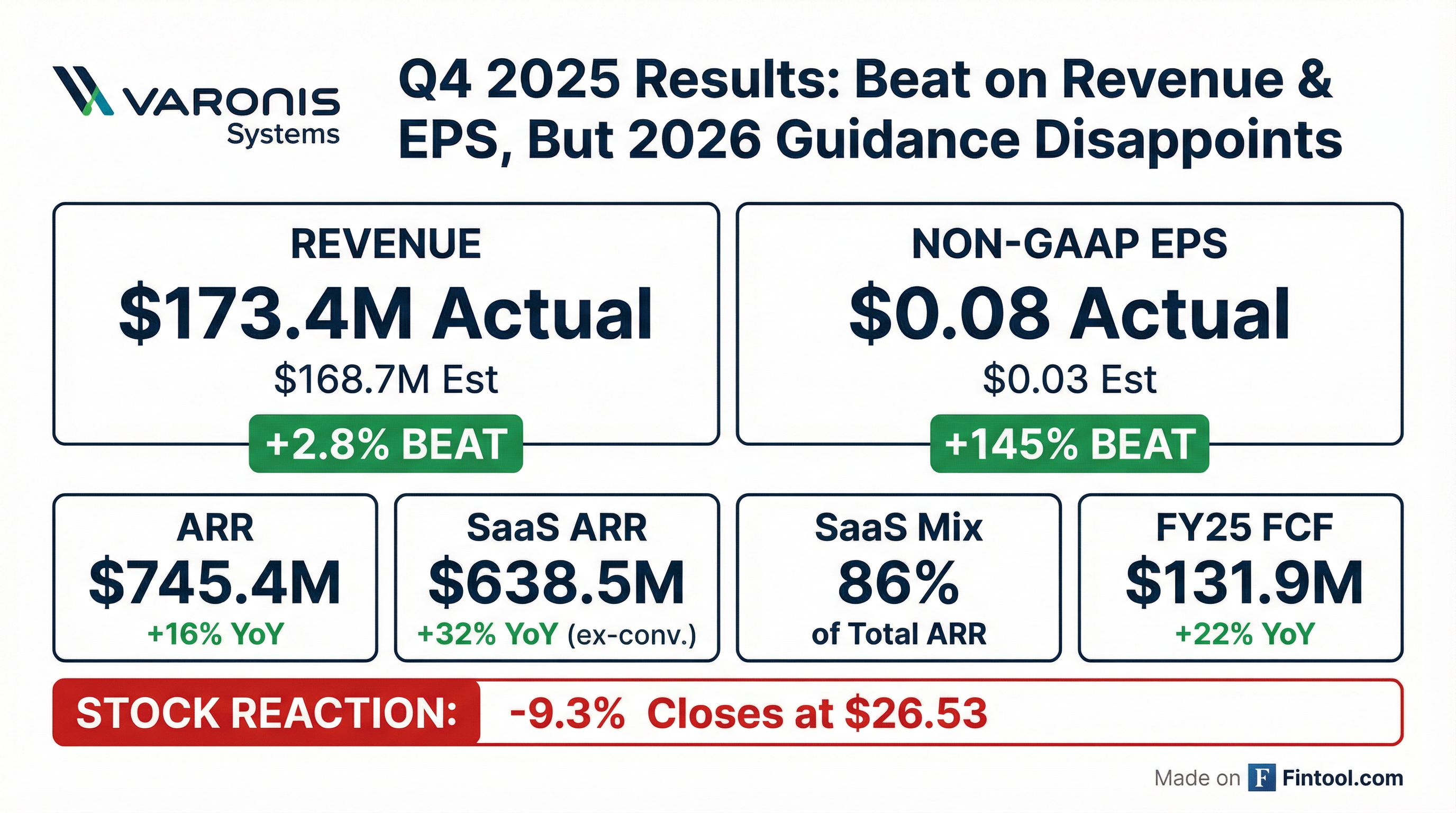

Earnings summaries and quarterly performance for VARONIS SYSTEMS.

Executive leadership at VARONIS SYSTEMS.

Yakov Faitelson

Chief Executive Officer

David Bass

Executive Vice President of Engineering and Chief Technology Officer

Dov Gottlieb

Vice President, General Counsel and Corporate Secretary

Gregory Pomeroy

Senior Vice President of Worldwide Sales

Guy Melamed

Chief Financial Officer and Chief Operating Officer

Board of directors at VARONIS SYSTEMS.

Avrohom J. Kess

Director

Carlos Aued

Director

Fred van den Bosch

Director

Gili Iohan

Director

John J. Gavin, Jr.

Lead Independent Director

Kevin Comolli

Director

Ofer Segev

Director

Ohad Korkus

Director

Rachel Prishkolnik

Director

Thomas F. Mendoza

Director

Research analysts who have asked questions during VARONIS SYSTEMS earnings calls.

Brian Essex

JPMorgan Chase & Co.

8 questions for VRNS

Jason Ader

William Blair & Company

8 questions for VRNS

Joseph Gallo

Jefferies & Company Inc.

8 questions for VRNS

Joshua Tilton

Wolfe Research

8 questions for VRNS

Rudy Kessinger

D.A. Davidson & Co.

8 questions for VRNS

Matthew Hedberg

RBC Capital Markets

7 questions for VRNS

Roger Boyd

UBS

7 questions for VRNS

Saket Kalia

Barclays Capital

6 questions for VRNS

Shrenik Kothari

Robert W. Baird & Co.

6 questions for VRNS

Fatima Boolani

Citi

5 questions for VRNS

Junaid Siddiqui

Truist Securities

5 questions for VRNS

Mike Cikos

Needham & Company, LLC

5 questions for VRNS

Shaul Eyal

TD Cowen

5 questions for VRNS

Meta Marshall

Morgan Stanley

4 questions for VRNS

Andrew Nowinski

Wells Fargo

3 questions for VRNS

Joel Fishbein

Truist Securities

3 questions for VRNS

Rob Owens

Piper Sandler Companies

3 questions for VRNS

Erik Suppiger

JMP Securities

2 questions for VRNS

Hamza Fodderwala

Morgan Stanley

2 questions for VRNS

Ethan Drake Weeks

Piper Sandler

1 question for VRNS

Jonathan Ruykhaver

Cantor Fitzgerald

1 question for VRNS

Keith Weiss

Morgan Stanley

1 question for VRNS

Mark Zhang

Citigroup

1 question for VRNS

Matt Dezort

William Blair & Company

1 question for VRNS

Michael Richards

RBC Capital Markets

1 question for VRNS

Robbie Owens

Piper Sandler

1 question for VRNS

Recent press releases and 8-K filings for VRNS.

- A securities class action has been filed against Varonis Systems (VRNS), with a deadline of March 9, 2026, for investors who purchased securities between February 4, 2025, and October 28, 2025, to seek the role of lead plaintiff.

- The lawsuit alleges Varonis made false or misleading statements regarding its ability to convert existing customers to its SaaS offering, which impacted Annual Recurring Revenue (ARR) growth potential.

- This follows Varonis's October 28, 2025, announcement of a significant miss to ARR and reduced full fiscal year 2025 projections, leading to a 48.67% stock price decline on October 29, 2025, from $63.00 to $32.34 per share.

- In response to these results, Varonis also announced the end of life for its self-hosted solution and a 5% headcount reduction.

- A securities class action lawsuit has been filed against Varonis Systems, Inc. (NASDAQ: VRNS) and certain executives, with a March 9, 2026, lead plaintiff deadline.

- The lawsuit alleges that Varonis executives concealed significant renewal softness within its Federal vertical and legacy on-premises business, while publicly touting a de-risked transition to its new Software-as-a-Service (SaaS) platform.

- It is further alleged that the company misrepresented its ability to convert existing customers to SaaS, and that weaker renewals in its Federal vertical and non-Federal on-prem subscription business led to a performance miss.

- Following an October 28, 2025, disclosure of a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook, VRNS shares experienced a 48% single-day stock crash, wiping out approximately $3.8 billion in market value.

- A securities class action lawsuit has been filed against Varonis Systems, Inc. (VRNS), with a March 9, 2026, lead plaintiff deadline.

- The lawsuit alleges that Varonis executives concealed significant renewal softness within its Federal vertical and legacy on-premises business, while publicly promoting a de-risked transition to its Software-as-a-Service (SaaS) platform.

- On October 28, 2025, the company disclosed that its SaaS model shift was allegedly plagued by an inability to convert existing customers, leading to a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook.

- This disclosure triggered a 48% single-day stock crash, wiping out approximately $3.8 billion in market value, and was followed by a significant reduction in Q4 revenue and full-year ARR guidance.

