UGI Shareholders Ratify Turnaround Team as Flexon Delivers Record Earnings in First Year

January 30, 2026 · by Fintool Agent

Ugi Corporation shareholders today delivered a resounding vote of confidence in CEO Bob Flexon's turnaround strategy, unanimously approving all three proposals at the company's virtual annual meeting—including the re-election of the entire board that recruited him to lead the $8.7 billion energy conglomerate through a critical transformation.

The meeting, presided over by Board Chair Mario Longhi, was notably quiet: no shareholder questions were submitted, a stark contrast to the contentious governance debates that have marked other utility sector annual meetings. The silence speaks volumes about investor alignment with management's direction after Flexon delivered record earnings in his first full fiscal year at the helm.

The Turnaround Specialist Returns

Flexon, 67, joined UGI in November 2024 after serving as Chair of PG&E Corporation during its emergence from Chapter 11 bankruptcy and leading Dynegy through a successful operational transformation from 2011 to 2018. His appointment marked a homecoming—he previously served as UGI's CFO in 2011 before departing for Dynegy.

"The Board welcomes back Bob to UGI's leadership team," Longhi said at the time of Flexon's appointment. "Bob has a proven track record in transforming and optimizing organizations."

That track record is now visible in UGI's results. Fiscal 2025 adjusted diluted EPS came in at $3.32—a record—beating the top end of the company's revised guidance range. GAAP EPS improved dramatically to $3.09 from just $1.25 the prior year, when AmeriGas impairments and restructuring costs weighed heavily on results.

Record Results Amid Transformation

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue ($B) | $8.9 | $7.2 | $7.3 |

| GAAP Net Income ($M) | ($1,502) | $269 | $678 |

| Adjusted Net Income ($M) | — | $658 | $728 |

| GAAP Diluted EPS | ($7.16) | $1.25 | $3.09 |

| Adjusted Diluted EPS | — | $3.06 | $3.32 |

*Values retrieved from S&P Global where citations not shown.

