Earnings summaries and quarterly performance for Waystar Holding.

Executive leadership at Waystar Holding.

Matthew Hawkins

Chief Executive Officer

Christopher Schremser

Chief Technology Officer

Eric Sinclair

Chief Business Officer

Greg Packer

Chief Legal Officer and Secretary

Kim Wittman

Chief People Officer

Missy Miller

Chief Marketing Officer

Steven Oreskovich

Chief Financial Officer

T. Craig Bridge

Chief Transformation Officer

Board of directors at Waystar Holding.

Aashima Gupta

Director

Eric Liu

Director

Ethan Waxman

Director

Heidi Miller

Director

John Driscoll

Chair of the Board

Lauren Young

Director

Michael Roman

Director

Paul Moskowitz

Director

Priscilla Hung

Director

Robert DeMichiei

Director

Samuel Blaichman

Director

Vivian Riefberg

Director

Research analysts who have asked questions during Waystar Holding earnings calls.

Elizabeth Anderson

Evercore ISI

6 questions for WAY

Richard Close

Canaccord Genuity Group

6 questions for WAY

Allen Lutz

Bank of America

5 questions for WAY

Brian Peterson

Raymond James Financial

5 questions for WAY

George Hill

Deutsche Bank

5 questions for WAY

Ryan Daniels

William Blair & Company, L.L.C.

5 questions for WAY

Adam Hotchkiss

Goldman Sachs

4 questions for WAY

Steven Valiquette

Mizuho

3 questions for WAY

Alexei Gogolev

JPMorgan Chase & Co.

2 questions for WAY

Anne McCormick

JPMorgan Chase & Co.

2 questions for WAY

Brian Tanquilut

Jefferies

2 questions for WAY

Jailendra Singh

Truist Securities

2 questions for WAY

Kevin Caliendo

UBS

2 questions for WAY

Michael Cherny

Leerink Partners

2 questions for WAY

Ryan Halsted

RBC Capital Markets

2 questions for WAY

Saket Kalia

Barclays Capital

2 questions for WAY

Alex L. Gogelov

JPMorgan Chase & Co.

1 question for WAY

Anne Samuel

JPMorgan Chase & Co.

1 question for WAY

Brian Tanquilit

Jefferies LLC

1 question for WAY

Charles Rhyee

TD Cowen

1 question for WAY

Daniel Grosslight

Citigroup

1 question for WAY

Jared Haase

William Blair & Company

1 question for WAY

Johnathan McCary

Raymond James

1 question for WAY

Liz Lee

Deutsche Bank

1 question for WAY

Ryan MacDonald

Needham & Company

1 question for WAY

Ryan McDonald

Needham

1 question for WAY

Sean Dodge

RBC Capital Markets

1 question for WAY

Stephanie Davis

Barclays

1 question for WAY

Recent press releases and 8-K filings for WAY.

- Waystar's AI capabilities earned the top ranking in the revenue cycle management industry, outperforming 49 other vendors in an independent Black Book Market Research™ survey.

- The company achieved a 9.75 out of 10 composite score for client satisfaction and outcomes, with nearly 100% of surveyed leaders indicating they are very likely to renew their AI engagements.

- Waystar's AltitudeAI™ has prevented $15 billion in denials and accelerated appeal package generation by 90% in less than a year, contributing to approximately 99% clean claim and first-pass acceptance rates.

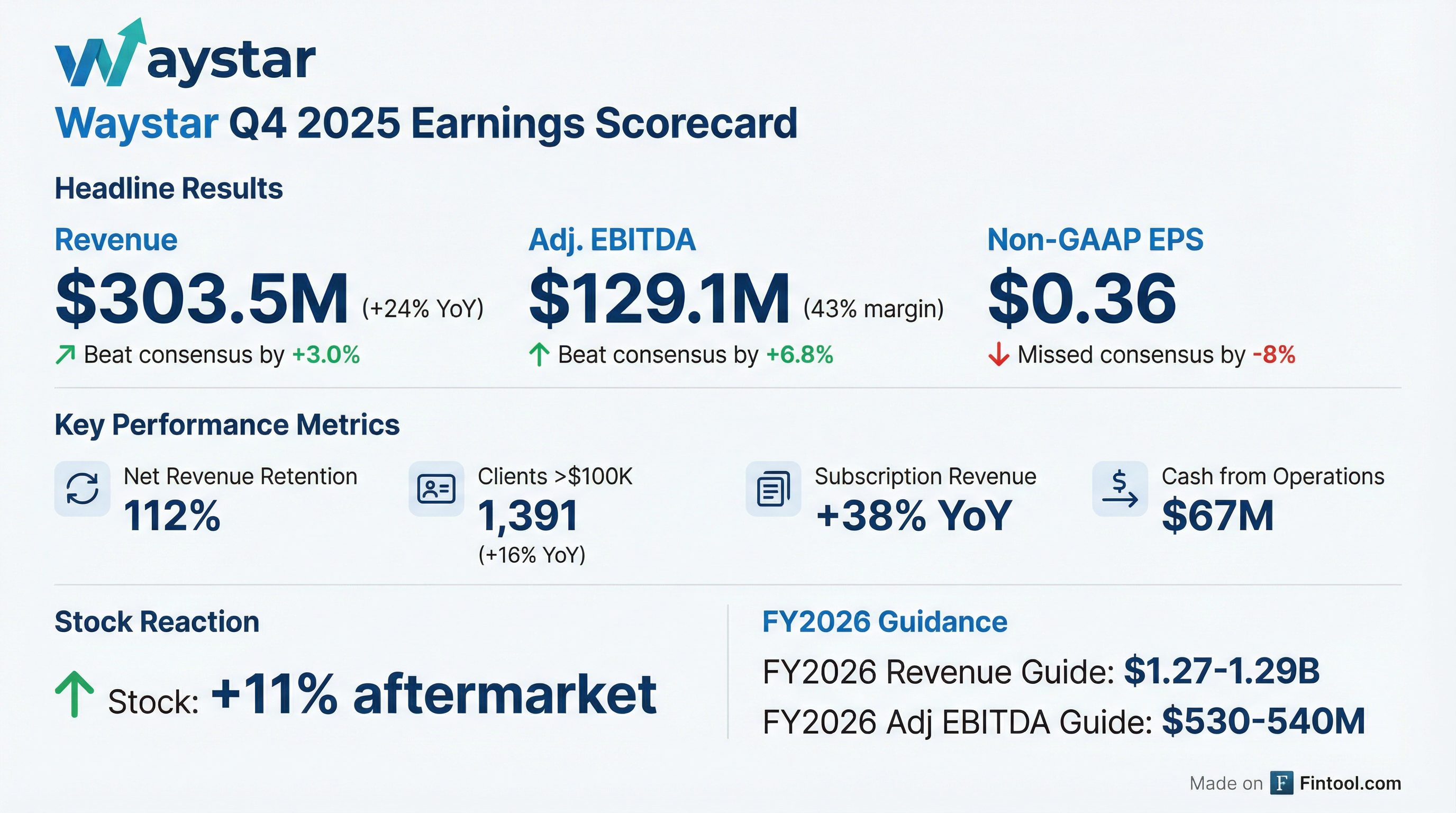

- Waystar Holding reported strong Q4 2025 performance, with 24% revenue growth and a 43% Adjusted EBITDA margin, generating $80 million in Unlevered free cash flow. These results include contributions from the IODINE acquisition, which added $31 million in revenue and ~$11 million in Adjusted EBITDA for the quarter.

- For the full year FY 2025, the company achieved $1,099 million in revenue and $462 million in Adjusted EBITDA , with an Adjusted Net leverage ratio of 3.0x.

- The company issued 2026 guidance, forecasting mid-point figures of $1,284 million in revenue, $535 million in Adjusted EBITDA, and $1.63 in Non-GAAP Diluted EPS.

- Waystar's AI platform is a key growth driver, contributing 40% of 2025 revenue from AI-deployed software, and the company anticipates its Total Addressable Market (TAM) to grow from $20 billion in 2025 to $25 billion by 2030.

- Waystar reported Q4 2025 revenue of $304 million, a 24% year-over-year increase (12% organically), and full-year 2025 revenue of $1.1 billion, up 17% year-over-year (13% organically).

- Adjusted EBITDA for Q4 2025 was $129 million (43% margin) and full-year 2025 was $462 million (42% margin).

- The Iodine Software acquisition in 2025 added over 1,000 hospitals and expanded the addressable market, with over 90% of committed cost synergies expected in fiscal 2026.

- Waystar's AI capabilities prevented over $15 billion in denials and reduced appeal time by 90% in 2025, with 40% of revenue driven by AI embedded in mission-critical reimbursement workflows.

- For full-year 2026, the company expects revenue between $1.274 billion and $1.294 billion (midpoint $1.284 billion), and Adjusted EBITDA between $530 million and $540 million (midpoint $535 million) with a 42% margin.

- Waystar reported strong Q4 2025 revenue of $304 million, a 24% year-over-year increase (12% organic), contributing to full-year 2025 revenue of $1.1 billion, up 17% year-over-year.

- Adjusted EBITDA reached $129 million in Q4 2025, achieving a 43% margin, and totaled $462 million for the full year 2025 with a 42% margin.

- For full-year 2026, Waystar expects revenue between $1.274 billion and $1.294 billion (midpoint $1.284 billion), reflecting 17% year-over-year growth, and Adjusted EBITDA between $530 million and $540 million (midpoint $535 million), with an approximate 42% margin.

- The Iodine Software acquisition contributed $31 million to Q4 revenue, and the company anticipates realizing over 90% of committed cost synergies in fiscal 2026.

- Waystar emphasized its AI leadership, with approximately 50% of its solutions leveraging AI and nearly 40% of its revenue driven by AI-embedded workflows.

- Waystar reported Q4 2025 revenue of $304 million, a 24% year-over-year increase (12% organically), and full year 2025 revenue of $1.1 billion, up 17% year-over-year (13% organically).

- Adjusted EBITDA for Q4 2025 was $129 million with a 43% margin, and for the full year 2025, it was $462 million with a 42% margin.

- The company completed the acquisition of Iodine Software in 2025, which contributed $31 million to Q4 revenue and is expected to realize over 90% of committed cost synergies in fiscal 2026, totaling approximately $14 million in savings.

- Waystar's AI-powered solutions are significant, with approximately 50% of solutions leveraging AI and nearly 40% of revenue driven by AI; in 2025, Waystar Altitude AI prevented over $15 billion in denials.

- For full year 2026, Waystar expects revenue between $1.274 billion and $1.294 billion (midpoint $1.284 billion), representing 17% year-over-year growth, and Adjusted EBITDA between $530 million and $540 million (midpoint $535 million), representing 16% year-over-year growth with a 42% margin.

- Waystar Holding Corp. reported Q4 2025 revenue of $303.5 million, marking a 24% year-over-year increase, and full-year 2025 revenue of $1,099.3 million, up 17% year-over-year.

- For Q4 2025, the company achieved net income of $20.0 million and non-GAAP net income of $70.7 million, with adjusted EBITDA of $129.1 million.

- For the full fiscal year 2025, Waystar reported net income of $112.1 million and non-GAAP net income of $262.9 million, with adjusted EBITDA of $462.1 million.

- The company provided full fiscal year 2026 guidance, projecting total revenue between $1.274 billion and $1.294 billion, and adjusted EBITDA between $530 million and $540 million.

- CEO Matt Hawkins noted strong growth and momentum, driven by record bookings, integration of the Iodine acquisition, and accelerated AI-powered innovation, with the 2026 guidance reflecting a robust pipeline and accelerating demand.

- Waystar Holding Corp. reported Q4 2025 revenue of $303.5 million, an increase of 24% year-over-year, with net income of $20.0 million and non-GAAP net income of $70.7 million.

- For the full fiscal year 2025, the company achieved revenue of $1,099.3 million, up 17% year-over-year, with net income of $112.1 million and non-GAAP net income of $262.9 million.

- Key performance metrics for FY 2025 included a net revenue retention rate (NRR) of 112% and 1,391 clients contributing over $100,000 in LTM revenue, marking a 16% year-over-year increase.

- The company provided guidance for full fiscal year 2026, expecting total revenue between $1.274 billion and $1.294 billion, adjusted EBITDA between $530 million and $540 million, and non-GAAP net income between $317 million and $335 million.

- Waystar reported six consecutive quarters of revenue and EBITDA beats compared to consensus through Q3 2025, and updated its full-year 2025 guidance by more than the Q3 beat.

- The company leverages a fabulous proprietary data set, having processed 7.5 billion insurance transactions in 2025 and acquired Iodine, which processes one out of every three hospital-based patient discharges in the U.S.. This data fuels its AI solutions, which prevented nearly $16 billion of denied claims in 2025 and achieve a nearly 99% first-pass claim acceptance rate.

- Waystar maintains strong client relationships with a 97% gross revenue retention and a net revenue retention averaging 108% to 110%, while expanding its addressable market from $20 billion to over $100 billion through AI-powered solutions.

- Waystar has demonstrated a proven and durable growth model, consistently meeting and exceeding revenue and EBITDA guidance for six consecutive quarters through Q3 2025, leading to an upward revision of full-year 2025 guidance.

- The company leverages a proprietary dataset, processing 7.5 billion insurance transactions and one out of every three hospital-based patient discharges in 2025, to develop AI solutions that prevented nearly $16 billion of denied claims in 2025.

- Waystar targets a $20 billion addressable market, with potential to expand into the $100 billion+ revenue cycle services market through AI-based automation.

- Key business metrics include a gross revenue retention of 97% and net revenue retention averaging 108% to 110% (recently higher), alongside an 80% win rate against competitors.

- Waystar reported Q3 2025 year-to-date revenue of $796M and Adjusted EBITDA of $333M, both reflecting a 42% margin.

- The company issued full-year 2025 guidance with a revenue mid-point of $1.089B and an Adjusted EBITDA mid-point of $453M.

- Waystar demonstrated strong client retention and growth, with a net revenue retention rate of 113% and 11% YoY growth in clients generating over $100K in TTM revenue for the twelve months ended September 30, 2025.

- The company projects its Total Addressable Market (TAM) to grow from $20B in 2025 to $25B by 2030, with AI-powered automation expected to capture a share of the $100B RCM services market.

- Waystar is advancing its AltitudeAI™ platform to Agentic AI, introducing capabilities for clinical integrity and revenue capture, and planning future features for claim resolution and denial prevention.

Fintool News

In-depth analysis and coverage of Waystar Holding.

Quarterly earnings call transcripts for Waystar Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more