Waystar Chief Business Officer Ric Sinclair Exits Ahead of Q4 Earnings

February 6, 2026 · by Fintool Agent

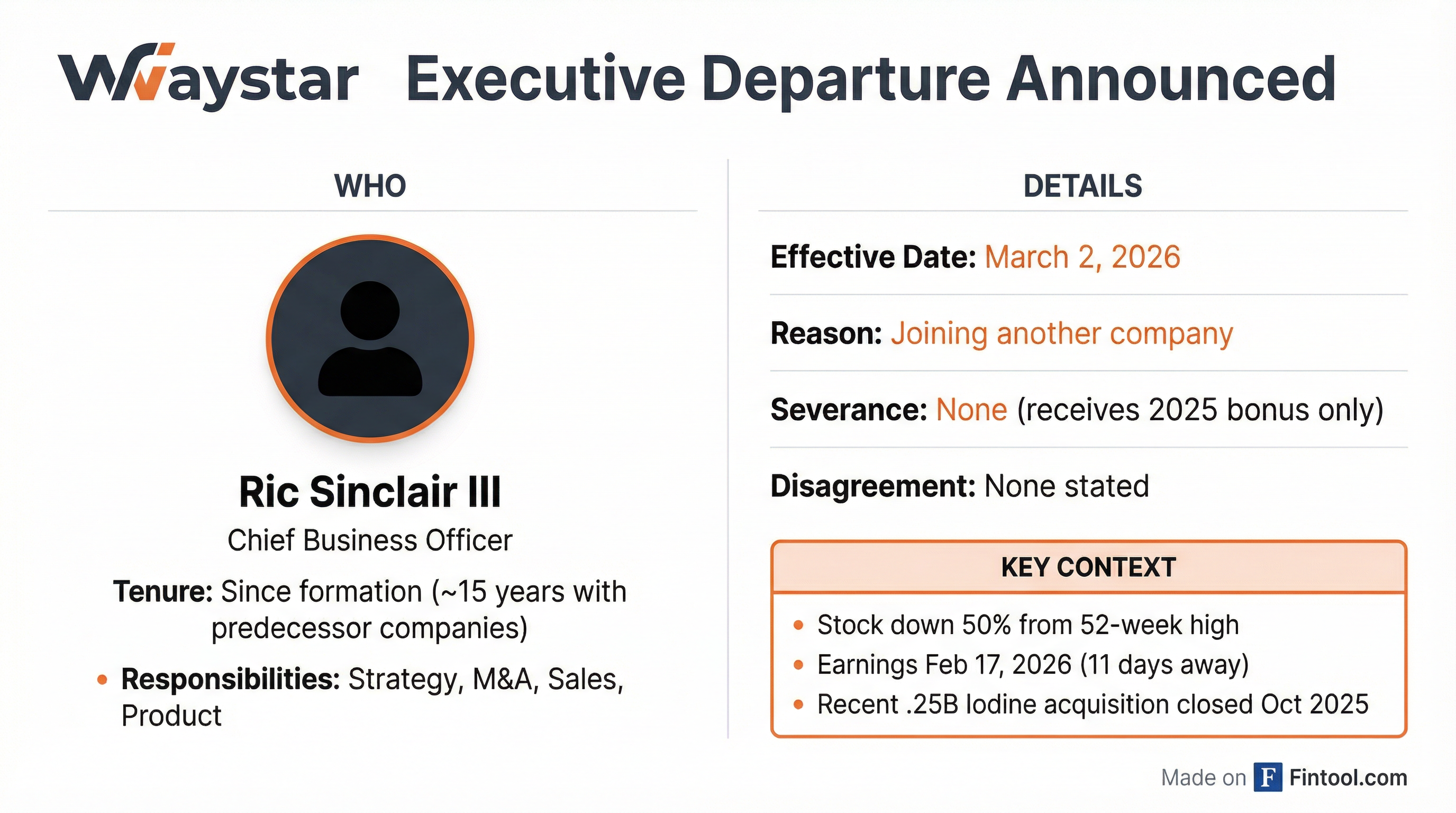

Waystar Holding Corp. (NASDAQ: WAY) disclosed that Chief Business Officer Eric "Ric" Sinclair III will resign effective March 2, 2026, to join another company. The filing explicitly states the departure is "not the result of any disagreement" with the company.