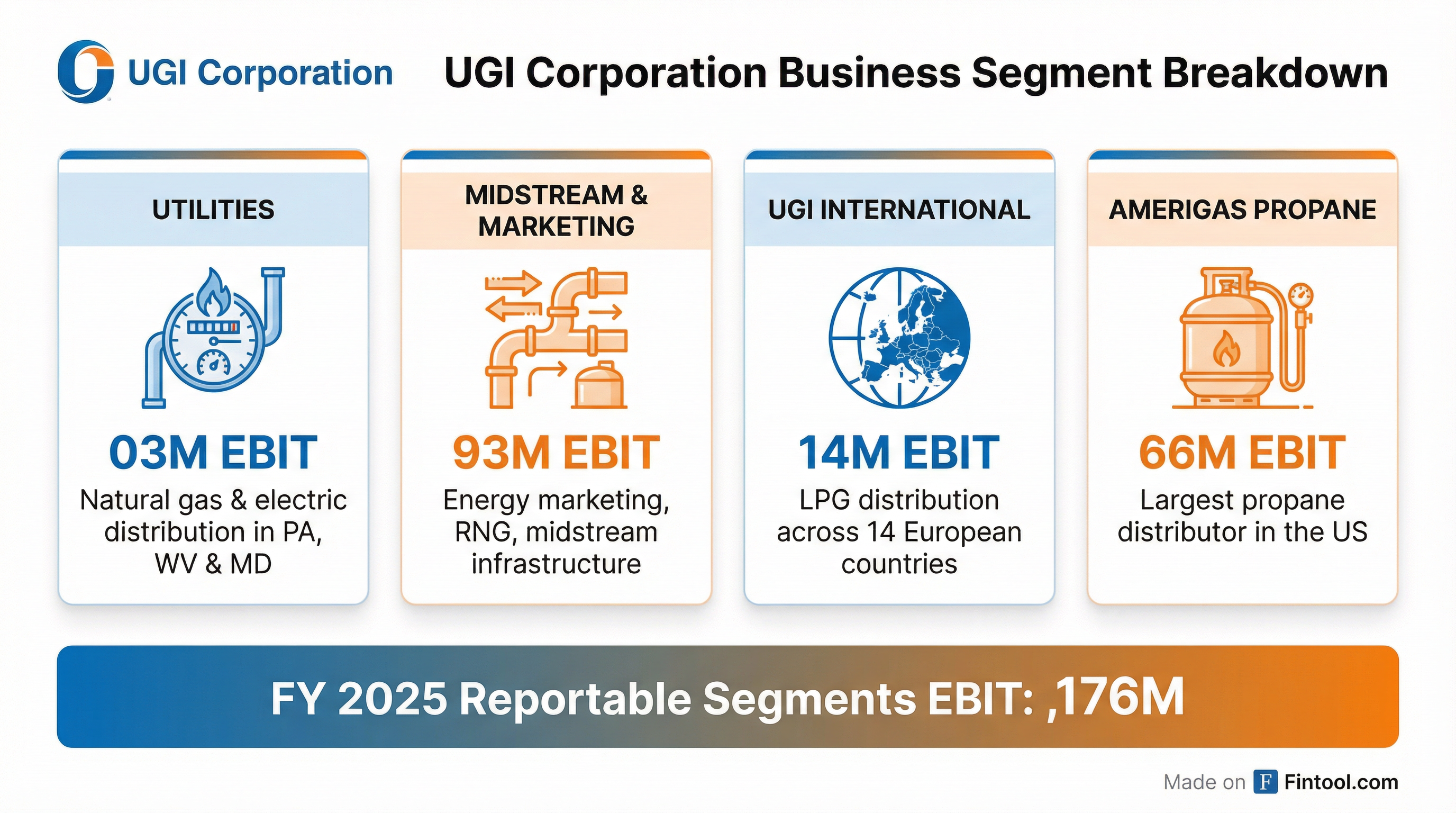

The turnaround story is most visible at AmeriGas, the nation's largest propane distributor, which swung to $166 million in segment EBIT from $142 million the prior year—a 17% improvement that came despite ongoing customer attrition pressures.

