Earnings summaries and quarterly performance for V F.

Executive leadership at V F.

Bracken Darrell

President and Chief Executive Officer

Abhishek Dalmia

Executive Vice President and Chief Operating Officer

Jennifer Sim

Executive Vice President, Chief Legal Officer and Corporate Secretary

Michael Phillips

Vice President, Chief Accounting Officer

Paul Vogel

Executive Vice President and Chief Financial Officer

Board of directors at V F.

Alexander Cho

Director

Carol Roberts

Director

Clarence Otis Jr.

Director

Juliana Chugg

Director

Kirk Tanner

Director

Laura Lang

Director

Mark Hoplamazian

Director

Matthew Shattock

Director

Mindy Grossman

Director

Richard Carucci

Chair of the Board

Trevor Edwards

Director

Research analysts who have asked questions during V F earnings calls.

Adrienne Yih-Tennant

Barclays

8 questions for VFC

Michael Binetti

Evercore ISI

8 questions for VFC

Brooke Roach

Goldman Sachs Group, Inc.

7 questions for VFC

Jay Sole

UBS

7 questions for VFC

Matthew Boss

JPMorgan Chase & Co.

6 questions for VFC

Jonathan Komp

Robert W. Baird & Co.

5 questions for VFC

Laurent Vasilescu

BNP Paribas S.A.

4 questions for VFC

Simeon Siegel

BMO Capital Markets

4 questions for VFC

Tom Nikic

Wedbush Securities

4 questions for VFC

Anna Andreeva

Piper Sandler

3 questions for VFC

Janine Stichter

BTIG

3 questions for VFC

Lorraine Hutchinson

Bank of America

3 questions for VFC

Tracy Kogan

Citigroup

3 questions for VFC

Dana Telsey

Telsey Advisory Group

2 questions for VFC

Ike Boruchow

Wells Fargo

2 questions for VFC

Irwin Boruchow

Wells Fargo Securities

2 questions for VFC

Jim Duffy

Stifel Financial Corp.

2 questions for VFC

Robert Drbul

Guggenheim Securities

2 questions for VFC

Brooke Siler Roach

Goldman Sachs Group Inc.

1 question for VFC

John Kernan

Cowen Inc.

1 question for VFC

Noah

Jefferies

1 question for VFC

Paul Lewis

Citigroup

1 question for VFC

Peter McGoldrick

Stifel

1 question for VFC

Recent press releases and 8-K filings for VFC.

