Walmart Reshapes Leadership for AI Era: eCommerce Architect Takes U.S. Helm

January 16, 2026 · by Fintool Agent

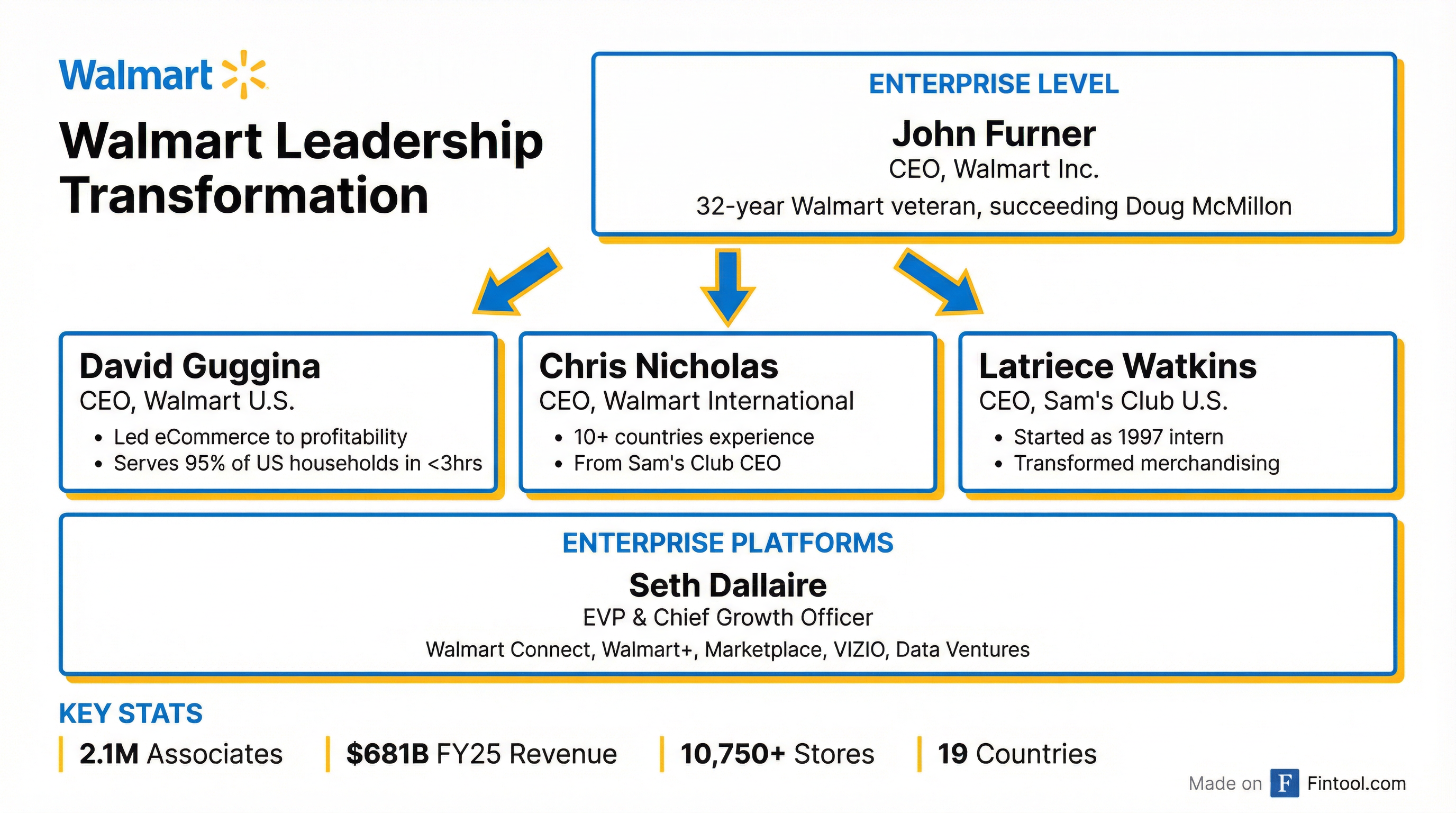

Walmart just named the architect of its digital transformation as the next leader of its largest division. David Guggina, 40, who led the retailer to its first-ever eCommerce profitability, will become President and CEO of Walmart U.S. effective February 1 — part of a sweeping leadership reorganization designed to position the $957 billion retailer for what incoming CEO John Furner calls "the new era of retail" driven by AI.

The changes mark the most significant leadership overhaul in Walmart's recent history, touching every major business segment and creating a new enterprise-level growth function. International CEO Kathryn McLay is departing after a decade with the company.

The New Structure

Furner, a 32-year Walmart veteran who started as an hourly associate in 1993, succeeds Doug McMillon as enterprise CEO after six years running the U.S. business. His message to the organization was clear: AI is reshaping retail, and Walmart's structure must evolve.

"Even the best teams need the right structure to win," Furner said in the announcement. "As AI rapidly reshapes retail, we are centralizing our platforms to accelerate shared capabilities, freeing up our operating segments to be more focused on and closer to our customers and members."

The key appointments effective February 1, 2026:

| Executive | New Role | Previous Role | Compensation |

|---|---|---|---|

| David Guggina | CEO, Walmart U.S. | Chief eCommerce Officer | $975K base + $8M equity |

| Chris Nicholas | CEO, Walmart International | CEO, Sam's Club U.S. | $1M base + $9M equity |

| Latriece Watkins | CEO, Sam's Club U.S. | Chief Merchandising Officer | $925K base + $7M equity |

| Seth Dallaire | Chief Growth Officer, Walmart Inc. | Chief Growth Officer, Walmart U.S. | Not disclosed |

The Guggina Era: From Amazon to Walmart's Digital Future

Guggina's path to the top of Walmart U.S. runs through Amazon.com, where he worked before joining Walmart in 2019 as Senior Vice President of Product and Engineering.