Sinclair receives his 2025 annual bonus but no severance package.

A Founding Executive Departs

Sinclair has been with Waystar since its formation and was instrumental in building the healthcare payments software company. He previously served as Chief Commercial Officer (2020-2023), Chief Strategy and Product Officer (2017-2020), and Head of Product at ZirMed (2008-2017) before Bain Capital acquired it and merged it into what became Waystar.

His responsibilities spanned the company's entire commercial operation: enterprise strategy, M&A, business development, alliances, product management, and sales.

The departure comes just four months after Waystar closed its largest acquisition—the $1.25 billion purchase of Iodine Software in October 2025—a deal that Sinclair's M&A team would have led.

$5.6 Million in Stock Sales Under Trading Plans

Sinclair has sold approximately $5.6 million in Waystar stock since the June 2024 IPO:

| Date | Shares Sold | Price | Proceeds |

|---|---|---|---|

| Jan 20, 2026 | 40,225 | $30.08 | $1,210,077 |

| Dec 22, 2025 | 9,701 | $32.82 | $318,396 |

| Nov 20, 2025 | 9,701 | $35.27 | $342,181 |

| Oct 20, 2025 | 9,701 | $36.94 | $358,334 |

| Sep 22, 2025 | 9,701 | $37.63 | $365,090 |

| Sep 8, 2025 | 19,404 | $40.03 | $776,713 |

| Earlier 2025 | 78,000 | Various | $2.2M |

Source: Form 4 filings. All sales executed under 10b5-1 trading plans disclosed in Q2 and Q3 2025 10-Qs.

The January 20 sale—his largest single transaction—occurred 13 days before he notified the company of his resignation on February 2. However, all sales were pre-scheduled under Rule 10b5-1 plans adopted in February 2025 and August 2025.

Stock Down 50% From Highs

Waystar shares have struggled since peaking at $48.11 in February 2025. The stock closed at $24.30 on February 6, 2026—down 49.5% from its 52-week high and roughly flat from its $21.50 IPO price.

| Metric | Value |

|---|---|

| Current Price | $24.30 |

| 52-Week High | $48.11 |

| 52-Week Low | $23.23 |

| IPO Price (Jun 2024) | $21.50 |

| Market Cap | $4.6B |

| Analyst Rating | Buy (14 analysts) |

| Price Target | $46.64 |

Source: Market data as of Feb 6, 2026

Despite the stock decline, analyst sentiment remains bullish. 50% of analysts rate the stock a Strong Buy and 43% rate it Buy, with a consensus price target of $46.64—implying 92% upside.

Financial Performance Remains Solid

Waystar's business fundamentals have been steady, though revenue declined sequentially in Q3 2025:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $244.1M | $256.4M | $270.7M | $268.7M |

| Net Income | $19.1M | $29.3M | $32.2M | $30.6M |

| EBITDA Margin | 36.2%* | 37.1%* | 35.1%* | 33.5%* |

*Values retrieved from S&P Global

Analysts expect $295 million in Q4 2025 revenue when the company reports on February 17, 2026.

What to Watch

No successor named. The 8-K does not mention a replacement for the CBO role, leaving questions about whether the position will be filled or responsibilities redistributed among existing leadership.

Earnings in 11 days. Management will face questions about the departure on the February 17 earnings call. Watch for commentary on leadership continuity, the Iodine integration, and go-to-market strategy.

Where is Sinclair going? The 8-K only states he is leaving "to accept a position at another company." His destination could signal competitive dynamics in healthcare IT.

Related: