Earnings summaries and quarterly performance for TTM TECHNOLOGIES.

Executive leadership at TTM TECHNOLOGIES.

Edwin Roks

President and Chief Executive Officer

Anthony Sandeen

Senior Vice President, Automotive & Medical, Industrial & Instrumentation and Global Sales

Catherine Gridley

Executive Vice President and President, Aerospace & Defense Sector

Dale Knecht

Senior Vice President, Global Information Technology

Daniel Boehle

Executive Vice President and Chief Financial Officer

Daniel Weber

Executive Vice President, Chief Legal Officer and Secretary

Douglas Soder

Executive Vice President and President, Commercial Sector

Elizabeth Romo

Chief Accounting Officer

Robert Farrell

President, Communication and Computing Business Unit

Shawn Powers

Executive Vice President and Chief Human Resources Officer

Steven Spoto

President, Integrated Electronics Business Unit

Thomas Clapprood

President, Radar Systems and Sensors Business Unit

Board of directors at TTM TECHNOLOGIES.

Research analysts who have asked questions during TTM TECHNOLOGIES earnings calls.

William Stein

Truist Securities

6 questions for TTMI

Ruben Roy

Stifel Financial Corp.

4 questions for TTMI

Michael Crawford

B. Riley Securities, Inc.

3 questions for TTMI

Mike Crawford

B. Riley Securities

3 questions for TTMI

Chris Grenga

Needham & Company

2 questions for TTMI

James Ricchiuti

Needham & Company, LLC

2 questions for TTMI

Jim Ricchiuti

Needham & Company

2 questions for TTMI

Matthew Sheerin

Stifel

1 question for TTMI

Recent press releases and 8-K filings for TTMI.