Portfolio Optimization Accelerates

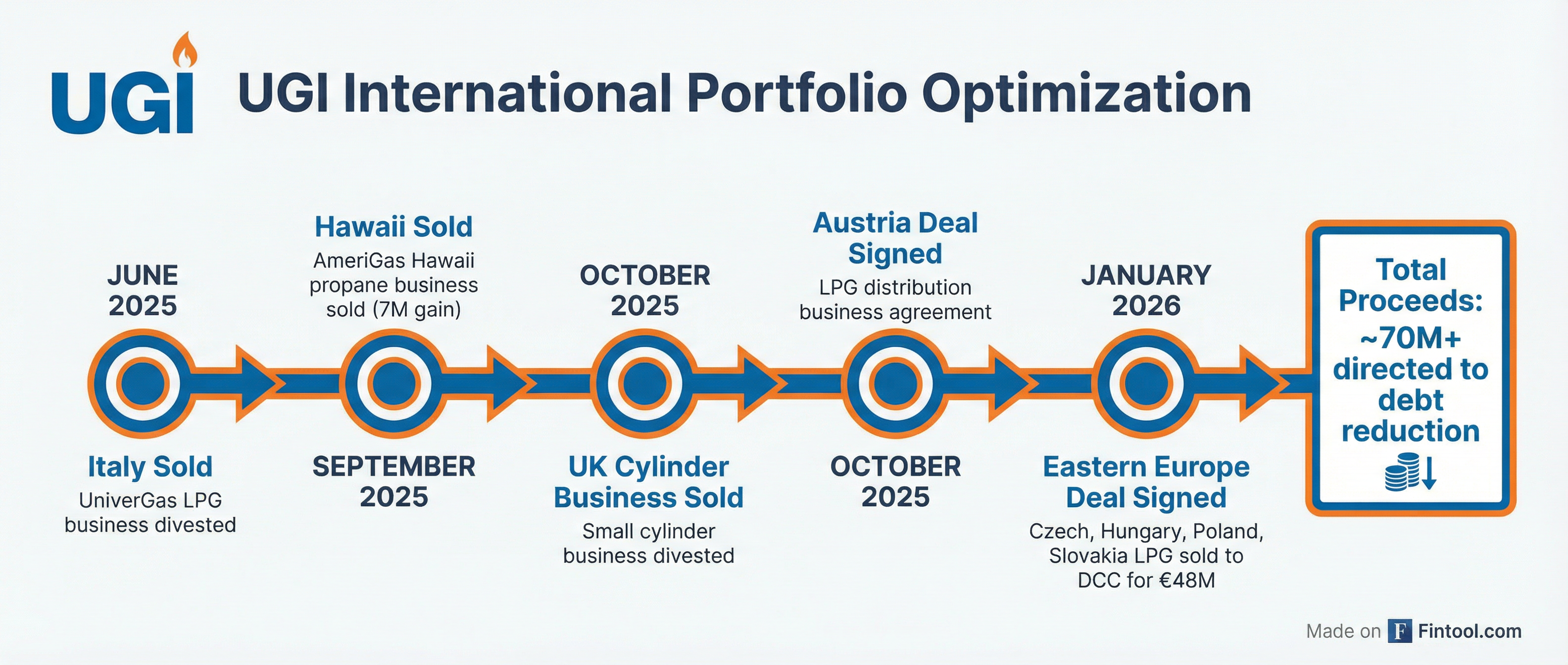

Two weeks before today's meeting, UGI announced the latest step in its European exit strategy: a €48 million ($52 million) sale of LPG distribution businesses in the Czech Republic, Hungary, Poland, and Slovakia to Dublin-based DCC PLC.

"This divestiture substantially completes UGI International's previously announced portfolio optimization program, allowing us to sharpen our focus on the segments where we have the strongest competitive positions and growth opportunities," said Julie Fazio, President of UGI International.

The Eastern European operations served approximately 30,000 bulk and cylinder customers with over 200 million liters of annual volume. All proceeds will be directed toward debt reduction at UGI Corporation, continuing management's focus on strengthening the balance sheet—leverage has already improved to 3.9x at the corporate level from higher levels in recent years.

Since June 2025, UGI has completed or announced divestitures of its LPG businesses in Italy, the UK, Austria, Hawaii, and now Eastern Europe, generating approximately $220 million in expected net cash proceeds from the fiscal 2025 transactions alone.

Stock Performance Reflects Confidence

UGI shares have rallied 39% from their 52-week low of $29.03 to $40.37 as of today, though they remain below the analyst consensus price target of $44.00.* The stock yields 3.7% based on the current quarterly dividend of $0.375 per share.

The valuation reflects both the progress made and challenges remaining. Trading at approximately 10x forward earnings, UGI remains one of the cheapest names in the regulated gas utility sector, though the discount partly reflects continued uncertainty around AmeriGas customer trends.

What to Watch: Q1 Earnings on February 5

Management's next test comes quickly. UGI will report fiscal 2026 first quarter results after market close on February 4, with a conference call scheduled for 9:00 AM ET on February 5.

The quarter will provide the first look at winter heating season performance under the new operational improvements at AmeriGas, which Flexon has made a personal priority. "I am particularly excited about the progress we've made at AmeriGas and anticipate that the winter season ahead will demonstrate the tangible impact of the initiatives underway," he said in November.

For fiscal 2026, UGI is guiding to adjusted diluted EPS of $2.90 to $3.15, implying 5-7% growth in reportable segment EBIT but a headline decline from FY25's record due to the absence of one-time tax benefits. The company has extended its long-term EPS compound annual growth target to 5-7% through fiscal 2029.

The Bottom Line

Today's annual meeting was a non-event in the best possible sense. Shareholders showed up, voted yes across the board, asked no questions, and moved on—a sign that the governance turbulence of recent years has given way to execution focus under Flexon's leadership.

The real test comes in the quarters ahead: Can AmeriGas stabilize its customer base? Will the utilities segment continue its steady growth? And will the portfolio optimization translate into meaningful deleveraging? For now, shareholders appear willing to give the turnaround specialist the time to finish the job.

Related

- Ugi Corporation — Company Profile

- UGI FY 2025 10-K — Annual Report

- DCC PLC — Acquirer of Eastern European LPG assets

*Target price from S&P Global consensus estimates.