Varonis Insiders Pour $1.2M Into Stock After 60% Crash—CEO's First Buy in a Year

February 18, 2026 · by Fintool Agent

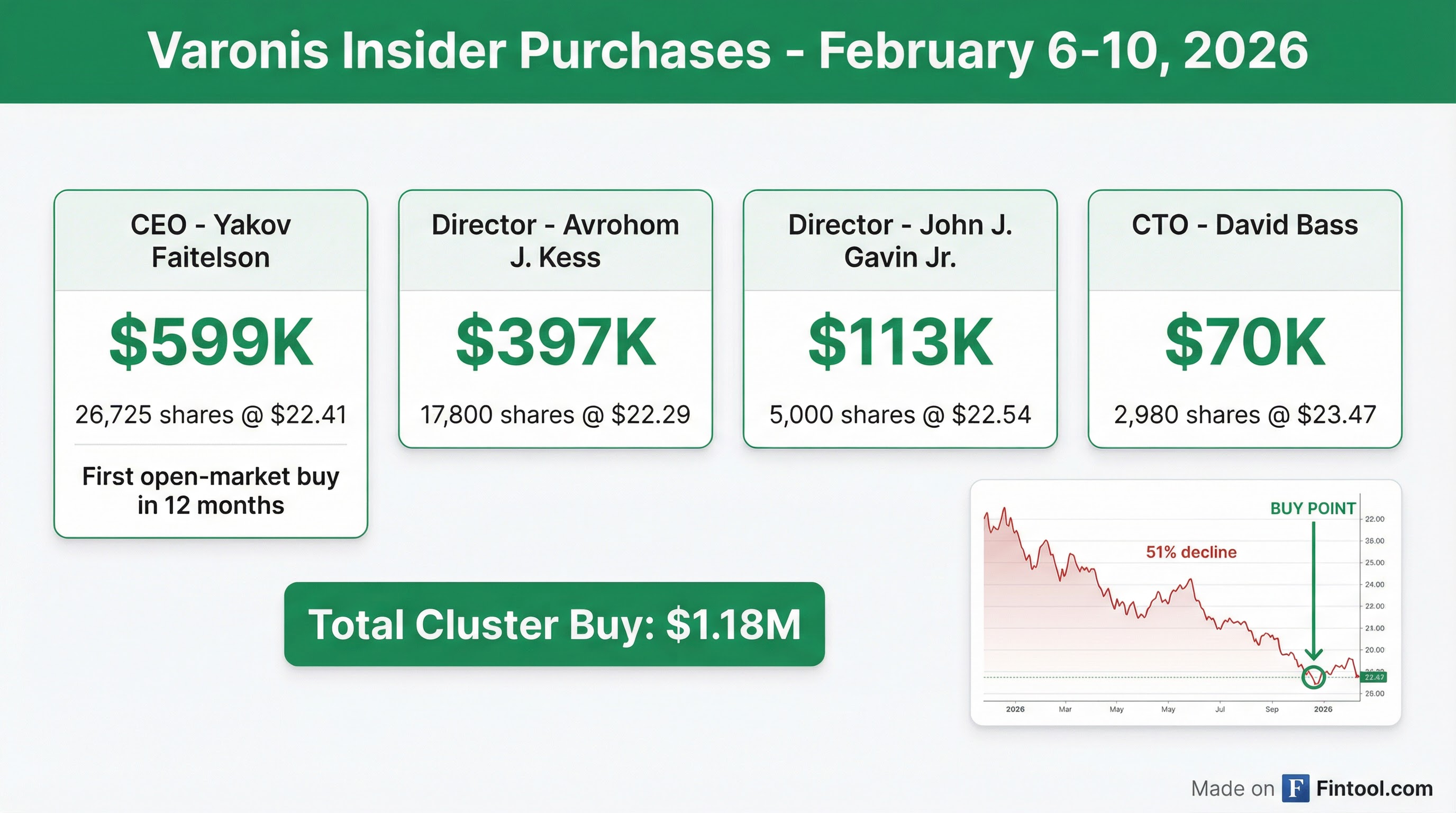

When a CEO who hasn't bought stock on the open market in 12 months suddenly puts nearly $600,000 of his own money into shares, Wall Street notices. When three other executives join him in the same week for a combined $1.2 million, it looks like a coordinated bet that the market has it wrong.

That's exactly what happened at Varonis Systems (NASDAQ: VRNS) during the first week of February, as four insiders made significant open-market purchases while the cybersecurity company's stock traded near 52-week lows—down 60% from its October 2025 peak.

The cluster buy came just days after Varonis beat Q4 earnings estimates but spooked investors with conservative 2026 guidance, sending shares tumbling another 15% on February 4.