His ascent has been rapid: Senior Vice President of Innovation and Automation (2021-2022), Executive Vice President of Supply Chain (2022-2025), then Chief eCommerce Officer starting January 2025. Each role built toward a singular achievement: making Walmart's digital business profitable.

That milestone came in Q1 2026 — the company's first-ever quarter of eCommerce profitability, both in the U.S. and globally.

"We achieved eCommerce profitability, both in the U.S. as well as for the global enterprise in Q1 for the first time, an important milestone for our company," CFO John David Rainey said on the earnings call, directly crediting the infrastructure Guggina's team built.

The numbers behind the milestone:

| Metric | Q1 2026 | Q4 2025 | YoY Change |

|---|---|---|---|

| U.S. eCommerce Growth | +21% | +20% | Accelerating |

| Same-Day Delivery Reach | 95% of U.S. households | 93% | +200 bps |

| 3-Hour Delivery Growth | +91% YoY | N/A | Surging |

| Expedited Delivery Adoption | 33%+ of orders | 30%+ | Growing |

"Under Guggina's leadership, Walmart has built industry-leading delivery capabilities that today serve 95% of U.S. households in under three hours," the company stated.

How Walmart Got eCommerce to Profitability

The path to profitability came from three drivers, according to CFO Rainey:

1. Network Densification "Think about the opportunity to deliver a package to 5 houses on the street versus 1 house on the street. As we grow, we continue to spread those costs over more volume," Rainey explained.

2. Customer Willingness to Pay for Speed Fully one-third of customers now pay convenience fees for 1-hour or 3-hour delivery — and the trend is accelerating.

3. Supply Chain Automation Investments in fulfillment center automation and store-fulfilled delivery have dramatically reduced unit costs. U.S. eCommerce losses improved 80% in fiscal 2025 alone.

"It's a combination of investments we made for about the last decade," outgoing Walmart U.S. CEO John Furner said. "Those investments would include getting our applications to a single app, building new fulfillment centers, enabling stores to be part of the Omni solution."

McLay's Exit and the International Question

The departure of Kathryn McLay, who led Walmart International since 2023, adds an unexpected wrinkle to the transition. The company offered no specific reason for her exit, though McMillon praised her results.

"Since stepping in to lead Walmart International in 2023, Kath has led a growth agenda, producing strong top- and bottom-line results, advancing our digital and technology transformation, and strengthening our leadership team," McMillon said.

McLay's track record at Sam's Club was exceptional — 12 straight quarters of double-digit sales growth during her tenure as CEO. At International, Q1 2026 showed 7.8% constant currency sales growth with particularly strong performance in China and Flipkart.

Her successor, Chris Nicholas, brings deep international experience, having lived and worked in more than 10 countries across retailers including Coles Group (Australia), Dansk Supermarked (Denmark), and Tesco (UK) before joining Walmart in 2018.

The Financial Context

Guggina inherits a U.S. business firing on nearly all cylinders:

| Metric | Q3 2026 | Q2 2026 | Q1 2026 | Q4 2025 |

|---|---|---|---|---|

| Revenue | $179.5B | $177.4B | $165.6B | $180.6B |

| Net Income | $6.1B | $7.0B | $4.5B | $5.3B |

| EBIT Margin | 3.7% | 4.4% | 4.3% | 4.1% |

| Gross Margin | 25.0% | 25.2% | 24.9% | 24.6% |

Full-year fiscal 2025 revenue reached $681 billion with net income of $19.4 billion — the company's second consecutive year of growing operating income faster than sales.

The stock trades near all-time highs at $119.20, just below its 52-week high of $121.24, with a market cap of $950 billion.*

The "People Led, Tech Powered" Playbook

The leadership changes operationalize Walmart's stated strategy of being "people-led, tech-powered."

The creation of an enterprise-level Chief Growth Officer role, now held by Seth Dallaire, centralizes Walmart's highest-margin digital businesses: Walmart Connect (advertising), Walmart+, Walmart Data Ventures, VIZIO, Sam's Club MAP, and a global Marketplace platform.

These businesses are driving disproportionate profit growth:

- Global advertising: +27% to $4.4 billion in FY25

- Global membership income: +21% to $3.8 billion

- Walmart Connect U.S.: +31% in Q1 2026

- U.S. Marketplace revenue: +37% in FY25

"The newer businesses... contributed to over half of the operating income growth this quarter," Rainey noted.

What to Watch

Near-term: Guggina's first earnings call as U.S. CEO in late February will set the tone. Investors will want to know if the eCommerce profitability milestone is sustainable and how tariff headwinds are being managed. The company has warned that casualty claims expense trends "will persist for at least a few quarters."

Medium-term: The real test is whether centralizing digital platforms under Dallaire accelerates capability deployment across segments — or creates new friction. Nicholas faces the challenge of maintaining international momentum without McLay's institutional knowledge.

Long-term: Furner's vision of AI reshaping retail is now Walmart's official strategy. Guggina's Amazon DNA may prove either an asset or a cultural friction point in a company that prides itself on its 32-year veteran leadership bench.

The world's largest retailer has placed its bets on digital transformation. The team that delivered profitability is now running the show.

Related:

*Values retrieved from S&P Global