U.S. Bancorp's $1 Billion Bet on Wall Street: The BTIG Acquisition

January 15, 2026 · by Fintool Agent

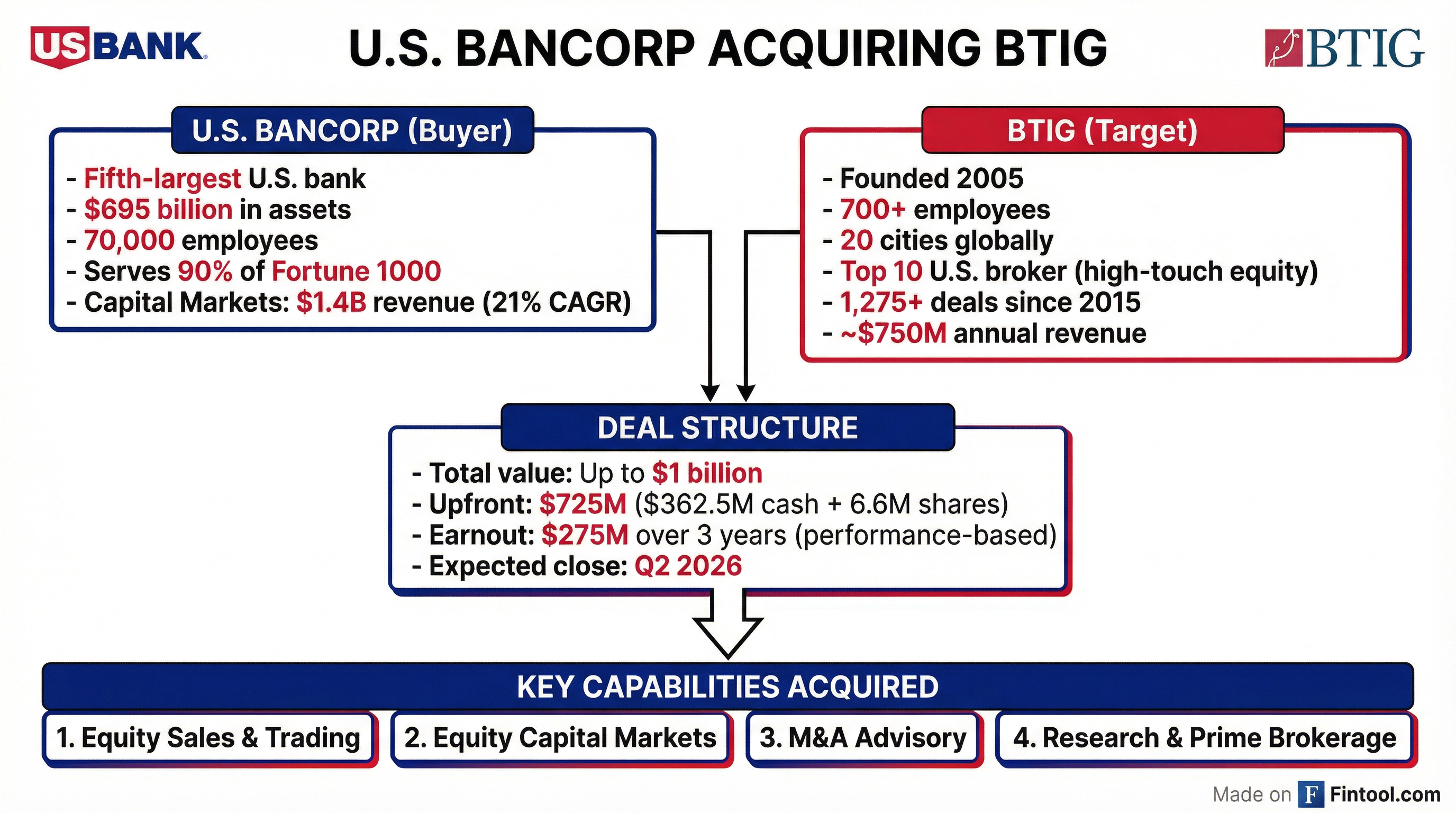

U.s. Bancorp is paying up to $1 billion to acquire BTIG, a Wall Street brokerage firm, in the most aggressive move yet by a regional bank to challenge the investment banking dominance of Goldman Sachs and Morgan Stanley.

The deal, announced January 13 and expected to close in Q2 2026, gives America's fifth-largest bank instant credibility in equity trading, equity capital markets, M&A advisory, and prime brokerage—capabilities it has lacked despite years of building its fixed-income franchise.

The Deal at a Glance

The transaction structure reflects both confidence and caution. USB will pay $725 million at closing—split evenly between $362.5 million in cash and 6.6 million shares of common stock. An additional $275 million in cash is payable over three years, contingent on BTIG meeting defined performance targets.

"BTIG's top talent, capabilities and technology will position us for continued capital markets growth and deeper client relationships," said Gunjan Kedia, U.S. Bancorp CEO, who became the first woman to lead a major U.S. bank when she took the helm in January 2025.

| Metric | Value |

|---|---|

| Total Deal Value | Up to $1 billion |

| Upfront Payment | $725 million |

| Cash Component | $362.5 million |

| Stock Component | 6.6 million shares |

| Earnout (Performance-Based) | Up to $275 million over 3 years |

| Expected Close | Q2 2026 |

| CET1 Impact | 12 basis points |

Why This Deal Matters

Filling the Equity Gap

U.S. Bancorp has built an impressive fixed-income operation—ranking among the top companies in investment-grade bonds and syndicated loans. Its capital markets business generated approximately $1.4 billion in revenue in the 12 months through September 2025, with a compound annual growth rate of 21% between 2021 and 2024.

But the equity side has been conspicuously absent. USB has relied on referral partnerships to serve corporate clients needing equity capital markets services—an arrangement that worked but left money on the table.

"While USB certainly has capital markets capabilities, they have historically been much more limited than those of several peers. This transaction therefore rounds out USB's offerings to become more competitive with those of other large banks," Piper Sandler analyst Scott Siefers noted.

The BTIG Advantage

Founded in 2005, BTIG has quietly become a formidable player in institutional trading. The firm ranks among the top 10 U.S. brokers for high-touch equity volume and has participated in more than 1,275 announced investment banking transactions since 2015.

With 700+ employees operating out of 20 cities across the U.S., Europe, Asia, and Australia, BTIG brings global reach that USB's primarily domestic franchise lacks. Adjusted net revenue was approximately $750 million last year.

The partnership isn't new—BTIG has served as USB's equity capital markets referral partner since 2014, and the two firms launched an M&A advisory referral program in 2023. This acquisition converts a decade of collaboration into full ownership.

Market Context: The Regional Bank Dilemma

The timing is instructive. Just this week, Goldman Sachs reported record annual revenue of $9.3 billion in investment banking fees for 2025—up 21% from the prior year. Morgan Stanley's investment banking revenue surged to $7.6 billion. Goldman CEO David Solomon predicted 2026 could be "a very, very good year" for Wall Street dealmakers.

Regional banks have watched this feast from the sidelines, constrained by their traditional focus on lending and payments. USB's move suggests that calculus is changing.

Stock Performance

USB shares have outperformed over the past year, rising from around $43 in January 2025 to $53.95 as of January 15, 2026—a gain of roughly 25%. The stock closed up 0.8% on January 15 at $53.95, trading near its 52-week high of $56.20.

| Bank | Current Price | YTD Change | Market Cap |

|---|---|---|---|

| U.S. Bancorp (USB) | $53.95 | +5.4% | $84B |

| JPMorgan (JPM) | $309.26 | -4.4% | $842B |

| Goldman Sachs (GS) | $975.86 | +3.1% | $173B |

| Morgan Stanley (MS) | $151.12 | +3.8% | $244B |

USB's Financial Position

U.S. Bancorp enters this acquisition from a position of strength. Net income has climbed steadily over the past year, rising from $1.66 billion in Q4 2024 to $2.0 billion in Q3 2025.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $2.83B | $2.84B | $2.92B | $3.08B |

| Net Income | $1.66B | $1.71B | $1.82B | $2.00B |

| ROE | 11.3% | 11.5% | 11.9% | 12.8% |

The bank serves nearly 90% of the Fortune 1000—a client base that could benefit significantly from BTIG's equity capabilities. As CFO John Stern noted in the Q1 2025 earnings call: "The capital markets business continues to show a lot of growth opportunities. We've been growing our client base both in terms of high grade as well as investment grade as well as high yield."

What to Watch

Integration Risks

BTIG's leadership will remain in place—CEO Anton LeRoy will continue leading the business, reporting to Stephen Philipson, USB's Vice Chair and Head of Wealth, Corporate, Commercial and Institutional Banking. Co-founder Steven Starker will maintain his client-facing role.

The earnout structure—$275 million contingent on performance targets—provides natural retention incentives and aligns BTIG's leadership with USB's growth objectives.

Regulatory Approval

The deal requires regulatory approval, but USB has characterized the impact as minimal: negligible 2026 EPS impact and approximately 12 basis points reduction in Common Equity Tier 1 capital ratio at closing. Management has indicated no change to near-term capital return plans.

Competitive Response

The acquisition comes as M&A activity is expected to accelerate in 2026. Global M&A value rose 41% in 2025 to $4.8 trillion—the second-highest year on record. With OpenAI, SpaceX, and Cerebras potentially preparing for IPOs, the pipeline for equity capital markets work is robust.

Whether USB can compete for these marquee deals alongside Goldman and Morgan Stanley remains the central question. For now, Kedia is clear about the opportunity: "This acquisition will enable both organizations to deliver greater value, innovation and efficiency to the companies and institutions we serve."