Earnings summaries and quarterly performance for TIMBERLAND BANCORP.

Research analysts covering TIMBERLAND BANCORP.

Recent press releases and 8-K filings for TSBK.

Timberland Bancorp Reports Record FY 2025 Financials, Increases Dividend, and Announces AGM Results

TSBK

Earnings

Dividends

Proxy Vote Outcomes

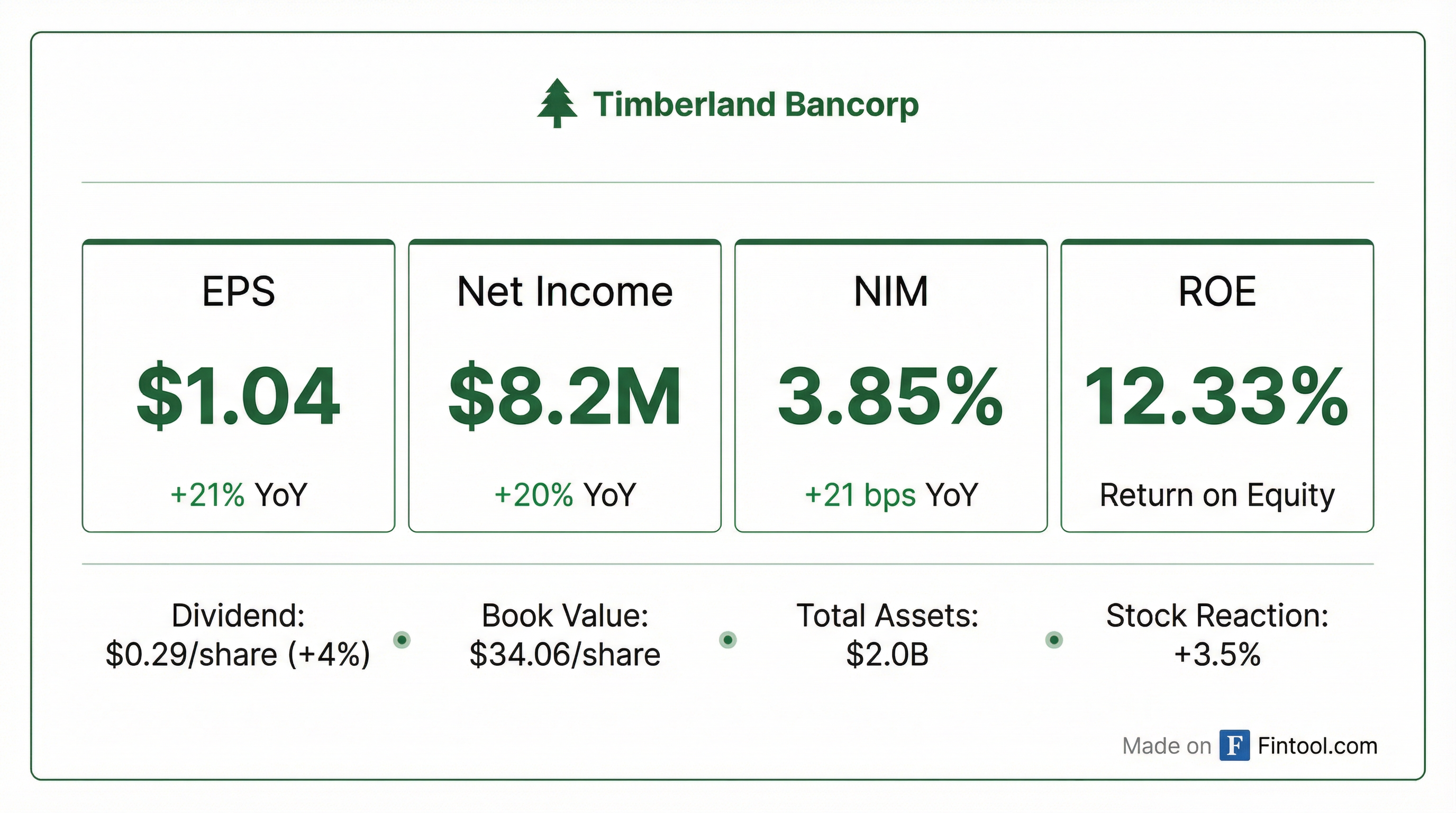

- Timberland Bancorp reported record net income of $29.2 million and EPS of $3.67 for fiscal year 2025, with Q1 fiscal 2026 net income of $8.2 million and $1.04 EPS, representing a 20% and 21% increase respectively from the prior year's comparable quarter.

- The company announced an increase in its quarterly cash dividend to $0.29 per share and reported a net interest margin of 3.85% for the most recent quarter, which has increased for the last seven quarters.

- Shareholders re-elected directors Dean Brydon, Michael Stoney, and Kelly Suter, approved executive compensation with 89.8% in favor, and ratified Aprio LLP as the independent auditor for fiscal year 2026 with over 97% in favor.

- Total assets grew by 5% in 2025, surpassing $2 billion, and the company opened a new branch in University Place, Washington, while continuing to enhance technology and residential lending solutions.

Jan 27, 2026, 9:00 PM

Timberland Bancorp Reports Record FY 2025 Results and Q1 FY 2026 Growth, Re-elects Directors, and Approves Auditor

TSBK

Earnings

Dividends

Proxy Vote Outcomes

- Timberland Bancorp reported record net income of $29.2 million and EPS of $3.67 for fiscal year 2025, representing increases of $4.9 million and 22% respectively over fiscal 2024.

- For the first quarter of fiscal 2026, net income increased 20% to $8.2 million and EPS increased 21% to $1.04 compared to the prior year's comparable quarter.

- The company announced an increase in its quarterly cash dividend to $0.29 per share.

- The net interest margin has shown consistent improvement, increasing for seven consecutive quarters to reach 3.85% in the most recent quarter.

- Shareholders re-elected Dean Brydon, Michael Stoney, and Kelly Suter as directors for three-year terms, approved the advisory vote on executive compensation, and ratified Aprio LLP as the independent auditor for the fiscal year ending September 30, 2026.

Jan 27, 2026, 9:00 PM

Timberland Bancorp Shareholders Re-elect Directors, Approve Compensation, and Ratify Auditor at Annual Meeting

TSBK

Proxy Vote Outcomes

Executive Compensation

Dividends

- At the virtual annual meeting held on January 27, 2026, shareholders re-elected Dean Brydon, Michael Stoney, and Kelly Suter to the Board of Directors for three-year terms, with each receiving over 95% of the votes.

- The advisory vote on executive compensation passed with 89.8% in favor, and the appointment of Aprio LLP as independent auditors for the fiscal year ending September 30, 2026, was ratified with over 97% approval.

- Timberland Bancorp reported record financial results for fiscal year 2025, with net income of $29.2 million and EPS of $3.67, and strong Q1 FY 2026 net income of $8.2 million and EPS of $1.04.

- The company announced an increase in its quarterly cash dividend to $0.29 per share.

Jan 27, 2026, 9:00 PM

Timberland Bancorp Reports Strong Q1 2026 Earnings and Dividend Increase

TSBK

Earnings

Dividends

- Timberland Bancorp, Inc. reported net income of $8.22 million and diluted earnings per share (EPS) of $1.04 for the quarter ended December 31, 2025, representing a 20% increase in net income and a 21% increase in EPS compared to the same quarter last year.

- The company's Board of Directors approved a 4% increase in the quarterly cash dividend to $0.29 per share, payable on February 27, 2026.

- Key performance indicators for the quarter include a Return on Average Assets of 1.60%, a Return on Average Equity of 12.33%, and a Net Interest Margin of 3.85%. The efficiency ratio improved to 52.65%.

- Total assets decreased less than 1% to $2.01 billion, and total deposits decreased 1% to $1.70 billion at December 31, 2025. Net loans receivable also saw a slight decrease of less than 1% to $1.46 billion.

- Credit quality remained stable, with the non-performing assets ratio flat at 0.23% at December 31, 2025.

Jan 27, 2026, 6:49 PM

Timberland Bancorp Reports First Fiscal Quarter Net Income of $8.2 Million

TSBK

Earnings

Dividends

- Timberland Bancorp reported net income of $8.22 million and diluted EPS of $1.04 for the quarter ended December 31, 2025, marking a 20% and 21% increase respectively, compared to the same quarter one year ago.

- The company's Board of Directors announced a 4% increase in the quarterly cash dividend, raising it to $0.29 per share.

- For the quarter ended December 31, 2025, the company achieved a Return on Average Assets of 1.60%, a Return on Average Equity of 12.33%, and its Net Interest Margin increased to 3.85%.

Jan 26, 2026, 9:15 PM

Timberland Bancorp Inc. Reports Record Fiscal Year 2025 Results and Dividend Increase

TSBK

Earnings

Dividends

Share Buyback

- Timberland Bancorp Inc. reported a 20% increase in net income to $29.16 million and a 22% increase in diluted EPS to $3.67 for the fiscal year ended September 30, 2025.

- For the fourth fiscal quarter ended September 30, 2025, net income was $8.45 million and diluted EPS was $1.07, with the net interest margin increasing to 3.82%.

- The company announced an 8% increase in its quarterly cash dividend to $0.28 per share and repurchased 56,562 shares for $1.89 million during the quarter.

- As of September 30, 2025, total assets reached $2.0 billion and total deposits increased 3% from the prior quarter.

Oct 31, 2025, 5:11 PM

Timberland Bancorp Reports Record Fiscal Year 2025 Earnings and Dividend Increase

TSBK

Earnings

Dividends

Share Buyback

- Timberland Bancorp reported a 20% increase in net income to $29.16 million for the fiscal year ended September 30, 2025, with diluted EPS increasing 22% to $3.67 from the prior fiscal year.

- For the quarter ended September 30, 2025, net income increased 19% to $8.45 million, and diluted EPS increased 19% to $1.07 compared to the preceding quarter.

- The company announced an 8% increase in its quarterly cash dividend to $0.28 per share, payable on November 28, 2025.

- The net interest margin (NIM) for the quarter ended September 30, 2025, strengthened to 3.82%, a two-basis point increase from the prior quarter.

- Total assets surpassed $2 billion for the first time, increasing 3% from the prior quarter and 5% year-over-year.

Oct 30, 2025, 10:33 PM

Fintool News

In-depth analysis and coverage of TIMBERLAND BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more