xAI Raises $20 Billion as Nvidia and Cisco Bet on Elon Musk's AI Challenger

January 7, 2026 · by Fintool Agent

Elon Musk's xAI closed the largest AI funding round ever—$20 billion at a roughly $230 billion valuation—with strategic backing from Nvidia Corporation+7.87% and Cisco Systems+2.99%, signaling that the GPU kingmaker is now placing bets on every major AI platform.

The Series E exceeded its original $15 billion target, with investors including Valor Equity Partners, Fidelity Management & Research, Qatar Investment Authority, MGX (Abu Dhabi), Baron Capital Group, and StepStone Group joining the round.

NVIDIA had planned to invest as much as $2 billion in the round, according to prior Bloomberg reporting, though xAI did not break out individual investment amounts or specify whether capital came as equity or debt.

The AI Platform War Intensifies

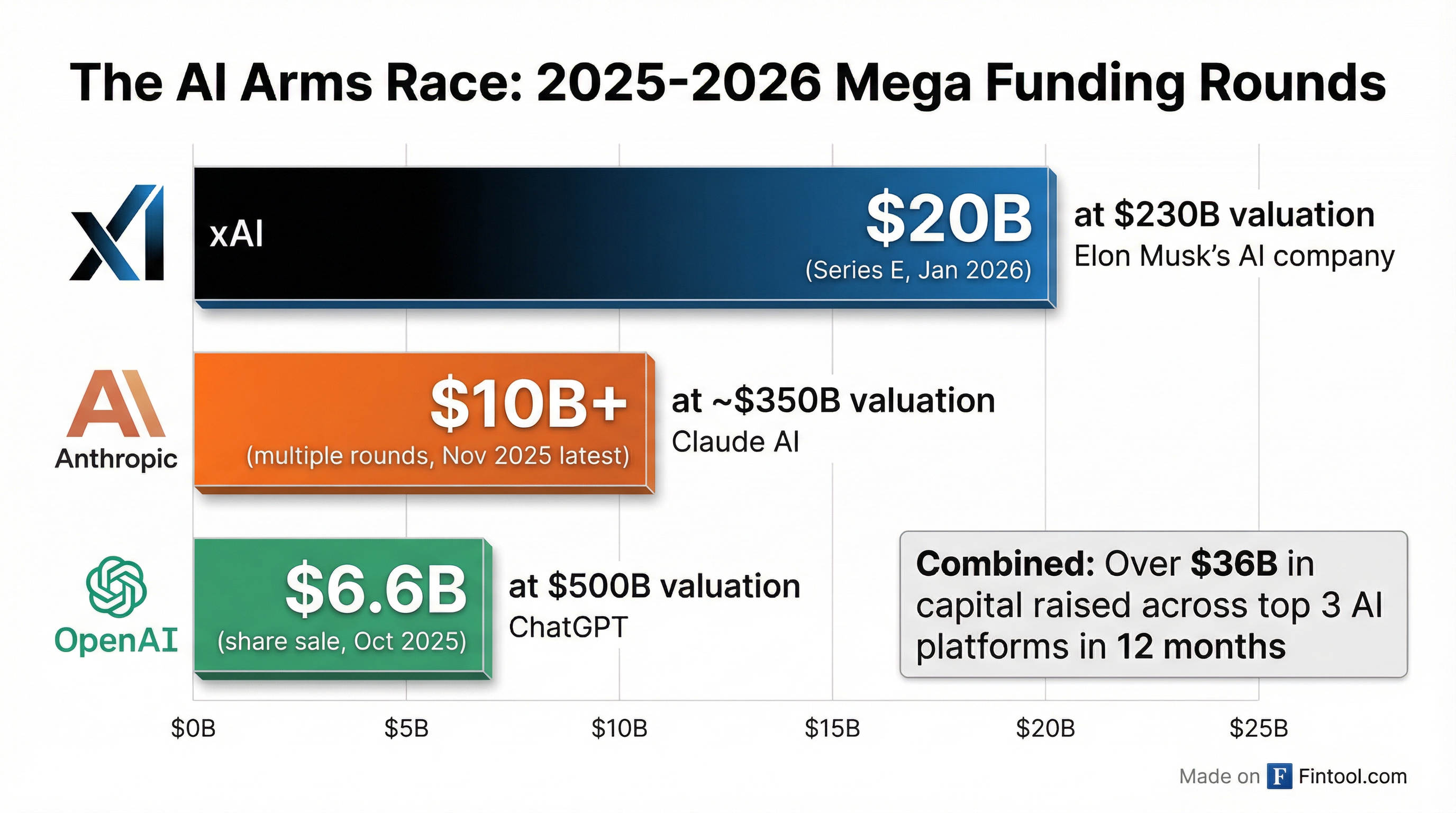

The xAI raise continues a staggering 12 months in AI private markets. OpenAI closed a $6.6 billion share sale at a $500 billion valuation in October 2025. One month later, Anthropic was valued at approximately $350 billion with Microsoft and NVIDIA providing capital. Now xAI joins the club at $230 billion, establishing a clear "Big Three" in the foundation model wars.

