphasizing Timberland's commitment to physical presence: "We still believe in branching. It's a great way to connect with our customers... we connect through technology, we connect through our people, we connect through locations" .

Stock Up 27% in 12 Months

Timberland shares have significantly outperformed regional banking indices over the past year. From $29.52 on January 27, 2025, the stock has climbed to $37.42—a gain of approximately 27% .

The stock trades at roughly 1.2x tangible book value and approximately 9x forward earnings, a modest premium to community bank peers but justified by the company's superior profitability metrics and consistent execution.

Credit Quality Remains Pristine

Asset quality continues to be a bright spot. Non-performing assets stood at just 23 basis points of total assets at quarter-end . Net charge-offs for fiscal 2025 totaled just $240,000, and Q1 FY2026 actually saw net recoveries of $18,000 .

"Our asset quality continues to perform well," Brydon stated, noting the bank's commercial real estate portfolio is well-diversified with average office building loans of only $811,000—avoiding exposure to troubled large urban office properties .

Technology and Fraud Prevention Investments

Looking ahead, Fischer outlined several technology initiatives including:

- Enhanced residential lending solutions as competitors exit mortgage banking

- Expanded fraud controls amid rising industry-wide threats

- Digital debit cards for instant issuance

- Construction draw management system improvements

"Good technology with great people makes a great community bank," Fischer said .

Annual Meeting Voting Results

Shareholders overwhelmingly approved all three ballot items at the meeting:

- Director Elections: Dean Brydon, Michael Stoney, and Kelly Suter re-elected for three-year terms with over 95% support

- Executive Compensation: Advisory vote passed with 89.8% approval

- Auditor Ratification: Aprio LLP (formerly Delap LLP) ratified with over 97% support

What to Watch

Timberland's next quarterly results (Q2 FY2026) will be reported in late April. Key metrics to monitor include:

- NIM sustainability: Can the bank maintain its 3.85%+ margin as rate cuts continue?

- Loan growth: Portfolio growth has flattened recently as payoffs increased

- University Place branch performance: Early traction in the new market

- Deposit costs: Further relief expected as high-rate CDs mature

For a community bank navigating a turbulent industry landscape, Timberland's 116th year was its best yet. The combination of record profitability, expanding margins, and a fortress balance sheet positions the bank well for continued outperformance—assuming credit conditions hold and the Pacific Northwest economy remains resilient.

Related Companies: Timberland Bancorp