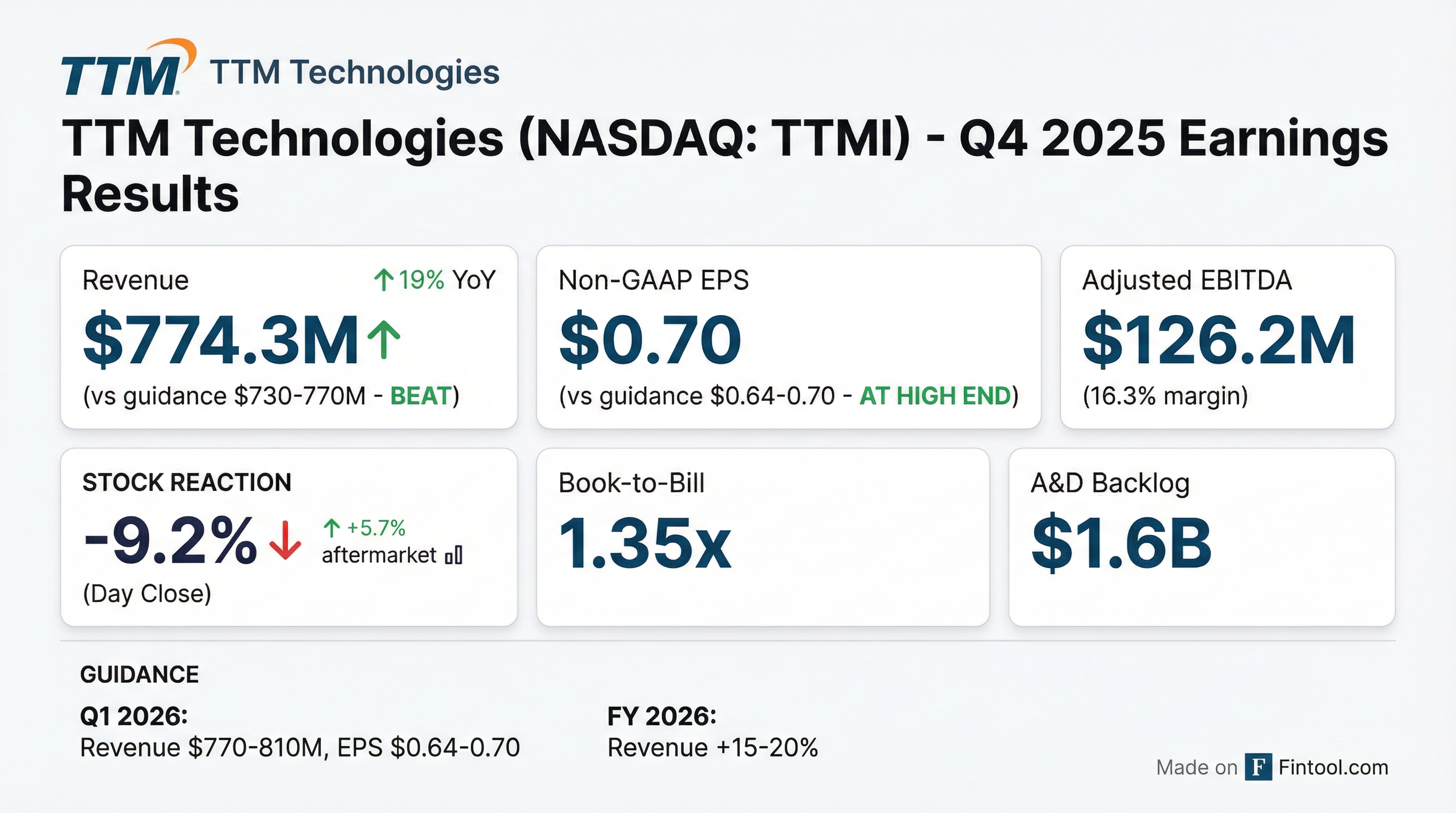

- TTM Technologies (TTMI) reported strong Q4 2025 financial results, with net sales of $774.3 million, a 19% year-over-year increase, and a record non-GAAP EPS of $0.70 per diluted share.

- Adjusted EBITDA margin improved to 16.3% in Q4 2025 from 14.7% in Q4 2024, driven by continued demand strength in data center computing, networking, medical, industrial, instrumentation, and aerospace and defense end markets.

- The company projects Q1 2026 net sales between $770 million and $810 million and non-GAAP EPS between $0.64 and $0.70 per diluted share, with full-year 2026 net sales expected to increase by 15%-20% over 2025.

- TTMI aims to grow revenues 15%-20% per year for the next three years and double earnings from 2025 to 2027, supported by investments in capacity expansion in China and the U.S. and strong demand from Artificial Intelligence and defense megatrends.

- TTM Technologies reported strong Q4 2025 results, with net sales of $774.3 million, a 19% year-over-year increase, and a record non-GAAP EPS of $0.70 per diluted share. Full-year 2025 net sales reached $2.9 billion, also up 19% from 2024, with Adjusted EBITDA at $456.3 million or 15.7% of net sales.

- The company provided Q1 2026 net sales guidance of $770 million to $810 million and non-GAAP EPS guidance of $0.64 to $0.70 per diluted share. For the full year 2026, total net sales are expected to increase by 15%-20% over 2025.

- Growth was primarily driven by strong demand in data center computing, networking, and aerospace and defense end markets, which together represent approximately 80% of net sales. The overall book-to-bill ratio for Q4 2025 was 1.35, with the A&D segment at 1.46.

- TTM Technologies is investing in capacity expansion, including an additional $200 million-$300 million over the next two to three years for data center/compute capacity in China, and expects to double earnings from 2025 to 2027 through organic growth.

- TTMI reported Q4 2025 Net Sales of $774 million, surpassing its guided range, and Non-GAAP EPS of $0.70, reaching the high end of its guidance.

- For the full year 2025, Net Sales grew to $2,906 million and Non-GAAP EPS was $2.46.

- The company issued Q1 2026 guidance with Net Sales projected between $770 million and $810 million and Non-GAAP EPS between $0.64 and $0.70.

- TTMI anticipates full year 2026 Net Sales growth of +15% to 20%.

- Key end markets such as Data Center Computing and Networking demonstrated significant YoY sales growth in both Q4 and full year 2025.

- TTM Technologies reported strong Q4 2025 net sales of $774.3 million, a 19% year-on-year increase, and a record high non-GAAP EPS of $0.70 per diluted share.

- The company's Adjusted EBITDA margin was 16.3% in Q4 2025, contributing to $292 million in cash flow from operations for the full year 2025.

- For Q1 2026, net sales are projected between $770 million and $810 million, with non-GAAP EPS in the range of $0.64-$0.70 per diluted share.

- TTM anticipates full year 2026 net sales to increase by 15%-20% over 2025 and aims to double earnings from 2025 to 2027 through organic growth, driven by demand in artificial intelligence and defense.

- TTM Technologies reported strong financial results for Q4 2025, with net sales of $774.3 million, up 19% year-over-year, and an all-time quarterly record high non-GAAP net income of $74.8 million, or $0.70 per diluted share.

- For fiscal year 2025, net sales increased to $2.9 billion, a 19.0% increase from 2024, and non-GAAP net income was $259.0 million, or $2.46 per diluted share.

- This growth was significantly influenced by generative AI demand in the Data Center Computing and Networking end markets, which saw their combined revenues rise to 36% of total company revenues.

- The company provided a positive outlook for Q1 2026, estimating net sales between $770 million and $810 million and non-GAAP net income per diluted share between $0.64 and $0.70, with fiscal year 2026 net sales projected to grow in the 15% to 20% range.

- TTM Technologies, Inc. (TTMI) reported net sales of $774.3 million for Q4 2025, a 19% increase year-on-year, and $2.9 billion for fiscal year 2025, also up 19.0% from 2024.

- Non-GAAP net income for Q4 2025 reached an all-time quarterly record high of $74.8 million, or $0.70 per diluted share, with full-year 2025 non-GAAP net income at $259.0 million, or $2.46 per diluted share.

- Adjusted EBITDA for Q4 2025 was $126.2 million (16.3% of net sales), and for fiscal year 2025, it was $456.3 million (15.7% of net sales).

- This growth was primarily driven by continued strong demand in the Data Center Computing and Networking end markets due to generative AI, alongside healthy performance in Aerospace and Defense, and Medical, Industrial, and Instrumentation sectors.

- For Q1 2026, the company forecasts net sales in the range of $770 million to $810 million and non-GAAP net income per diluted share between $0.64 and $0.70.

- TTM Technologies and Raytheon, an RTX business, have reached a multi-year agreement.

- The agreement has a potential value of $200 million over a three-year period.

- TTM will provide radio frequency assemblies, electronic hardware, and printed circuit boards to support Raytheon's Lower Tier Air and Missile Defense Sensor (LTAMDS).

- This contract reinforces TTM's partnership with Raytheon and aligns with the Department of War's emphasis on strengthening supply chains and accelerating delivery of needed capabilities.

- TTM Technologies projects 5-20% annual top-line growth for the next three years and aims to double its earnings from 2025 to 2027.

- The Data Center Computing and Networking segments, driven by artificial intelligence, are forecast to grow over 30% this year and accounted for approximately 22% of sales through the first nine months of 2025.

- The company is expanding capacity, including a 25% increase in its Chinese AI plants and a planned $200 million-$300 million investment over the next 2-3 years for equipment and refurbishments. The Syracuse facility for defense applications is on schedule to ramp up in the second half of this year, and the recently acquired Eau Claire facility in Wisconsin is expected to ramp potentially in 2027.

- Aerospace and Defense remains the largest end market, comprising about 45% of 2025 sales, with a strong backlog of around $1.5 billion.

- Capital deployment priorities are focused on supporting growth and expansion, with no current plans for share buybacks.

- TTM Technologies targets 15-20% top-line growth annually and aims to double earnings from 2025 to 2027.

- The company's Data Center Computing and Networking segment, driven by AI, is forecast to grow over 30% in 2026, supported by a 25% capacity expansion in its Chinese facilities.

- Capacity expansion efforts include a new facility in Syracuse, New York, for aerospace and defense, expected to ramp up in the second half of 2026, and an acquired facility in Eau Claire, Wisconsin, with ramping potentially in 2027.

- The Aerospace and Defense segment, representing approximately 45% of 2025 sales, maintains a strong backlog of around $1.5 billion and is a key focus for growth and differentiation in RF technologies.

- Management plans to hold an analyst day in 2026 to update its financial model and set new targets, given the significant impact of AI and the three-year age of the previous model.

- TTM Technologies projects annual top-line growth of 5-20% and expects to double its earnings from 2025 to 2027.

- The company forecasts over 30% growth in its data center computing and networking sales for 2026, driven by AI, after a 44% increase in Q3 2025. TTM expanded capacity in its Chinese AI plants by 25% in 2025 and plans to invest $200-$300 million over the next 2-3 years for further expansion.

- The defense business represented 45% of 2025 sales and has a backlog of approximately $1.5 billion, ensuring revenue visibility for the next 18-24 months.

- The Penang facility experienced initial ramp-up challenges, causing an approximate 180 basis point headwind to Q3 2025 margins, but yields are now improving weekly.

- TTM is expanding its U.S. manufacturing with a new Syracuse facility for defense, expected to ramp in H2 2026, and the Eau Claire, Wisconsin, acquisition for high-volume PCB production, with ramping anticipated in 2027.

Fintool News

In-depth analysis and coverage of TTM TECHNOLOGIES.

Quarterly earnings call transcripts for TTM TECHNOLOGIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more