Collectively, these platforms have raised over $36 billion in the past year alone—capital that will flow into GPU purchases, data center buildouts, and talent acquisition as each company races to scale compute capacity.

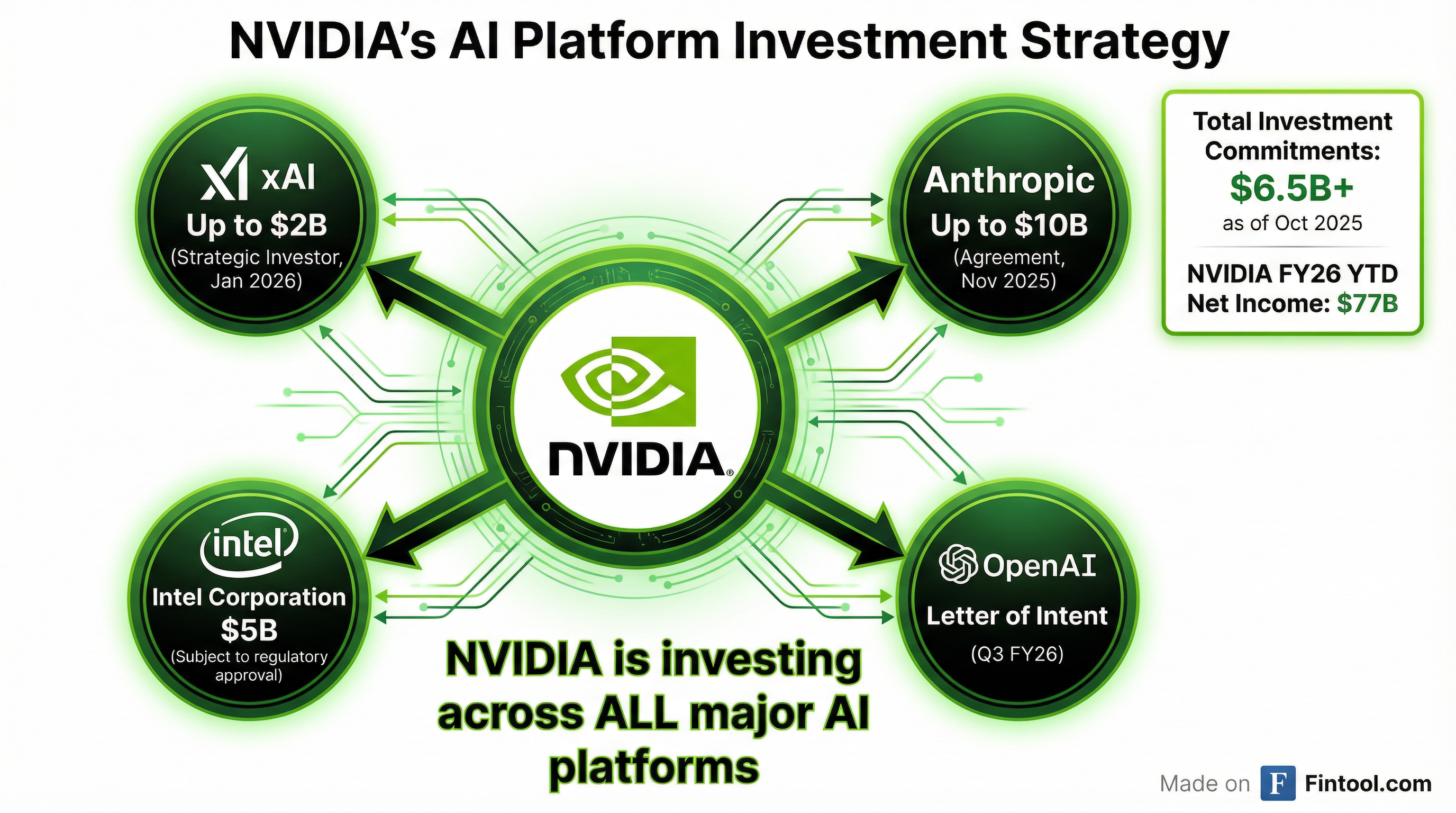

NVIDIA's Platform Agnostic Bet

For NVIDIA, the xAI investment is just one piece of a broader strategy to have skin in the game across all major AI platforms. According to the company's Q3 FY2026 10-Q filing, NVIDIA has committed to invest in nearly every leading AI company:

- Intel Corporation: $5 billion investment commitment (subject to regulatory approval)

- Anthropic: Agreement to invest up to $10 billion (subject to closing conditions, announced November 2025)

- OpenAI: Letter of intent for potential investment (Q3 FY2026)

- xAI: Strategic investor in the $20B Series E (January 2026)

Total investment commitments stood at $6.5 billion as of October 26, 2025—before the Anthropic agreement and xAI investment.

NVIDIA has the firepower to back these bets. The company generated $57 billion in revenue in Q3 FY2026 alone—up 64% year-over-year—and produced $23.8 billion in operating cash flow for the quarter.

| Metric | Q4 2025 | Q1 2026 | Q2 2026 | Q3 2026 |

|---|---|---|---|---|

| Revenue ($B) | $39.3* | $44.1 | $46.7 | $57.0 |

| Net Income ($B) | $22.1 | $18.8 | $26.4 | $31.9 |

| Cash from Operations ($B) | $16.6 | $27.4 | $15.4 | $23.8 |

*Values retrieved from S&P Global

Yet NVIDIA explicitly warns investors about the risks: "These investments may generate realized and unrealized gains or losses and we could realize losses up to the value of the investments." Many targets are "early-stage companies still defining their strategic direction," and securities are often "non-marketable and illiquid."

Cisco's Quiet AI Infrastructure Pivot

Cisco+2.99% is the less-discussed strategic investor in the xAI round, but the investment aligns with the networking giant's renewed focus on AI infrastructure. In its most recent 10-K, Cisco emphasized that "AI represents a generational shift in technology and the advent of AI agents is driving an order of magnitude higher requirement for network connectivity."

Cisco is positioning its networking portfolio to power AI workloads: "We provide network infrastructure to power AI training and inference workloads for both webscale providers and enterprises. We help to scale our customers' network infrastructure with high-density routers and switches, improved network management, and high-performance optics."

The company generated $14.9 billion in revenue in Q1 FY2026, with $8.4 billion in cash on the balance sheet.

What xAI Gets

The capital injection addresses xAI's voracious appetite for compute. The company has been building out its "Colossus" data center in Memphis—one of the largest GPU clusters in the world—and burning through capital at a prodigious rate. Bloomberg reported in mid-2025 that xAI was burning approximately $1 billion per month.

xAI said it will use the funding to:

- Accelerate infrastructure buildout for the "world's largest GPU clusters"

- Deploy AI products reaching xAI's claimed 600 million monthly active users across X and Grok

- Fund research toward the company's stated mission of "Understanding the Universe"

The company noted that Grok 5 is currently in training and teased "innovative new consumer and enterprise products."

Market Reaction

Both NVIDIA and Cisco shares were relatively flat on the day following the announcement:

| Company | Jan 6, 2026 Close | Change |

|---|---|---|

| Nvidia+7.87% | $187.24 | -0.47% |

| Cisco+2.99% | $75.23 | -0.46% |

| Tesla+3.50% | — | — |

The muted reaction suggests markets have already priced in NVIDIA's platform-agnostic investment strategy—the xAI announcement simply confirms a pattern that began with the company's commitments to Intel, OpenAI, and Anthropic throughout 2025.

What to Watch

Grok 5 launch timing: xAI disclosed the model is in training but provided no release date. A competitive response to OpenAI's latest models could validate the valuation.

Regulatory reviews: NVIDIA's investments in Intel, Anthropic, and potentially OpenAI all face regulatory hurdles. The xAI deal structure—equity vs. debt, conditions—was not disclosed.

Burn rate sustainability: At roughly $1 billion/month, even $20 billion provides less than two years of runway at current spending. Either monetization must accelerate or additional capital will be required.

X platform integration: Musk merged xAI with X (formerly Twitter) in March 2025. The 600 million MAU claim depends heavily on X's user base and how Grok is embedded in the product.

Related Companies: Nvidia+7.87% · Cisco Systems+2.99% · Tesla+3.50%