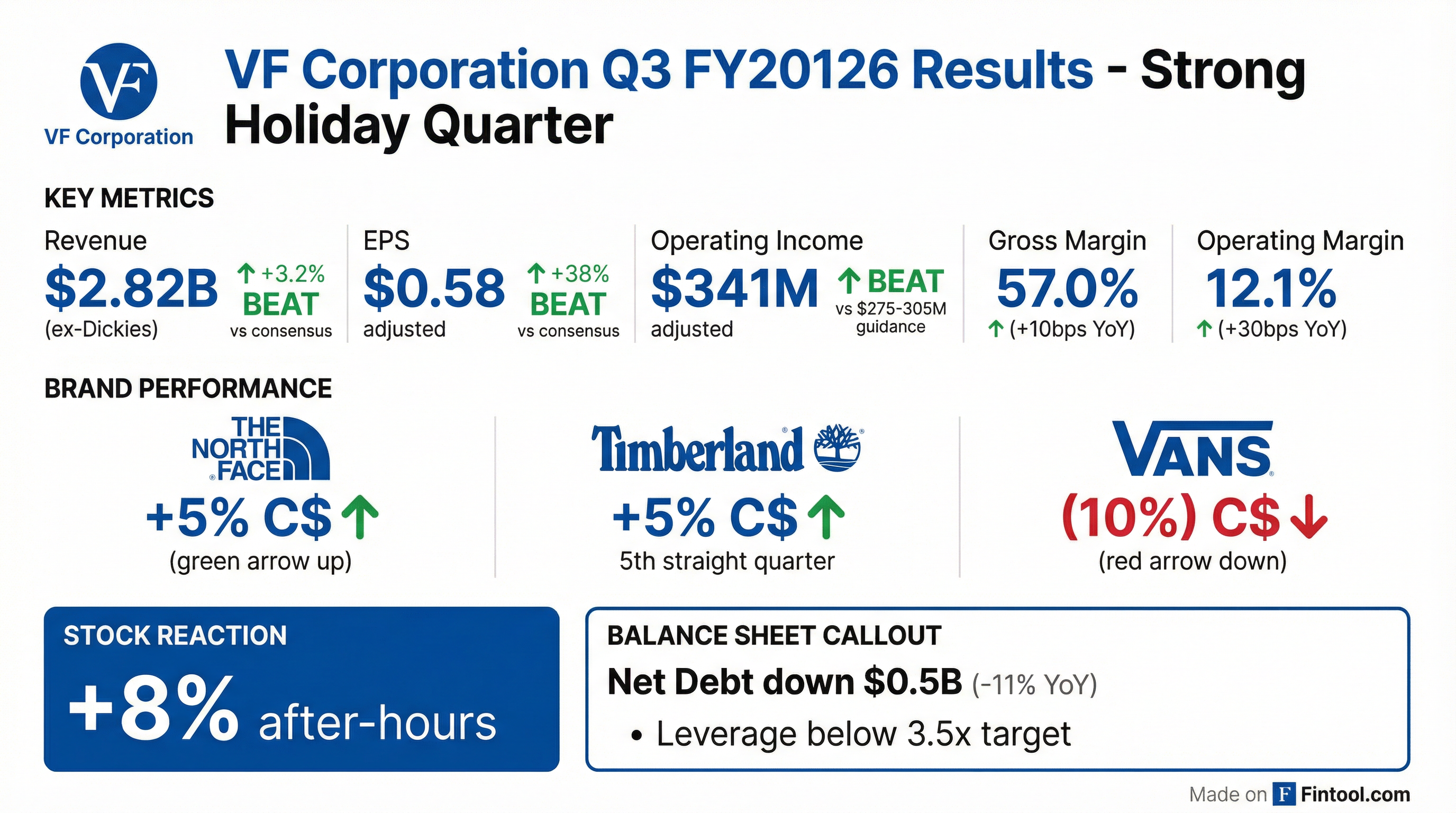

- VFC reported Q3 fiscal 2026 revenue of $2.8 billion, up 2% year-over-year on a constant dollar basis, exceeding its guidance. Operating income was $341 million , and adjusted earnings per share was $0.58.

- The North Face delivered strong growth, with revenue up 5% in Q3, including a 15% increase in the Americas. Timberland also saw revenue growth of 5% , while Vans revenue was down 10%.

- The company's reported net debt, excluding lease liabilities, decreased by almost $600 million (almost 20%) compared to last year.

- For Q4 fiscal 2026, VFC expects revenue to be flat to up 2% on a constant dollar basis and adjusted operating income between $10 million and $30 million. Full-year fiscal 2026 revenue is projected to be flat to up, with gross margin at 54.5% or better, operating margin at 6.5% or better, and leverage at 3.5x or lower.

- VFC reported strong Q3 2026 results, with total revenue up 2% and an adjusted operating margin of 12.1%, exceeding guidance.

- Brand performance was varied, with The North Face revenue up 5%, Timberland up 5%, and Altra up 23%, while Vans revenue was down 10%.

- The company significantly reduced its reported net debt by almost $600 million (excluding lease liabilities) year-over-year, demonstrating progress on financial priorities.

- For fiscal year 2026, VFC anticipates annual revenue to be flat to up, gross margin at 54.5% or better, and operating margin at 6.5% or better.

- Q4 2026 revenue is projected to be flat to up 2% on a constant dollar basis, with Vans expected to decline roughly mid-single digits.

- VFC reported Q3 2026 revenue of $2.8 billion, up 2% on a constant dollar basis, exceeding expectations, with an adjusted operating margin of 12.1%.

- The North Face and Timberland brands both delivered 5% revenue growth, while Altra grew 23%. Vans revenue was down 10%, though global digital revenue for the brand grew in the quarter.

- The company reduced net debt, excluding lease liabilities, by almost $600 million (almost 20%) compared to last year.

- For fiscal year 2026, VFC anticipates annual revenue to be flat to up, gross margin at 54.5% or better, operating margin at 6.5% or better, and leverage at 3.5x or lower.

- VF Corporation reported Q3 Fiscal 2026 revenue growth of 1% year-over-year, or 4% excluding Dickies® (or 2% in constant currency), surpassing guidance.

- Adjusted operating income excluding Dickies® for Q3 Fiscal 2026 was $341 million, exceeding guidance, with adjusted diluted EPS from continuing operations of $0.58 excluding Dickies®.

- The company completed the sale of the Dickies® brand business on November 12, 2025, and previously sold the Supreme® brand business on October 1, 2024, with financial results reflecting a segment realignment to Outdoor and Active in Q1 Fiscal 2026.

- VF provided Q4 Fiscal 2026 guidance for revenue to be flat to +2% in constant currency year-over-year and adjusted operating income of $10 million to $30 million.

