VF Corp CCO Martino Scabbia Guerrini Exits After 20 Years as Turnaround Accelerates

January 28, 2026 · by Fintool Agent

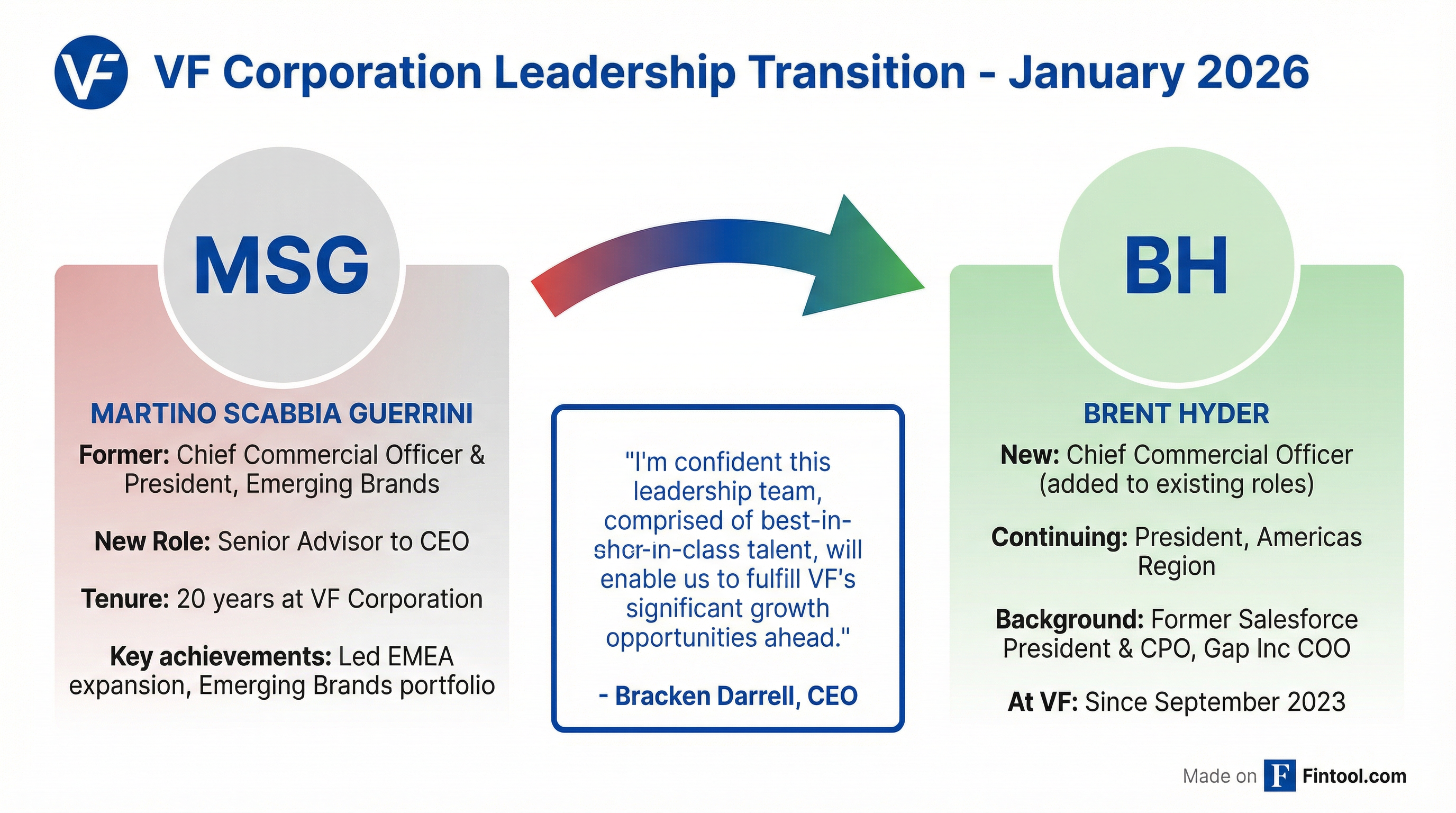

VF Corporation is reshuffling its C-suite as CEO Bracken Darrell's turnaround gains traction. Chief Commercial Officer Martino Scabbia Guerrini—a 20-year company veteran who helped build VF's European empire—is stepping aside, with Brent Hyder adding the CCO title to his existing role as President of the Americas.

