ULA CEO Tory Bruno Resigns After 12 Years in Surprise Departure

December 22, 2025 · by Fintool Agent

Tory Bruno, the longtime chief executive of United Launch Alliance, resigned Monday in an abrupt departure that caught the aerospace industry off guard. The announcement came with no advance warning—Bruno had recorded a lighthearted holiday podcast episode just hours earlier without any hint of his exit.

"After nearly 12 years leading United Launch Alliance (ULA), current ULA President and CEO Tory Bruno has resigned to pursue another opportunity," the company's board chairs from Boeing+2.57% and Lockheed Martin+2.36% stated. "We are grateful for Tory's service to ULA and the country, and we thank him for his leadership."

The resignation comes at a pivotal moment for the Boeing-Lockheed joint venture, which is in the midst of transitioning from its legacy rockets to the new Vulcan launch system while fending off intensifying competition from SpaceX and the emerging threat of Blue Origin's New Glenn.

The Interim Leadership Scramble

Perhaps most telling of the resignation's sudden nature: the company named John Elbon as interim CEO—the same executive who had just been announced as retiring from ULA earlier this month.

Elbon, who served as chief operating officer, was supposed to be winding down his eight-year career at the company. Instead, he's now steering it through what could be a critical leadership transition. Mark Peller, the newly appointed COO who was set to succeed Elbon, will work alongside him as the board searches for a permanent CEO.

"We have the greatest confidence in John to continue strengthening ULA's momentum while the board proceeds with finding the next leader of ULA," the board chairs said.

Bruno's Legacy: Navigating Disruption

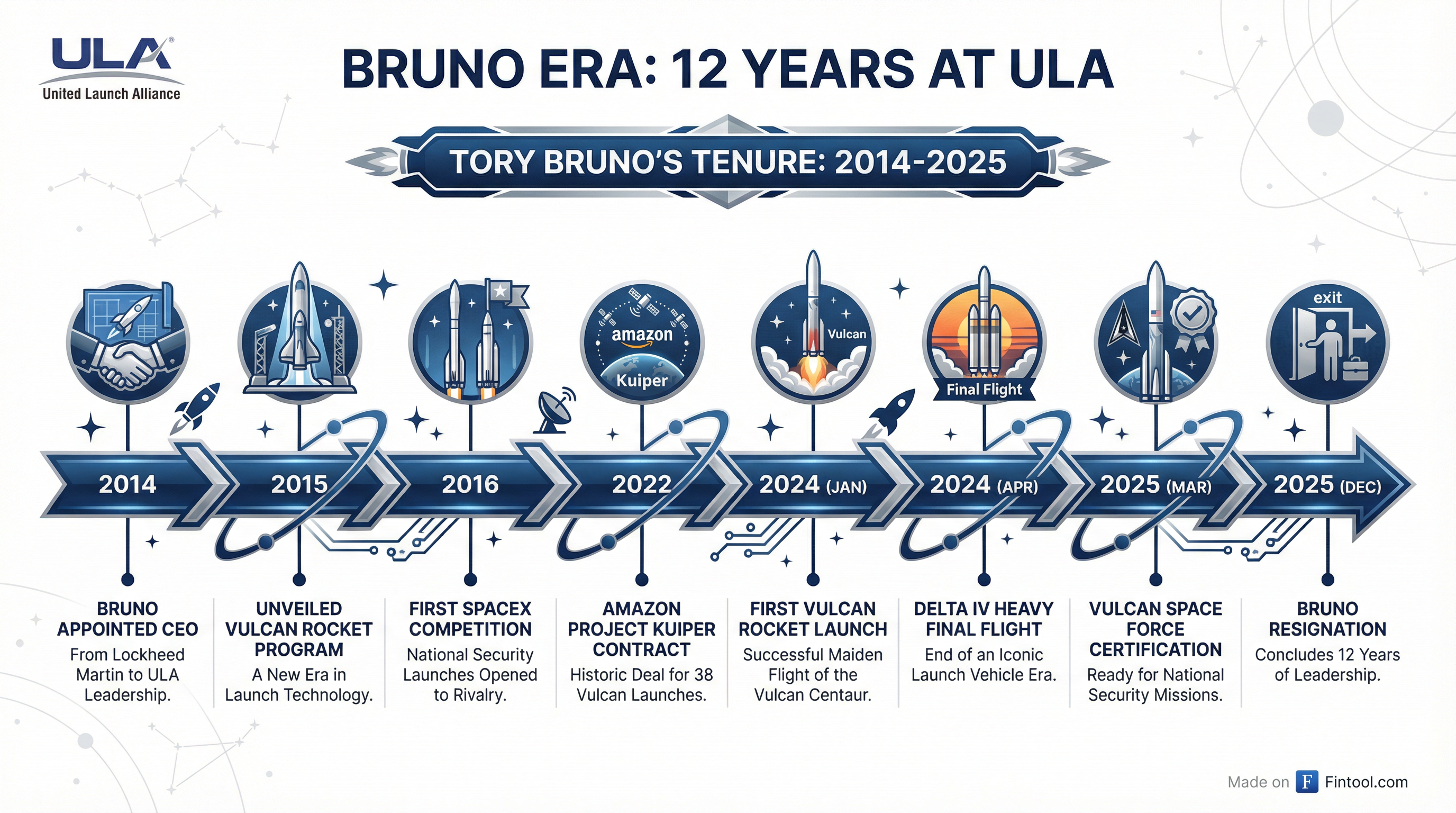

Bruno took the CEO role in 2014 after a 30-year career at Lockheed Martin, where he led strategic and missile defense programs. He inherited a company that had enjoyed an effective monopoly on U.S. national security launches—and was about to lose it.

SpaceX, then still establishing itself, was aggressively challenging ULA's grip on government contracts. Elon Musk's company even sued the Air Force to win the right to compete for national security missions. Meanwhile, ULA faced an existential threat to its workhorse Atlas V rocket, which relied on Russian RD-180 engines—a supply chain that became politically untenable after Russia's annexation of Crimea.

Bruno's response was to bet the company on Vulcan, a next-generation rocket powered by Blue Origin's BE-4 engines. The development was protracted—the rocket didn't fly until January 2024—but it ultimately achieved Space Force certification in March 2025, preserving ULA's position as one of only two companies authorized to launch the military's most sensitive satellites.

"Thank you for the opportunity to lead this amazing team," Bruno posted on X after the announcement. "They have put ULA in a great position to do important things for our customers and Nation."

Financial Reality Check

Despite operational achievements, ULA's financial contribution to its parent companies has been declining. Lockheed Martin's+2.36% most recent filings show equity earnings from ULA dropping due to "lower launch volume" and "higher initial costs associated with Vulcan profitability" .

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| LMT ULA Equity Earnings | $15M | $(5)M | -$20M |

| % of Space Operating Profit | 5% | (1)% | -6 pts |

Source: Lockheed Martin SEC filings

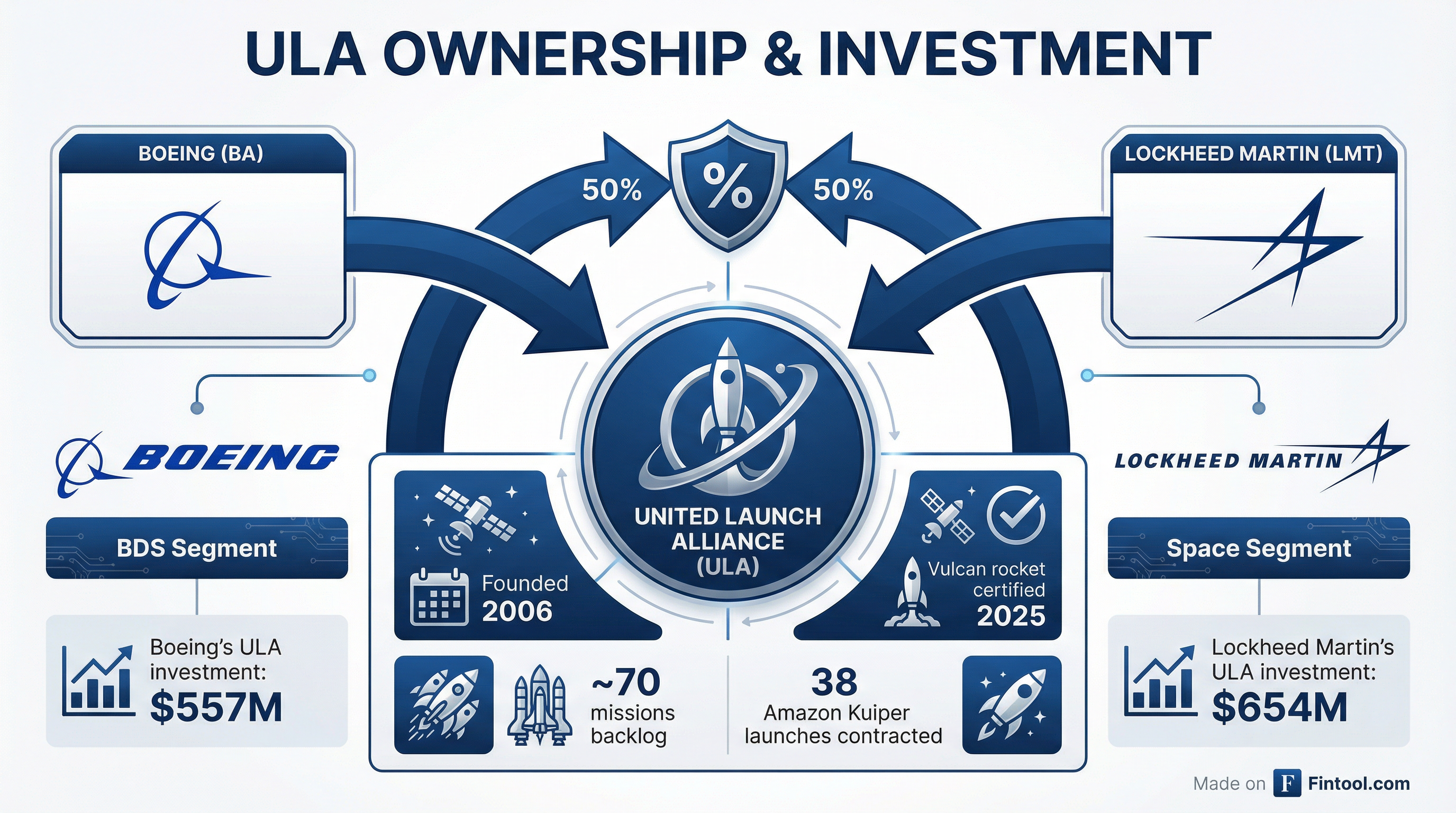

Boeing's+2.57% BDS segment recorded $125 million in equity method investment income from ULA and other joint ventures in 2024, up from $44 million in 2023, according to its 10-K filing . The company's ULA investment was valued at $557 million as of year-end 2024 .

Competition Is Intensifying

Bruno's departure comes as the U.S. launch market has become far more competitive than when he took the helm.

SpaceX has dramatically outpaced ULA in launch cadence, flying over 100 missions in 2025 compared to ULA's single-digit totals. Blue Origin, which supplies ULA's BE-4 engines, has emerged as a direct competitor with its New Glenn rocket achieving successful flights in late 2024.

ULA had projected 20 to 25 Vulcan launches in 2026 to meet commercial and government demand. "We are in that good problem to have of having more customers wanting to ride on this rocket than is easy to accommodate," Bruno said in August.

The company's backlog includes approximately 70 Vulcan missions, with 38 contracted to Amazon for its Project Kuiper satellite constellation—a crucial revenue stream as the legacy Atlas V is phased out.

What's Next?

The unnamed "other opportunity" Bruno is pursuing remains a mystery. Given his deep government connections and decades in missile and space defense programs, speculation will likely range from roles at other aerospace companies to government positions.

For ULA, the immediate priority is maintaining execution momentum on Vulcan while the board searches for permanent leadership. The company has historically been rumored as a potential sale target, with Sierra Space and Blue Origin reportedly expressing interest over the past year.

Whether Bruno's sudden exit accelerates those discussions—or reflects knowledge of changes already in motion—remains to be seen.

Related Companies:

- Boeing (ba)+2.57% — 50% owner of ULA

- Lockheed Martin (lmt)+2.36% — 50% owner of ULA