- FY 2026 targets were reiterated, forecasting free cash flow, adjusted operating income, and operating cash flow to be up year-over-year, with year-end leverage at or below 3.5x.

- VF Corporation reported Q3 2026 financial results on January 28, 2026, with reported revenue increasing 1% and adjusted revenue (excluding Dickies®) growing 4% compared to the prior year.

- Reported operating income for Q3 2026 was $289 million, and adjusted operating income (excluding Dickies®) reached $341 million.

- The company completed the sale of Dickies® on November 12, 2025, during the quarter, and its Board of Directors authorized a quarterly dividend of $0.09 per share.

- For Q4 2026, revenue is projected to be flat to +2% in constant dollars compared to the prior year, with adjusted operating income expected between $10 million and $30 million.

- VF Corporation reported Q3 Fiscal 2026 financial results, with revenue increasing 1% (reported) and 4% (adjusted excluding Dickies) year-over-year, and adjusted operating income reaching $341 million.

- The North Face and Timberland brands each grew 8% (or 5% constant dollar basis) in Q3'26, while Vans' results were as expected.

- The company completed the sale of Dickies during the quarter and authorized a quarterly dividend of $0.09 per share.

- For Q4 Fiscal 2026, VF Corporation anticipates revenue to be flat to +2% on a constant dollar basis and adjusted operating income between $10 million and $30 million.

- The company is progressing towards its medium-term targets, expecting FY'26 free cash flow and adjusted operating income to be up year-over-year, and FYE'26 leverage at or below 3.5x.

- Bracken Darrell, CEO (joined mid-2023), and Paul Vogel, CFO (joined mid-2024), are leading a turnaround for V.F. Corporation, which includes significant leadership changes and a focus on building a multi-brand company with consistent processes.

- The company is on track to achieve a 10% operating margin exit velocity by fiscal 2028, a plan that requires modest revenue growth from the fiscal 2024 baseline. VFC is also confident in growing cash flow and operating income for the current fiscal year.

- VFC expects to be on a run rate to offset all tariffs within fiscal 2027, with approximately $60 million in tariffs mitigated during the current fiscal year.

- Brand-specific strategies include actions for Vans (though financial outcomes are "yet to show up" ), expanding Timberland's distribution from its current eight full-price U.S. stores , and growing Altra, which saw 37% growth last quarter.

- CEO Bracken Darrell, who joined in mid-2023, and CFO Paul Vogel, who joined in mid-2024, are leading a turnaround strategy for VF Corp, which includes significant leadership changes and a focus on building a multi-brand company with best practices.

- The company is on track to achieve a 10% operating margin by the exit of fiscal 2028, requiring modest revenue growth from the fiscal 2024 baseline and continued efficiencies. VF Corp also expects to be on a run rate to offset all tariffs within fiscal 2027.

- Key brand strategies include improving Vans through new products and marketing for consistent growth , expanding The North Face into more year-round categories and elevating its presence in the underdeveloped U.S. market , and broadening Timberland beyond its "Yellow Boot" focus with expanded distribution. The Altra brand demonstrated strong growth of 37% last quarter.

- While the consumer is generally described as "stubbornly positive," recent weeks have shown a shift to more negative commentary from medium and lower-end consumers, particularly in the U.S.. The company is confident in growing cash flow and operating income, with the Dickies sale supporting debt repayment.

- VF Corp.'s CEO Bracken Darrell (joined mid-2023) and CFO Paul Vogel (joined mid-2024) have made significant leadership changes and are executing a turnaround strategy to build a multi-brand company with best-in-class processes.

- The company is implementing brand-specific turnaround strategies for Vans, The North Face, and Timberland, focusing on product innovation, marketing, and distribution expansion, with a notable effort to expand Timberland's U.S. retail footprint from its current eight full-price stores.

- VF Corp. is on track to achieve a 10% operating margin by FY 2028, which requires modest revenue growth from the FY 2024 baseline. The company expects to be on a run rate to offset all tariffs within fiscal 2027, mitigating approximately $60 million in the current fiscal year, and is confident in free cash flow growth and debt reduction.

- The CEO describes the consumer environment as "stubbornly positive" but notes a recent shift with more negative commentary from medium and lower-end consumers, particularly in the U.S..

- V.F. Corporation (VFC) completed the sale of its Dickies® brand to Bluestar Alliance LLC on November 12, 2025.

- The transaction was finalized for an aggregate base purchase price of $600 million in cash, subject to customary adjustments.

- Supplemental financial information was provided to offer investors insights into VF's historical quarterly and annual results for fiscal 2025 and the first and second quarters of fiscal 2026, adjusted to exclude the operating results of Dickies.

Quarterly earnings call transcripts for V F.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more