TTM Technologies Surges 20% to All-Time High on AI Data Center Boom

January 13, 2026 · by Fintool Agent

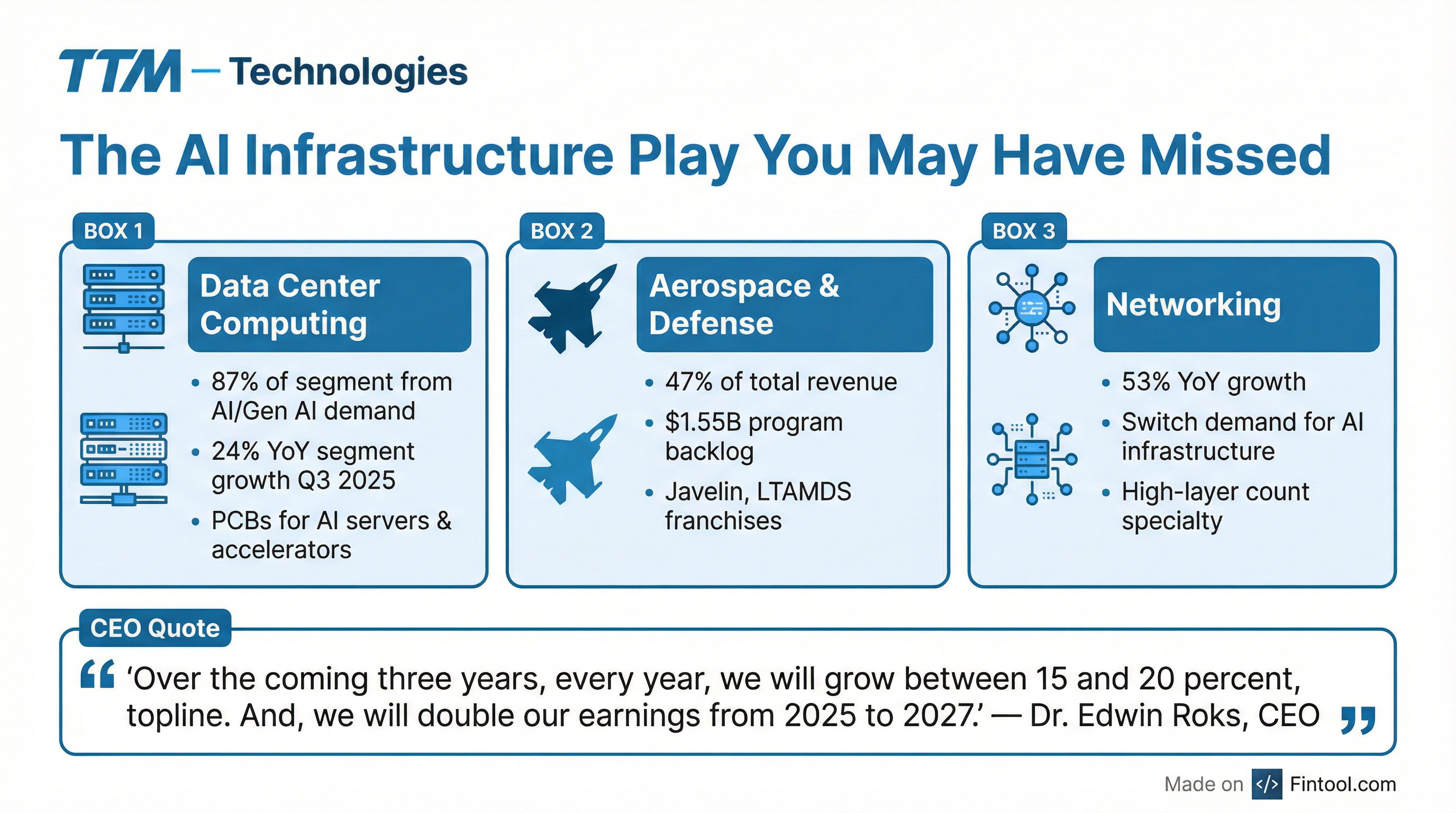

TTM Technologies stock exploded 20% to an all-time high after CEO Edwin Roks issued one of the most bullish multi-year outlooks in the AI infrastructure space: 15-20% annual revenue growth for the next three years and a doubling of earnings from 2025 to 2027.

The disclosure, made at the Needham Growth Conference in New York, sent shares from $77.89 to as high as $96.45 before settling at $93.24—a gain that adds roughly $1.5 billion to the company's market cap in a single session. The move caps a remarkable 490% rally from the 52-week low of $15.77 and establishes TTM as a primary beneficiary of the generative AI infrastructure buildout.

The Hidden AI Play

While Nvidia and Super Micro dominate AI infrastructure headlines, TTM occupies a critical position in the supply chain that's increasingly difficult to replicate. The company manufactures the complex printed circuit boards (PCBs) that connect AI accelerators, memory, and networking components inside data center servers. As AI server designs grow more sophisticated, demand for TTM's high-layer count and HDI (high-density interconnect) boards has surged.

"I can disclose here that over the coming three years, every year, we will grow between 15 and 20 percent, topline. And, we will double our earnings from '25 to '27," Roks told the audience during a fireside chat.

The comments were significant enough to trigger an 8-K filing under Regulation FD, the SEC rule requiring companies to publicly disclose material information shared with investors.

Generative AI Transforms the Business

TTM's transformation is visible in the numbers. In Q3 2025, the Commercial segment—which houses data center computing and networking—grew 24% year-over-year to $409 million, with the primary driver being "strong demand in our data center computing and networking end markets driven by generative AI."

The shift within data center computing has been dramatic. Management noted that data center demand, historically about 60% of that end market, now exceeds 87%—nearly all of it tied to generative AI applications.

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $569 | $570 | $605 | $617 | $651 | $649 | $731 | $753 |

| Net Income ($M) | $17 | $10 | $26 | $14 | $5 | $32 | $42 | $53 |

| Gross Margin | 20.3% | 18.2% | 19.4% | 21.1% | 19.4% | 20.2% | 20.3% | 20.8% |

Revenue growth has accelerated from low single digits to 22% year-over-year in the most recent quarter, while net income has more than tripled compared to Q3 2024.

Stock Performance

The stock has been on a tear, gaining nearly sixfold from its 52-week low. Today's surge reflects a re-rating of the business as investors digest the magnitude of the growth opportunity.

Defense Business Provides Ballast

While AI drives the narrative, TTM's Aerospace & Defense segment provides substantial stability and visibility. The segment contributes 47% of total revenue and maintains a program backlog of approximately $1.55 billion—up from $1.38 billion a year ago.

Key franchise programs include Javelin missiles and LTAMDS (Lower Tier Air and Missile Defense Sensor) radar systems. Unlike commercial orders that ship within weeks, defense bookings convert to revenue over longer timeframes, providing visibility into multi-year growth.

"The solid demand in the defense market is a result of a positive tailwind in defense budgets, our strong strategic program alignment and key bookings for ongoing franchise programs," management stated in the Q1 2025 earnings call.

Capacity Expansion Underway

To meet surging demand, TTM is expanding production capacity through two major initiatives:

Penang, Malaysia: The new fabrication facility is ramping production with "book-to-bill well above 1" and expected to reach breakeven by late Q3 2025. Customer qualifications continue with increasing revenues each quarter.

Syracuse, New York: External construction is largely complete on a new U.S.-based facility with equipment installation beginning summer 2025 and production slated for mid-2026.

The Syracuse expansion is particularly significant given the "onshoring" trend in critical technology supply chains and U.S. government focus on domestic semiconductor and electronics manufacturing.

Competitive Moat

TTM operates in a market with meaningful barriers to entry. The company competes primarily with Taiwanese manufacturers Unimicron and Gold Circuit, and Korean manufacturer IZU in the high-layer count and HDI segment.

Manufacturing advanced PCBs for AI servers requires specialized capabilities—high layer counts, tight tolerances, and HDI designs—that take years to develop and certify. Combined with defense program qualifications that require security clearances and lengthy approval processes, TTM has built meaningful competitive advantages.

Valuation and Estimates

Wall Street is scrambling to catch up. Truist raised its price target to $91 from $78, citing AI infrastructure growth potential. The current analyst consensus target stands at $87.25*, now below where the stock trades.

Looking ahead, consensus estimates project continued growth:

| Metric | Q4 2025 | Q1 2026 | Q2 2026 | Q3 2026 |

|---|---|---|---|---|

| Revenue ($M) | $753* | $742* | $786* | $801* |

| EPS | $0.68* | $0.63* | $0.71* | $0.75* |

*Values retrieved from S&P Global

The guidance from Roks suggests these numbers may prove conservative. A 15-20% annual growth trajectory would push 2027 revenues toward $3.5-4 billion, roughly 40% above current run rates.

What to Watch

Near-term catalysts:

- Q4 2025 earnings (expected late January/early February)

- Penang facility achieving breakeven

- Syracuse facility production timeline updates

Risks:

- Margin pressure from new facility ramp costs in Malaysia

- Customer concentration in data center segment

- Potential AI spending pause if macro conditions deteriorate

- Automotive segment weakness (11% of revenue, declining YoY)

The stock now trades at roughly 60x trailing earnings—rich by historical standards but potentially justified if management's growth targets prove achievable. The AI infrastructure buildout shows few signs of slowing, and TTM sits at a critical chokepoint in the supply chain.

The Bottom Line

TTM Technologies has emerged from relative obscurity as one of the clearest beneficiaries of AI infrastructure spending. The CEO's bold multi-year projections—15-20% annual growth and earnings doubling—reflect genuine confidence in secular demand that shows no signs of abating. While the stock's 490% rally from its lows prices in significant optimism, the company's unique position in the AI supply chain and substantial defense business provide a compelling combination of growth and stability.

Related: