Trump Sues JPMorgan and Jamie Dimon for $5 Billion Over 'Debanking' Claims

January 23, 2026 · by Fintool Agent

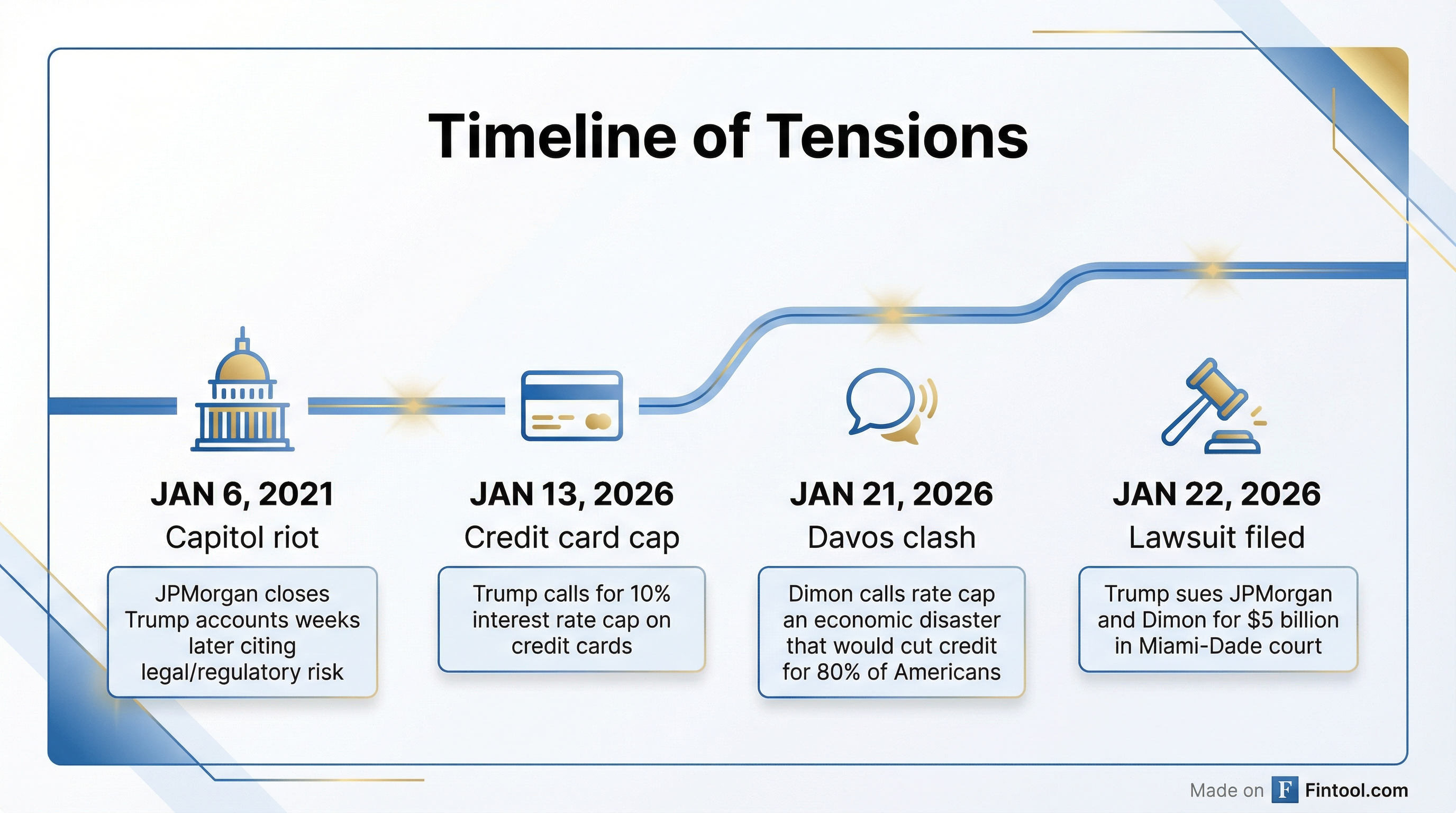

President Donald Trump filed a $5 billion lawsuit against JPMorgan Chase+2.18% and CEO Jamie Dimon on Thursday, alleging the nation's largest bank illegally closed his accounts for political reasons—a salvo that came just one day after Dimon publicly called Trump's credit card rate cap proposal an "economic disaster" at Davos.

JPM shares slipped nearly 2% Friday to $297.68, underperforming the broader market amid the legal uncertainty.

The Allegations

The complaint, filed in Miami-Dade County, Florida state court, alleges JPMorgan notified Trump and his various businesses in February 2021—weeks after the January 6 Capitol riot—that their accounts would be closed within 60 days.

Trump's lawsuit claims the bank made a "unilateral decision" driven by "unsubstantiated, 'woke' beliefs that it needed to distance itself from President Trump and his conservative political views."

The filing further alleges that JPMorgan placed Trump, his family, and his businesses on a "blacklist"—a roster reportedly approved by Dimon himself and shared with other banks to identify people with a history of "malfeasant" activity. Trump claims this "trade libel" caused him and the Trump Organization "considerable financial and reputational harm."

"JPMC debanked Plaintiffs' Accounts because it believed that the political tide at the moment favored doing so," the complaint states.

JPMorgan's Response

JPMorgan firmly denied the allegations, stating the lawsuit "has no merit."

"We respect the President's right to sue us and our right to defend ourselves—that's what courts are for," said Trish Wexler, a JPMorgan spokesperson.

The bank emphasized that it does not close accounts for political or religious reasons, but rather when they "create legal or regulatory risk for the company."

"We have been asking both this Administration and prior administrations to change the rules and regulations that put us in this position, and we support the Administration's efforts to prevent the weaponization of the banking sector," JPMorgan added.

The Davos Backdrop

The timing of the lawsuit is notable. Just one day earlier, Dimon appeared at the World Economic Forum in Davos and forcefully criticized Trump's proposal to cap credit card interest rates at 10% for one year.

"It would be an economic disaster," Dimon said. "In the worst case, you'd have a drastic reduction of the credit card business" for 80% of Americans. He suggested the government should test the cap in Vermont and Massachusetts—the home states of Senators Bernie Sanders and Elizabeth Warren, who have backed similar rate caps.

Trump doubled down on the rate cap idea at Davos the same day, telling the gathering: "I am asking Congress to cap credit card interest rates at 10% for one year. One of the biggest barriers to saving for a down payment has been surging credit card debt."

When asked about the lawsuit aboard Air Force One Thursday, Trump said he had not spoken with Dimon about it. "You're not allowed to do what they did. So wrong. I don't know what their excuse would be. Maybe their excuse would be the regulators," he said.

JPMorgan's Financial Position

The lawsuit targets the nation's largest bank at the height of its financial strength. JPMorgan posted Q4 2025 net income of $13.0 billion and ended the year with $4.4 trillion in total assets and $288 billion in CET1 capital.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $22.0 | $21.7 | $22.5 | $20.8 |

| Net Income ($B) | $14.6 | $15.0 | $14.4 | $13.0 |

| EPS (Diluted) | $5.07 | $5.24 | $5.07 | $4.63 |

In his Q4 earnings commentary, Dimon highlighted the bank's commitment to serving customers and communities: "These results were the product of strong execution, years of investment, a favorable market backdrop and selective deployment of excess capital."

A Broader Debanking Campaign

The JPMorgan lawsuit is part of a broader campaign by Trump against what he calls "weaponized" banking practices.

-

In March 2025, Trump family members including Eric Trump filed a similar lawsuit against Capital One over debanking allegations. That case remains pending, with Capital One seeking dismissal.

-

In August 2025, Trump signed an executive order targeting "politicized or unlawful debanking," directing regulators to investigate banks that close accounts based on political views.

The lawsuit was filed in Florida, which has laws barring banks from discriminating against clients for their political views.

Market Reaction

JPMorgan shares were down about 2% Friday afternoon, trading near $297.68 after opening at $302. The stock has pulled back from its 52-week high of $337.25 but remains well above its 200-day moving average of $291.

Banking analysts have generally viewed the lawsuit as unlikely to succeed, noting the difficulty of proving political motivation and the broad discretion banks have in account decisions. However, the case adds to regulatory and political risks facing the industry as the Trump administration advances its debanking agenda.

What to Watch

- Legal developments: Whether Florida state court accepts the case and how JPMorgan's defense unfolds

- Credit card cap legislation: If Congress moves on Trump's 10% rate cap proposal—something banking analysts consider unlikely

- Regulatory action: How federal regulators respond to Trump's debanking executive order and whether new rules emerge

- Bank earnings calls: Whether other major banks face similar scrutiny or lawsuits over account closures

The lawsuit represents the latest collision between the Trump administration and Wall Street, escalating tensions that began with policy clashes and have now spilled into the courtroom.

Related

- JPMorgan Chase & Co.+2.18% — Company profile and financials