The move, disclosed in an 8-K filed today alongside better-than-expected Q3 results, consolidates commercial leadership under the executive whose region just posted 6% growth—VF's best Americas performance in over three years.

The Transition

Scabbia Guerrini, 59, will transition to a senior advisor role to Darrell "to ensure a smooth transition." On the earnings call this morning, Darrell thanked him for "20 years of outstanding contributions to the company," noting that "Martino's energy, passion, and deep focus on design and consumer-led brands have left an enduring impact on our business and on me."

Hyder—a former Salesforce President and Gap Inc. COO—joined VF in September 2023, shortly after Darrell took the helm. His Americas region has become the turnaround's bright spot, with The North Face up 15% in the region and global DTC inflecting positive for the first time in years.

Why This Matters

This isn't a sudden exit—it's the latest move in Darrell's systematic overhaul of VF's leadership team. Since taking over in July 2023, the former Logitech CEO has replaced most of the executive bench:

- CFO: Paul Vogel joined in 2024

- Vans President: Sun Choe brought in from Lululemon

- North Face President: Caroline Brown (former DKNY CEO)

- Chief People Officer: Hyder himself (now adding CCO)

"I've never done that before, where we changed that many people in the first year," Darrell admitted at the ICR Conference earlier this month.

The consolidation under Hyder makes strategic sense. His Americas region delivered the goods in Q3 while international markets struggled—EMEA down 3%, APAC down 4%. Adding global commercial oversight to someone who's proven he can drive growth aligns resources with results.

The Turnaround Picture

Today's leadership change comes as VF Corp reports its strongest quarter in years:

| Metric | Q3 2026 | vs. Prior Year |

|---|---|---|

| Revenue | $2.88B | +2% (+4% ex-Dickies) |

| Operating Margin | 12.1% | +30bps |

| Net Debt | Down $600M | -20% |

This marks the first revenue growth since FY2023 (excluding divestitures). The North Face grew 5% globally, Timberland notched its fifth consecutive quarter of growth, and even struggling Vans showed green shoots—global digital revenue grew for the first time in 19 quarters.

Despite beating estimates, shares fell roughly 6% as management flagged the first meaningful tariff impacts flowing through gross margins—an unmitigated $40 million hit in Q3 alone.

The Activist Factor

VF's transformation accelerated after activist Engaged Capital took a stake in late 2023, backed by the Barbey family descendants (founders' heirs holding ~15% of shares). The fund pushed for cost cuts, brand divestitures, and board refreshment—all of which VF has delivered:

- Supreme sold: $1.5B in September 2024 (down from $2.1B acquisition price)

- Dickies sold: $600M in November 2025

- Reinvent program: $208M in restructuring charges, substantially complete

- Board seats: Caroline Brown (Engaged's nominee) joined in February 2024

The company has targeted 2.5x leverage by FY2028 (down from 4.1x at FY2025 end) and 10% operating margins at exit run rate. Progress is evident: leverage should hit 3.5x or below by fiscal year-end.

What About Scabbia Guerrini?

The departing CCO spent two decades rising through VF's European operations. He led EMEA expansion, oversaw emerging brands like Napapijri and Kipling, and most recently held the Chief Commercial Officer title alongside President of Emerging Brands since October 2023.

According to SEC filings, Scabbia Guerrini holds approximately 609,000 shares of VFC common stock, valued at roughly $11.6 million at current prices. His most recent transaction was a tax-related share withholding in October 2025.

The "senior advisor" role—a common soft landing in executive transitions—suggests a clean departure rather than any performance concerns. Darrell's effusive praise on the call reinforced the narrative of planned succession rather than pushout.

What to Watch

- Hyder's expanded mandate: Can the Americas playbook work globally, especially in struggling APAC?

- Chief People Officer vacancy: With Hyder adding CCO duties, who leads HR?

- Vans recovery timeline: Digital traffic is up, but store traffic still negative. Management won't give a turnaround date.

- Tariff escalation: Q4 pricing actions kick in, but full FY27 mitigation remains the bigger test.

VF's next earnings in April will show whether the Americas momentum can spread and whether the leadership consolidation delivers operational efficiency or creates bandwidth constraints.

Related