Trump Threatens 50% Tariff and 'Decertification' of All Canadian Aircraft

January 29, 2026 · by Fintool Agent

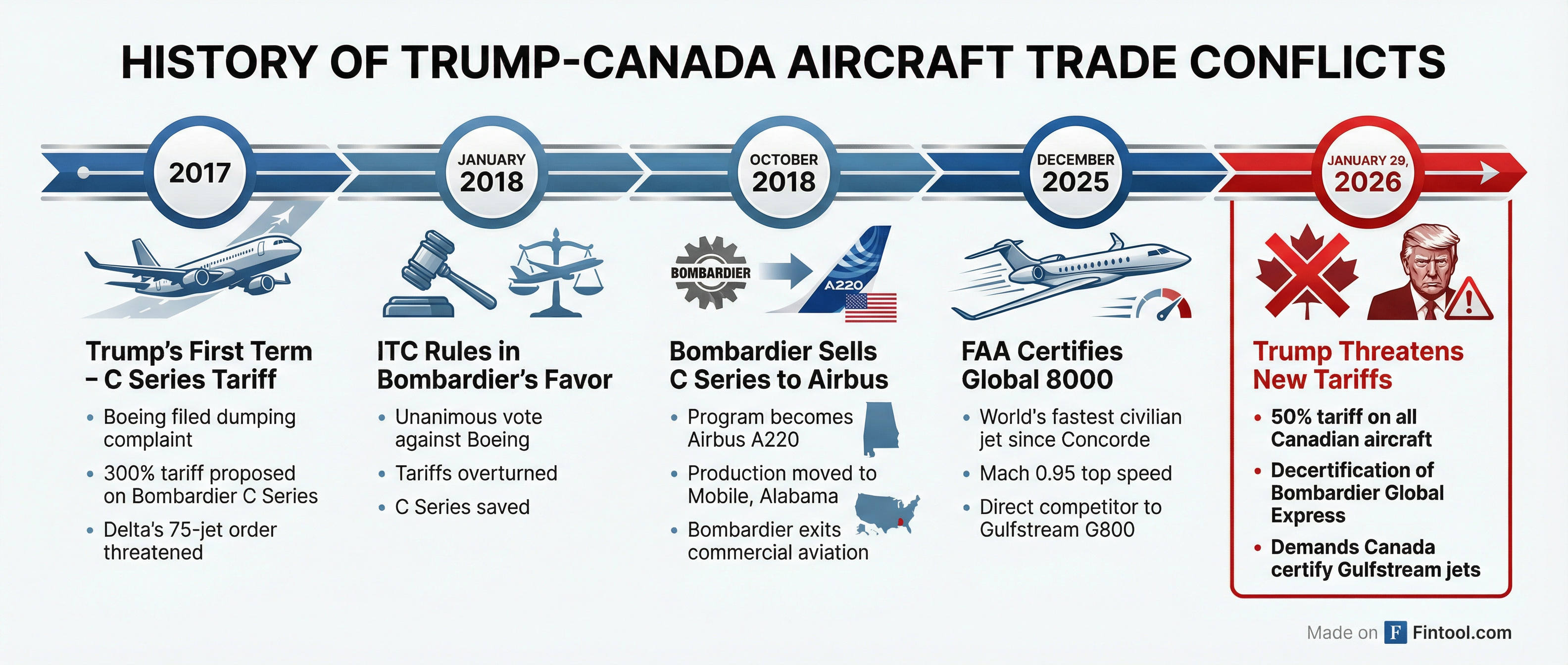

President Donald Trump escalated his trade war with Canada on Thursday, threatening to "decertify" Bombardier Global Express business jets and impose a 50% tariff on all aircraft sold into the United States from Canada.

The threat, posted on Truth Social, specifically targets Bombardier's flagship business jet line and demands Canada certify American-made Gulfstream jets—setting up a high-stakes standoff in the lucrative $30 billion business aviation market.

The Ultimatum

"Based on the fact that Canada has wrongfully, illegally, and steadfastly refused to certify the Gulfstream 500, 600, 700, and 800 Jets, one of the greatest, most technologically advanced airplanes ever made, we are hereby decertifying their Bombardier Global Expresses, and all Aircraft made in Canada," Trump wrote.

The president added: "If, for any reason, this situation is not immediately corrected, I am going to charge Canada a 50% Tariff on any and all Aircraft sold into the United States of America."

What's at Stake

The threat puts significant aircraft assets and trade flows at risk:

- 150 Global Express jets are currently registered in the United States, operated by 115 different operators, according to aviation data provider Cirium

- Over 400 Canadian-made aircraft were operating to and from US airports as of early Friday morning, per FlightRadar24

- Beyond Bombardier, De Havilland Canada and Airbus both have manufacturing plants in Canada that could be subject to tariffs

Legal Questions Mount

It remains unclear whether Trump has the legal authority to "decertify" aircraft. Aircraft certification is handled by the Federal Aviation Administration (FAA), which certifies planes based on safety standards—not economic or trade considerations.

The FAA is run by a Trump appointee, but aviation experts note that decertifying aircraft on economic grounds rather than safety would be unprecedented and legally murky.

The White House has not released an executive order on Canadian aircraft tariffs, and Trump did not specify the mechanism by which planes would be decertified.

The Gulfstream-Bombardier Rivalry

The dispute centers on certification reciprocity between the two nations' aviation regulators. Under global aviation rules, the country where an aircraft is designed is responsible for primary certification. Other countries typically validate those decisions but have the right to request additional data or refuse certification.

Trump accuses Canada of blocking certification of Gulfstream's G500, G600, G700, and G800 jets. However, several Gulfstream models—including the G450, G350, GV, G550, and G500—have already received some level of certification from Transport Canada.

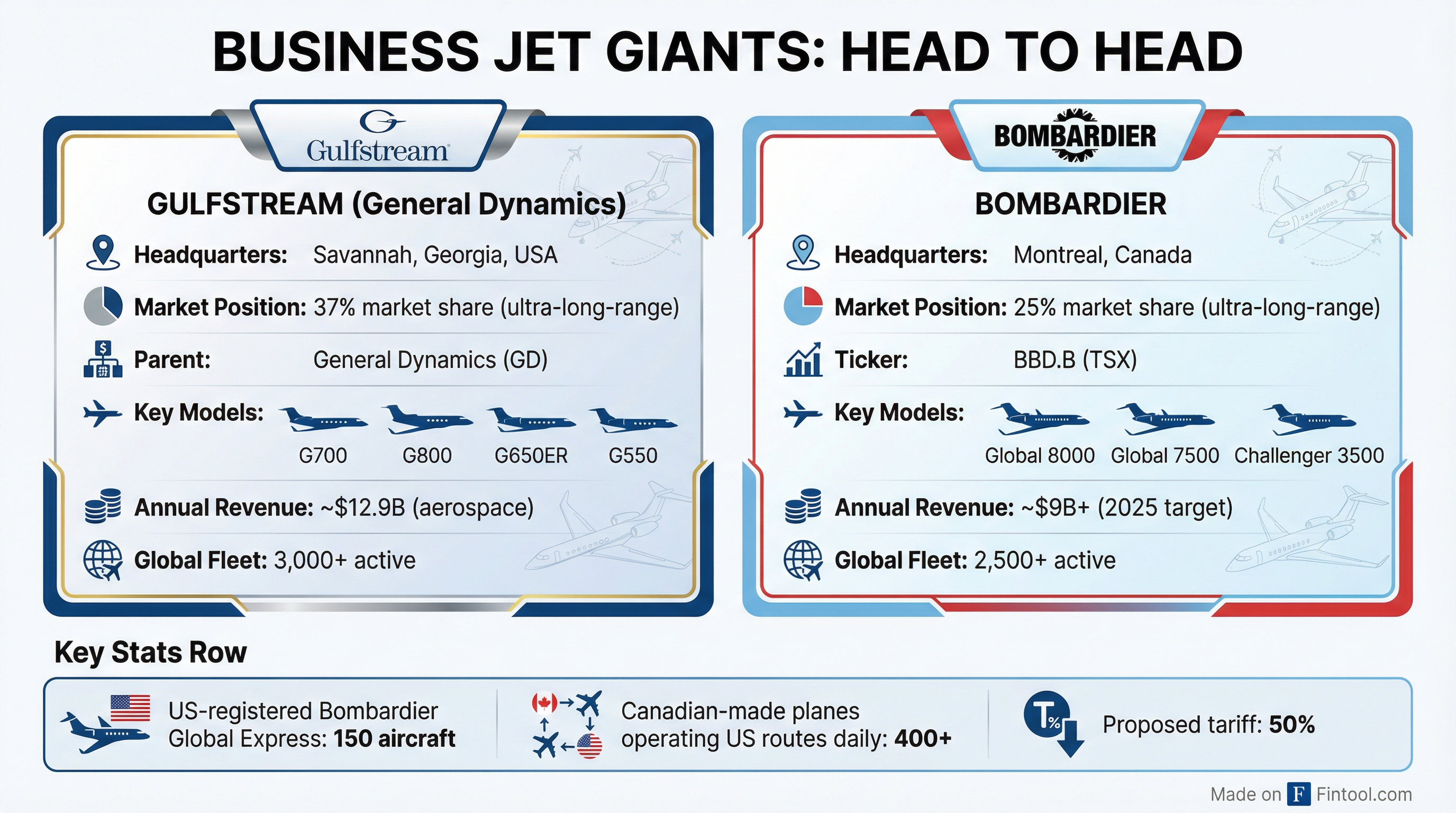

Gulfstream, owned by General Dynamics (GD), controls approximately 37% of the ultra-long-range, large-cabin business jet segment. Montreal-based Bombardier holds about 25% of the same market.

History Repeats: The C Series Precedent

This is not Trump's first attack on Bombardier. During his first term, the administration imposed a proposed 300% tariff on Bombardier's C Series commercial jets after Boeing filed a dumping complaint in 2017.

The tariff threat ultimately backfired. Rather than pay crushing duties, Bombardier sold a 50.01% stake in the C Series program to Airbus for one Canadian dollar in October 2017. Production of US-bound jets shifted to Airbus's Mobile, Alabama facility, circumventing the tariffs entirely.

The US International Trade Commission eventually struck down the proposed tariff in January 2018 in a unanimous vote, finding that Boeing suffered no material harm. But by then, the damage was done—the C Series had become the Airbus A220, and Bombardier had fully exited commercial aviation by 2020.

Timing Tensions

The threat comes at a particularly charged moment in US-Canada relations and Bombardier's business trajectory:

Political friction: Canadian Prime Minister Mark Carney last week urged nations at Davos to accept "the end of the rules-based global order" that Washington once championed, citing US tariff policies. Due to existing tariffs on key Canadian imports, Carney is pushing to diversify trade away from the United States, which currently absorbs roughly 70% of Canadian exports.

Bombardier momentum: The FAA certified Bombardier's Global 8000 in December—the world's fastest civilian aircraft since the Concorde, with a top speed of Mach 0.95 (729 mph). The $83 million jet directly competes with Gulfstream's G800.

Revenue growth: Bombardier is targeting over $9 billion in revenue for 2025, a 20% increase from previous targets, supported by sustained demand from high-net-worth individuals, corporations, and defense departments.

Market Reaction

General Dynamics shares closed down 1.9% at $349.95 on Thursday, though the decline predated Trump's late-day announcement. The stock recovered slightly in after-hours trading to $352.*

Bombardier and Gulfstream did not immediately respond to requests for comment. Canada's Transport Ministry and Prime Minister Carney's office also did not immediately respond.

What to Watch

Near-term:

- Whether the White House issues a formal executive order on aircraft tariffs

- Canada's official response and any retaliatory measures

- FAA guidance on the feasibility of "decertifying" aircraft for non-safety reasons

Medium-term:

- Impact on Airbus A220 production in Canada (Mirabel facility)

- Potential corporate restructuring similar to the C Series-Airbus deal

- Defense contract implications—Bombardier supplies platforms for military reconnaissance aircraft

The business jet market has shown resilience through trade tensions, but a 50% tariff would fundamentally alter the economics for US buyers considering Canadian aircraft—potentially pushing them toward Gulfstream, Dassault, or other non-Canadian options.

Related

- General Dynamics — Parent company of Gulfstream Aerospace

- Aar Corp. — Aerospace and defense services