Treasury Cancels All Booz Allen Contracts Over IRS Data Breach

January 26, 2026 · by Fintool Agent

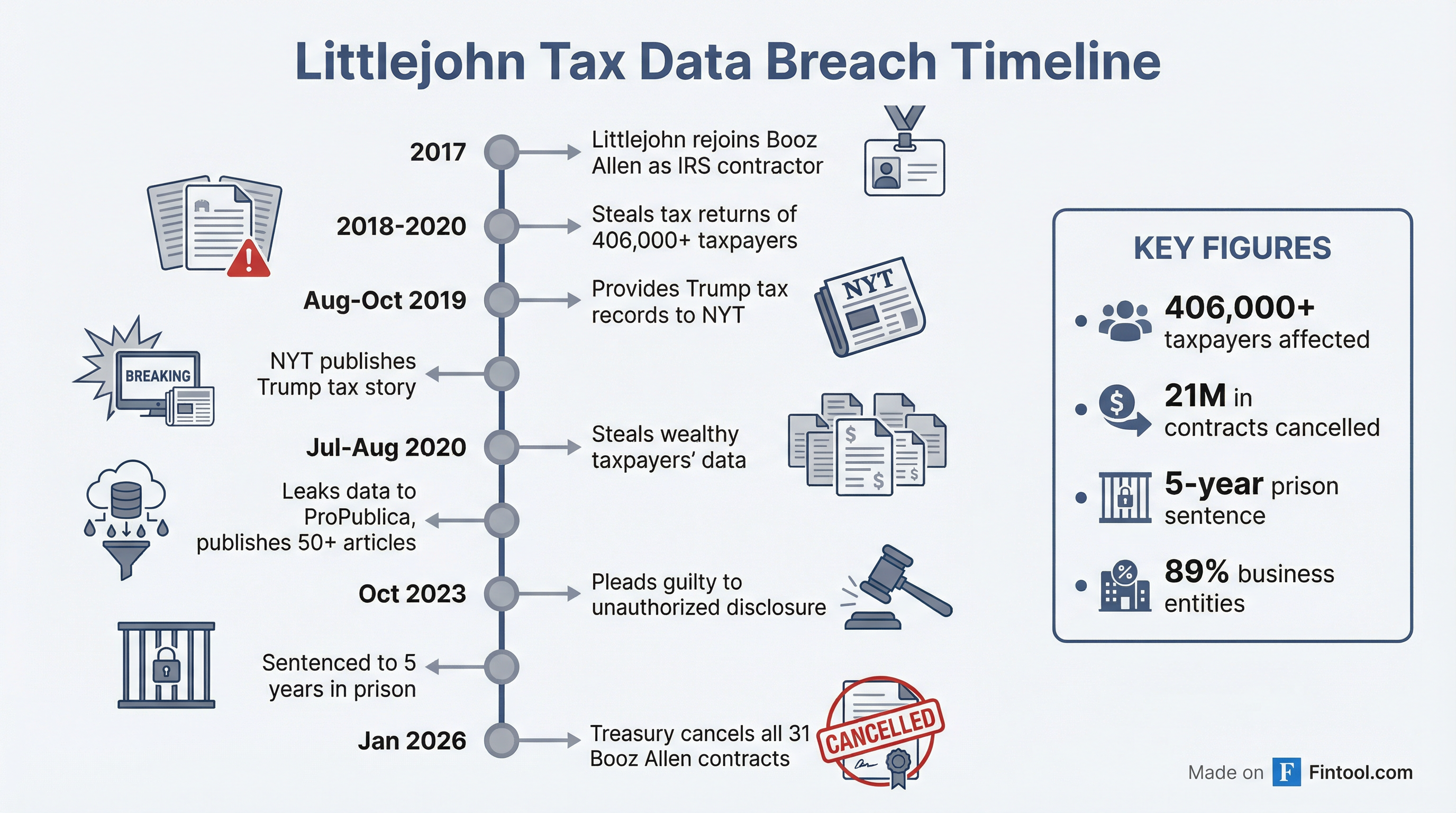

The U.S. Treasury Department announced today that it has terminated all 31 contracts with consulting giant Booz Allen Hamilton, citing the firm's failure to protect sensitive taxpayer information in one of the largest data breaches in IRS history. The $21 million cancellation sent shares plunging 8.5% and raises questions about the $12 billion government contractor's exposure to further federal scrutiny.

"Booz Allen failed to implement adequate safeguards to protect sensitive data, including the confidential taxpayer information it had access to through its contracts with the Internal Revenue Service," Treasury Secretary Scott Bessent said in the announcement.

The Breach That Changed Everything

The contract terminations stem from actions by Charles Edward Littlejohn, a Booz Allen Hamilton employee who, between 2018 and 2020, systematically stole tax return information from IRS databases and leaked it to news organizations. The scope of the breach is staggering: the IRS has now determined that approximately 406,000 taxpayers were affected—nearly six times higher than the 70,000 figure initially reported by the Biden administration.

The most prominent victim was Donald Trump. Littlejohn deliberately targeted the now-President's tax returns, providing them to The New York Times beginning in August 2019. The newspaper published a series of articles about Trump's taxes starting in September 2020, just weeks before the presidential election.

But Trump was just the beginning. In July and August 2020, Littlejohn separately stole tax return information for thousands of America's wealthiest individuals and disclosed it to ProPublica, which published over 50 articles using the stolen data.

Littlejohn evaded IRS detection by crafting broad search queries designed to conceal the true purpose of his searches. He uploaded tax returns to a private website to avoid protocols established to detect large downloads, then saved the data to personal storage devices including an iPod before contacting news organizations.

In January 2024, Littlejohn was sentenced to five years in federal prison—the maximum allowed under the plea agreement—after pleading guilty to one count of unauthorized disclosure of tax information. The judge who oversaw his sentencing admitted she was "perplexed" and "troubled" by the plea agreement's leniency.

Market Reaction

Booz Allen shares tumbled as much as 9.4% on the news, trading at $93.35—down from a 52-week high of $136.40 reached in October 2025.

| Metric | Value |

|---|---|

| Stock Price (Today) | $93.35 |

| Daily Change | -8.5% |

| 52-Week High | $136.40 |

| 52-Week Low | $79.23 |

| Market Cap | $11.5B |

While the $21 million in terminated Treasury contracts represents a tiny fraction of Booz Allen's $12 billion annual revenue, the symbolic and reputational damage may prove far more significant.

The firm derives over 96% of its revenue from U.S. government contracts, making it uniquely vulnerable to any erosion in federal relationships. The company's 10-K explicitly warns of "misconduct or other improper activities from our employees, subcontractors, or suppliers, including the improper access, use, or release of our or our customers' sensitive or classified information" as a key risk factor.

A Company Under Pressure

Today's announcement comes at a particularly difficult time for Booz Allen. The Trump administration has already signaled its intent to scrutinize government consulting contracts, with the General Services Administration ordering agencies to review contracts with the "top 10 consulting firms"—a list that prominently features Booz Allen alongside Leidos, Saic, and Accenture Federal Services.

Acting GSA Administrator Stephen Ehikian wrote in February 2025: "We have identified the 10 highest paid consulting firms are set to receive over $65 billion in fees in 2025 and future years. This needs to, and must, change."

| Period | Revenue | Net Income | EBITDA Margin |

|---|---|---|---|

| Q4 2025 | $2.97B* | $193M* | 10.5%* |

| Q1 2026 | $2.92B | $271M | 11.4% |

| Q2 2026 | $2.89B | $175M | 11.2% |

| Q3 2026 | $2.62B | $200M | 11.3% |

*Values retrieved from S&P Global

Despite the headwinds, Booz Allen had been posting strong results. In its most recent earnings call, CEO Matthew Calderone touted "roughly 14% top line growth" and noted that the company's $39 billion backlog is "our highest ever at this point in the year."

Legal Exposure Mounting

The Treasury cancellation may be just the beginning of Booz Allen's legal woes. A class action lawsuit has been filed against both the IRS and Booz Allen on behalf of the hundreds of thousands of affected taxpayers.

The complaint alleges that "for over a decade, the IRS and Treasury Department have known that their cybersecurity safeguards for protecting confidential taxpayer information are woefully inadequate" and that "Booz Allen repeatedly failed to implement adequate safeguards of its own to protect the confidential taxpayer information it had access to through its contracts with the IRS and Treasury Department."

A federal court recently allowed one victim's claim to proceed under Section 7431 of the tax code, which provides for civil damages for unauthorized disclosure of tax information. The ruling noted that the plaintiff adequately alleged that Littlejohn was "acting within the scope of his employment with Booz Allen" when he committed the theft.

Broader Implications for Government Contractors

The Booz Allen situation highlights the unique risks facing government contractors, particularly those handling sensitive data. The company's most recent 10-Q identifies "internal system or service failures and security breaches" as a key risk factor, noting the potential for "cyber attacks on our network and internal systems, or on our customers' network or internal systems."

For Booz Allen specifically, the path forward is treacherous. The company still holds significant IRS-related contracts, including:

- A position on the $2.6 billion IRS Enterprise Development Operations Services (EDOS) contract vehicle

- A $421 million CDM DEFEND contract to support CISA cybersecurity efforts, which includes work for the IRS

Whether these contracts face similar scrutiny remains to be seen, but today's announcement establishes a clear precedent: the administration is willing to hold contractors accountable for security failures, even years after the fact.

What to Watch

Near-term catalysts:

- Booz Allen's response and any company statement on the cancellation

- Whether other agencies follow Treasury's lead in reviewing Booz Allen contracts

- Progress of class action litigation and potential settlement exposure

- March 7 deadline for agencies to report on consulting contract reviews

Key questions:

- Will the IRS terminate its remaining contracts with Booz Allen?

- Could other Trump tax-related litigation implicate Booz Allen further?

- How will the company's security-cleared workforce navigate the reputational damage?

Related: