Earnings summaries and quarterly performance for UGI CORP /PA/.

Research analysts who have asked questions during UGI CORP /PA/ earnings calls.

GM

Gabriel Moreen

Mizuho Financial Group, Inc.

8 questions for UGI

Also covers: AROC, ATO, DKL +16 more

PZ

Paul Zimbardo

Jefferies Financial Group Inc.

5 questions for UGI

Also covers: ATO, AWK, CEG +11 more

Julien Dumoulin-Smith

Jefferies

3 questions for UGI

Also covers: AEE, AEP, AES +60 more

PF

Paul Fremont

Ladenburg Thalmann

2 questions for UGI

Also covers: AEE, CNP, CPK +18 more

Recent press releases and 8-K filings for UGI.

UGI Corporation Reports Q1 2026 Earnings with Increased EBIT and Strategic Progress

UGI

Earnings

New Projects/Investments

Guidance Update

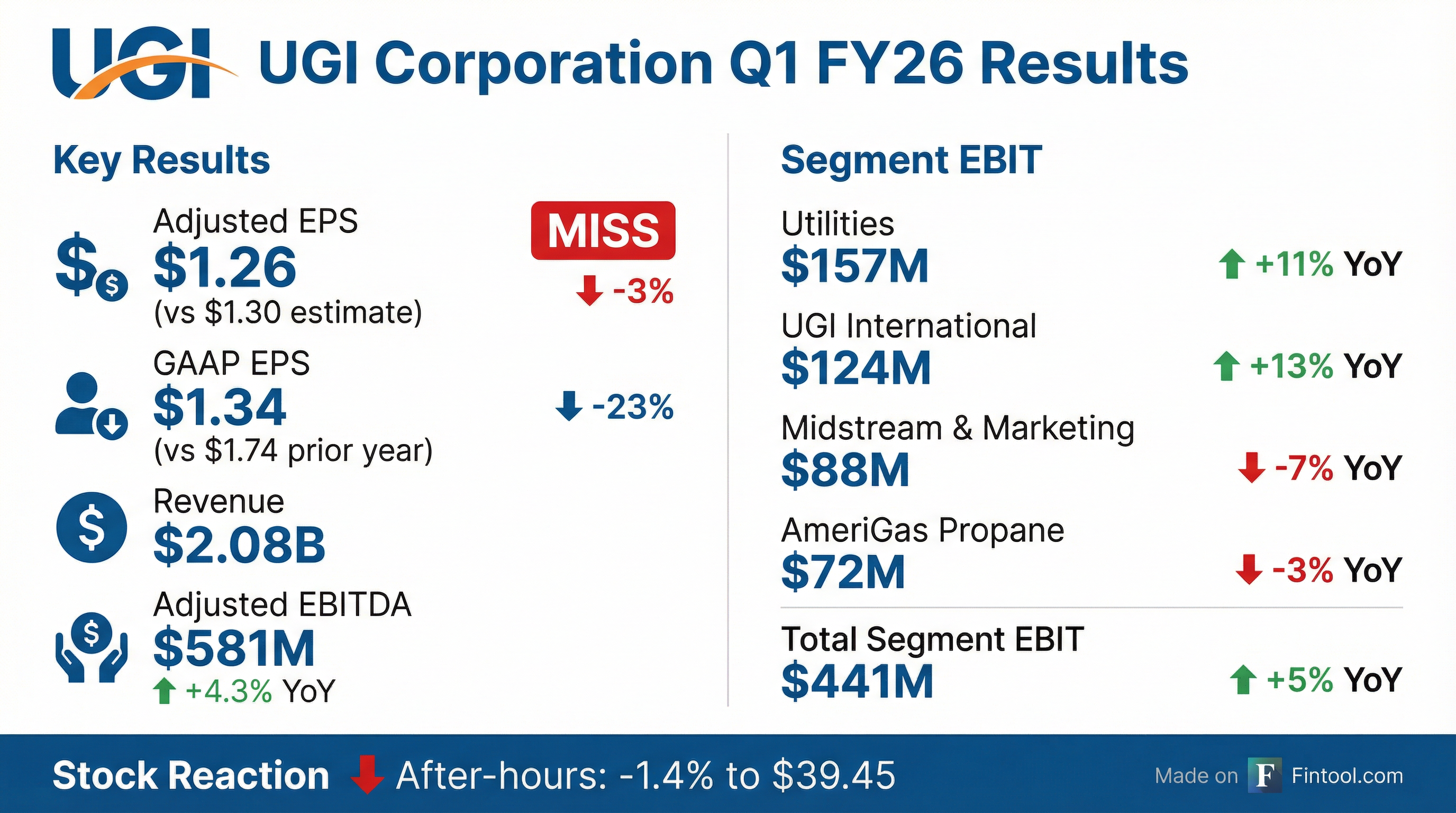

- UGI Corporation reported Q1 2026 total reportable segments EBIT of $441 million, marking a 5% increase year-over-year, primarily driven by strong natural gas businesses and effective margin management in global LPG operations.

- Adjusted diluted EPS for Q1 2026 was $1.26, down from $1.37 in the prior year, mainly due to the absence of prior year investment tax credits, higher interest expense, and impacts from divestitures.

- The company's LPG portfolio optimization is substantially complete, with divestitures in seven European countries expected to generate approximately $215 million in cash proceeds to strengthen the balance sheet.

- UGI Utilities and Mountaineer Gas Company filed gas base rate cases requesting distribution rate increases of approximately $99 million and $27 million, respectively, to fund over $500 million in system and technology upgrades.

- Operational improvements at AmeriGas led to a 45% reduction in recordable incidents and a 60% reduction in lost time injuries year-over-year, with Moody's upgrading AmeriGas's outlook to positive from negative.

Feb 5, 2026, 2:00 PM

UGI Reports Q1 2026 Financial Results with 5% EBIT Growth

UGI

Earnings

New Projects/Investments

- For Q1 2026, UGI reported total reportable segments EBIT of $441 million, up 5% over the prior year, driven by strong natural gas businesses, colder weather, and increased unit margins at UGI International.

- Adjusted diluted EPS was $1.26 for the quarter, compared to $1.37 in the prior year, primarily due to the absence of investment tax credits, higher interest expense, and lost earnings from divestitures.

- UGI deployed $225 million of capital during the quarter, with 73% allocated to its regulated utilities for infrastructure replacement and system betterment.

- AmeriGas showed significant operational improvements, including a 45% reduction in recordable incidents and 60% less lost time injuries compared to the prior year, leading to Moody's upgrading AmeriGas's outlook to positive from negative.

- Subsequent to the quarter, UGI filed gas base rate cases for UGI Utilities and Mountaineer Gas Company, requesting distribution rate increases of approximately $99 million and $27 million, respectively, to support over $500 million in system and technology upgrades.

Feb 5, 2026, 2:00 PM

UGI Corporation Reports Q1 2026 Earnings and Strategic Progress

UGI

Earnings

M&A

New Projects/Investments

- UGI Corporation reported Q1 2026 total reportable segments EBIT of $441 million, a 5% increase over the prior year period, with adjusted diluted EPS at $1.26.

- The company's natural gas businesses delivered strong results, driven by robust gas demand and the impact of the 2025 gas base rate case at its Pennsylvania utility.

- UGI International's portfolio rationalization efforts are substantially complete, with agreements to divest LPG operations in seven European countries expected to generate approximately $215 million in cash proceeds.

- AmeriGas showed significant operational improvements, including a 45% reduction in recordable incidents and a positive outlook upgrade from Moody's.

- UGI filed gas base rate cases for UGI Utilities and Mountaineer Gas Company, requesting overall distribution rate increases of approximately $99 million and $27 million, respectively, to support continued infrastructure investments.

Feb 5, 2026, 2:00 PM

UGI Reports Q1 FY26 Financial Results

UGI

Earnings

New Projects/Investments

M&A

- UGI reported Q1 FY26 GAAP diluted EPS of $1.34 and Adjusted diluted EPS of $1.26.

- Reportable segment EBIT for Q1 FY26 included Utilities at $157 million, Midstream & Marketing at $88 million, UGI International at $124 million, and AmeriGas Propane at $72 million.

- The company deployed $225 million in capital during the quarter, with 73% invested in regulated utilities businesses, and filed gas base rate cases requesting increases of $99 million for UGI Utilities and $27 million for Mountaineer Gas.

- Moody's upgraded AmeriGas's outlook from "Negative" to "Positive," and UGI Corporation's leverage stood at 4.0x as of December 31, 2025.

- UGI International has substantially completed its portfolio rationalization, divesting LPG operations in 7 countries since FY25 and generating approximately $215 million in cash proceeds.

Feb 5, 2026, 2:00 PM

UGI Corporation Reports Q1 FY26 Results and Strategic Updates

UGI

Earnings

M&A

New Projects/Investments

- UGI Corporation reported Q1 FY26 GAAP diluted earnings per share (EPS) of $1.34 and adjusted diluted EPS of $1.26, compared to $1.74 and $1.37 respectively in the prior-year period.

- Total reportable segment Earnings Before Interest Expense and Income Taxes (EBIT) increased 5% to $441 million in Q1 FY26, up from $420 million in the prior-year period.

- In January 2026, UGI entered into definitive agreements to divest LPG businesses in the Czech Republic, Hungary, Poland, Slovakia, and Romania for an enterprise value of approximately €48 million. This is part of a broader initiative since fiscal 2025 to divest LPG operations in seven countries, expected to generate approximately $215 million in cash proceeds.

- Moody's upgraded AmeriGas' rating outlook from negative to positive in January 2026.

- Subsequent to the quarter, UGI filed gas base rate cases for UGI Utilities and Mountaineer Gas, requesting overall distribution rate increases of $99 million and $27 million, respectively, to recover investments in upgrading aging infrastructure.

Feb 5, 2026, 1:30 PM

UGI Reports First Quarter Fiscal 2026 Results

UGI

Earnings

M&A

New Projects/Investments

- UGI Corporation reported Q1 GAAP diluted earnings per share of $1.34 and adjusted diluted EPS of $1.26 for the fiscal quarter ended December 31, 2025, compared to $1.74 and $1.37 respectively in the prior-year period.

- Total reportable segments' earnings before interest expense and income taxes (EBIT) increased by 5% to $441 million in Q1 2025, up from $420 million in the prior-year period.

- In January 2026, UGI entered into definitive agreements to divest LPG businesses in five European countries for an enterprise value of approximately €48 million, contributing to total cash proceeds of approximately $215 million from divestitures since fiscal 2025.

- Moody’s upgraded AmeriGas’ rating outlook from negative to positive in January 2026.

- UGI Utilities and Mountaineer Gas filed gas base rate cases subsequent to the quarter, requesting overall distribution rate increases of $99 million and $27 million, respectively.

Feb 4, 2026, 9:45 PM

UGI International Agrees to Divest Eastern European LPG Businesses

UGI

M&A

- UGI International, a subsidiary of UGI Corporation, has entered into a definitive agreement to divest its LPG distribution businesses in Czech Republic, Hungary, Poland, and Slovakia to DCC plc.

- The transaction is valued at approximately €48 million and is expected to close in the first half of calendar 2026.

- The net proceeds from the sale will be used to reduce debt at UGI Corporation, aiming to strengthen the corporation's balance sheet and increase financial flexibility for future growth investments.

- This divestiture substantially completes UGI International's previously announced portfolio optimization program.

Jan 15, 2026, 12:00 PM

Uinta Infrastructure Group Corp. Completes Business Combination

UGI

M&A

Delisting/Listing Issues

New Projects/Investments

- Integrated Rail and Resources Acquisition Corp. (IRRX) has completed its business combination with Tar Sands Holdings II, LLC (TSII), forming a new parent entity, Uinta Infrastructure Group Corp. (UIGC).

- UIGC will be led by Brian Feldott as Chief Executive Officer and is set to advance an infrastructure platform in the Uinta Basin.

- IRRX public shareholders who did not redeem their shares will become UIGC shareholders, and outstanding IRRX warrants will be exchanged for UIGC warrants at a one-to-one ratio.

- UIGC is preparing to file an S-1 registration statement with the SEC to enable its shares and warrants to list on a national stock exchange; trading of IRRX's securities has ceased.

Dec 13, 2025, 12:30 AM

UGI Reports Record Q4 2025 Adjusted EPS of $3.32 and Raises Long-Term Growth Target

UGI

Earnings

Guidance Update

New Projects/Investments

- UGI Corporation delivered record-adjusted diluted earnings per share of $3.32 for fiscal 2025, surpassing its revised guidance range of $3-$3.15, which is $0.26 higher than the prior year.

- The company generated approximately $530 million of free cash flow and returned about $320 million to shareholders through dividends in fiscal 2025.

- AmeriGas achieved 17% EBIT growth, reaching $166 million in fiscal 2025, and improved its leverage ratio from approximately six to 4.9 times by year-end.

- UGI is raising its long-term EPS compound annual growth rate target to 5-7% and announced fiscal 2026 adjusted diluted EPS guidance of $2.85 to $3.15.

- The company deployed approximately $900 million of capital in fiscal 2025, primarily in its natural gas businesses, and plans a $4.5 billion to $4.9 billion capital investment program for fiscal 2026 to 2029.

Nov 21, 2025, 2:00 PM

UGI Corporation Reports Record Fiscal 2025 Adjusted EPS and Provides Fiscal 2026 Guidance

UGI

Earnings

Guidance Update

New Projects/Investments

- UGI Corporation reported record-adjusted earnings per share of $3.32 for Fiscal 2025, surpassing its revised guidance, and generated approximately $530 million of free cash flow. The company also achieved a 42% total shareholder return.

- For Fiscal 2026, UGI provided adjusted diluted EPS guidance of $2.85-$3.15, anticipating a 5%-7% increase in reportable segment EBIT year-over-year.

- The company raised its long-term EPS compound annual growth rate target to 5%-7% for Fiscal 2026-2029, supported by a robust capital investment program of $4.5 billion-$4.9 billion.

- Strategic initiatives include continued portfolio optimization, with approximately $150 million from LPG divestitures in Fiscal 2025, and an ongoing operational transformation at AmeriGas, which saw 17% EBIT growth in Fiscal 2025. UGI aims for leverage ratios at or below 3.75x for UGI Corporation and at or below 4.0x for AmeriGas.

Nov 21, 2025, 2:00 PM

Fintool News

In-depth analysis and coverage of UGI CORP /PA/.

Quarterly earnings call transcripts for UGI CORP /PA/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more