The Cluster Buy

Four Varonis executives made open-market purchases between February 6-10, 2026:

| Insider | Title | Shares | Price | Value |

|---|---|---|---|---|

| Yakov Faitelson | CEO, President, Chairman | 26,725 | $22.41 | $598,907 |

| Avrohom J. Kess | Director | 17,800 | $22.29 | $396,762 |

| John J. Gavin Jr. | Director | 5,000 | $22.54 | $112,700 |

| David Bass | EVP Engineering & CTO | 2,980 | $23.47 | $69,940 |

| Total | 52,505 | $1,178,309 |

For CEO Faitelson, this marks his first open-market stock purchase in 12 months. The purchases came at prices between $22-24, well below the stock's 52-week high of $63.90 and roughly in line with its 52-week low of $20.06.

Varonis shares have recovered modestly since the insider buying, closing at $25.32 on February 17—up 12% from Faitelson's $22.41 purchase price but still down 60% from October highs.

Why the Stock Crashed

Varonis's 60% decline since October 2025 reflects a perfect storm of company-specific and sector-wide headwinds.

The SaaS Transition Squeeze

Varonis is in the final stages of transitioning from a self-hosted software model to SaaS delivery. While this shift promises higher-quality recurring revenue long-term, it's creating near-term profit pressure.

On the Q4 2025 earnings call, CFO Guy Melamed explained the 2026 headwinds:

"We expect a lower ARR contribution margin and lower free cash flow due to the impact of the end-of-life announcement. While this announcement negatively impacts 2026 ARR contribution margin and free cash flow by $30 million-$50 million based on our guidance, we believe it will allow us to show a healthier financial profile beginning in 2027."

The company's 2026 guidance disappointed investors:

| Metric | FY 2025 Actual | FY 2026 Guidance |

|---|---|---|

| Revenue | $623.5M | $722M-$730M (+16-17%) |

| Non-GAAP EPS | $0.08 (Q4) | $0.06-$0.10 |

| Free Cash Flow | $131.9M | $100M-$105M |

| SaaS ARR Growth (ex-conversions) | 32% | 18-20% |

The AI Disruption Panic

Varonis also got caught in the broader software selloff that began in late January 2026, triggered by fears that AI could rapidly displace traditional software businesses. The S&P 500 Software & Services Index fell 13% in six trading sessions, erasing roughly $830 billion in market value.

Varonis shares are down 30% year-to-date in 2026.

The Bull Case: Why Insiders Might Be Right

Despite the carnage, insiders appear to see value the market is missing.

$1.1 Billion Cash War Chest

Varonis ended 2025 with $1.1 billion in cash, cash equivalents, short-term deposits, and marketable securities—providing substantial runway to navigate the transition. The company generated $147 million in operating cash flow and $132 million in free cash flow in 2025, up from $108 million the prior year.

AI Security Pivot

Three days before the insider buying spree, Varonis announced its acquisition of AllTrue.ai for approximately $150 million—a strategic bet on AI security.

CEO Faitelson framed the opportunity on the Q4 earnings call:

"Cybercriminals are leveraging AI agents to infiltrate organizations with minimal human involvement. Recent incidents, such as Chinese state actors using Claude Code to breach major corporations, highlight the sensitivity and ease of these attacks... AI security depends on data security. The more data agents can access, the more useful and more risky they become."

AllTrue.ai adds capabilities to monitor and control AI systems across the enterprise—a growing concern as companies deploy AI agents that can autonomously access, modify, and act on sensitive data.

SaaS Momentum

Despite the guidance reset, Varonis's underlying SaaS business is showing strong growth:

- SaaS ARR reached $638.5 million in Q4, representing 86% of total ARR

- SaaS ARR grew 32% year-over-year excluding conversions

- Dollar-based net retention for SaaS customers was 110%

- Subscription customer count grew 14% to approximately 6,400

Analyst Reaction

Analysts have cut price targets significantly in recent weeks, though most maintain buy or hold ratings:

| Firm | Rating | Price Target | Action |

|---|---|---|---|

| DA Davidson | Neutral | $25 | Cut from $40 |

| Morningstar | — | $29 (Fair Value) | Cut from higher |

| Consensus | — | $35* | — |

*Values retrieved from S&P Global

Morningstar analyst Malik Ahmed Khan wrote after Q4 results: "Varonis reported mixed fourth-quarter results that included sales of $173 million, up 9%, and adjusted operating margins of 3%, down 700 basis points. The firm's 2026 ARR outlook guides to a slowdown in growth."

The stock trades at approximately 4x forward revenue, down from 8-10x during its 2025 highs.

The Bottom Line

Cluster insider buying is one of the most reliable signals of management confidence. Four executives committing $1.2 million of personal capital—including a CEO making his first open-market purchase in a year—suggests those closest to the business believe the stock is significantly undervalued.

Key catalysts to watch:

- Q1 2026 earnings (late April/early May): First test of 2026 guidance

- AllTrue.ai integration: Expected to close Q1 2026

- SaaS conversion progress: $105 million of non-SaaS ARR remaining to convert

- 2027 visibility: Management expects "healthier financial profile" post-transition

The question for investors: Is this the bottom of a temporary transition-related selloff, or the beginning of a fundamental derating? The insiders have made their bet.

Related