- A class action lawsuit has been filed against Varonis Systems, Inc..

- The Class Period for the lawsuit is from February 4, 2025, to October 28, 2025, with a Lead Plaintiff Deadline of March 9, 2026.

- The complaint alleges that Varonis was ill-equipped to continue its Annual Recurring Revenue (ARR) growth trajectory without a significantly high rate of quarterly conversions, and that the company's positive statements were materially misleading.

- Hagens Berman is notifying investors of a March 9, 2026, lead plaintiff deadline in a securities class action lawsuit against Varonis Systems, Inc. (VRNS).

- The lawsuit alleges that Varonis executives concealed significant renewal softness in its Federal vertical and legacy on-premises business, while misrepresenting its SaaS transition.

- On October 28, 2025, Varonis disclosed issues with its SaaS model transition, including a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook.

- This disclosure led to a 48% single-day stock crash, wiping out approximately $3.8 billion in market value, and the company also slashed its Q4 revenue and full-year ARR guidance.

- A securities class action lawsuit has been filed against Varonis Systems (VRNS) and its executives, with a March 9, 2026, lead plaintiff deadline.

- The lawsuit alleges misrepresentations regarding the company's cloud migration and concealed significant renewal softness in its Federal vertical and legacy on-premises business.

- This litigation follows an October 28, 2025 disclosure of a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook.

- The disclosure led to a 48% single-day stock crash, wiping out approximately $3.8 billion in market value.

- A securities class action lawsuit has been filed against Varonis Systems, Inc. (NASDAQ: VRNS), with a lead plaintiff deadline of March 9, 2026.

- The lawsuit alleges that Varonis executives concealed significant renewal softness within its Federal vertical and legacy on-premises business, and misrepresented the conversion potential of existing customers to its new Software-as-a-Service (SaaS) platform.

- On October 28, 2025, Varonis disclosed issues with its SaaS transition, which included a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook.

- This disclosure triggered a 48% single-day stock crash, wiping out approximately $3.8 billion in market value, with shares falling from $63.00 to $32.34.

- Following a Q3 miss, the company also slashed its Q4 revenue and full-year ARR guidance.

- A securities class action lawsuit has been filed against Varonis Systems, Inc. (VRNS) by Hagens Berman, alleging misrepresentations regarding its cloud migration and undisclosed renewal softness in its Federal vertical and legacy on-premises business.

- The lawsuit stems from Varonis's October 28, 2025, disclosure that its SaaS transition was allegedly struggling, resulting in a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook.

- This disclosure triggered a 48% single-day stock crash, wiping out approximately $3.8 billion in market value for VRNS.

- Investors who purchased VRNS shares between February 4, 2025, and October 28, 2025, and suffered substantial losses, have until March 9, 2026, to act as lead plaintiff.

- A securities class action lawsuit has been filed against Varonis Systems (NASDAQ: VRNS), with a lead plaintiff deadline of March 9, 2026.

- The lawsuit alleges that Varonis executives concealed significant renewal softness in its Federal vertical and legacy on-premises business, while publicly touting a de-risked transition to its new Software-as-a-Service (SaaS) platform.

- On October 28, 2025, the company disclosed issues with its SaaS model transition, including a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook.

- This disclosure led to a 48% single-day stock crash, wiping out approximately $3.8 billion in market value and causing VRNS shares to fall from $63.00 to $32.34.

- Following a Q3 miss, the company also slashed its Q4 revenue and full-year ARR guidance.

- Hagens Berman is notifying Varonis Systems (VRNS) investors about a pending securities class action lawsuit, with a lead plaintiff deadline of March 9, 2026.

- The lawsuit alleges Varonis executives concealed significant renewal softness in its Federal vertical and legacy on-premises business, contradicting public statements about a de-risked transition to its Software-as-a-Service (SaaS) platform.

- On October 28, 2025, Varonis disclosed issues with its SaaS model transition, which included a 63.9% year-over-year decline in term license revenue and a slashed ARR outlook.

- This disclosure led to a 48% single-day stock crash, wiping out approximately $3.8 billion in market value.

- The Class Period for investors who suffered substantial losses is February 4, 2025 – October 28, 2025.

Fintool News

In-depth analysis and coverage of VARONIS SYSTEMS.

Quarterly earnings call transcripts for VARONIS SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more